Table of Contents

TDS on Dividend on Equity Shares

Applicable:

This section is effective beginning on April 1, 2020, for the financial year 2020-21.

Update on Dividend Tax in Union Budgets 2020 and 2021

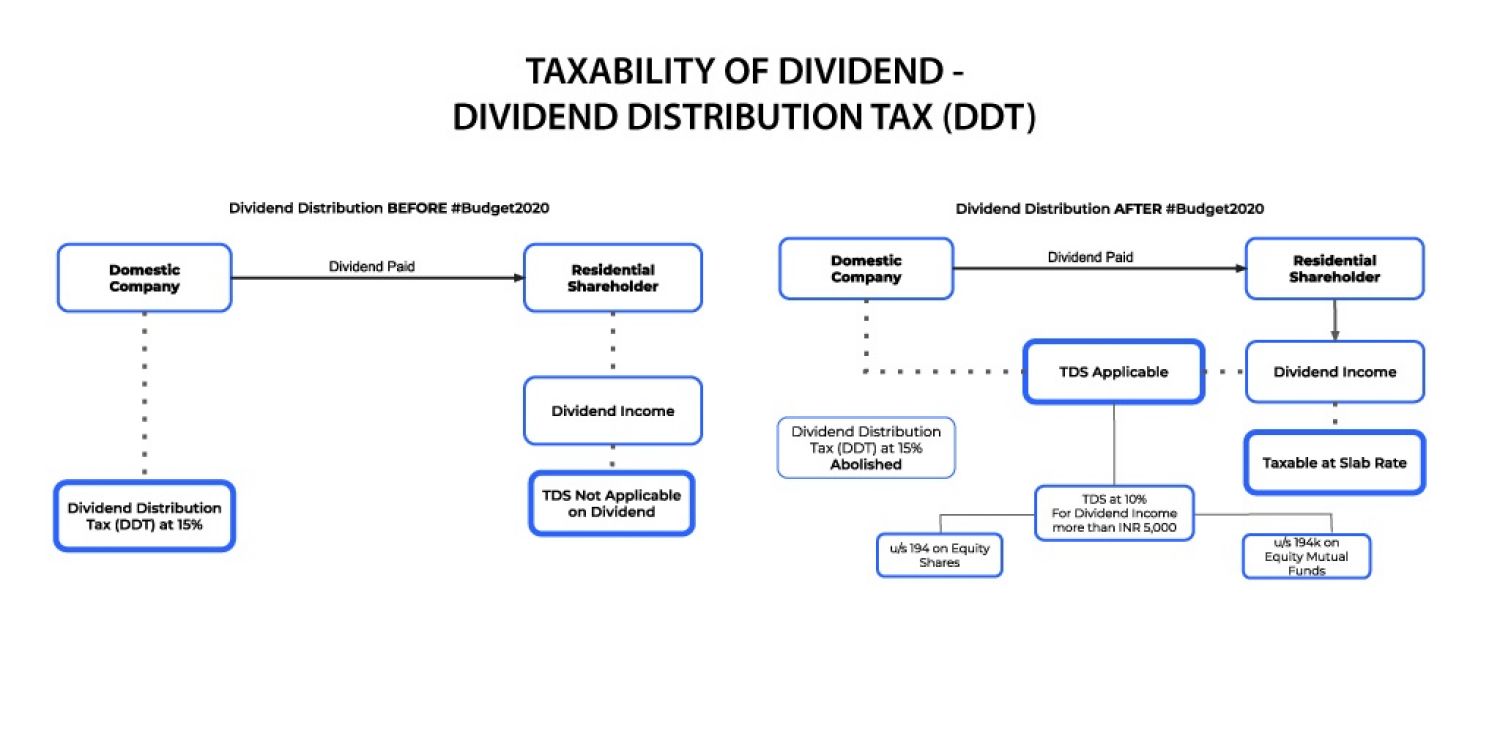

After the elimination of the Dividend Tax in Budget 2020, dividends that were previously exempt will now be taxed beginning in FY 2020-21. TDS under Section 194 and Section 194K were introduced in Budget 2020 to allow for the deduction of TDS on dividends received on equities shares and equity mutual funds. Following that, Dividends paid to REITs and InvITs are now exempt from TDS under Budget 2021.

Because it is impossible for shareholders to precisely forecast dividend income, the advance tax liability on dividend income would arise only if the payout is declared or paid.

The tax on dividend income from equities shares and equities mutual funds in India, as well as TDS application, is explained in full below.

