OTHERS

RISE IN ETHER: A THREAT TO BITCOIN

RJA 01 May, 2021

RISE IN ETHER: A THREAT TO BITCOIN Ether price went beyond $4,000 on 10th May, Monday, thereby hitting its all-time high. Though it is the second-largest cryptocurrency, this new record is seen as an out beat to Bitcoin for the world’s largest cryptocurrency. Ether runs on the ...

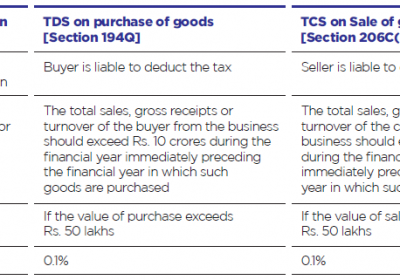

TDS

FAQs ON TDS ON PURCHASE OF GOODS

RJA 01 May, 2021

FAQs ON TDS ON PURCHASE OF GOODS Q.: Who will be liable to deduct TDS under Section 194Q? The provisions of section 194Q apply to a buyer, who makes a total sales, gross receipts, or turnover from any business undertaken by them, exceeds Rs 10 Crores during the financial year immediately ...

Goods and Services Tax

SUMMARY OF PENALTY ON DEFAULTS UNDER THE GST LAW

RJA 01 May, 2021

Summary of Penalty on Defaults under the GST Law The GST law specifies the types of violations that can be committed and the penalties that will be imposed in each case. This is critical information for all business owners, accountants, and tax professionals, as even a minor error can ...

INCOME TAX

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT

RJA 28 Apr, 2021

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT Exempted Income tax income under the Income Tax Act 1961 like interest on PPF account etc need not be reported. The CBDT published detailed guidelines for reporting information on taxpayers' interest & dividend income from banks and companies. The “specified reporting ...

GST Registration

Complete Overview of GST Registration

RJA 25 Apr, 2021

PERSON LIABLE FOR GST REGISTRATION OR NOT Provisions on persons responsible for registering for GST are provided for. Under Section 22 & Section 24 the Central Goods and Service Tax Act (CGST) 2017, are provide and made the provision for GST registration explained by this article. Personal persons registered under Pre-GST law ...

INCOME TAX

Highlights of Faceless Penalty Scheme, 2021.- E-penalty or faceless penalty Scheme, 2021

RJA 22 Apr, 2021

Highlights of Faceless Penalty Scheme, 2021.- E-penalty or faceless penalty Scheme, 2021 CBDT Through Notification No. 03/2021 dated 12.01.2021 - has notified Faceless Penalty Scheme, 2021. to provide for the online imposition of e-penalty or faceless penalty by the Tax Authorities. This scheme shall become effective with effect from 13.01.2021. Salient features Faceless Penalty Scheme, 2021 ...

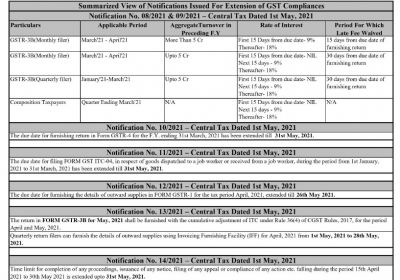

GST Filling

Extension of the due dates for different GST returns in April-2021

RJA 22 Apr, 2021

Extension of the due dates for different GST returns in April-2021 All India Traders' Confederation has demanded the enhancement in April-2021 of due dates in respect of the income tax and GST compliance. All the following compliance measures may lead to interest and late fees if not complied in time. ...

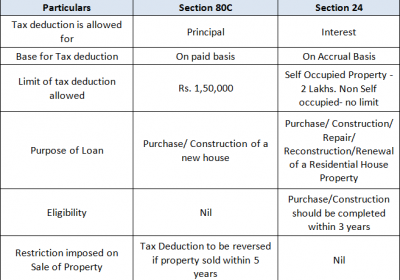

Income tax return

Can HRA & Home Loan Benefits be claimed when ITR is filing?

RJA 22 Apr, 2021

Can HRA & Home Loan Benefits be claimed when ITR is filing? Manny Employees earning a monthly income for both the House Rent Allocation (HRA) and home loans are often confused that they claim the income tax benefit on ITR furnishings. Based on rent, but payment for the domestic loan. ...

