Table of Contents

CLOSURE OF ONE-PERSON COMPANY

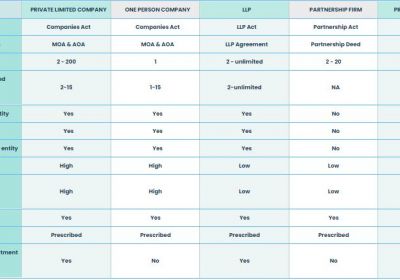

A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to the one-person company.

If one person company is inoperative for more than one year from the date of incorporation then the owner can apply for closure of the company either normal procedure or fast track exit scheme of the ministry of corporate affairs. The company can be wound up voluntarily or by the order of the tribunal.

DOCUMENTS REQUIRED CLOSURE OF ONE-PERSON COMPANY

- Company’s memorandum of association, articles of association, certificate of incorporation, pan card.

- Board resolution

- Consent of creditors

- Latest financial statement of the company.

- Details whether the company has been inoperative for any period. If yes, since when the company has inoperative.

- Statement of pending litigation

- Provide NOC for closure from creditors.

- NOC for closure to be obtained from the income tax department, Sebi.

METHODS CLOSURE OF ONE-PERSON COMPANY

Winding-up of OPC

- In case of winding up liquidator is appointed to manage the affairs of winding up.

- Dissolution is done when holding a meeting is approved by 2/3rd creditors of the meeting.

- The management board submits to the commercial registrar a request for a member dissolution and minutes of the general meeting.

Striking off of OPC

- Striking off or removal of one person company by fast track exit scheme.

- Striking off is done by the registrar under the act.

- This can be filed by the registrar of the company or the company itself.

- When a company gains the status of defunct company i.e it has no activity since inception or last one year then it becomes a defunct company which can be wound up by fast track exit through STK – 2 form.

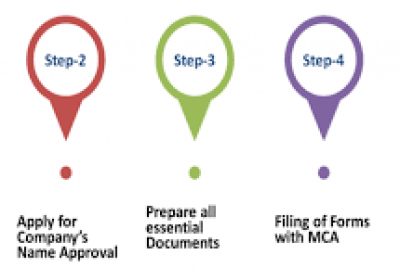

CLOSURE OF ONE-PERSON COMPANY

- For the voluntary winding up of the company, the resolution is passed by 2/3rd in value of the creditors of the one-person company.

- within 10 days from the date of approval from the creditors the notice of board, the resolution is to be given to the registrar of the companies.

- the declaration is also made by the registrar of the companies that no debts are pending in the company, or if there are some debts, these will be paid off within one year.

- application is filed for striking off the one-person company with the concerned registrar of companies along with submitting the Board Resolution in favor of winding up.

- Form FTE is to be filed with ROC if one person company is inoperative for one year after its incorporation within 30 days from the date of signing the statement of assets and liabilities of the closing one-person company.

- Appoint a Liquidator for winding up of the one-person company.

- This liquidator is required to submit all reports and accounts to the Tribunal and the Registrar.

- winding-up resolution is also advertised in the Official Gazette and in a newspaper which is widely circulated in the district where the registered office of the one-person company is located.

- The following statement is to be submitted-

- Statement of Accounts

- Statement of Assets and Liabilities

- Indemnity Bond

- After verification of the above, the Registrar will pass the order of winding up of one person company.

FAQ ON CLOSURE OF ONE-PERSON COMPANY

Q1-if one person company is inoperative then is the company needs to get an audit or file a return?

Ans.-yes, even if the company is an inoperative company needs to get an audit or file a return.

Q2- how much is the value of creditors needed for resolution for the closure of a one-person company?

Ans.- 2/3rd in value of creditors needed for resolution for the closure of the one-person company.

Q3- what is the time limit for submission of board resolution to the registrar of companies?

Ans.-within 10 days from the date of approval from the creditors the notice of board resolution is to be given to the registrar of the companies.