Table of Contents

FAQs ON TDS ON PURCHASE OF GOODS

Q.: Who will be liable to deduct TDS under Section 194Q?

The provisions of section 194Q apply to a buyer, who makes a total sales, gross receipts, or turnover from any business undertaken by them, exceeds Rs 10 Crores during the financial year immediately preceding the current financial year of purchasing the goods. Thus, the liability to deduct TDS shall be effective from the financial year 2021-2022 and the same shall arise, where the buyer has made a turnover of more than Rs. 10 crores in the financial year 2020-21.

Q.: What all assesses are liable to deduct TDS under this section?

The provisions of this section are applicable to all types of assesses, falling in the definition of the buyer.

Q.: What are the provisions regarding the TDS deduction?

TDS be deducted from the purchases made by a buyer where the following conditions are fulfilled –

- The buyer purchases goods from a resident supplier.

- The goods purchased are of value either in a single transaction or in aggregate during a financial year, exceeding Rs 50 lakhs.

- The buyer shall not be deducting TDS under any other provision.

Q.: At what time shall the TDS be deducted?

TDS be deducted, at the time of crediting the amount in the account of the seller or at the time of payment at the place of purchase, whichever is earlier. In case the amount is credited to any account, named as “suspense account” or by any other name, in the books of account buyer, such credit be deemed to be the credit of income to the account of the seller and the provisions under this section shall apply to it.

Q.:On what amount shall the TDS rate be applied?

As per section 194Q (1), the rate of TDS is applied only on the number of goods exceeding Rs 50 lakhs. Thus, 0.1% is applied on an amount in excess of Rs 50 lakhs.

Q.: What is the rate of TDS under section 194Q?

Such tax should be deducted only on the purchase of goods from a resident seller and the rate of TDS is 0.1% on the value or aggregate value of the goods exceeding Rs 50 Lakh in a financial year. However, the said rate shall be @ 5%, where the seller does not hold a PAN card in India.

Q.: What does section 206AB provide for?

Under the Finance Act, 2021, a special provision of TDS was inserted in the Income Tax Act, 1961. The special provision was provided by inserting Section 206AB that shall be effective from July 01, 2021. Under this new section, a higher rate of TDS is required to be deducted where the payment is made to the ‘Specified person’.

The rate of TDS to be applied in such a case would be higher of the following –

- Twice the rate determined in the relevant provision of the Act.

- Twice the rate already in force.

- @ 5%

Under this section, a specified person is termed as a person –

- Who has not filed their ITR for two years immediately preceding the year in which tax is required to be deducted and the due date of the said ITR filing has expired?

AND

- Whose aggregate amount of TDS and TCS equals Rs 50,000 or more in each of the immediately preceding two years.

Such a specified person does not include any non-resident supplier.

This section is not applicable to the following transaction –

- TDS to be deducted on salary under Section 192.

- TDS to be deducted on payment made towards balance under EPF account under section 192A.

- TDS to be deducted on the income from lottery or crossword puzzle under Section 194B.

- TDS to be deducted on income from horse races under Section 194BB.

- TDS to be deducted on income in respect of investment in securitization trust under Section 194LBC

- TDS to be deducted on cash withdrawal in excess of INR 20 Lakhs under Section 194N.

