What's Cryptocurrencies-Bitcoin?

- Bitcoin is a cryptocurrency invented by a few unknown groups of people. You can buy or sell bitcoins on a bitcoin exchange. The currency is not controlled by any bank or government. Blockchain is the leading technique behind bitcoin and other cryptocurrencies. It's a public ledger of information that records all bitcoin transactions.

Where is bitcoin coming from, or how is it obtained?

You can either get bitcoins by:

- Buying them from a bitcoin exchange to a real currency: No one can be a bitcoin miner. You could therefore consider buying bitcoins from bitcoin exchanges and store them in a digital cryptocurrency exchange online.

- Obtaining cryptocurrencies in consideration of the sale of goods and services : Although this may not be a popular phenomenon in India at present, few skilled traders accept bitcoins (instead of real currency) for the sale of goods or services.

- Mining: Mining is a process where an individual (called the "miner") uses his computer skills to crack computationally difficult puzzles. The procedure of cracking such puzzles, which are an integral part of blockchain technology, helps to maintain them. As an incentive for this, the miner gets new bitcoins that are nothing but a bitcoin or mining creation. Zebpay, Unicorn, Coinbase Bitxoxo, etc. are some of the main bitcoin exchanges currently taking place in India. Such bitcoins would have been bought in consideration of the real currency. It would be interesting to note that currently, the value of 1 bitcoin is approximately INR 30,00,000/-

- Bitcoin generation is done through specialized computers, and miners process bitcoin transactions to keep the network secure. Miners earn transaction fees and bitcoins in exchange for bitcoins mining. Startups are raising funds for bitcoins as well as other currencies through an initial coin offering or an ICO. It is similar to the original public offering or the IPO where the company provides shares to the general person for the first time.

