Table of Contents

TDS on Purchase-Tax Deducted at Source (TDS) u/s 194Q when purchasing the goods-Applicability

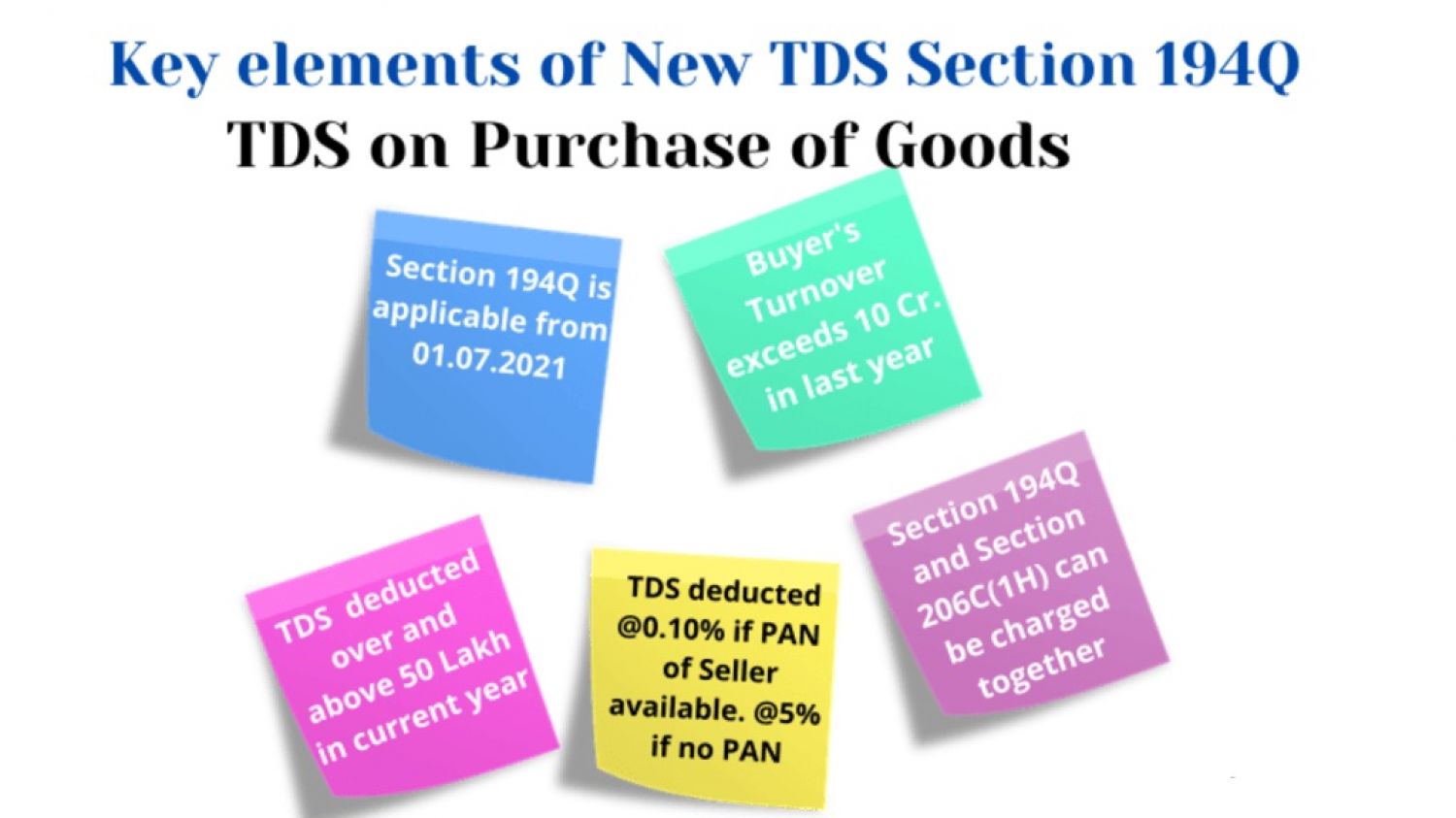

A new section 194Q was introduced in Budget 2021-22, which will come into force on July 1, 2021.

