TCS on Tax Foreign Remittance Transactions under LRS

Forex Facility for Residents – $250,000 per FY Under Liberalised Remittance Scheme (LRS)

Scheme of LRS

- The Foreign Exchange Management Act, 1999 (FEMA) limits forex transactions to the limit permitted by its regulations.

- RBI Regulations apply to the LRS. Indian residents are permitted to Remit 250,000 USD (approximately Rs 2 crore) outside India per financial year under the RBI LRS Regulation. These remittances would be used for a variety of purposes under the LRS regulations:

- As a standard of Living: Travel Expenses, Donations, Study Expenses, Medical Expenses, Gift to Non-Resident Relatives etc

- As a monetary investment: Bank Account, Shares, Debt Instrument, Immovable Property etc.

- Indian residents are permitted to transfer a specified sum (per fiscal year) of forex outside India to anyone for all permissible capital account transactions under LRS, without any prior approval from RBI. Anything they would have to do is to contact an Authorised Person/Dealer (i.e. Full Fledged Money Changer, Banks).

- The LRS limit of $250,000 is per financial year basis. As a result, an individual will remit this much money per fiscal year. This cap applies to all people, regardless of their age. As a result, a minor is also eligible for this scheme.

- Since LRS is available for all residents, including minors. The limit can be set for the entire family.

- Residents can use the application-cum-Declaration Form to conduct transactions under this Scheme (mentioning that funds belong to remitter and will not be used for prohibited purposes).

- PAN number is compulsorily required to make remittances under the Scheme.

New TAX Provisions Enacted under Finance Act 2020 (Budget 2020) – Section 206C(1G)

- In reference to the Budget 2020, as passed by the Government of India in parliament, a new subsection 1G has been inserted in TCS (Tax Collected at Source) Section 206C to tax foreign remittance transactions under the Liberalised Remittance Scheme. The section will go into effect on October 1, 2020.

Permissible Transactions Under LRS

- LRS remittances can be enforced towards eligible current and capital account transactions.

- Eligible current account transactions such as: Private Visit, Gift, Donation, Emigration, Medical Expenses, Overseas business travel, Overseas Studies, Employment outside India, Maintenance for close relative.

- The permitted capital account transactions under LRS: (i) Foreign Bank Accounts (ii) Real State Investment Outside India (iii) Share Market Investments, Mutual Funds Investments etc (iv) Setting up of Wholly Owned Subsidiary/Joint Venture (v) Loan to Relative NRIs.

- To simplify transactions for Resident Individuals and to rationalise current and capital account transactions, all allowed current account transactions would be subsumed under the total limit of $250,000. As a result, residents can now borrow up to $250,000 USD per fiscal year for approved current or capital account transactions, or a combination of both. However, forex can be obtained in excess of the total cap for the purposes of emigration, medical expenses abroad, and studies abroad, as determined by the requirements of the country/medical institute/university.

- Remittances for unauthorised or irregular activities, such as margin trading, lottery, and so on, are not permitted.

- Under this arrangement, AD is not permitted to provide supported or non-funded services to residents in order to encourage remittance.

- To be eligible for remittance under this scheme, the applicant must have held a bank account with the bank for at least one year prior to the remittance.

- Remittances under this scheme are not permitted to countries designated by FATF as non-cooperative countries/territories.

- ADs will address to the RBI on a monthly basis the number of applicants and total amount remitted under the scheme.