INCOME TAX

Document Required For Permanent Account Number (PAN) application

RJA 21 Apr, 2021

Document Required For Permanent Account Number (PAN) application Proof of Identity- Copy of following : Ration card having a photograph of the applicant; or Aadhaar Card issued by the Unique Identification Authority of India; or Elector’s photo identity card; or Pensioner card having a photograph of the applicant; or ...

One Person Company

WITHDRAWAL OR DEATH EITHER NOMINEE OR ITS MEMBER OF A ONE-PERSON COMPANY

RJA 08 Apr, 2021

WITHDRAWAL OR DEATH EITHER NOMINEE OR ITS MEMBER OF A ONE-PERSON COMPANY A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to the one-person company. NOMINEE OF A ...

One Person Company

CONVERSION OF ONE PERSON COMPANY INTO PUBLIC OR PRIVATE COMPANY OR VICE - VERSA

RJA 08 Apr, 2021

CONVERSION OF ONE PERSON COMPANY INTO PUBLIC OR PRIVATE COMPANY OR VICE - VERSA A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to one person company. CONVERSION ...

One Person Company

DOCUMENTS REQUIRED CLOSURE OF ONE PERSON COMPANY.

RJA 08 Apr, 2021

CLOSURE OF ONE-PERSON COMPANY A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to the one-person company. If one person company is inoperative for more than one year ...

FCRA

MHA extends FCRA registration certificates validity of NGOs till 31.05.2021

RJA 03 Apr, 2021

Ministry of Home Affairs extends FCRA registration certificates validity of NGOs till 31.05.2021 The Ministry of Home Affairs said that Non-governmental organization’s whose registration in accordance with the 2010 Foreign Contributions Act expired between Sept 29, 2020 — when notifying fresh amendments to the Act were filed and May 31, 2021, will now receive ...

FCRA

Frequently Asked Question on Fcra Registration

RJA 01 Apr, 2021

Frequently Asked Question on Fcra Registration Q.: What is FCRA stand for? FCRA stands for Foreign Contribution Regulation Act. Q.: Is the Reserve Bank of India (RBI) is governed by the FCRA? The FCRA is an internal security law that is not governed by the RBI. It is ...

Business Setup in India

Planning for start a Private Limited company ?

RJA 28 Mar, 2021

Business setting-up in India It is much easier to set up a business in India nowadays. Starting a business in India now takes less time than it did years ago. A company can be registered in any part of India in just over 5 weeks. The time spent on company registration ...

ROC Compliance

E-KYC, Aadhaar, Linking required for Existing GST Taxpayers

RJA 15 Mar, 2021

GST Portal allowed e-KYC/ Aadhaar/Linking for Present GST Taxpayers The GST Portal has allowed Aadhaar Authentication/E-KYC on the GST Portal for Existing Taxpayers. Performance for Aadhaar Authentication and e-KYC where Aadhaar is not accessible has been dispatched to GST Common Portal w.e.f. 6 January 2021 for existing taxpayers. ...

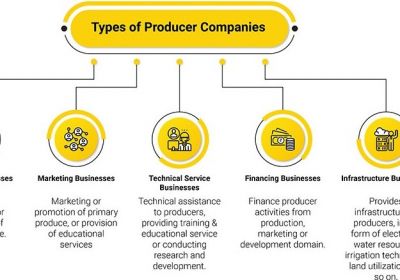

COMPANY LAW

SHARE CAPITAL AND ACCOUNT, AUDIT & OTHER FEATURE OF A PRODUCER COMPANY

RJA 07 Mar, 2021

Normal characteristics of Producer Companies: Producer Company is always a Pvt Ltd company. The name of the Company shall end with “Producer Company Limited” which shall be stated in the MOA of Producer Company. There must be a minimum of Five directors & No need for Minimum Capital ...

COMPANY LAW

Annual Filing & Compliance of a Producer Company

RJA 07 Mar, 2021

Annual Filing & Compliance of a Producer Company A Producer Company is a business registered under the Company Act 2013 with the aim of producing, harvesting, promoting mutuality techniques, etc. Like other registered companies, a producer company also needs to file compliance on a fair and annual basis in order to ...

