Table of Contents

What is the Process of Cancellation / Surrendering of multiple TANs Allotted?

Although we know, many times the assessee acquires Tax Deduction and Collection Account Number only to make some Tax Deduction at Sources payments, and there is no need for that Tax Deduction and Collection Account Number (TAN) in the future after those transactions and payments. A multiple TAN may also have been issued to an assessee for a variety of reasons. i.e. It may have applied many times for the allocation of Tax Deduction and Collection Account Number (TAN), and every time it has been allocated a TAN or may have unintentionally given multiple TANs by the Income Tax Department, National Securities Depository Limited (NSDL) or UTI. The taxpayer (Assessee) who has more than one TAN can automatically allot to them, He should apply for the surrender of additional TAN number(s) allotted to them.

What's a duplicate Tax Deduction and Collection Account Number

Duplicate TAN is a TAN that has been unintentionally acquired by a person who is liable for deducting/collecting tax and who already has a TAN allocated to him. It is unlawful to own and use more than one TAN. Even so, various regions/divisions of an organisation can have different TANs.

In the case of duplicate Tax Deduction and Collection Account Number, which TAN should be used

If multiple TANs have been allocated, the TAN used on a daily basis can continue to be used. The other TAN / s should be surrendered for cancellation by using the 'Change or TAN Correction Form' which can be downloaded from the NSDL-TIN website or purchased from TIN-FCs or other vendors.

How to File an Application for Cancellation of TAN?

