Table of Contents

Business setting-up in India

- It is much easier to set up a business in India nowadays. Starting a business in India now takes less time than it did years ago. A company can be registered in any part of India in just over 5 weeks.

- The time spent on company registration has decreased significantly as a result of the digitalization of the process.

- Before starting a business in India, the owner must decide what type of business they want to run. Limited private companies and limited public companies are the two most common types of business organizations.

- There are other types of business organizations based on the specific needs of business owners, in addition to these general business organizations.

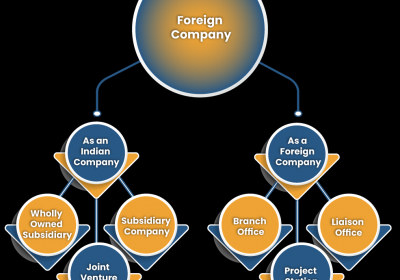

- From the perspective of a foreign company, India is one of the most promising countries in which to establish a presence.

- In terms of economy, growth, infrastructure, and technology, India is still in its early stages. There are many untapped businesses in which India has yet to intervene, or where some of them are being outsourced.

- Changes in government policies, a boost in international trade, India's welcoming culture, population spending habits, and a large market base are all expected to drive tremendous growth in all areas of business set up in India.

INCORPORATION OF PRIVATE LIMITED COMPANY

A private limited company is held for run small businesses. It has a perpetual succession a liability of the members is limited by the number of shares held by the members. Name of the private company end with the words private limited.

PRE-INCORPORATION REQUIREMENT OF PRIVATE LIMITED COMPANY

- To start a private limited company minimum of 2 and a maximum of 200 shareholders are required.

- Minimum 2 directors are necessary and a maximum of 15 directors are necessary for the incorporation of a private limited company

- In order to incorporate private limited company digital signature certificate is necessary by the director

INCORPORATION PROCESS Of PRIVATE LIMITED COMPANY.

After you closing the company name, below mentioned steps to follow:

1: Needed to Apply for DSC

2: Apply for the DIN

3: Apply for the name availability

4: File the EMoa and EAOA to register the private limited company

5: Apply for the PAN and TAN of the company

6: Certificate of incorporation will be issued by RoC with PAN and TAN

7: Open a current bank account on the company name

Digital signature certificate - first requirement to form a private limited company is that they must have a digital signature certificate. At the time of filing the e- form, a digital signature certificate is required.

Director identification number – it is mandatory to obtain the director identification number by any of the following 2 methods –

- at the time of filing SPICe

- by filing form DIN, 3 proposed director is required to give his aadhaar card or address proof.

Selection of name – the of the company should not be undesirable or similar to any existing company. It shall not resemble any registered company. The word private limited is mentioned at the end of the name of the company.

Approval of name- by using the facility of RUN on the MCA portal approval of the name can be done. MCA has permitted the proposal of two names for registration.

The second method for approval of name is SPICe or INC – 32. Applicants can fill the form again in case of rejection.

Documents required – following documents are required-

- subscribers need to give the affidavit.

- Copies of utility bills.

- copy of the approval of proposed names.

- proof of office address.

- trademark registration certificate.

- owners no objection certificate.

- proof of address of the director.

- identity of director.

E- memorandum of association and E-articles of association – the next step is making of MOA and AOA .both the forms are digitally signed by the subscribers.

Permanent account number and tax deduction and collection account number – application for PAN and TAN made through SPICe. Form 49A and form 49B are filled for PAN and TAN respectively. both the form is uploaded on MCA portal after digital signature certificate.

UPON REGISTRATION CORPORATE IDENTITY NUMBER WILL BE ALLOCATED BY THE MINISTRY OF CORPORATE AFFAIRS

POST-INCORPORATION REQUIREMENT OF PRIVATE LIMITED COMPANY

- The company should hold a board meeting within 30 days of incorporation.

- The company should need to open a bank account.

- The company shall have a registered office within 15 days of incorporation.

- The first auditor is appointed by the board of directors within 30 days of incorporation.if the board of directors did not appoint an auditor then members shall appoint an auditor within 90 days in an extraordinary general meeting.

- The company shall maintain true and fair books of accounts.

- At the first board meeting, every director shall disclose his interest in any other company.

- The company shall maintain all the statutory registers at the registered office.

FAQ ON REGISTRATION OF COMPANY.

Q1- at the time of registration of name is it necessary to attach documents?

Ans.-no, at the time of registration it is not necessary to attach documents.

Q2- is a passport is necessary to document to attach by subscriber or director?

Ans.-if the subscriber or director is from a foreign national then a passport is necessary for the subscriber or director.

Q3-how many names can be applied through RUN?

Ans.-proposal of 2 names is allowed through RUN.

Q4-what is the limit for the maximum number of directors before the incorporation of a private limited company?

Ans.-maximum 15 directors can have in private limited company.