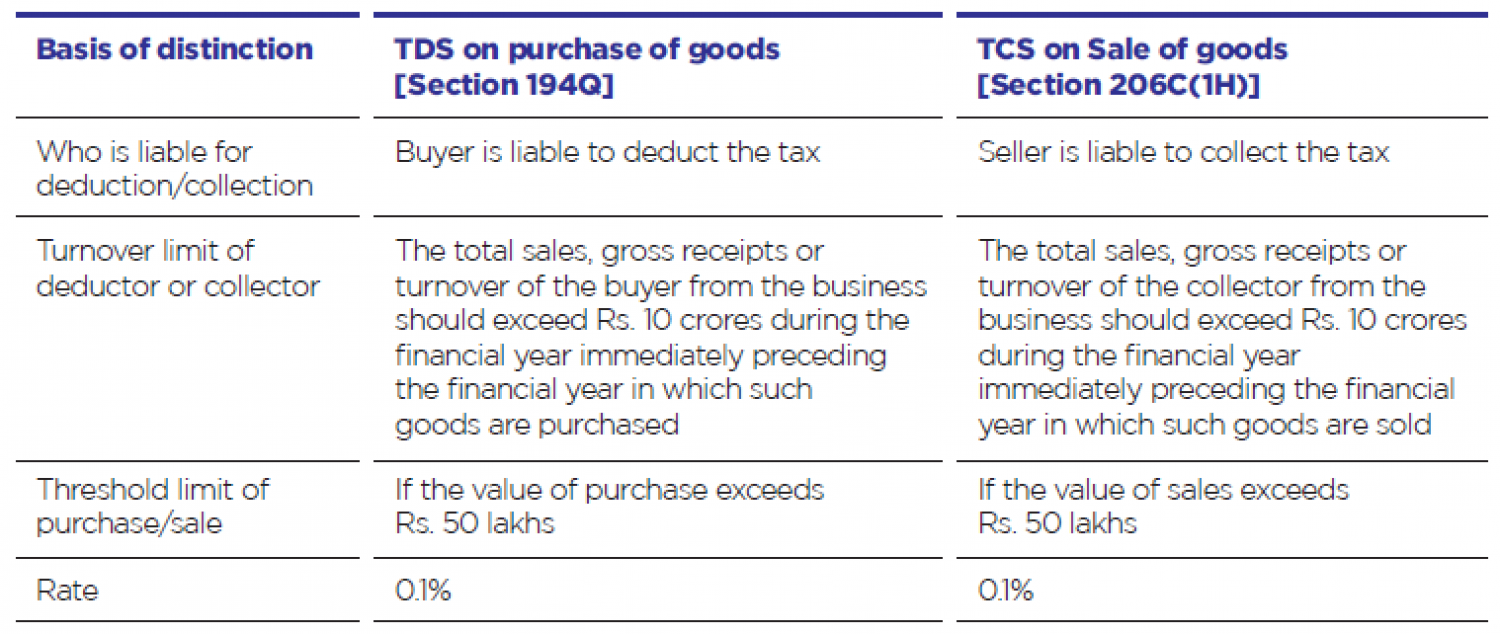

Q.: What are the provisions related to transactions where both TDS and TCS are liable to be deducted?

As per the second proviso of Section 206C(1H). where the buyer is liable to deduct TDS on the goods purchased by him from the seller and such tax has been deducted, then no tax shall be collected by the seller on the same transaction. However, section 194Q (5) provides that TDS shall not be deducted by the buyer on the goods purchased, where such goods are liable to TDS or TCS under any other section.

Thus, the buyer has the foremost obligation to deduct TDS on the goods purchased, and no TCS be collected on such transaction under Section 206C(1H)

Example

PARTICULARS |

SCENARIO 1 |

SCENARIO 2 |

SCENARIO 3 |

|

SELLER’S TURNOVER (IN CR.) |

20 |

6 |

20 |

|

BUYER’S TURNOVER (IN CR.) |

6 |

20 |

20 |

|

SALE OF GOODS (IN CR.) (A) |

2 |

2 |

2 |

|

PERSON LIABLE TO DEDUCT OR COLLECT TAX |

SELLER |

BUYER |

BUYER |

|

RATE OF TDS/TCS |

0.1% |

0.1% |

0.1% |

|

AMOUNT ON WHICH RATE IS APPLIED [AMOUNT IN EXCESS OF RS. 50,00,000 IS THE TAXABLE AMOUNT] |

0.5 [(B) – 0.5] |

1.5 [(A) – 0.5] |

1.5 [(A) – 0.5] |

|

AMOUNT OF TDS/TCS |

5,000 |

15,000 |

15,000 |

Since the buyer has the primary responsibility to deduct the TDS, they shall provide a declaration to the seller providing the information related to TDS already been deducted at the time of booking the invoice or at the time of making the advance payment, whichever is earlier.

Q.: What is the obligation of a buyer importing goods from outside India?

As discussed earlier, Section 194Q is applied where the buyer is purchasing the goods from a resident seller. Thus, the obligation to deduct TDS arises only when the payment is made to a resident seller.

However, in the case of import of goods, the seller is a non-resident, and thus, the buyer is not liable to deduct tax under this section. But, TDS under Section 195 or payment of Equalisation Levy shall be required to be deducted in respect of such transaction. It is also to be noted, that where the import involves the purchase of goods through High Seas sales transaction, the same shall not be considered as a non-resident and hence the section 194Q will be applicable.

Q.: What is the obligation in respect of goods exported from India?

