Table of Contents

Extension of the due dates for different GST returns in April-2021

All India Traders' Confederation has demanded the enhancement in April-2021 of due dates in respect of the income tax and GST compliance. All the following compliance measures may lead to interest and late fees if not complied in time. It is stated that the late fee should be permanently exempted, taking into consideration Covid-19 and the resulting delay in compliance by trade not deliberately until the conditions in the region becomes normal and the interest should, if not exempted, be decreased.

Statutory dates in April 2021 for traders to file their various GST returns. In view of the sharp rise in COVID cases in many States, various rigorous precautionary measures, such as the night curfew, lockdowns, containment zones, etc. have been taken by the respective State governments to limit the movement of people in their States to limit Covid 19 spread. Many taxpayers are not able to compile and provide information for the production of their GST returns on or before the due date during these challenging and frustrating times so that delayed conformities to part of the trade are not intended,

The late payment must be permanently waived until such time as the scenario is normal in the nation and all subsequent due dates are demanded to be increased to the next 3 months

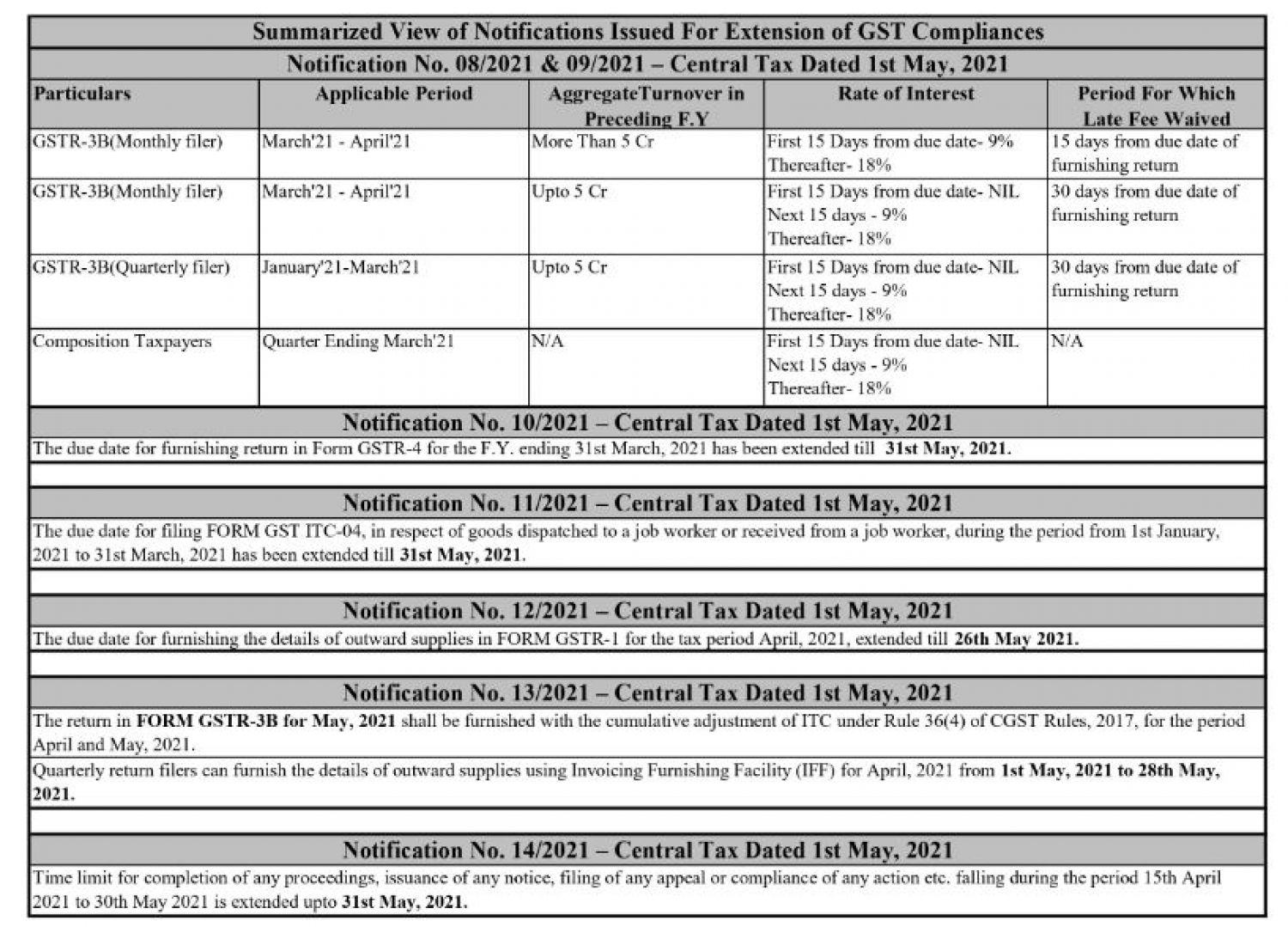

New Update on 1 May 2021

Summarized View of GST Notifications Issued For Extension of GST Compliances on 1 May 2021

- Income tax Returns for Assessment year 2021-22 (Other Than Tax Audit & of Corporations) can be filed until September 30th, 2021.

