INCOME TAX

Foreign Assets of Small Taxpayers (Disclosure Scheme 2026)

RJA 21 Feb, 2026

FAST DS, 2026 : Foreign Assets of Small Taxpayers (Disclosure Scheme 2026) A one time compliance window under the Finance Bill, 2026. FAST DS (Foreign Assets of Small Taxpayers Disclosure Scheme), 2026, is a one‑time, six‑month voluntary disclosure window announced in the Union Budget 2026 and introduced through the Finance Bill, 2026. ...

INCOME TAX

Tax Snapshot of Union Budget 2026

RJA 19 Feb, 2026

Ease of Doing Business & Ease of Living through Union Budget 2026 1. Reliefs & Rationalisation Income tax Insurance compensation received by a natural person from a motor accident tribunal is fully exempt from income tax, and no TDS will apply. Due date for filing revised returns shifted from 31 December to 31 March (...

Goods and Services Tax

GST on Interest Income applicability Business Owner Must Know

RJA 19 Feb, 2026

GST on Interest Income applicability Business Owner Must Know Understanding Goods and Services Tax implications on interest income are crucial for businesses, professionals, and tax consultants. While many assume interest is completely exempt, the reality depends on the nature of the transaction. Interest income under Goods and Services Tax is ...

Chartered Accountants

ICAI UDIN Directorate – New Validation & Audit Ceiling

RJA 17 Feb, 2026

UDIN Directorate Update: Field-Level Validation & 60 Tax Audit Ceiling (Effective 1 April 2026) The Unique Document Identification Number Directorate of the Institute of Chartered Accountants of India has announced important changes relating to UDIN generation under the “GST and Tax Audit” category. At its 442nd Council Meeting (May 2025), the the ...

OTHERS

Individuals OVD for Address Verification IFSCA Guidelines

RJA 17 Feb, 2026

Officially Valid Documents for Address Verification of Individuals under IFSCA (AML/CFT and KYC) Guidelines, 2022 The International Financial Services Centres Authority has issued the IFSCA (AML, CFT, and KYC) Guidelines, 2022, prescribing detailed anti-money laundering and combating the financing of terrorism requirements for regulated entities operating in International Financial Services Centres ...

INCOME TAX

New Draft Income Tax Rules, 2026 – Objective, Areas, Highlights,

RJA 16 Feb, 2026

New Draft Income Tax Rules, 2026 – Objective, Areas, Highlights, The Central Board of Direct Taxes has proposed significant reforms under the Draft Income Tax Rules, 2026, to simplify compliance, enhance transparency, and modernize tax administration. Objective of the New Draft Income Tax Rules, 2026 : The proposed changes aim to simplify complex tax ...

GST Consultancy

GST on Commercial Rent from Unregistered Landlord – RCM Position

RJA 13 Feb, 2026

GST on Commercial Rent from Unregistered Landlord—RCM Position When Does RCM Apply? GST under the Reverse Charge Mechanism (RCM) applies when the property is commercial, the tenant is a registered person, and the landlord is unregistered. Renting of immovable property (other than residential dwelling for personal use)&...

GST Filling

GST Amendments with Implications under Finance Bill 2026

RJA 12 Feb, 2026

GST Amendments with Implications under Finance Bill 2026 The Finance Bill 2026 introduces several progressive changes to the GST framework, aimed at reducing litigation, simplifying compliance, and aligning GST law with commercial realities. Below is a structured and comprehensive explanation of each amendment along with its practical impact on businesses. Post‑Supply ...

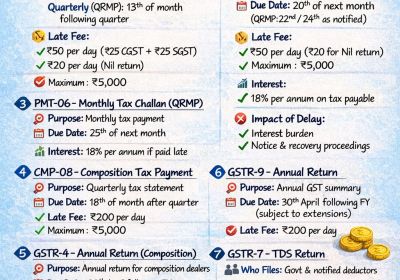

GST Consultancy

Guide on Mandatory GST Forms – Due Dates, Late Fees & Penalties

RJA 11 Feb, 2026

Guide on Mandatory GST Forms – Due Dates, Late Fees & Penalties Goods and Services Tax compliance is non-negotiable. Missing deadlines can lead to late fees, interest, ITC blockage, notices, and even cancellation of Goods and Services Tax registration. Goods and Services Tax Taxpayer Always reconcile GSTR-2B before ...

INCOME TAX

New Income Tax Slab Rate for FY 2026‑27 & AY 2027‑28 (Budget 2026)

RJA 01 Feb, 2026

New Income Tax Slab Rate for FY 2026 2027 & AY 2027 2028 (Budget 2026) The Finance Minister’s announcement marks one of the biggest overhauls of India’s tax framework in decades. Following are some of the key highlights from the budget speech Income Tax Slab Rates (Default New Regime – FY 2026 2027) ...

Goods and Services Tax

GST Notice Trap: Section 160(2) and the Point of No Return

RJA 31 Jan, 2026

GST Notice Trap: Section 160(2) of the CGST Act and the Point of No Return Section 160(2) of the CGST Act creates a critical but silent trap for taxpayers who receive any GST notice with procedural defects. If a GST notice, order, or communication is made available on the GST portal, ...

GST Filling

Overview of TDS & TCS Under GST

RJA 29 Jan, 2026

QUICK CLARITY ON TAX DEDUCTED AT SOURCE & TAX COLLECTED AT SOURCE UNDER GST: Many GST mismatches don’t happen due to wrong tax rates; they happen because TDS and TCS are misunderstood. A clear understanding of tax deducted at source & TCS under GST helps avoid unnecessary mismatches ...