TDS

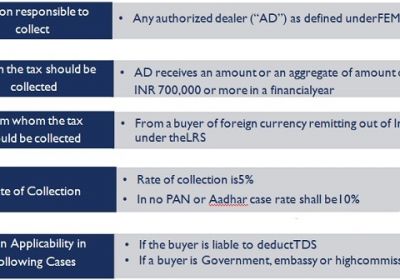

TCS on Tax Foreign Remittance Transactions under LRS

RJA 01 Mar, 2021

TCS on Tax Foreign Remittance Transactions under LRS Forex Facility for Residents – $250,000 per FY Under Liberalised Remittance Scheme (LRS) Scheme of LRS The Foreign Exchange Management Act, 1999 (FEMA) limits forex transactions to the limit permitted by its regulations. RBI Regulations apply to the LRS. Indian residents are permitted ...

GST Compliance

Option to upload e-KYC documents or authenticate your Aadhar card On the GST Portal

RJA 01 Mar, 2021

Now you have the option to upload e-KYC documents or authenticate your Aadhar card On the GST Portal, What is Aadhaar Authentication, and how does it work? Aadhaar authentication is the process of submitting the Aadhaar number, along with other biometric details, to the Central Identities Data Repository (CIDR) for ...

OTHERS

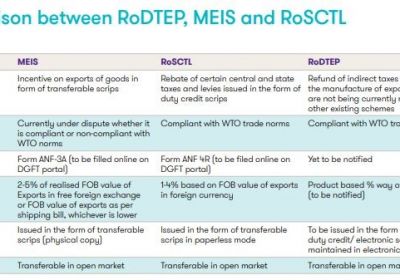

Basics of RoDTEP Scheme – Remission of Duties or Taxes on Export

RJA 19 Feb, 2021

RoDTEP Scheme: The Govt of India announced the Remission of Duties & Taxes on Export Product (RoDTEP) Scheme, which is a combination of 2 existing GOI schemes, including MEIS (Merchandise Export from India Scheme) and RoSCTL (Rebate of State & Central Taxes and Levies Scheme) to ensure compatibility with the World ...

OTHERS

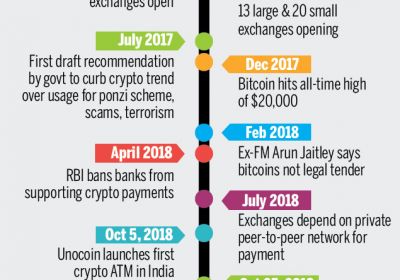

Govt has introduced legislation to ban crypto-currency in India

RJA 13 Feb, 2021

What's Cryptocurrencies-Bitcoin? Bitcoin is a cryptocurrency invented by a few unknown groups of people. You can buy or sell bitcoins on a bitcoin exchange. The currency is not controlled by any bank or government. Blockchain is the leading technique behind bitcoin and other cryptocurrencies. It's a public ...

TDS

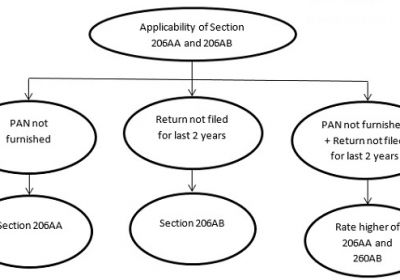

Higher Rates TDS/TCS on non filed the ITR on time.

RJA 07 Feb, 2021

Income Tax Return filing: Applicable of at higher rates TDS/TCS on non filed the ITR on time (New Section 206AB and Section 206CCA) A higher rate of TDS for Non-Filer of Income Tax Return has been implemented in Budget 2021. The Proposed Section: 1. Section 206AB was proposed in ...

GST Filling

No GST Audit needed in Budget 2021 : latest Update

RJA 07 Feb, 2021

No GST Audit Required in New Budget 2021 On 1 February 2021, Finance Minister Nirmala Sitharaman delivered the 2021 paperless budget. FM also announced several improvements to the tax system on goods and services to target helping small and medium businesses to overcome pandemic disruptions. Relevant GST changes carried out in the ...