CONVERSION OF ONE PERSON COMPANY INTO PUBLIC OR PRIVATE COMPANY OR VICE - VERSA

A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to one person company.

CONVERSION OF ONE PERSON COMPANY INTO EITHER PUBLIC OR PRIVATE COMPANY

- when One Person Company's paid-up capital exceeds fifty lakh rupees or the average annual turnover exceeds two crore rupees then the company should stop running a business as a one-person company.

- Than One Person Company shall need to convert within six months from the date on which paid-up share capital exceeds 50 lakh rupees or average annual turnover exceeds 2 crore rupees during that period of the company as the case may be, into either private company or a public company.

- The One Person Company shall alter its memorandum of association and articles

- of association by passing a resolution and making necessary changes.

- One Person Company shall within sixty days from the date on which its paid-up share capital is increased fifty lakh rupees or the period during which its average annual turnover exceeds two crore rupees, shall notice to the Registrar in Form No.INC.5 informing that it has stopped running its business of One Person Company and needs to convert itself into a private company or a public company.

- One Person Company or officer of the One Person Company contravenes any of the provisions, One Person Company or any officer shall be punishable with a fine which may extend to 10,000 rupees and with a further fine which may extend to 100 rupees for every day.

- One Person Company can convert into a Private after increasing the minimum 2 members and 7 directors or Public company after increasing the minimum 2 members and 3 directors.

CONVERSION OF EITHER PUBLIC OR PRIVATE COMPANY INTO ONE PERSON COMPANY

- private company except the companies registered under section 8 having paid-up share capital of fifty lakhs rupees or less or average annual turnover is two crore rupees or less may convert itself into one person company.

- No objection certificate is obtained in writing from members and creditors.

- a special resolution needs to pass in the general meeting for conversion.

- a copy of the special resolution in Form No. MGT.14. filed with the Registrar of Companies within thirty days from the date of passing such resolution.

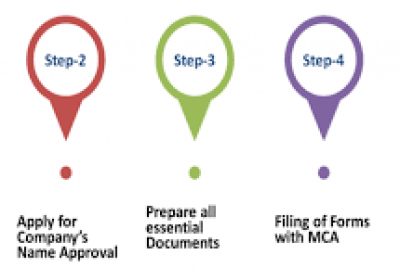

- The company shall apply Form No.INC.6 for its conversion into One Person Company along with fees by attaching the following documents, namely-

- All the directors of the company shall give a declaration through an affidavit that all members and creditors of the company have given their consent for conversion.

- list of members and list of creditors of the company

- latest Audited Balance Sheet and the Profit and Loss Account of the company

- the copy of No Objection from the secured creditors.

6. Registrar shall issue the Certificate of incorporation after verification of the application of conversion.

FAQ CONVERSION OF EITHER PUBLIC OR PRIVATE COMPANY INTO ONE PERSON COMPANY

Q1- What is the relevant period to check turnover in case of conversion of one person company into a private company or public company?

Ans.- 3 years is the relevant period to check turnover in case of conversion of one person company into a private company or public company.

Q2- Is it compulsory for a private company or public company to convert itself into one person company in coming paid-up share capital within the limit of one person company?

Ans.- no, it is not compulsory for a private company or public company to convert itself into one person company in coming paid-up share capital in the limit of a one-person company.

Q3- Is section 8 company need to convert into one person company when its paid-up share capital decrease to 50 lakh rupees?

Ans.- no, there is no need to convert section 8 company into one person company when its paid-up share capital of private company decrease to 50 lakh rupees.