The liability to deduct TDS arises where a buyer makes the payment for goods purchased, to a resident seller. However, the residential status of the buyer is not relevant under this provision. Thus, under the export of goods, the liability to deduct TDS shall be applicable on the non-resident buyer. However, it is believed to be a cumbersome exercise involving determination and satisfaction of all the conditions of section 194Q, section 206AB, availability of PAN, etc.

Q.: What does the word goods include under this section?

As per the Income-tax Act, no specific definition has been provided. But under the Sale of Goods Act, 1930 and Central Goods and Services Tax Act, 2017, the following items have been defined as goods -

|

PARTICULARS |

CGST ACT, 2017 |

CUSTOMS ACT, 1962 |

SALE OF GOODS ACT, 1930 |

|

MEANING |

EVERY KIND OF MOVABLE PROPERTY OTHER THAN SERVICES |

INCLUSIVE DEFINITION TO COVER ALL GOODS |

EVERY KIND OF MOVABLE PROPERTY |

|

INCLUDES |

ACTIONABLE CLAIMS, CROPS, GRASS, AND THINGS ATTACHED TO LAND |

VESSELS, STORES, BAGGAGE, CURRENCY, NEGOTIABLE INSTRUMENT & OTHER KIND OF MOVABLE PROPERTY |

STOCKS & SHARES, CROPS, GRASS, AND THINGS ATTACHED TO LAND |

|

EXCLUDES |

MONEY & SECURITIES |

- |

ACTIONABLE CLAIMS & MONEY |

Q.: Does any transaction in securities undertaken by means of stock exchanges be subject to TDS under this provision?

Against the confusion created about the TCS application after the Finance Act 2020, the CBDT issued a Circular No. 17 in 2020 and clarified that provisions of Section 206C(1H) shall not be applicable on the transactions in securities (and commodities) undertaken using the recognized stock exchanges or cleared and settled by means of recognized clearing corporation. Also, including the recognized stock exchanges or recognized clearing corporations located in International Financial Service Centre (IFSC).

Q.: What are TDS provisions on capital goods under this section?

As discussed above, goods involve every kind of movable property subject to certain exclusions and inclusions but do not provide any details excluding capital goods from the definition of goods. Thus, capital goods shall be liable to TDS under this section.

Q.: Does any transfer of immovable property welcome TDS deduction under section 194Q?

As discussed earlier, goods include every all kinds of movable property subject to certain exclusions and inclusions. Since the immovable property is not a kind of movable property, the same is not treated as 'goods'. Thus, the provisions of section 194Q are not applicable on the transfer of immovable property.

Q.: What are the TDS provisions in relation to electricity?

It is observed that the transaction related to electricity can be undertaken either by way of direct purchase from the company generating and providing electricity or through power exchanges. However, the CBDT clarified that any transaction in electricity, renewable energy certificates, and energy-saving certificates traded through power exchanges which are registered under Regulation 21 of the CERC, shall not be subject to TCS under the provision of Section 206C(1H).

Thus, it is believed that a similar kind of rationale shall also be applied in the case of TDS, and a similar exemption from TDS under Section 194Q be provided.

Q.: Does the TDS provisions applicable on software purchases?

It is to be noted that under the Finance Act, 2012, a clarification was made regarding the amendments in Section 9 which thereby broadened the scope of taxation of royalty. It was believed that software is considered as royalty in case of taxation aspect and since royalty is liable to TDS under Section 194J or Section 195, the same be applied in software purchases as well. Since software is subject to TDS under section 194J and 195, the same shall not be liable to TDS under 194Q.

Q.: Which section for TDS deduction will apply in the case of goods purchased from an e-commerce operator?

With the introduction of Section 194-O, the e-commerce operators were under the obligation to deduction TDS while making payments to e-commerce participants. Now since the e-commerce operator is liable to deduct TDS under section 194-O, the provisions of section 194Q shall not be applied.

Q.: Does any purchase of jewelry attract the TDS deduction under section 194Q?

It is provided that TDS liability arises where a buyer carrying on business and having the total sales, gross receipts, or turnover exceeding Rs. 10 crores during the financial year immediately preceding the current year of purchasing goods. But there is no restriction as to the goods purchased by such buyer i.e., the same is not required to be connected with the business. Thus, where a person falls within the definition of the buyer, TDS be deducted even if the purchase is not connected with the business carried on by them. Also, jewelry, being a movable property, comes in the definition of goods.

Q.: Do the expenses made in respect of the purchase of goods, constitute the value of purchase?