From Financial Year 2020-21 onwards

The DDT was repealed as a result of the abolition of Section 115-O in Budget 2020. As a result, a Domestic Company is exempt from paying tax on dividends paid on Equity Shares to Indian shareholders. Dividends would be taxable in the shareholder's hands (as per applicable slab rates). TDS would be applicable because the income is taxable in the hands of the shareholder. As a result, Section 194 of the Criminal Code was changed.

If the amount exceeds INR 5000, a Domestic Company delivering dividends to a resident is required by Sec 194 to deduct TDS at a rate of 10%. Such revenue should be reported in the ITR filed on the IRS website under the heading IFOS.

Legal Information:

With the start of the Financial Year 2020-21, dividend taxation in India has been completely turned upside down. The new provisions have once again asked the Dividend Recipient to pay taxes rather than the Company that was distributing the dividends.

The changes in income-tax law that resulted in the above change are as follows:

- The Dividend Distribution Tax (DDT) has been eliminated.

- The dividend has been taxed in the hands of shareholders.

- The dividend exemption limit of Rs. 10 lakhs has been removed.

- The dividend surcharge has been set at 15%.

- Interest expense against dividend income is limited to 20% of dividend income.

- Dividends received on or after April 1, 2020, on which DDT has already been paid, are not subject to taxation again.

In addition to the preceding, the reinstatement of Tax Deducted at Source (TDS) or Withholding Tax (WHT) on Dividends is a significant change.

Deductor:

TDS should be deducted by the company that distributes dividends to equity shareholders. The deductor is required to deposit TDS and file the TDS Return on TRACES.

Deductee:

Dividend income on equity shares earned by shareholders residing in India will be paid after TDS under Section 194. Dividend income from equity mutual funds will be paid to shareholders in India after TDS under Section 194K. NRI investors/shareholders who earn dividend income will receive the amount after TDS is deducted under Section 195.

Payment Method:

Sec 194 addresses the payment of Dividends on Equity Shares to a resident shareholder in excess of INR 5000 in a financial year.

Payment Date:

TDS is deducted at the time income is credited to the payee account or at the time payment is made, whichever comes first. If the amount to be paid is credited to a "suspense account" or any other account, it is considered a "deemed payment," and the payer must deduct TDS on such credit.

Rate:

If the dividend amount exceeds INR 5000, the deductor must deduct TDS at the rate of 10% under Section 194. If the payee fails to provide the PAN, TDS at the rate of 20% will be deducted.

In addition to the foregoing, the reinstatement of Tax Deducted at Source (TDS) or Withholding Tax (WHT) on Dividends is a significant change.

Companies are in the process of distributing dividends as the financial year 2019-20 comes to a close. However, they are struggling with the above changes because the rate of TDS varies from shareholder to shareholder depending on a variety of factors such as residential status, shareholder type, dividend quantum, and so on. In this regard, the following table summarizes the TDS rates (as provided under the Income-tax provisions) as well as the various conditions to be met.

Residential status |

Type of shareholder |

Other conditions |

Base rate (%) |

Surcharge (%) |

HEC (%) |

Effective rate of TDS (%) |

|

|

Resident |

Government/ RBI/ Corporation under central Act/ Mutual Fund |

Copy of PAN along with a declaration that it holds the beneficial interest in shares owned by it |

– |

– |

– |

– |

|

|

LIC/ GIC/ any other insurer |

Copy of PAN along with a declaration that it holds the beneficial interest in shares owned by it |

– |

– |

– |

– |

||

|

Any other |

Less than 5,000 |

– |

– |

– |

– |

||

|

More than 5,000 |

Form 15G/H |

– |

– |

– |

– |

||

|

PAN |

7.5 |

– |

– |

7.500 |

|||

|

No PAN |

20 |

– |

– |

20.000 |

|||

|

Non-Resident |

Any |

Dividends in respect of bonds or Global Depository Receipts (GDRs)2 |

10 |

* |

4 |

10.400 |

|

|

FIIs/ FPIs |

– |

20 |

* |

4 |

20.800 |

||

|

Company |

upto 1 cr |

20 |

– |

4 |

20.800 |

||

|

1 cr – 10 cr |

20 |

2 |

4 |

21.216 |

|||

|

exceeds 10 cr |

20 |

5 |

4 |

21.840 |

|||

|

Other than the above (including NRIs and others) |

upto 50 lacs |

20 |

– |

4 |

20.800 |

||

|

50 lacs – 1 cr |

20 |

10 |

4 |

22.880 |

|||

|

exceeds 1 cr |

20 |

15 |

4 |

23.920 |

|||

The surcharge rates apply to all non-residents (based on their income), regardless of the type of assessee. As a result, the rate of surcharge for FIIs/ FPIs and dividends in respect of GDRs will be determined by the type of shareholder, i.e. company or non-company.