- The deadline for submitting an income tax audit report for FY 2021-22 is October 31, 2021.

- Tax Deducted at Source (TDS) Returns for the fourth quarter of the fiscal year 2020-21 can be filed without any additional fees until June 30, 2021.

- Income tax returns for the Assessment year 2021-22 can be filed up to the 30th of November 2021 in the case of a tax audit and for companies.

- The FY 2020-21 Statement of Financial Transactions (SFT) can now be filed until June 30, 2021.

For regular taxpayers (filing returns on a monthly or quarterly basis) and composition taxpayers, interest and late fees are waived.

Waiver of late fee & interest for composition taxpayers and normal taxpayers (filing the return on a monthly or quarterly basis) (Part1)

Normal (Monthly / Quarterly) and composition taxpayers have been exempted from paying interest and/or late fees for the tax periods of March, April, and May 2021, by Government has granted via Notification Nos. 18/2021 and 19/2021, both dated 1st June 2021. The details are concluded as follows:

A. Relaxation to normal taxpayers in the filing of monthly return in Form GSTR-3B

|

Sl.No. |

Tax Period |

Class of taxpayer |

Due date of filing |

Reduced Rate of Interest |

Waiver of late fee till |

||

|

First 15 days from the due date |

Next 45 days |

From 61st day onwards |

|||||

|

1 |

March 2021 |

> Rs. 5 Cr. |

20th April |

9% |

18% |

18% |

5th May 2021 |

|

Up to Rs. 5 Cr |

20th April |

Nil |

9% |

18% |

19th June 2021 |

||

B.

|

Sl.No. |

Tax Period |

Class of taxpayer |

Due date of filing |

Reduced Rate of Interest |

Waiver of late fee till |

||

|

First 15 days from the due date |

Next 30 days |

From 46th day onwards |

|||||

|

1 |

April 2021 |

> Rs. 5 Cr. |

20th May |

9% |

18% |

18% |

4th June 2021 |

|

Up to Rs. 5 Cr |

20th May |

Nil |

9% |

18% |

4th July 2021 |

||

C.

|

Sl.No. |

Tax Period |

Class of taxpayer |

Due date of filing |

Reduced Rate of Interest |

Waiver of late fee till |

||

|

First 15 days from the due date |

Next 15 days |

From 31st day onwards |

|||||

|

1 |

May 2021 |

> Rs. 5 Cr. |

20th June |

9% |

18% |

18% |

5th July 2021 |

|

Up to Rs. 5 Cr |

20th June |

Nil |

9% |

18% |

20th July 2021 |

||

Waiver of late fee & interest for composition taxpayers and normal taxpayers (filing return on monthly or quarterly basis) (Part2)

the government waived interest and/or late fees for normal (monthly / quarterly) and composition taxpayers for the tax periods of March, April, and May 2021. via Notification Nos. 18/2021 and 19/2021, both dtd. 1st June, 2021,

A. Relaxation in the filing of Form GSTR-3B (Quarterly) by Taxpayers under QRMP Scheme

|

Sl.No. |

Tax Period |

Form Type |

Due date of filing |

Reduced Rate of Interest |

Waiver of late fee till |

||

|

First 15 days from the due date |

Next 45 days |

From 61st day onwards |

|||||

|

1 |

March 2021 |

Form GSTR-3B (Quarterly) |

22/24th April 2021,(Group A/B) |

Nil |

9% |

18% |

21/ 23rd June 2021,(Group A/B) |

B.

|

Sl.No. |

Tax Period |

Form Type |

Due date of filing |

Reduced Rate of Interest |

Waiver of late fee till |

||

|

First 15 days from the due date |

Next 30 days |

From 46th day onwards |

|||||

|

1 |

April 2021 |

Form GST PMT-06 |

25th May 2021 |

Nil |

9% |

18% |

NA |

C.

|

Sl.No. |

Tax Period |

Form Type |

Due date of filing |

Reduced Rate of Interest |

Waiver of late fee till |

||

|

First 15 days from the due date |

Next 15 days |

From 31st day onwards |

|||||

|

1 |

May 2021 |

Form GST PMT-06 |

25th June 2021 |

Nil |

9% |

18% |

NA |

C. Relaxations in filing Form CMP-08 for Composition Taxpayers:

|

Sl.No. |

Tax Period |

Due date of filing |

Reduced Rate of Interest |

Waiver of late fee till |

||

|

First 15 days from the due date |

Next 45 days |

From 61st day onwards |

||||

|

1 |

March 2021 (Qtr.) |

18th April 2021 |

Nil |

9% |

18% |

NA |