It is really important to determine the exact amount of the purchase value as it is relevant both for the application of section 194Q and the amount on which the tax should be deducted. Thus, where the expenses in relation to purchasing, are provided on the invoice issued by the supplier, the same should form part of the purchase value.

Q.: What is the effective date for application of TDS under section 194Q and how to determine the period for considering the Rs 50 lakhs?

It was provided in the Finance Act, 2021, that Section 194Q shall be effective from 01-07-2021. However, in the case of reckoning the period for calculation of Rs 50 lakhs limit, the same is not clear. But in respect of Section 206C(1H) which was introduced in the Finance Act, 2020, and became effective from 01-10-2020, the CBDT issued Circular No. 17, dated 29-09-2020, and clarified the number of Rs 50 lakhs be reckoned from 01-04-2020. Thus, applying the same principle, it can be understood that the section 194Q limit of Rs 50 lakhs is reckoned from 01-04-2021.

Q.: Is there any obligation to deduct TDS on advance payment received?

Under Section 194Q, TDS is required to be deducted in respect of transactions involving the purchase of goods. But nothing was mentioned regarding the time at which the goods are received or the purchase is effective. Since TDS is required to be deducted at the earlier of payment or credit of money, the same concludes that the provision is applicable even in case of purchase effective in the future.

Where the advance payment is made in respect of the future purchase of goods, the same shall be liable to TDS at the time of making the advance payment. However, it is to be noted that since section 194Q be effective from 1st July 2021, the provisions shall apply to transactions undertaken after 1st July 2021.

Q.: Where any transaction required deduction and collection of TDS and TCS both, will the TCS be collected for transactions undertaken before 1st July 2021?

Since the obligation to deduct TDS arises only after 01st July 2021, the provisions of TCS shall be applicable on the transactions undertaken before 1st July 2021.

Q.: Does any branch transfer be liable to TDS under section 194Q?

As specified under section 194Q, TDS be deducted by the buyer on making purchases from a resident seller. Thus, there is an existence of two distinct parties named 'seller' and 'buyer' which is a pre-requisite to signify a transaction as a purchase. However, the said condition of purchase is not fulfilled in the context of branch transfer, thus, the provisions of this section will not apply to branch transfers.

Q.: What treatment is provided for debit notes issued by the supplier?

Since TDS is computed and deducted on the purchase value, any adjustment made to the ledger of the seller on account of the debit note will not impact the tax to be deducted. The situation would remain the same, where after the deduction of tax, the seller repays some amount of consideration to the buyer. However, the amount of purchase value in such a situation, shall not be reduced with the amount of debt issued.

Q.: Does the purchase return be reduced from the purchase value for computing the number of TDS?

It is provided that the threshold of Rs 50 lakh shall be computed on the amount paid as the consideration for ‘purchase’ of goods and thus, where any purchase return is made or the goods are returned to the seller, the same be reduced from the value of purchase. However, such purchase returns are required to be made on or before the point of tax deduction as the threshold of Rs 50 lakh is checked at the point of time when the liability to deduct at source arises.

Q.: What is the application of TDS on works contract, for which a single invoice is issued?

Works contract involves the supply of goods, labor, and other services which is termed as the supply of service under the GST Regulations. However, where a single invoice is issued, there is a possibility that it does not provide for bifurcation of the value of goods and services. Thus, if the said invoice is liable to TDS under any other section in respect of the full whole amount, then the provisions under 194Q are not applicable.

Q.: What is the basis of aggregation in terms of turnover of business having multiple units?

It is provided that the seller shall aggregate the threshold limit of Rs. 50 lakhs based on all the businesses registered under a single PAN. Thus, in case a seller has different units registered under the same PAN, the amount paid or payable to all such units shall be aggregated to compute the limit of Rs. 50 Lakhs.

Q.: Does the application for a lower TDS certificate allowed under section 194Q?

It is to be noted that an assessee is allowed to make an application to the Assessing Officer regarding the issue of a certificate for deduction of tax at lower rates, where TDS is deducted under sections 194C, 194J, 194I, etc. The certificate is issued where the existing and estimated tax liability of the assessee justifies that the assessee is benefitted from the deduction of tax at a lower rate.

However, under the Finance Act, 2021, the said benefit shall not be provided in respect of transactions covered under Section 194Q. Thus, the assessee is not allowed to apply to the assessing officer to issue a certificate for a lower tax deduction or to file a declaration for nil deduction in relation to transactions covered under section 194Q.

Q.: What is the procedure for making TDS payments under this section?