Based on the above, the TDS rates will range from 0% to 23.92%.

TDS Certificate:

The deductor shall issue Form 16A to the deductee as the Tax Credit Certificate for the amount deducted as TDS. The Deductor can obtain Form 16A from his or her TRACES account. Using Form 16A, the deductee can claim credit for the tax deducted while filing the Income Tax Return.

Return of TDS:

After depositing TDS with the income tax department, the deductor must file Form 26Q on TRACES. This report includes information about the dividend payment. After filing the report, the deductor should provide Form 16A to the deductee.

Double Taxation Avoidance Agreement(DTAA):

However, the above-mentioned rates are based solely on the provisions of the Income Tax Act, and do not take into account any benefit available under the Double Taxation Avoidance Agreement (DTAA or tax treaty) of the shareholder's country of residence. If a shareholder is entitled to and willing to claim tax treaty benefits, he or she must submit the following documents to the company before the dividend is distributed:

- Tax Residency Certificate (TRC) issued by the country of residence's tax authorities.

- Completed Form 10F in the prescribed format.

- No PE declaration.

- PAN card copy.

After obtaining and validating the previously mentioned documents, the companies must analyze the provisions of India's DTAA with the shareholder's country of residence, as well as the recently introduced provisions of Multilateral Instrument (MLI), to determine the final TDS rate. Even after the aforementioned TDS, the non-resident shareholder will not be exempt. If TDS is calculated in accordance with the DTAA provisions, the non-resident shareholder must also file an income tax return in India in accordance with the provisions of the Indian Income-tax Act.

Considering the above mentioned, it appears that corporations with a large non-resident shareholder base will face undue instability when it comes to dividend distribution. As a result, it is past time for the Government of India to wake up and provide at least some relief to alleviate this massive compliance burden from the shoulders of Indian companies that are already trapped in the current Covid-19 scenario.

Frequently Asked Question on TDS on Dividend on Equity Shares

Q.: TDS applicable to a resident individual shareholder with a valid PAN:

Effective April 1, 2020, dividend income is taxable in the hands of shareholders under the Income Tax Act of 1961. As a result, if any resident individual shareholder receives a dividend in excess of Rs. 5,000 in a fiscal year, the entire dividend will be subject to TDS at 7.5 percent. If the shareholder has updated his/her Permanent Account Number (PAN) with the depository/Registrar and Transfer Agent, the rate of 7.5 percent will apply (RTA). Otherwise, the TDS rate will be 20%.

- No TDS is imposed if a resident individual shareholder's dividend does not exceed Rs 5,000 in a fiscal year.

- No TDS is applicable if the resident individual shareholder provides a declaration in Form 15G/ Form 15H. Annexure – 1 (Form 15G) and Annexure – 2 contain forms (Form 15H).

Q.: TDS applicable to a resident individual shareholder who does not have or has an invalid PAN.

If the resident individual shareholder has not updated his or her PAN or has provided an invalid PAN to the depository/ RTA, TDS at the rate of 20% will be levied.

Q.: TDS for a resident non-individual shareholder (HUF, Firm, AOP, BOI, Company).

For non-individual resident shareholders, the entire dividend will be subject to TDS, with no threshold limit. If a valid PAN is updated with the company or the depository/ RTA, the tax deduction rate will be 7.5 percent. Otherwise, the TDS rate will be 20%.

Q.: Insurance companies are subject to TDS.

TDS is not imposed on dividends paid to insurance companies if they provide a self-declaration stating that they own the shares and have full beneficial interest, as well as a self-attested PAN.

Q.: Tax deducted at source (TDS) for mutual funds.

TDS is not imposed on dividends paid to a Mutual Fund as defined in clause (23D) of Section 10 of the Income Tax Act of 1961. Such Mutual Funds must provide a self-declaration that they meet the requirements of Section 10 (23D) of the Income Tax Act of 1961, as well as a self-attested copy of their PAN card and registration certificate.

Q.: Foreign Institutional Investors (FIIs) and Foreign Portfolio Investors (FPIs) are subject to TDS (FPIs).

In accordance with Section 196D of the Income Tax Act of 1961, tax will be deducted at source at a rate of 20% (plus applicable surcharges and cess) on dividends to Foreign Institutional Investors (“FIIs”) and Foreign Portfolio Investors (“FPIs”).

Please keep in mind that there is no specified threshold below which no tax will be withheld. The entire dividend is subject to tax withholding.