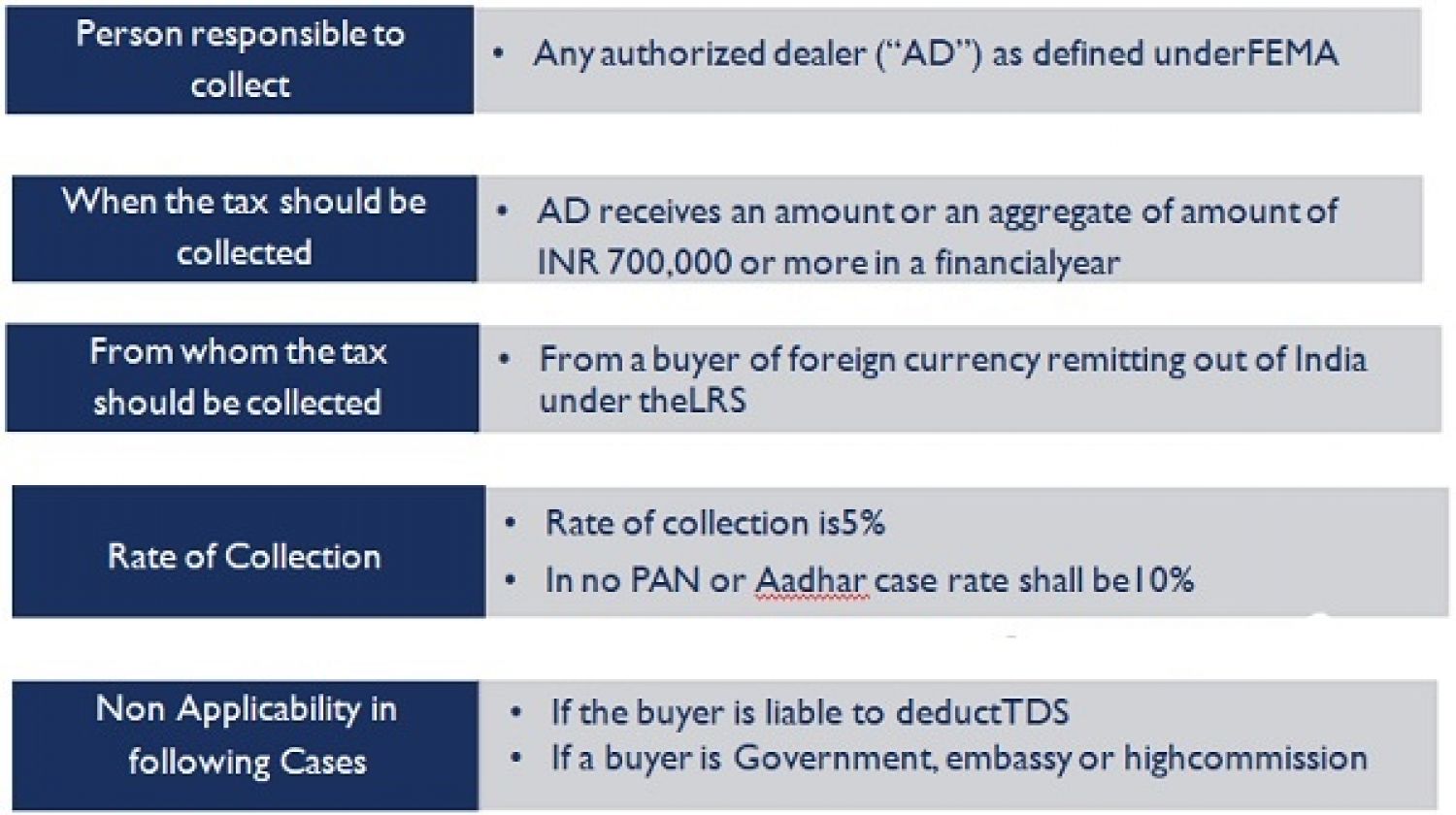

Tax Collected at Source (TCS) @5% on Transactions under Liberalised Remittance Scheme

- Budget 2020 inserted a new tax provision, section 206C(1G), which imposed a Tax Collection at Source (TCS) of 5% on remittances made under the LRS Scheme.

- Under this provision, anyone remitting money abroad under the LRS scheme will now be required to pay an additional amount in the form of TCS to the Authorised Dealer (i.e. Bank, any other agency etc). As a result, there is an increase in cash outflow. This new levy will go into effect on October 1, 2020.

Monetary Limit for TCS on LRS Transactions

- According to section 206C(1G), TCS is applicable if the total remittance amount in a year exceeds Rs 7 Lakh. TCS will also be levied on amounts in excess of Rs 7 lakh. As a result, if a person transfers 18 lakh rupees during the year (via three transactions of Rs 6 lakh each), TCS will be levied at 5% on 11 lakh rupees (i.e. 18 lakh – 7 lakh).

