Table of Contents

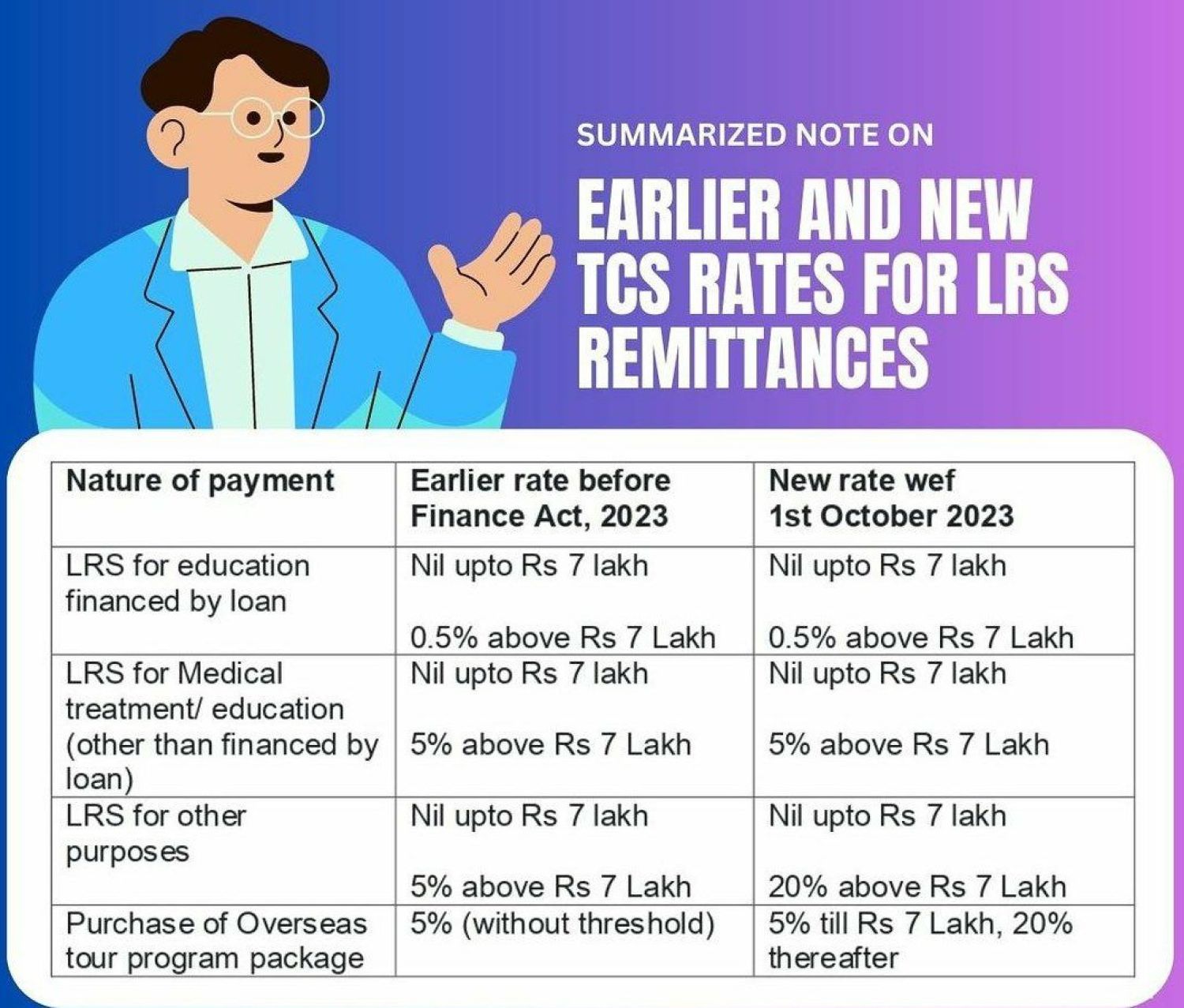

Important changes w.r.t Liberalised Remittance Scheme and Tax Collected at Source

- The Finance Ministry, Gov of India has, via a press release dated 28th June, 2023, announced significant changes to the LRS & TCS, which shall be implemented from 1st October, 2023 as against earlier deadline of 1st July, 2023.

- One of the notable changes is the restoration of the threshold for triggering Tax Collected at Source on all categories of Liberalised Remittance Scheme payments. The celling Limit of INR Seven lakh per FY individual, regardless of the purpose, will now determine whether Tax Collected at Source is applicable.

Summary of the Revised Tax Collected at Source rates for Liberalised Remittance Scheme payments from 1st Oct 2023:

A. Liberalised Remittance Scheme for education financed by a loan:

i) No Tax Collected at Source for the first INR Seven lakh

ii) 0.5 Percentage Tax Collected at Source for amounts exceeding INR Seven lakh

B. Liberalised Remittance Scheme for medical treatment/education (other than financed by a loan):

i) No Tax Collected at Source for the first INR Seven lakh

ii) 5 Percentage Tax Collected at Source for amounts exceeding INR Seven lakh

C. Liberalised Remittance Scheme for Overseas Travel:

i) 5 Percentage Tax Collected at Source for the first INR Seven lakh

ii) 20 Percentage Tax Collected at Source for amounts exceeding INR Seven lakh

C. Liberalised Remittance Scheme for other purposes:

i) No Tax Collected at Source for the first INR Seven lakh

ii) 20 Percentage Tax Collected at Source for amounts exceeding INR Seven lakh