Surcharge rates are as follows:

|

Dividend amount |

Rate of Surcharge |

|

Above ? 50 Lacs but not exceeding ? 1 Crore |

10% |

|

Above ? 1 Crore |

15% |

A 4% cess will be levied on the above-mentioned surcharge.

Q.: TDS is applicable to non-resident shareholders who are not FIIs or FPIs.

According to the Indian Income-tax Act of 1961, the rate of withholding tax for non-resident shareholders is 20% (plus applicable surcharge and cess). However, if a non-resident shareholder is entitled for a tax treaty benefit and the tax rate given in the appropriate tax treaty is advantageous to the shareholder, the tax treaty rate will be used. Non-resident shareholders must submit ALL of the following documents in order to take advantage of tax treaty benefits:

- Tax Residency Certificate for the fiscal year 2020-21, the year in which the dividend is paid (to be obtained from the Revenue / Tax authorities of the country in which the shareholder resides).

- Form 10F in the format prescribed by the Income Tax Act of 1961 (Annexure - 3).

- Attested copy of PAN Card

- Self-declaration of beneficial ownership and absence of a PE in India (For Foreign Companies – Annexure 4; Individual Non-Residents – Annexure 5).

Please keep in mind that the Company is not required to use the advantageous DTAA rates when calculating the dividend amount for tax deduction/withholding. The application of the beneficial DTAA Rate is contingent on the completeness and satisfactory review of the documents submitted by the non-resident shareholder by the Company.

If the required documents are not provided or are insufficient to apply the advantageous DTAA rates, tax will be deducted at a rate of 20%, plus a 4% surcharge and cess.

Q.: Surcharge rates for non-resident individuals, HUF, AOP, and BOI.

|

Dividend amount |

Rate of Surcharge |

|

Above ? 50 Lacs but not exceeding ? 1 Crore |

10% |

|

Above ? 1 Crore |

15% |

Q.: Surcharge rates for non-resident businesses.

|

Dividend amount |

Rate of Surcharge |

|

Above ? 1 Crore but not exceeding ? 10 Crores |

2% |

|

Above ? 10 Crores |

5% |

Q.: Information on the amount of tax that has been deducted:

Shareholders can look up Form 26AS on their e-filing accounts at https://incometaxindiaefiling.gov.in.

Shareholders can also access the “View Your Tax Credit” tool at www.incometaxindia.gov.in. Please note that the credit on Form 26AS will be recognized after the Company files its TDS Return on a quarterly basis and the Income-tax Department processes it.

Q.: Is TDS required on dividends paid to NRI shareholders?

Section 195 of the Income Tax Act applies to dividends paid to NRI investors/shareholders. As a result, TDS of 20% must be deducted from dividends paid on equity shares and equity mutual funds. As a result, TDS must be deducted at a rate of 10% for an NRI shareholder under Section 194 and Section 194K.

Q.: What exactly is Dividend Distribution Tax (DDT)?

DDT is a 15% tax paid by an Indian company on the declaration, distribution, or payment of a dividend. Due to the fact that the Indian Company pays DDT, dividend income is tax-free in the hands of the shareholder or investor.

However, the applicable Budget 2020 scrapped DDT on April 1, 2020, i.e. 2020-21 financial years In the hands of the shareholder or investor, the dividend is now taxable. If the dividend exceeds Rs. 5000, the company is required to deduct TDS at a rate of 10%.

Q. : Is TDS deducted from a non-resident shareholder's dividend?

Yes, absolutely. TDS should be deducted at the required rates by a domestic company giving dividends to a shareholder who is not a resident of India, as per Section 195 of the Income Tax Act. TDS should be deducted at the rate of Sec 194 or Sec 194K in the case of a resident shareholder.

Q. : Is TDS needed to be deducted on mutual fund sales under Sec 194K?

TDS on Mutual Fund Income (Section 194K) was introduced in Budget 2020. It was unclear if capital gains on mutual fund sales would be included in ‘Income from Mutual Funds.' TDS under section 194K should be deducted at 10% only on Dividend Income and not on Capital Gains on the sale of Equity Mutual Funds, according to the CBDT.

Q.: What is the maximum amount of dividend that can be deducted for TDS purposes under Section 194K?

- The maximum amount of TDS that can be deducted on dividend income is Rs. 5000.

- Sec 194K – If the dividend income per beneficiary exceeds Rs. 5000 in a financial year, the domestic company must deduct 10% of the dividend income from mutual funds.

- Sec 194 – If the dividend income per recipient exceeds Rs. 5000 in a financial year, the domestic company must deduct 10% of the dividend income.