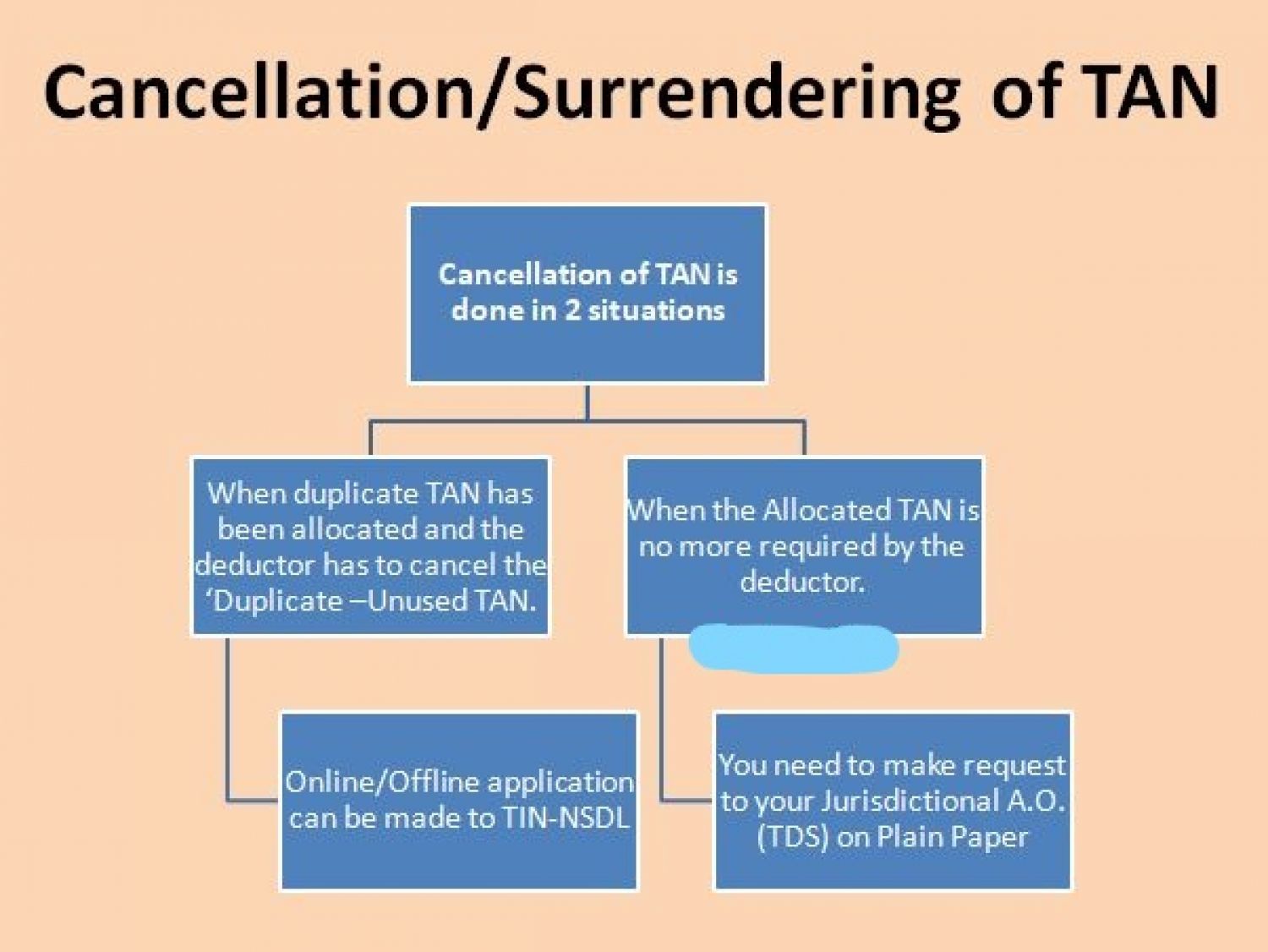

Cancellation / Surrendering of TAN Application can be performed in two circumstances;

CASE 1 |

CASE 2 |

|

Where the duplicate Tax Deduction and Collection Account Number has been allotted to the Company; |

Where TAN is allotted to the Assessee/deductor is no longer needed. |

|

The deductor must apply the NSDL to cancel the 'Duplicate –Unused TAN.' For this reason, the application form specific to 'Changes and TAN Correction' should be used. This can be obtained from the NSDL website and is also available from TIN-FCs Center. The request can be made online electronically as well as in a physical submission of form in the TIN-FCs Center. In this process 'Duplicate TAN allotted to the Company' can be cancelled |

the deductor shall be made an application to the competent authority of the Assess officer – TDS under the Income-tax ward in a plain paper for request on cancellation of Tax Deduction and Collection Account Number and specifying the reasons for such a request of the cancellation.

|

Process of Cancellation as prescribed by the National Securities Depository Limited (NSDL)

If a duplicate Tax Deduction and Collection Account Number is assigned, which TAN should be used for our company?

If duplicate Tax Deduction and Collection Account Number have been issued, the TAN used on a regular basis can be used as company TAN. The remaining TANs can be surrendered for cancellation by using the "Form for Changes or Correction in TAN" which can be obtained from the NSDL website (http:/tin.nsdl.com).

The following procedure can be used to cancel the TAN:

- Visit the http:/tin.nsdl.com, then.

- Go for Download the form "Form for change and correction in TAN"

- Fill in appropriately and show the Tax Deduction and Collection Account Number numbers you want to cancel in point 6 of the form.

What do you have to do in case you have allotted TAN duplicate under an unintentional failure to notice?

In the event that a duplicate Tax Deduction and Collection Account Number has been allotted, an application can be made for cancellation of the Tax Deduction and Collection Account Number that has not been used in the " Form for Changes or TAN Correction" that can be accessed from the NSDL website (http:/tin.nsdl.com) or printed by local printers or collected by some other source. The request application can also be made available in the TIN Facilitation Centres.

An application seeking the cancellation of the TAN and a statement of reasons for an application. Usually, we surrender TAN only in case of company closure:

The form of the written request for TAN Surrender is given see below reference:

To,

The Assessing Officer (TDS)- Income Tax Dept,

TDS Ward

Dear Sir,

Re: Application Request for cancellation of TAN No

We, (Company / Entity Name), were involved in the Commercial origination of (details of business activity). We got TAN registration because_____________. Consequently, the TAN was allocated and the above described (TAN No ................) was given.

We have been filing TDS returns on a regular basis and paying TDS (above the above-mentioned payments). However, we have agreed to discontinue operations in the state of as a result of (Reason to discontinue).

Screenshot of TRACES, along with a copy of the last income tax returns, is included as evidence of no outstanding payments.

We hereby further accept that if any government payments are identified to be recoverable against us in the future and are claimed by the Income Tax Department, we shall immediately deposit the same with Interest.

In light of these, we ask you to cancel our TAN registration with effect immediately.

For ...... (Company / Entity Name)

Authorised Signatory

Place:

Date:

How to check the status of the TAN Application on the TIN NSDL Portal