Table of Contents

RoDTEP Scheme:

The Govt of India announced the Remission of Duties & Taxes on Export Product (RoDTEP) Scheme, which is a combination of 2 existing GOI schemes, including MEIS (Merchandise Export from India Scheme) and RoSCTL (Rebate of State & Central Taxes and Levies Scheme) to ensure compatibility with the World Trade Organization (WTO). The scheme was implemented with effect from 1 January 2021 and was created to replace the current MEIS (Merchandise Exports from India Scheme).

For RoDTEP Press Release issued by the Government (Click here to download)

This scheme could boost domestic industry and Indian exports providing Indian producers with a fair competition in the global market so that domestic taxes/duties are not exported. Further, end-to-end digitalization would be introduced by this Scheme.

The RoDTEP scheme would also refund the embedded duties/taxes to exporters that have not been reimbursed/refunded so far. e For e.g., VAT on fuel used in transport, Mandi tax, electricity duty used in production, etc. Therefore, Reimbursement would be covered under the RoDTEP Scheme. The reimbursement would be claimed as a percentage of the Freight on Board (FOB) value of exports.

The detailed procedure to be followed for shipment by exporters under the RoDTEP Scheme w.e.f. 1.1.2021 (click here to download )

The Need for RoDTEP Scheme/Reason behind the introduction of RoDTEP Scheme

The US criticized India's key export subsidy schemes in the World Trade Organization (WTO), arguing that they were affecting American workers. A WTO dispute panel ruled against India that the export subsidy schemes offered by the Government of India violated the provisions of the standards of the trade body. The panel also recommended that the export subsidy schemes be withdrawn. This has led to the introduction of the RoDTEP Scheme to ensure that India remains consistent with the WTO.

Some of the export subsidy schemes that were recommended to be withdrawn were as follows:—

- Merchandise Exports from Indian Scheme

- Export Oriented Units Scheme

- Electronics Hardware Technology Parks Scheme

- Scheme for Bio-Parks of Technology

- Capital Goods System of Export Promotion

- Scheme for Special Economic Zones (SEZ)

- Duty-Free Imports Program for Exporters

Some Key Features of the RoDTEP Scheme

-

Reimburse of duties and taxes that were previously non-refundable

Under this RoDTEP scheme, Mandi fee, VAT, Coal cessation, Central Excise duty on fuel etc. will now be reimbursed. All MEIS and RoSTCL (Rebate of State and Central Taxes and Levies) elements are now under the responsibility of the RoDTEP Scheme.

-

The Automated Credit System

The refund will be represented in the form of electronic scripts that are transferable. These duty credits will maintain and monitor via an electronic ledger.

-

Fast verification via digital technology

The acceptance occurs at a much faster rate with the introduction of the digital platform. To ensure the speed and accuracy of transaction processing, the verification of exporter records will be achieved with the help of an IT-based risk management system.

-

Multi-Sector Strategy

Under RoDTEP, all industries are covered, including the textile industry, in order to ensure consistency across all areas. In addition, a dedicated committee will be formed to decide on the sequence of implementation of the scheme across the different sectors, what degree of benefits to be provided to each sector, and other related issues.

For RoDTEP Committee Press Release issued by the Government (Click here to download )

The ICEGATE (Indian Customs Electronic Gateway) portal will contain the details of the exporter's credits. At the port, the exporter must specify in the shipping bill the data related to the RoDTEP benefit claim with respect to a particular export item and generate a credit script for it. These credit scripts are then used for the payment of basic customs duties or may be transferred to other importers, as the case may be.

Basic provisions under RoDTEP are as follows:

- The exporter shall make a claim for RoDTEP in the shipping bill for the benefit of the scheme by making a declaration.

- Once an export general manifest (EGM) has been filed, the claim will generate by Customs.

- Once a scroll with all individual shipping bills for the admissible amount has been processed, it will be generated and made available in the ICEGATE user account.

- Under the Credit Ledger section, a user can create a RoDTEP credit ledger account. IECs who have registered with a DSC on ICEGATE can do this.

- After selecting the relevant shipping bills, the exporter may log into his account and generate scripts.

Eligibility to obtain benefits of the RoDTEP Scheme

- The RoDTEP Scheme may benefit all sectors, including the textiles industry. Priority will be given to labour-intensive sectors which received benefits under the MEIS scheme.

- Exporters of manufacturers and exporters of merchants (traders) are both eligible for benefits under this scheme.

- To claim the RoDTEP, there is no particular turnover threshold.

- Under this scheme, re-exported products are not eligible.

- To be able to avail of the benefits of this scheme, the exported goods must have the country of origin as India.

- Units of the Special Economic Zone and Export Oriented Units are also eligible to claim benefits under this scheme.

- If goods have been exported via courier through e-commerce platforms, they are also covered under the RoDTEP scheme.

Two key Benefits from RoDTEP:

- The RoDTEP scheme would be reimbursed the embedded central, state and local duties/taxes that have not been reimbursed/refunded so far.

