Table of Contents

Frequently Asked Question on Fcra Registration

Q.: What is FCRA stand for?

FCRA stands for Foreign Contribution Regulation Act.

Q.: Is the Reserve Bank of India (RBI) is governed by the FCRA?

The FCRA is an internal security law that is not governed by the RBI. It is governed by the Indian government's Ministry of Home Affairs.

Q.: Is the Foreign Exchange Management Act (FEMA) also relevant to foreign contributions received by Indian non-governmental organisations (NGOs)?

FEMA is a fiscal law administered by the Ministry of Finance of the Government of India. It does not apply to international contributions received by Indian non-governmental organisations.

Q.: Is it required to have a registered non-profit organisation in order to apply for FCRA registration?

The term "association" is defined as follows in Section 2(1)(a) of the FCRA: "association" means an association of individuals, whether incorporated or not, having on office in India, and involves the society, regardless of whether registered under the Societies Registration Act, 1860 (21 of 1860), or not, or other Organization, with whatever name called; The act does not specify registration as a precondition to establishing a contract. An association does not need to be registered, but there must be some documentary evidence to prove the association's existence and activity.

However, registration is a defecate necessity in all practical aspects.

Q.: Is it required to register under Section 12A of the Income Tax Act before applying for FCRA registration?

The FCRA does not make a registration under the Income Tax Act a prerequisite for registration under the FCRA. In fact, there are several examples of businesses that have both FCRA and Income Tax registrations. However, because Income Tax registration is a requirement, it is best to complete Income Tax registration before registering for FCRA registration.

Q.: What are the different types of registration that can be used to receive Foreign Contribution under FCRA?

Under FCRA, there are two options for registering.

(i) Regular registration (Apply in form F.C 8) - under this registration, there have been no restrictions on accepting Foreign Contribution (either in terms of the total amount or from a single donor).

(ii) Prior authorization (Apply in Form F.C 1A) - the authorization is provided for a particular sum from a specified donor under this registration. Along with the application form, a letter of intent from the donor to gift the amount is required (Form F.C 1A).

In both of the aforementioned circumstances, however, filing the yearly return in Form F.C 3 is required.

Q.: Are the donations received as foreign contributions considered in kind?

The word "foreign contribution" is defined broadly enough to cover in-kind donations. The term "foreign contribution" refers to any donation, delivery, or transfer of any article, currency, or foreign security made by any foreign source.

Q.: Will an NGO's consulting fees be considered a foreign contribution?

All types of foreign receipts are included in the definition of "foreign contribution." Because it does not differentiate between a commercial receipt and a voluntary gift, consulting fees should be counted as a foreign contribution as well. The purpose of the FCRA is to regulate the foreign receipts of certain prescribed associations and individuals, regardless of the nature of the receipt, unless expressly excluded in the FCRA.

Q.: Are donations made in Indian rupees by a foreigner being considered foreign currency in India?

Yes, money received from a foreign source, whether obtained in India or abroad, and whether acquired in Indian or foreign currency, is considered a foreign contribution.

Q.: Will funds received in foreign currency from an NRI be counted as a foreign contribution?

The term 'foreign source' does not include non-resident aliens. As a result, any money received from a non-resident alien will not be counted as a foreign donation.

Q.: Will the United Nations or the World Bank be considered foreign sources?

No, the Central Government has announced in the official gazette that United Nations agencies and certain other international organisations will not be considered foreign sources for the purposes of the Act.

Q.: Which organizations/individuals are specifically prohibited from receiving foreign aid?

According to Section 4 of the FCRA, the following individuals are not eligible to receive foreign contributions:

(a) a candidate of politics.

(a) A registered newspaper's correspondent, columnist, cartoonist, editor, owner, printer, or publisher.

b) A judge, a government employee, or a company employee.

d) a member of a legislative body

e) a political party or a member of it.

The above-mentioned person is not eligible to accept foreign contributions, with the exclusions listed in section 8, which are as follows:

(a) If they are paid in foreign currency as a salary, wage, or payment for services provided.

(b) If such foreign organisation or source pays them in the ordinary course of business in India.

c) If the money are received in the course of international trade or commerce, or in the usual course of business outside of India.

(d) Payment is received as an agent of a foreign source of organisation in connection with any transaction that foreign source of organisation has with the governance.

(e) If the payment is made as a gift or presentation as part of an Indian delegation that meets the Central Government's acceptance criteria.