In Budget 2021-22 a new section 194Q relating to the payment of a certain sum to purchase goods. As described in this section the person who is the buyer shall pay the purchasing value of a good or aggregate exceeding Rs. 50 lakhs (fifty lakh rupees) in any preceding year for any resident (hereinafter referred to as the seller) shall, at the time of credit of the amount, be responsible in respect of the purchase on the account of the seller or at the date of the payment, in any way at all.

In Section 194Q of the Finance Act, 2021 new section was included for the purchase of the goods starting from July 1, 2021, and the taxes deducted from the Source ("TDS"). This section is similar in structure to the Finance Act 2020 section 206C(1H) which allows taxes to be collected on the amount the buyer receives. During Section 206C(1H), the seller is liable to collect the buyer's tax (i.e., the tax incidence falls on the buyer).

Section 194Q TDS deduction time :

(i) when such sum was credited to the seller's account.

(ii) Any mode shall apply at the time of payment.

Whichever comes earlier.

Key Points of TDS under section 194Q:

- Where a tax is deductible under one of the Act's provisions.

- when tax is collected under section 206C of the Act, with the exception of transactions covered by section 206C. (1H).

- It should also be emphasized that this item only applies to the sale of commodities; services are currently excluded from the scope of the clause. As a result, a limit of Rs. 50 lakhs must be set for each financial year for the sole purpose of purchasing goods.

“Buyer” refers to a person whose total sales, gross receipts, or turnover from the business carried on by him surpasses 10 Crore Rupees during the financial year immediately preceding the financial year in which the purchase of goods is carried out, who wasn't a person as the Central Government may specify for this purpose by notice in the Gazette, subject to such conditions as may be specified.

Any sum credited to any account in the books of account of the person (Buyer) liable to pay such income, whether called "suspense account" or by any other name, shall be considered to be the credit of such revenue to the account of the payee (Seller), and the provisions of this section shall apply accordingly.

TDS Deduction Exception under Section 194Q

The provisions of this section do not apply to a transaction where

(a) tax is deductible under any of the Act's provisions.

(b) a transaction for which sub-section (1H) of section 206C applies is receivable under the provisions of section 206C.

Section 194Q of the Income Tax Act of 1961 specifies the TDS rate.

- 0.1 percent on amounts in excess of Rs. 50 lakhs in any previous year

- 5% if the Seller's PAN number is not available (section 206AA).

It implies that if a TDS or tax collection at source (TCS) is required to be deducted on a transaction under any other provision, it will not be subject to TDS under this section. However, there is one exception to this general rule: if TCS is required under sub-section (1H) of section 206C as well as TDS under this section, only TDS u/s194Q shall be deducted on that transaction.

Section 194Q non-compliance:

Disallowance of up to 30% of the transaction amount under section 40a(ia) of the Income Tax Act of 1961. It indicates that if the buyer fails to deduct and deposit TDS as required, the disallowance will be limited to 30% of the amount of expenditure for which TDS has not been deducted and deposited.

How to make sure you're in compliance with section 194Q:

Purchase is an ongoing process in any business, and it is difficult to keep track of when purchase from any vendor exceeds Rs. 50 lakhs, especially in a large organization. As a result, automation is the only way to comply with section 194Q. As a result, automation requires the following actions.

- Based on the previous year, identify the vendors from whom purchases of more than Rs. 50 lakhs were made in the previous year and arrange for a change in the master of these vendors, as well as the activation of the TDS deduction option in your accounting software.

- Make changes to your accounting software so that it can automatically identify and deduct TDS or send you an alert when any vendor's purchases exceed Rs. 50 lakhs during the current fiscal year.