- The refund would be credited to the exporter's Customs ledger account and used to pay the Customs Basic Duty on imported goods. Like MEIS/SEIS scripts, the credits can also be transferred to other importers.

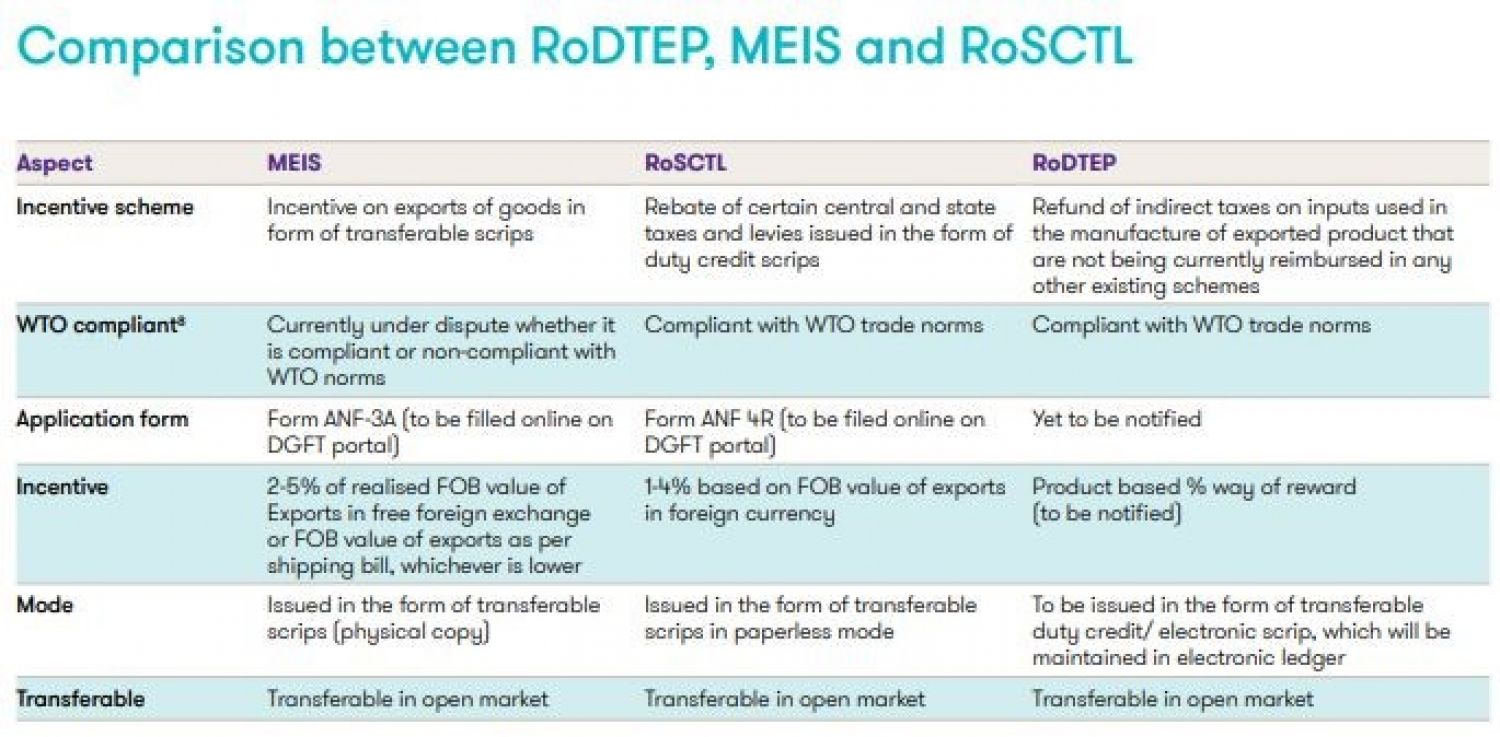

RoDTEP vs. MEIS vs. RoSCTL

|

Aspect |

MEIS |

RoSCTL |

RoDTEP |

|

Incentive scheme |

Incentive on exports of goods in form of transferable scripts |

Rebate of certain central and state taxes and levies issued in the form of duty credit scripts |

Refund of indirect taxes on inputs used in the manufacture of exported products that is not being currently reimbursed in any other existing schemes |

|

WTO compliant |

Currently under dispute whether it is compliant or non-compliant with WTO norms |

Compliant with WTO trade norms |

Compliant with WTO trade norms |

|

Application form |

Form ANF-3A (to be filled online on DGFT portal) |

Form ANF 4R (to be filed online on DGFT portal) |

Yet to be notified |

|

Incentive |

2-5% of realized FOB value of exports in free foreign exchange or FOB value of exports as per shipping bill, whichever is lower |

1-4% based on FOB value of exports in foreign currency |

Product-based % way of reward (to be notified) |

|

Mode |

Issued in the form of transferable scripts (physical copy) |

Issued in the form of transferable scripts in paperless mode |

To be issued in the form of transferable duty credit/ electronic scrip, which will be maintained in the electronic ledger |

|

Transferable |

Transferable in the open market |

Transferable in the open market |

Transferable in the open market |