Table of Contents

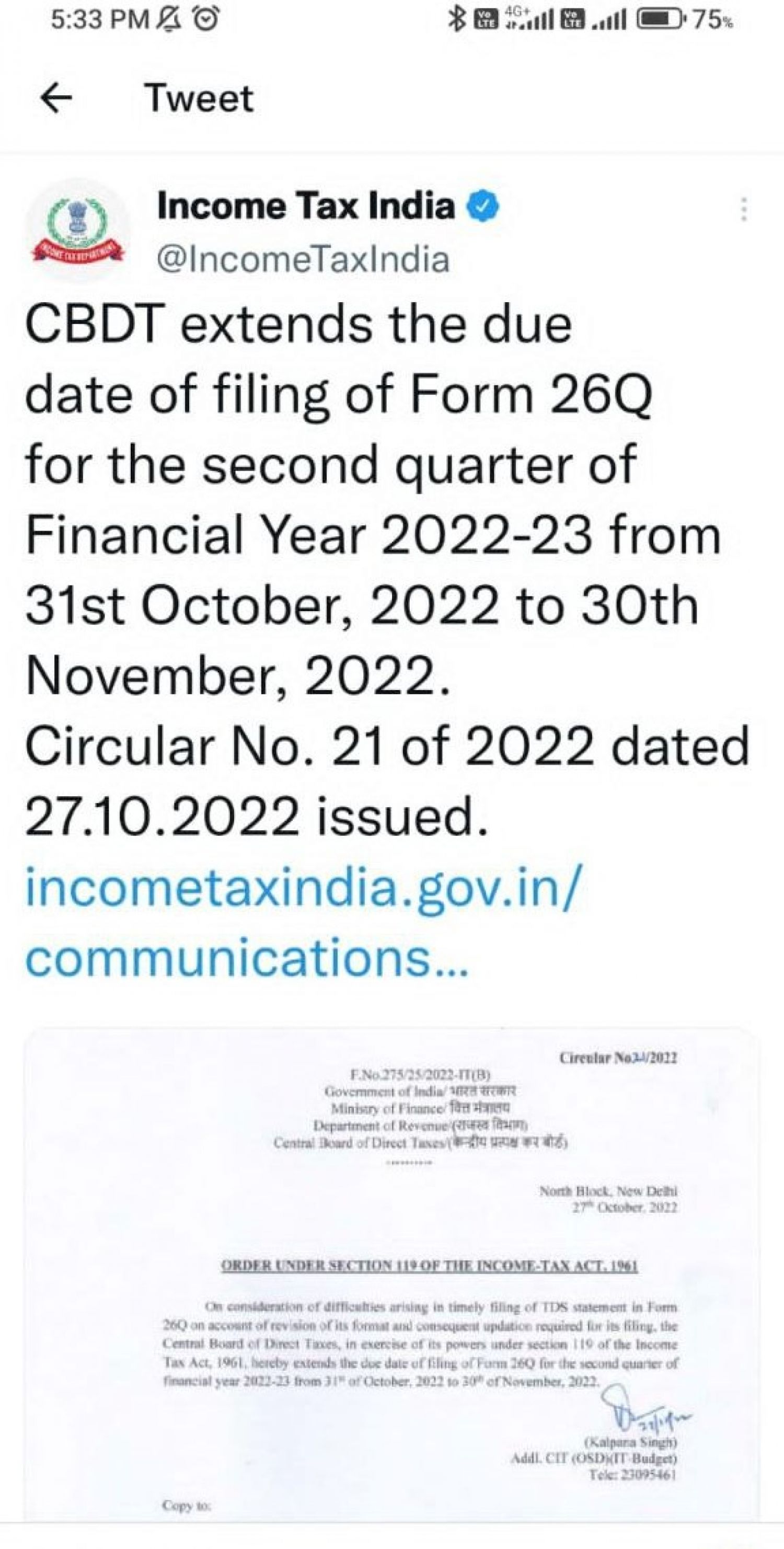

Deadline of submitting TDS Return(Form 26Q) for second quarter of Financial Year 2022-23 extended till to 30th Nov 2022.

- CBDT has extended the Timeline of filing of TDS Return in Form 26Q for 2nd QTR of FY 2022-23 from 31st Oct 2022 to 30th Nov 2022. Central Board of Direct Taxes issue the Income tax Circular No. 21 of 2022 dated 27.10.2022. there is two reason on that extention.

- A decision by the Central Board of Direct Taxes has been made in response to the challenges faced by tax payers in timely submitting the TDS Form (Form 26Q) due to revision and the subsequent filing requirement.

- Above decision of Central Board of Direct Taxes has been made on account of the revision of the format of Form 26Q & Consequent updating needed for its submission, Board has extended the deadline of filing of TDS return for the 2nd quarter of the FY 2022-23 from Oct 31, 2022, to Nov 30, 2022

CBDT CIRCULAR ON TDS DEDUCTION FROM SALARIES DURING THE FY 2022-23 U/s 192

- The above Circular explains various pertinent provisions of the Act and Income-tax Rules, 1962 as well as the rates of income tax deduction from payments of income chargeable under the head "Salaries" during the financial year 2022–2023 (hereinafter the Rules). Unless otherwise indicated, all sections and rules are from the Income-tax Act of 1961 and the Income-tax Rules of 1962, respectively.

- For the guidance of the concerned employers and employees, CBDT has been issued circular or instructions compiling the rates or provisions applicable u/s 192 for TDS on Salary payments to employees for AY 2023-24.