Table of Contents

Can HRA & Home Loan Benefits be claimed when ITR is filing?

Manny Employees earning a monthly income for both the House Rent Allocation (HRA) and home loans are often confused that they claim the income tax benefit on ITR furnishings. Based on rent, but payment for the domestic loan.

In accordance with tax and investment experts, both tax advantages can be used by individuals if they comply with dual ITR rules. They remarked that the benefits of HRA tax are a separate set of rules. While home loans are a different set of rules for tax relief. If a person is a salaried person and possesses a house on the loan, the person has the right to a house loan and HRA provided they meet the income tax rules.

Only under certain conditions is HRA benefit available to employed earners. The first thing is that one receives HRA as part of the salary, but the other condition is that the employee pays rent for his or her home, which he or she has, but does not own. Address the income tax rule for the tax liberty of HRA "If the employee provides these conditions, then the income tax advantage for HRA can be taken advantage of. Comment on the rules for tax on household loans Head of the Fee-Only Investment Advisor, Swatantra Kumar Singh Partner Rajput Jain and Associates, said, He further added that if the employee submits these terms, he or she may take advantage of the HRA income tax benefits.

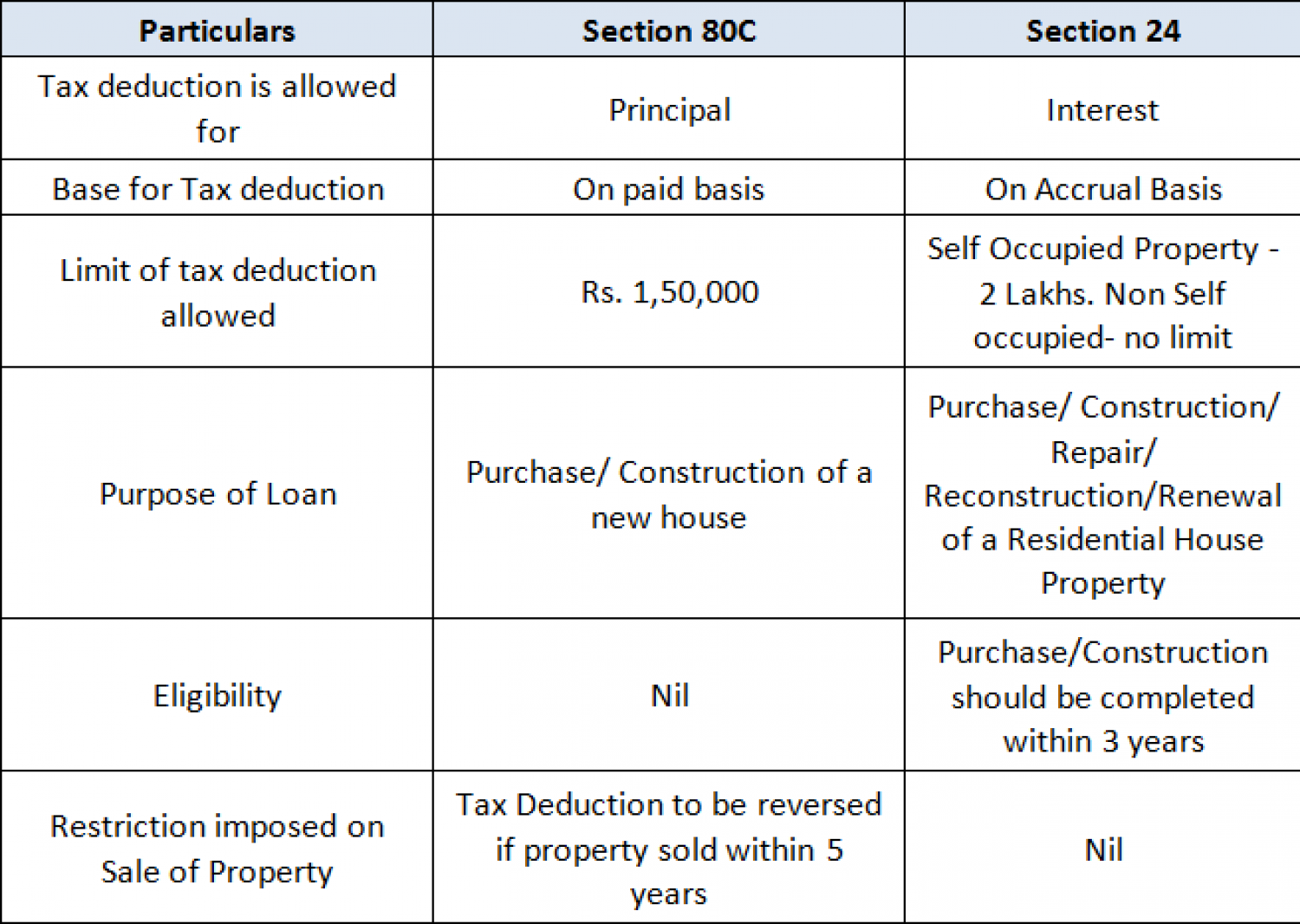

Comment on the rules for tax on household loans "Income-tax advantage for home loans may be claimed under two sections," Swatantra Kumar Singh Partner Rajput Jain and Associates Head in Fee-Only Investment Advisers said. The benefit under Section 80C, which cannot go beyond 1,5 lakh in a single financial year, can be claimed for the principal repayment of house loans. You can claim income tax advantages under Section 24(b) for a refund of the interest on the home loan."

Up to 2 lakh homes can benefit from the advantage stated by Swatantra Kumar Singh Partner Rajput Jain and Associates if interest paid up to two occupying properties can be paid. Further added that only if it is owned by earning individuals can the person take advantage of the revenue tax benefit of a home loan. Also commented that there was no law stating that those who own the home and provide the home loan would not benefit from both the home loan and the HRA tax advantages. They said that earners provide that legislation take advantage of the domestic loan and HRA benefits. They can benefit from both HRA and home credit tax benefits.

The deduction under HRA available is the least of the following amounts:

a. Actual HRA received;

b. 50% of [basic salary + DA] for those living in metro cities (40% for non-metros); or

c. Actual rent paid less than 10% of basic salary + DA

A loan taken jointly with your family can help you claim a larger tax benefit.

| Deductions | Section | Maximum Deduction (INR) | Conditions |

| Principal | 80c | 1.5 Lakh | house property should not be sold within 5 years of possession |

| Interest | 24b | 2 Lakh | the loan must be taken for purchase/construction of a w house and the construction must be completed within 5 years from the end of the financial year in which loan was taken |

| Interest | 80EE | 50,000 Thousand | amount of loan taken should be Rs 35 lakhs or less and the value of the property does not exceed Rs 50 lakhs |

| Stamp Duty | 80C | 1.5 Lakh | can be claimed only in the year in which these expenses are incurred |

| Interest | 80EEA | 1.5 Lakh | The stamp value of the property should be Rs 45 lakhs or less. The taxpayer is not eligible to claim deduction under section 80EE |

Rajput Jain and Associates, Chartered Accountants, are one of India's best providers of ITR filing services and are not deceived. We assure you that with an expert Income tax consultant, we will provide you with one sort of personal finance for your financial situation. We provide income tax return services to you online at Rajput Jain and Associates. The advantages of easy and accurate filing are exploited by 10,000+ users. You can too!