It is provided that any corporate assessee and other assesses required to make payment of TDS, be made electronically through an internet banking facility or by way of debit cards. To deposit the amount of tax, the deductor is required to fill Challan No. ITNS 281. Also, any other deductors can deposit the amount of tax so deducted with any branch of the RBI or the State Bank of India, or any authorized bank.

Q.: What is the due date for depositing such a TDS amount with the government?

TYPE OF DEDUCTOR |

MODE OF PAYMENT |

DUE DATE |

||

|

OFFICE OF GOVERNMENT |

WITHOUT INCOME-TAX CHALLAN |

ON THE DAY ON WHICH TAX IS DEDUCTED |

||

|

WITH INCOME-TAX CHALLAN ITNS 281 |

WITHIN 7 DAYS FROM THE END OF THE MONTH IN WHICH TAX IS DEDUCTED |

|||

|

OTHER DEDUCTORS |

WITH INCOME-TAX CHALLAN ITNS 281 |

|

Q.: What is the consequence of non-compliance under section 194Q?

Under section 40a(ia) of Income Tax Act 1961, where any person is required to deduct TDS but does not comply with it, shall be disallowed to deduct the amount of TDS in profit and loss account, by 30% of the value of the transaction. Thus, where the buyer fails to deduct and deposit TDS as applicable then 30% of the amount of expenditure be disallowed, on which TDS was to be deducted and deposited. Apart from the disallowance, the buyer shall also be liable to pay interest @ 1% for every month or part of the failure to deduct tax. While in case the buyer fails to deposit the amount of TDS, the same shall be liable to pay interest @ 1.5% for every month or part of the failure of deposit.

Q.: Will the buyer be treated as an assessee in default, in case the seller pays the tax due on the income declared in their ITR?

As per Section 201 of the Income-tax Act, where a deductor fails to deduct tax at source, shall not be deemed to be in default if the deductee has admitted such amount and paid the same while computing their income in the return. In this case, the deductor shall obtain a certificate from a Chartered Accountant in Form No. 26A and submit it electronically.

Thus, the buyer will not be termed as an assessee-in-default where the seller considers the TDS on purchase amount and make the payment of same while computing his income.

Q.: Give a detailed due date for TDS return filing?

As per the provisions, the following due dates have been prescribed for TDS return filing -

PERIOD |

DUE DATE |

|

APRIL- JUNE |

31ST JULY OF THE FINANCIAL YEAR |

|

JULY- SEPTEMBER |

31ST OCTOBER OF THE FINANCIAL YEAR |

|

OCTOBER- DECEMBER |

31ST JANUARY OF THE FINANCIAL YEAR |

|

JANUARY- MARCH |

31ST MAY AFTER THE END OF THE FINANCIAL YEAR |

Q.: What is the penalty in respect of non-filing of TDS return?

In case the deductor fails to file their TDS return on and before the due date, shall be liable to a late filing fee under Section 234E. The late fee is levied @ Rs. 200 per day of default. However, the amount shall be subject to a maximum of the total amount deductible or collectible.

In case the person fails to file their TDS, return, or does not file it on and before the due dates, the same shall be liable to pay penalty under Section 271H. The minimum amount of penalty is Rs. 10,000 which can be increased to a maximum of Rs. 1,00,000.

Q.: What consequences are faced by an assessee in default as per Income Tax Act, 1961?

The following consequences are faced by an assessee in default –

- Simple interest is levied under section 220 @ 1% per month or part for the period of default, payable on the amount not paid.

- The penalty is imposed under section 221 where the Assessing Officer may direct impose a penalty to be paid that shall not exceed the amount of tax in arrears.

- Recovery under sections 222, 227, 229, and 232 be initiated, where recovery is made against the assessee, apart from penalty and interest.

- Prosecution Proceedings be also initiated leading to arrest under Chapter XXII of the Income Tax Act, 1961, based on the nature and gravity of the default. Where a person fails to pay to the credit of the Central Government, the same be liable to rigorous imprisonment for a term of not less than three months, and the same be extended to seven years along with fine, as prescribed under Section 276BB.

Q.: At what time does the seller’s responsibility to collect tax arises?

It is provided that the primary responsibility to deduct and deposit if TDS lies on the buyer, however in case the buyer fails to deduct tax, the onus to deposit the tax lies with the seller. The seller will need to collect the tax from the amount of consideration received. Where the buyer does not deduct TDS at the point of sale, the seller can obtain a declaration from the buyer regarding the status of tax deduction at the source.