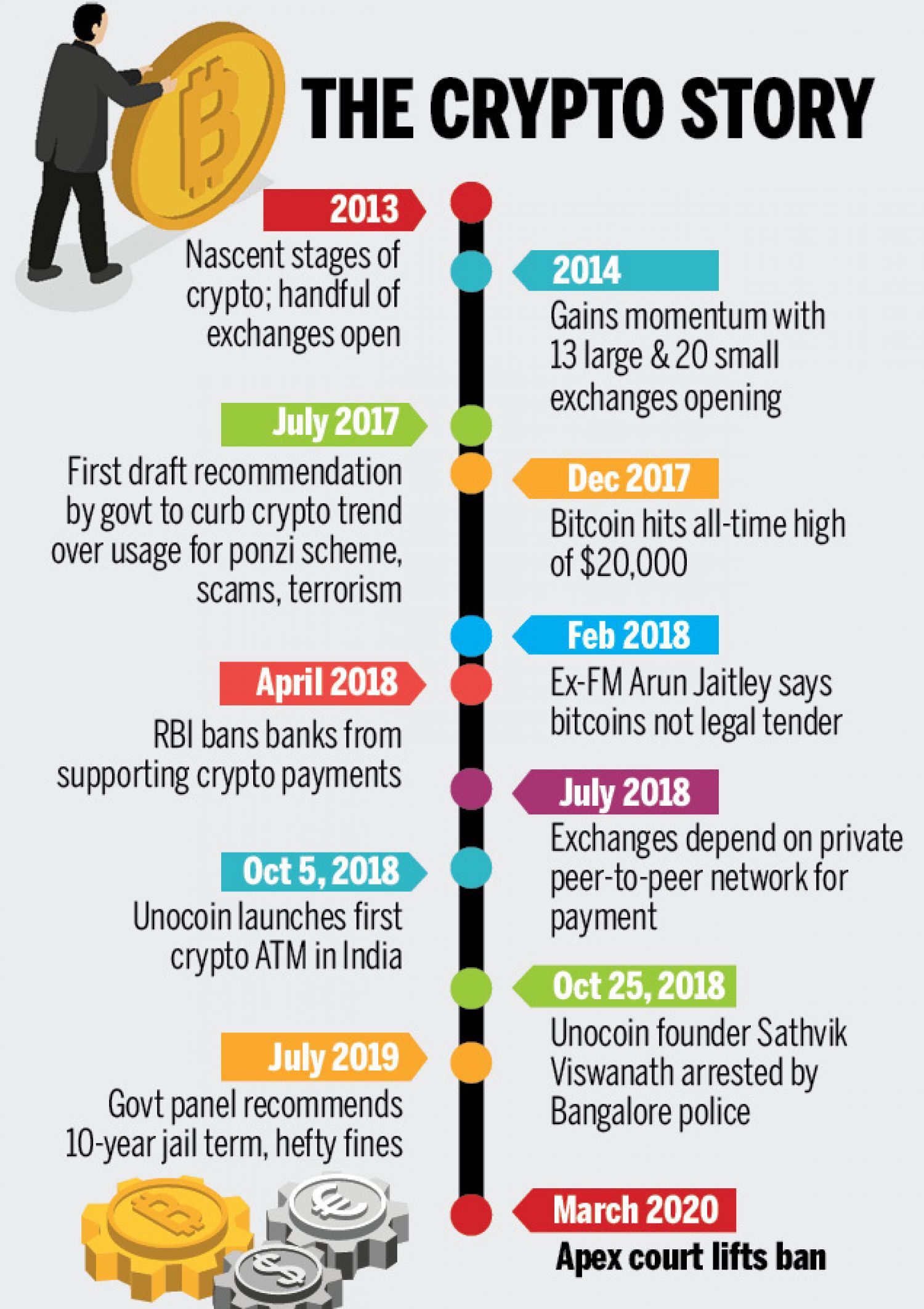

- RBI forbade cryptocurrencies in 2018 after many frauds. Even so, cryptocurrencies were confirmed legal in India in March 2020. The government holds talks with various ministries to bring into force a law to forbid cryptocurrencies.

Is bitcoin legal in India?

- Will India ban Bitcoin? Here's the narrative so far: The Government Of India is fairly close than ever to imposing a blanket prohibition on currency transactions, mining, and investment in the country.

- As a means of payment, Bitcoin was neither authorised nor controlled by any central authority in India. Furthermore, no set rules, regulatory requirements, or protocols have been established to resolve disputes that could arise while dealing with bitcoins. Bitcoin transactions involve their own set of risks. Even so, given this background, one cannot conclude that bitcoins are illegal, as there has so far been no prohibition on bitcoins in India. In its ruling of 25 February 2019, the Supreme Court of India asked the Government to adopt Cryptocurrency Regulation policies. The issue was postponed at the proceeding on 29 March 2019 and was postponed for hearing in the second week of July 2019.

- The Govt is taking into consideration the introduction of legislation to ban cryptocurrency trading, mining, and investment. At the very same time, the draft law will open the path for the Reserve Bank of India (RBI) to establish a Digital Currency backed by the Central Bank (CBDC). While the govt's decision to ban cryptocurrency trading in India is at an early stage, the final outline of the bill would depend on industry consultations and feedback.

Govt has introduced legislation to ban virtual currency in India:

- The Government of India is nearer than ever to impose a blanket prohibition on cryptocurrency trading, mining, and investment in the country. This will also include the much-talked-about cryptocurrency along with other popular cryptos. Legislation for the same has already been suggested and, on Tuesday, Finance Minister Nirmala Sitharaman said in Rajya Sabha that a high-level Inter-Ministerial Committee (IMC) was set up under the chairmanship of the Secretary (Economic Affairs) to study issues related to virtual currencies and propose actions through which all private cryptocurrencies, apart from cryptocurrencies issued, would be obtained.

Indian Govt planning to intro a The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, during this parliament session in 2021,

- The Govt has also implemented the release of Reserve Bank of India (RBI) backed Central Bank-backed Digital Currency (CBDC). This tends to leave the industry and investors uncertain about the future of cryptocurrencies in India. It's not the first time, however, that the government was trying to act against cryptocurrency. Here's a comprehensive look at all that has occurred so far.

- Having followed the recommendation as well as provide clarification, the Cryptocurrency and Regulation of the Official Digital Currency Bill 2021 ('ODC Bill') were proposed with the aim of establishing a system for the establishment of the official digital currency to be authorised by the RBI & restricting all private cryptocurrencies in India. It will, consequently, support and use the underlying cryptocurrency technologies.

CBDCs vs. cryptocurrencies

- With exception of cryptocurrencies issued without any of the support of the central bank and issued and traded on exchanges, the CBDC is a digital currency that holds the very same value as the fiat currencies granted by the central bank of the country. The significance of the CBDC is linked to the value of the fiat currency. The 'private' cryptocurrencies usually involve Bitcoin, Ethereum and Ripple, among others.

- Even when cryptocurrency is being used as a currency or as a means of transaction, regulators around the world have taken a different approach. Many other regulatory bodies treat the large proportion of cryptocurrencies as alternative investments, as in the case of the US Securities and Exchange Commission. But since Bitcoins can be used as payment instruments in Singapore and Japan, the central bank in each country is responsible for issuing rules for the use of cyrptocurrencies such as Bitcoin as a medium of exchange.

- It is important to remember that each cryptocurrency may have many use-cases. Whilst also bitcoin may be used as a payment method,

- It continues to behave like such a stock and is exchanged on a daily basis for prospective returns on investment. Certain cryptos such as Ethereum and Ripple, that are also traded for investment gains, are going to build blockchain-based systems and methods.

- The CBDC can take a number of forms. It can be provided on a blockchain ledger, such as regular cryptocurrencies, or through a demat account or a specific payment instrument. There may be retail CBDCs that would be accessible to all categories of customers, or wholesale CBDCs that are intended only for organisations.

There are three main models for releasing CBDCs:

Direct Model: in this methods they issued by Central bank to banks then on to consumers; claims for CBDC payments are made to the central bank.

Indirect Model : In this model digital currencies are granted to the consumer by banks; claims on CBDC payments are made to the bank or market players.