0.50% TCS on LRS Transactions for Education Purposes

- At the time of passing the budget, the finance minister proposed a relaxed TCS of 0.50 percent on LRS remittances made for education purposes (though it was proposed at 5% in budget proposals, but at the time of passing the budget in parliament, the reduced rate is proposed for LRS Education Purpose). This exemption applies if the funds are transferred from a loan obtained from an approved financial institution in India (as provided in section 80E of Inc Tax Act).

- The 0.5 percent tax will be levied only on amounts exceeding Rs 7 lakh. For example, if a resident remit 15 lakh Rs in a year for educational purposes from a loan obtained from a financial institution, TCS will be 0.50 percent of 8 lakh (15 lakh–7 lakh).

Refund of TCS

- The TCS amount paid by the money remitter will be available as a tax credit to the remitter at the time of ITR filing. If no tax is owed, the TCS amount can be claimed as a refund from the Income Tax Department.

Frequently Asked Questions – TCS on Foreign Tour Packages & LRS Transactions

Applicability and Implications for Non-Residents (NRIs, PIOs, OCIs)

Q. What is Liberalised Remittance Scheme (LRS)?

- A Resident Indian can remit 2.50 Lakh USD outside India for expenses (travel expenses, gifts, donations, etc.) or investment purposes under the LRS scheme, which is governed by RBI regulations (property purchase, bank account, shares etc).

Q. What is the TCS taxation levied on LRS remittances by Budget 2020?

- 5% if remittance exceeds Rs 7 Lakh.

Q. What TCS tax breaks are available for LRS remittances for education?

- TCS rate is 0.5% if remittance is out of loan from specified financial institutions.

Q. What is the monetary limit for TCS to be applied to LRS transactions?

- TCS is applicable if LRS remittances exceed Rs 7 Lakh in a scheduled year.

Q. Is TCS applicable to the entire amount of LRS remittance?

- No. TCS is applied to LRS remittances that exceed Rs 7 lakh.

Q. What impact would TCS have on non-residents?

- Non-residents who used to receive money from Resident relatives in India will face a decrease in cash inflows because banks will collect TCS on the remittance amount. Hence, if a Resident Indian wishes to send a gift remittance or other remittance to his/her Non-Resident Relatives (NRI, Foreign Citizen), a Tax Collected at Source will be deducted from the total cash flow available with Residents.

- The remittance amount will be reduced accordingly. As a result, there is less money flowing to non-residents.

Q. Is TCS relevant to balances transferred from NRO account holders to NRE/Foreign Accounts by NRIs or Foreign Residents?

- No, remittances from NRO accounts by NRIs, PIOs, and OCIs are not covered by the USD 1 Million Scheme. TCS u/s 206C(1G) does not apply to the USD 1 Million Scheme for NRIs and PIOs.

Q. What is another transaction in which TCS is levied under Section 206C(1G), which include TCS on Foreign Travel?

- In addition to the TCS on LRS transactions, Budget 2020 imposes a TCS of 5% on foreign travel expenses. The section states that the seller of an overseas tour programme package must collect 5% TCS in relation to the sale of an overseas tour package. This TCS has no monetary restrictions. To summarise, TCS @5% is applicable on foreign travel expenses, which shall be collected by the tour package seller from the tour package buyer regardless of package amount.

Q. What is the effective date for TCS under Section 206C(1G)?

- Commencing on October 1, 2020. Prior to that, this TCS is inapplicable.

This article is relevant for both Residents as well as NRIs. It also clarifies a number of general doubts and commonly asked questions concerning Forex Drawal Laws, including the:

- What are the forex remittance regulations for sending money abroad to buy immovable property?

- Can I establish a company in another country without obtaining RBI approval?

- I am an Individual. Can I make investments abroad? What are the regulations for making Investments Abroad?

- Can I extend credit to a non-resident relative? I am an NRI. Can I take funds from my Indian relatives?

- I am an Individual. Can I open a Bank account abroad? Can I deposit money in Bank Account Abroad?

- In the future, I hope to relocate my children abroad. Can I buy some investments and property abroad?

- What are the limits of remittance foreign exchange abroad?

- I am an Individual resident in India. I have a wife and two small kids. What is my foreign exchange remittance limit for buying investments, opening a bank account, and acquiring an immovable property?

- Which countries do I have access to through the LRS scheme?

- What are the procedures for remitting forex under the LRS Scheme?

Whom should I touch in order to remit foreign exchange under the LRS Scheme?