Table of Contents

Ministry of Home Affairs extends FCRA registration certificates validity of NGOs till 31.05.2021

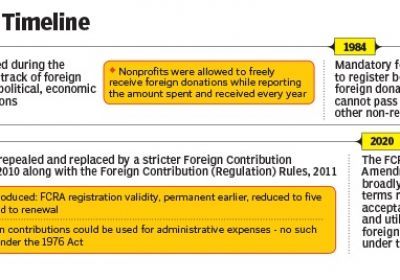

The Ministry of Home Affairs said that Non-governmental organization’s whose registration in accordance with the 2010 Foreign Contributions Act expired between Sept 29, 2020 — when notifying fresh amendments to the Act were filed and May 31, 2021, will now receive an extension of their Certificate of the Foreign Contribution regulation to May this year.

Under the amended rule that requires Non-governmental organizations to apply, in the course of a period of 6 months "from" the expiry of the registration certificate, for a certificate to be renewed on an electronic basis together with the declarations of affidavits of each office-bearer or key functionary.

Therefore, the Ministry of Home Affairs notice grants relief to the NGO, who did not immediately request the renewal of the registration under the amended rules, as they understood that they had 6 months to do so from the date of their Foreign contribution regulation certificates

During the last few months, a many large No. of NGO’s seem to be in a high state of anxiety over 3 main problems, Do not panic over:

-

Pending Filing Form CSR-1: Due to Filing Form CSR-1 with Ministry of Corporate Affairs in order to be eligible for Corporate social responsibility grants. Let’s look at each of these issues carefully and calmly!

-

Not opening NGO SBI account as yet: Their designated FCRA Bank account with State Bank of India. New Delhi Main Branch not opened before the provided due line of 31st March 2021,

-

NGO 12AA & 80G renewal : pending renewal of under section 12AA registration & Certificate U/s 80G under the income tax act 1961.

Foreign funding certificates of two hundred sixty-four NGOs were suspended in the last 5 years, The center govt also told the Rajya Sabha that the 8,353 NGOs certificates had not been renewed in five years,

FAQ on FCRA

Q.: Is it possible for an organisation with registration or prior authorisation to transfer the FC it has acquired to another organisation?

Ans. If yes, what is the procedure for doing so? Is there a limit to the amount of money that can be transferred to other organisations? Ans. Yes. The following is taken from Section 7 of the 2010 FCRA:

Q.: Is inter-account money transfer authorised inside the several accounts that an Association is now entitled to form for the purpose of utilising foreign contributions, and what level of attention is needed of banks in this regard?

No, funds can be transferred from an Association's authorised FC account to additional accounts or accounts formed for its use. No funds other than the funds (FC) received in the authorised FC account shall be received or placed in such duplicate account(s). Transferring foreign contributions between usage accounts is not prohibited. However, in order to keep the accounting process simple, the Association should avoid such practises. The banks should use extreme caution in keeping track of the transfers.

Q.: How would an organisation that is registered or has acquired prior permission under the FCRA and wants to transfer a portion of a foreign contribution it has received to another organisation know if the receiving organisation has been investigated under the FCRA?

Ans. Any action taken against a company under the FCRA is done with due notice to the company in question. As a result, it is recommended that the donor organisation insist on a written undertaking from the intended beneficiary organisation.

Q.: Is it possible to combine international contributions with local receipts?

Ans. No Accounts and records relevant to the receipt and use of foreign contributions must be kept exclusively/ separately.

Popular article :