Hybrid Model: In this model market players on-board customers and issue CBDCs; payment claims to the central bank

- Among the country's biggest central banks, the People's Bank of China was the first main central bank to declare an experiment with the CBDC. This, alongside Facebook's Libra project, has prompted other leading central banks to do so as well.

- As per the January 2020 survey of 66 central banks conducted by the Bank of International Settlements, 80 percent of central banks around the world have been involved in CBDC observation and experiments. Approximately 40 percent of the central banks surveyed had moved from conceptual research in 2018 to the PoC phase, while another 10 percent had developed pilot projects in 2019, according to the survey.

What is crypto-currency and how is it different from CBDC?

- Crypto-currency is the general term of virtual currency. It is used as a digital asset designed to operate as a means of exchange. They work using blockchain, a decentralised technology spread across a number of computers that manage and record transactions.

- That neither of these digital currencies is issued by a nation's central bank. That's what makes them different from the CBDCs. The latter is a virtual currency that holds the very same value as the fiat currency issued by the central bank of the country. People’s Bank of China was the first major central bank to announce it would experiment with a CBDC.

India may have its own cryptocurrency in the future :

- On 28 Feb 2019, the Ministry of Finance Committee on Digital Currency advised a ban and proposed that India should set up a digital rupia. It also drafted a bill prohibiting all virtual currency activity in the country, punishable by a fine of up to INR 25 Cr or a prison term of one to 10 years, or both. Even so, this has not been approved by the Parliament.

- This month, the Government of India introduced the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 during the Parliamentary Union Budget 2021 session. Reserve Bank of India also suggested that it plans to introduce a digital version of the Indian Rupee & explore the possibility of a digital version of the Fiat Currency and in case there was then how to operationalise it.”

What's the future of blockchain technology / Cryptocurrency in India?

- Swatantra Kumar Singh, Partner, at Rajput Jain and Associates said that in India, regulators and governments have been skeptical about digital currencies and are apprehensive about the risks associated.

- 'Because the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 has been underway to establish a 'positive and constructive framework' for the creation of an official digital currency to be obtained by the RBI, the road ahead would be tumultuous for private cryptocurrency, as the aforementioned Bill would prohibit all private cryptocurrency in India, but would allow for only certain exclusions to the promo.

- However, CEO, WazirX thinks that the future of cryptocurrency in India is interesting.

- "We've seen our Central Government talk strongly about blockchain, and I'm optimistic that he's going to ensure that the Young generation doesn't stay behind in this worldwide phenomenon! Gradually, ever more consumers are fully aware of crypto and want to pursue a career in Blockchain. Positive regulations will give a big boost to crypto adoption in India with more startup companies constructing blockchain projects. With tech giants like JP Morgan, & Facebook jumping on the crypto bandwagon, over the next few years, crypto will become mainstream, and we'll see more and more crypto cases coming to life. The future is thrilling! "The CEO, WazirX said.

Govt backed Inter-Ministerial Committee (IMC) to propose actions:

- The Minister of Finance further explained the government's stance against cryptocurrency with her reply to the Rajya Sabha. "The High-Level Inter-Ministerial Committee (IMC) formed under the chairmanship of the Secretary (Economic Affairs) to study issues related to virtual currencies and propose specific actions to be taken in the issue proposed in its report that all private cryptocurrencies, apart from cryptocurrencies issued by the State, be prohibited in India," said Nirmala Sitharaman.

- Minister of State for Finance Anurag Thakur also raised concerns about the authority to regulate these currencies. He said that cryptocurrency is hardly currency nor assets, leaving it outside the direct regulatory sphere of SEBI or RBI. The govt will therefore bring forward a bill on the issue.

- According to two sources involved with the discussions, the government intends to tighten regulation of cryptocurrencies in order to discourage investors from keeping them. However, the government is unlikely to follow through on an earlier intention to ban private digital coins.

- Instead, only those that have been pre-approved by the government could be listed and traded on exchanges, according to the sources, who asked not to be named since the discussions are private.

- "A coin can only be traded if it has been approved by the government; otherwise, holding or trading it in may result in a penalty," claimed the first source.

- In the parliamentary session that begins this month, the government hopes to propose and pass a cryptocurrency law.

- Thousands of peer-to-peer currencies that thrive on being outside the scope of regulatory scrutiny would be hampered by such a pre-verification approach.

- the idea is to outlaw private crypto-assets in the long run while preparing the way for a new Central Bank Digital Currency (CBDC).

Goods and services tax on Cryptocurrency transactions?

- Dubey argued that the Central Economic Intelligence Bureau, an arm of the Ministry of Finance, had performed research on the collection of GST on cryptocurrency and submitted a proposal to the Central Board of Indirect Taxes & Customs, trying to suggest that cryptocurrency could be handled as current assets and GST charged on the margins of its trading.

Position of other countries:

- India wasn't the only country to face the potential of deploying its own cryptocurrency. Others either did that, or they mulled their options. Nations such as Venezuela, Tunisia Ecuador, China, Singapore & Senegal have issued their own cryptocurrencies. Those exploring options include Palestine, Russia, Estonia, Japan & Sweden are exploring options for launching their own digital assets.

Also Read articles :