Table of Contents

- Form 71 Helps To Claim Tds Credit In Respect Of Income Disclosed In Income Tax Return Submitted In Earlier Years

- Correcting Tds Errors Via Filling New Income Tax Form 71

- E-form No. 71: Issuance And Processing

- Applicability Of Filing Form 71:

- What Are The Time Limit For Filing Form 71:

- What Are The Basic Details Required For Filing Form 71:

- Main Key Considerations While Follow The Procedural Guidelines For Form 71

- Tds & Tcs Rate Chart For Fy 2024-25

- Conclusion

- Tds & Tcs Rate Chart For Fy 2024-25

- Comprehensive Study About Tds & Tcs Chapter

Form 71 helps to claim TDS Credit in respect of income disclosed in Income tax return submitted in earlier years

- CBDT has issued Notification No. 73/2023, dated August 30, 2023: The Finance Act 2023 introduced Section 155(20) of the Income-tax Act, effective from October 1, 2023. This provision addresses situations where income has been reported in an earlier year's tax return, but the tax deducted at source is deposited in a subsequent financial year.

- Income tax Form 71 makes it easier to reconcile differences between TDS deductions & income reporting as of October 1, 2023. Visit the Income Tax Department's e-filing portal to find out more about Rule 134 and the filing procedure. Understand the details required, including PAN, address, tax year, and TDS amount.

- The introduction of Form 71 by the Central Board of Direct Taxes (CBDT) aims to resolve TDS (Tax Deducted at Source) mismatches when income is reported in a tax return for a specific assessment year but the TDS is deposited in a later financial year. Here’s a detailed look at the purpose, applicability, and procedural requirements for this form.

- The procedural guidelines for Form 71 were formalized through Notification No. 73/2023, dated August 30, 2023. , which states that the Assessee must submit the application in Form No. 71 to the Principal Director General of Income Tax or the Director General of Income Tax, who will then forward it to the relevant Assessing Officer.

- Taxpayers can ensure that their TDS credits are appropriately aligned with their income declarations, thereby preventing any potential tax disputes or discrepancies.

Correcting TDS Errors via filling New Income Tax Form 71

Practical Implementation procedural guidelines for Form 71

- This electronic process simplifies the correction of TDS errors, ensuring taxpayers can efficiently align their TDS credits with the corresponding income. By leveraging digital signatures and electronic verification codes, the system enhances security and reduces administrative burden.

E-Form No. 71: Issuance and Processing

Issuance of Form No. 71

The CBDT mandates that Form No. 71, introduced for correcting TDS mismatches, be issued electronically. The issuance will be overseen by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), or an authorized person.:

Electronic Issuance:

- If the Income Tax Return (ITR) requires submission under a digital signature, Form No. 71 will also be issued under a digital signature.

- For cases not requiring a digital signature, the form will be issued through an EVC.

Process Specification:

- The Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) will specify the process for issuing Form No. 71. They are responsible for developing appropriate security measures, archival, and retrieval procedures for the form.

Forwarding to Assessing Officer:

- Once issued, Form No. 71 must be forwarded to the relevant Assessing Officer (AO). This can be done by the Principal Director General of Income-tax (Systems), the Director General of Income-tax (Systems), or any authorized individual.

Applicability of Filing Form 71:

Form 71 addresses the issue where income is reported on an accrual basis, but the corresponding TDS is deducted and deposited in a subsequent year. This creates a mismatch in the taxpayer's records, which Form 71 aims to rectify. This situation typically arises in scenarios where:

- A taxpayer reports income on an accrual basis in an earlier tax return.

- The tax on that income is withheld by the deductor and paid to the government in a later financial year.

- This leads to a TDS mismatch because the income has already been taxed on an accrual basis, but the TDS is credited later when payment is made.

- The tax deductor deducts TDS in the financial year when the actual payment is made.

- There is a mismatch in the year of income declaration and the year of TDS deposit.

What are the Time Limit for Filing Form 71:

- Section 155(20) allows taxpayers to apply to the Assessing Officer (AO) for TDS credit within two years from the end of the financial year in which the tax was withheld. The AO is then required to amend the assessment to allow the TDS credit. The taxpayer must apply to the Assessing Officer (AO) within two years from the end of the financial year in which the TDS was actually deducted.

What are the basic details required for Filing Form 71:

- The form must be submitted electronically, either with a digital signature or through an electronic verification code (EVC). Rule 134 outlines the requirement for Form 71.

- This information ensures the accurate application and adjustment of TDS credits for the taxpayers, aligning their tax liabilities correctly.

- Form No. 71 must be submitted electronically, either with a digital signature or through an electronic verification code. This rule mandates that taxpayers file an application in Form No. 71. The form requires the following information:

- Personal details: Name, address, PAN, Aadhaar, residential status, email, mobile number, relevant assessment year, and date of filing the return of income.

- Income details: Total income reported in the relevant assessment year, the amount of specified income, and the rate at which it was taxed.

- TDS details: Amount of tax deducted, date of deduction, section and rate of TDS, date of payment to the central government, and the amount of TDS claimed for the relevant assessment year.

- Deductor details: Name, PAN, and TAN of the deductor.

Main Key Considerations while follow the procedural guidelines for Form 71

- Form No. 71 requires the taxpayer to provide comprehensive personal and tax-related information. This includes personal identification details (PAN, Aadhaar, etc.), income details, and specific TDS details.

- Form is to be submitted electronically, ensuring the process is streamlined and secure.

- The designated authorities are tasked with ensuring the secure handling of Form No. 71, including its issuance, archival, and retrieval.

- Ensure accurate and complete details to avoid further mismatches.

- Adhere to the electronic submission requirements.

- Utilize the form to rectify discrepancies between the year of income reporting and TDS deduction.

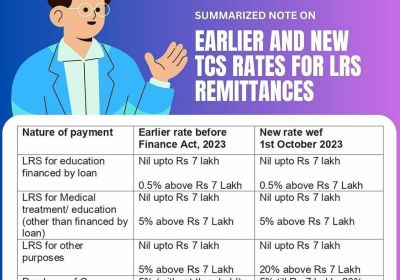

TDS & TCS Rate chart for FY 2024-25

Conclusion

One significant development in the area of tax administration is Form 71, which allows people to adjust TDS credit disparities related to income from prior fiscal years. The programme promotes a more equal taxation system while also improving taxpayer convenience by providing a straightforward and easy-to-use avenue for adjustment. When using Form 71 to handle TDS-related issues, people should be aware of the filing date and make use of the online submission option for a hassle-free experience.

TDS & TCS Rate chart for FY 2024-25

Comprehensive study about TDS & TCS chapter

Yiou may contact us at singh@carajput.com or singh@caindelhiindia.com in if you have any questions. You can also follow our most recent blogs and articles.