Pros and Cons of section 194Q:

Pros:

Despite the fact that the tax rate is 0.1 percent, the government will receive income tax in advance every month; otherwise, this portion of the tax will be available to the government on the 15th of June, 15th of September, 15th of December, and 15th of March (at the time of payment of advance tax installments).

Cons:

Another compliance burden on the organization's/professionals' staff without an increase in the time limit for depositing and filing TDS returns. This will also raise the organization's costs.

Applicability of section 194Q with Examples:

- The seller's turnover is Rs. 9 crores.

- The buyer's turnover is Rs. 15 crores.

- Receipt or Payment for Goods Sold or Purchased in the Previous Year: Rs. 55 lakhs.

Taxability Computation case 1:

- Buyer's Turnover Exceeds Rs. 10 Crores

- Rs. 5 lakhs is the taxable amount ( Rs. 55 lakhs-Rs.50 lakhs).

- TDS u/s194Q: 0.1 percent on amounts exceeding Rs. 5* lakhs.

- TCS u/s 206C(1H): not applicable because the Seller's annual revenue is less than ten crores.

- The seller's turnover is Rs. 15 crores.

- The buyer's takeover is Rs. 9 crores.

- Receipt or Payment for Goods Sold or Purchased in the Previous Year: Rs. 55 lakhs

Taxability Computation case 2:

- The buyer's annual turnover is less than Rs. 10 crores.

- The seller's turnover exceeds Rs. 10 crores.

- Rs. 5 lakhs is the taxable amount ( Rs. 55 lakhs-Rs.50 lakhs).

- TDS u/s194Q: Does not apply.

- TCS under Section 206C(1H): 0.1 percent on Rs. 5 lakhs**.

- The seller's turnover is Rs. 15 crores.

- The buyer's takeover is Rs. 15 crores.

- Receipt or Payment for Goods Sold or Purchased in the Previous Year: Rs. 55 lakhs

Taxability Computation case 3:

- Buyer's Turnover Exceeds Rs. 10 Crores

- The seller's turnover exceeds Rs. 10 crores.

- Rs. 5 lakhs is the taxable amount ( Rs. 55 lakhs-Rs.50 lakhs).

- TDS u/s194Q: 0.1 percent on amounts exceeding Rs. 5 lakhs*.

- TCS u/s 206C(1H): This is not applicable (see exception).

Note:

*In the event that the seller's PAN number is not available, the TDS rate shall be 5%.

**If the buyer's PAN number is not available, the TDS rate shall be 1%.

Exception:

(a) Tax is deductible under any provision of this Act; and

(b) TCS under the provisions of section 206C, except in the case of a transaction to which section 206C-subsection (1H) applies.

TDS Section 194Q V/S TCS Section 206C (1H):

Under Section 206C, the buyer has the primary and predominant obligation to deduct the tax, and no tax shall be collected on such transaction (1H). Regardless, if the buyer fails to pay the tax, the seller is responsible for collecting it.

Non-compliance carries a risk of liability:

Dis-allowance to the tune of 30% of the transaction's value. It means that if the buyer is unable to deduct and deposit TDS as applicable, the disallowance is limited to 30% of the expenditure amount on which TDS is not deducted and deposited. Furthermore, if a deductor fails to deduct tax at source, he or she will be liable to pay interest at the rate of 1% per month or part thereof on the amount of tax that he or she failed to deduct002E.

Points to Consider:

- The Procurement Team will identify vendors with a turnover of more than INR 50 lacs.

- The IT team will make critical changes to the software.

- Open POs will be revised as of 01-July-21, as TCS will no longer be applicable.

Conclusion:

TDS and Tedious have similar pronunciations. There are currently 38 provisions that require TDS from various transactions. If all of these provisions are harmonized in a table, the Assessee's compliance burden is increased at no cost. Section 194Q's goal is to broaden and deepen the tax base.

For query or help, contact: info@carajput.com or call at +91 9555 555 480