NBFC

Understanding FIU‑IND Reporting Requirements for Regulated Entities

RJA 29 Jan, 2026

Understanding FIU IND Reporting Requirements for Regulated Entities All Regulated Entities (REs) in India are mandated under the Prevention of Money Laundering Act (PMLA) to file specific reports with the Financial Intelligence Unit–India (FIU IND) for designated transactions. These reports play a crucial role in helping FIU‑IND ...

INCOME TAX

Comparative Summary on 44AD / 44ADA / 44AE vs. Section 58 (Income-tax Act, 2025)

RJA 28 Jan, 2026

Comparative Chart: 44AD / 44ADA / 44AE vs. Section 58 (Income Tax Act, 2025) Conceptual Understanding “Presumptive “Taxation Reimagined” Presumptive Taxation Reimagined Section 58—Income Tax Act, 2025 Section 58 of the Income Tax Act, 2025, marks a structural shift—not merely a rate revision—in the presumptive taxation framework. Under the ...

INCOME TAX

Best Judgment Assessment under Income-tax Act 1961 & Income-tax Act, 2025

RJA 27 Jan, 2026

Summary of Changes in Best Judgment Assessment from Income Tax Act, 1961 to Income Tax Act, 2025 Applicability of Best Judgment Assessment under Section 144 Section 144 of the Income-tax Act, 1961, deals with what is commonly known as a best judgment assessment. This provision is invoked when a taxpayer fails to ...

Goods and Services Tax

Assessment on a Deceased Person Is Void: High Courts

RJA 26 Jan, 2026

Assessment on a Deceased Person Is Void: High Courts Reiterate Limits of GST Jurisdiction Case 1: Proceedings Against Deceased Proprietor – Assessment Quashed Facts of the Case Late B. Kameswara Rao was a registered person under GST, carrying on business as M/s Aravinda Enterprises. He passed away on 21.12.2021. The business ...

Chartered Accountants

ICAI NOW ALLOWS ADVERTISING: BIG UPDATE FOR CA FIRMS

RJA 26 Jan, 2026

ICAI NOW ALLOWS ADVERTISING: BIG UPDATE FOR CA FIRMS In a landmark reform, the Institute of Chartered Accountants of India has issued a press release dated 12 December 2025, announcing a major relaxation in the Code of Ethics. The Institute of Chartered Accountants of India has issued a press release dated 12 December 2025, ...

Chartered Accountants

Overview on AI (Artificial Intelligence) and Tax Compliance in India

RJA 19 Jan, 2026

Transforming Enforcement, Compliance, and Taxpayer Services India’s tax administration is undergoing a structural transformation, driven by Artificial Intelligence (AI), Big Data, and advanced analytics. The article explores the evolution of India’s digital tax ecosystem, current AI implementations by CBDT and CBIC, global benchmarks, and future policy ...

Outsourcing Services

Mandatory compliances applicable to UAE companies at a Glance

RJA 27 Dec, 2025

Mandatory compliances applicable to UAE companies at a Glance Mandatory UAE Compliances Corporate Tax Registration Deadline: Corporate Tax Registration is compulsory to be applied for within 90 days of the license issuance. In case, we fail to apply within the stipulated time, then there is a heavy penalty of AED 10,000. ...

OTHERS

NSE Trading Holidays 2026 (CM & F&O Segments)

RJA 26 Dec, 2025

NSE Trading Holidays 2026 (CM & F&O Segments) Market is closed on these weekdays: Date Day Holiday 26 Jan 2026 Monday Republic Day 3 Mar 2026 Tuesday Holi 26 Mar 2026 Thursday Shri Ram Navami 31 Mar 2026 Tuesday Shri Mahavir Jayanti 3 Apr 2026 Friday Good Friday 14 Apr 2026 Tuesday Dr. B. R. Ambedkar Jayanti 1 May 2026 Friday Maharashtra Day 28 ...

INCOME TAX

CBDT issued FAQs on Income Tax Bill 2025 with Key Highlights & Change

RJA 25 Dec, 2025

CBDT issued FAQs on the Income Tax Bill, 2025, & key highlights and major changes: The CBDT FAQs are designed to explain and interpret provisions of the Income Tax Bill, 2025, especially where language/definitions are simplified, changes affect recurring compliance, procedural aspects are clarified, and ambiguities that historically caused disputes are ...

INCOME TAX

Top Personal Income Tax Rates Around the World (2025)

RJA 25 Dec, 2025

Top Personal Income Tax Rates Around the World (2025) India at 39% falls in the mid-range category, similar to New Zealand and Colombia. Nordic countries dominate the highest tax bracket (Finland, Denmark, Sweden). Tax havens and Gulf countries have zero personal income tax. & Global trend is Developed nations generally have higher ...

NRI

Income Tax Dept. is Closely Tracking These 10 Transactions

RJA 25 Dec, 2025

Income Tax Department is Closely Tracking These 10 Transactions Tax dept. has significantly strengthened its surveillance mechanisms to curb tax evasion and ensure transparency in financial dealings. If you engage in high-value transactions, it’s crucial to understand the reporting norms and thresholds that can trigger scrutiny. Staying informed helps ...

IBC

Lok Sabha Unveils Game-Changing IBC Amendment Recommendation

RJA 18 Dec, 2025

Lok Sabha Select Committee Unveils Game-Changing IBC Amendment Recommendations The IBC (Amendment) Bill, 2025, introduced in Lok Sabha on August 12, 2025, seeks to overhaul the Insolvency and Bankruptcy Code, 2016, by addressing delays, judicial ambiguities, and creditor recovery issues through measures like mandatory admission on default proof and clarified security interests. The Lok ...