NSDL: Update on Extension of Quarterly TDS/TCS statement filing dates for Quarters.

Extension of quarterly TDS / TCS statement submission of By the NSDL circular dates for Extension of due date for TDS returns for four Quarters of the Financial year.

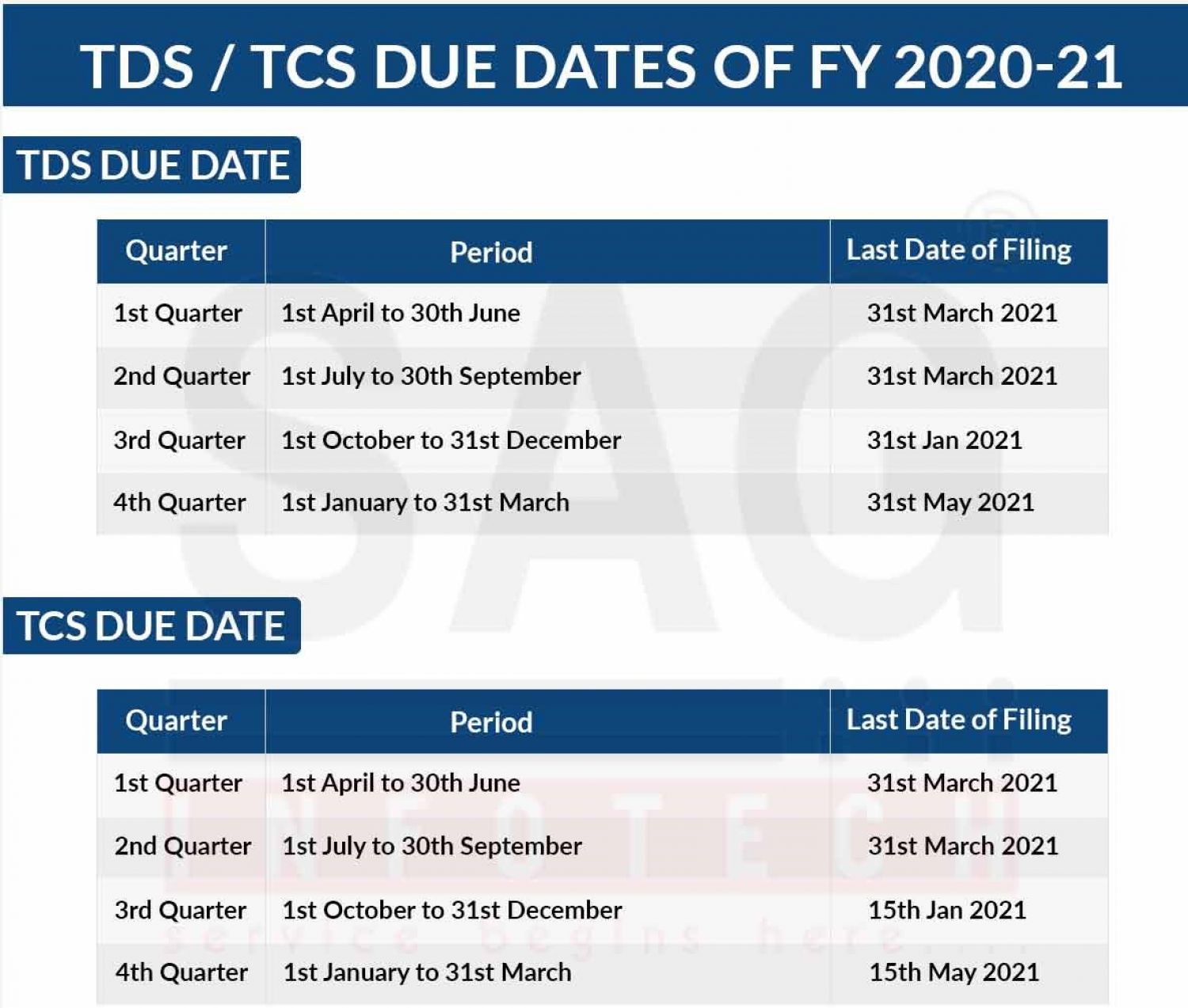

Due date of TDS/ TCS Return filling for the FY

|

Quarter |

Last Date of Filing |

Period |

Last Date of Filing |

|

1st Quarter |

31st March |

1st April to 30th June |

31st March |

|

2nd Quarter |

31st March |

1st July to 30th September |

31st March |

|

3rd Quarter |

31st Jan |

1st October to 31st December |

31st Jan |

|

4th Quarter |

31st May |

1st January to 31st March |

31st May |

- TDS Certificate - Quarterly: After filling out the TDS quarterly return you can generate a TDS/TCS certificate within fifteen days of filing your TDS return.

Dead Line to File Tax Collected at Source (TCS) Returns for Financial Year

|

S. No |

Quarter |

Quarter Ending |

Quarter Period |

Due Date |

|---|---|---|---|---|

|

1 |

1st Quarter |

30 June |

April – June |

31 March |

|

2 |

2nd Quarter |

30 September |

July – September |

31 March |

|

3 |

3rd Quarter |

31 December |

October – December |

15 January |

|

4 |

4th Quarter |

31 March |

January – March |

15 May |

Kind of TDS Return filling Forms

The below are the TDS Return filling Forms and the aim for which they are used:

|

S. No. |

Return filling Forms |

Particular Purpose |

|---|---|---|

|

1 |

Form 27Q |

Subtraction of tax from dividend, interest or any other amount payable to non-residents |

|

2 |

Form 27EQ |

TCS |

|

3 |

Form 24Q |

Tax deducted at sources from salaries |

|

3 |

Form 26Q |

Tax deducted at sources on all payments apart from salaries |

Deadline dates for TDS payment for Financial Year

|

S. No |

Month |

The due date for other deductors (Company, Individual, HUF, etc) |

The due date for Govt deductors |

|

1 |

April |

7th May |

7th May |

|

2 |

May |

7th June |

7th June |

|

3 |

June |

7th July |

7th July |

|

4 |

July |

7th August |

7th August |

|

5 |

August |

7th September |

7th September |

|

6 |

September |

7th October |

7th October |

|

7 |

October |

7th November |

7th November |

|

8 |

November |

7th December |

7th December |

|

9 |

December |

7th January |

7th January |

|

10 |

January |

7th February |

7th February |

|

11 |

February |

7th March |

7th March |

|

12 |

March |

30th April |

7th April |

Late fees for filing

Failing to file your TDS returns within the due date means that you will be subjected to a late filing fee of Rs.200 per day. The fee will be paid each day after the due date, till the date on which your return is submitted. However, the maximum fees that you will have to pay will be limited to the sum of the TDS.

Penalty for the return of TDS

In the event that TDS returns are filed after the due date or that there is a difference in the TDS return form, the Below penalties shall apply:

- The penalty under Section 234E: under that same section of the Income Tax Act, the deductor will be fined Rs.200 every day before the TDS is paid, but the penalty cannot be more than the TDS sum.

- The penalty under Section 271H: a penalty which may be between a minimum of Rs.10,000 and a maximum of Rs.1 lakh shall apply if incorrect details have been given, such as incorrect PAN, incorrect tax number, etc

A penalty will not be paid under Section 271H of the Income Tax Act in the event that TDS/TCS returns are not submitted within the deadline, given that the following condition applies:

- The TDS/TCS shall be paid to the Government's credit.

- The filing of the TDS/TCS return shall take place before the expiration of one year from the deadline.

- Interest and late filing fees (if any) have been charged to the Govt credit.

The interest rate applicable for the payment of TDS

As per Section 201(1A) of the Income Tax Act, 1961, if the tax is not deducted at source, either in part or in full, an interest rate of 1% per month would occur from the date on which the tax was deducted to the date on which it was actually subtracted. If the tax has been withheld and has not been paid either in part or in full, an interest rate of 1.5 percent per month would apply from the date on which the tax was deducted on the date on which it was payable.

COMPLIANCES OF TAX DEDUCTED AT SOURCES(TDS)

TDS & TCS Rate chart for FY 2024-25

Comprehensive study about TDS & TCS chapter

Yiou may contact us at singh@carajput.com or singh@caindelhiindia.com in if you have any questions. You can also follow our most recent blogs and articles.