(f) Payment is collected from a relative who is currently residing in another country. Such payments should only be accepted with prior permission if they exceed Rs.8, 000.00.

(g) Payment is obtained in the ordinary course of business through an official channel, a post office, or any authorised dealer.

Q.: Is the FCRA applicable to ordinary people?

With the exception of the individuals mentioned in Section 4 (as discussed above), all individuals are entitled to receive foreign funds without restriction. In other words, the FCRA does not apply to private individuals. The only exception is that if you receive a stipend or scholarship from a foreign source for more than Rs.36, 000.00, you must notify the Central Government under Section 7.

Q.: Does FCRA apply to commercial and business organisations?

The FCRA does not apply to the movement of foreign funds in the ordinary course of business. As a result, corporate organisations do not need to be concerned by FCRA because it is merely an internal security measure. However, the Foreign Exchange Management Act of 1999, which is a piece of financial legislation, would apply.

Q.: What are the legal requirements for accepting a foreign contribution?

According to Section 6 of the FCRA, any organisation with a specific cultural, social, educational, religious, or economic purpose may receive foreign contributions only if two conditions are met:

- It is required to register with the Central Government.

- It must agree to solely accept foreign contributions through a single bank account.

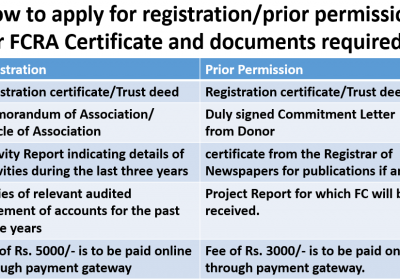

Q.: What are the required documents that must be submitted with an FCRA application?

For registration, the following documents must be submitted:

I Form FC-8, filled in triplicate.

ii) Accounts for the previous three years that have been audited.

iii) Annual Report detailing operations over the last five years.

iv) Detailed information on the recipients and the socioeconomic conditions affecting the region in which the NGO operates.

v) A list of the state and districts where work is intended, as well as a map.

vi) A certified copy of the Certificate of Registration.

vii) If relevant, a certified copy of the bylaws, memorandum, and Article of association.

viii) A copy of the Income Tax Department's 80G and 12A exemption or registration certifications.

ix) A copy of any prior approval the organisation has received.

x) A copy of the organization's Governing Body's resolution approving the FCRA registration.

ix) A copy of the Chief Functionary's Power of Attorney or the Governing Body's resolution authorising the submission of FC-8.

xii) A list of the organization's current Governing Body members and office bearers.

xiii) Copies of the organization's journals and other publications.

xiv) If the association has a parent, sister, or subsidiary organisation that is registered under the FCRA, the registration number should be included, as well as the Ministry of Home Affairs file number.

xv) If the association has previously submitted an application, the reference number should be mentioned.

xvi) If the association received any foreign contributions, whether with or without prior approval from the Central Government, the details should be provided.

Q.: How long does it take to submit a registration request?

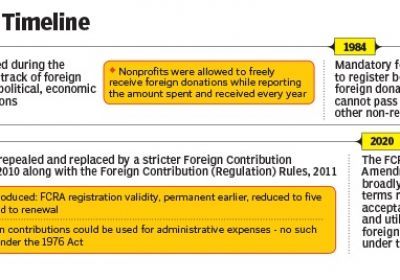

In contrast to the Income Tax Act, which requires an organisation to apply within one year of its incorporation or registration under section 12A, the FCRA does not specify a time restriction for filing an application. FCRA is usually given after 3 years of operation.

Q.: A Chief functionary is obliged to give an undertaking; what are the implications?

The FC-8 application form was amended by the Foreign Contribution (Regulation) (Amendment) Rules, 1996 [GSR 592(E), dated December 27, 1996].

Following the amendment, the Chief Functionary is required to give an undertaking that the information is correct and that the organisation undertakes to comply with the following:

I Provide evidence of a change in name, address, objects, etc. within 30 days.

(ii) Not to accept any foreign contribution without prior permission if more than half of the office-bearers named in the registration application are changed or replaced.

(iii) Not to change the bank account or branch without prior approval.

(iv) Accepting foreign contributions only with prior permission or before registration is granted.

As previously discussed, after December 27, 1996, all organisations applying for registration are required to provide an undertaking that, among other conditions, specifies that foreign contributions should not be accepted if more than half of the office-bearers mentioned in the application for registration are changed or replaced. However, organisations that applied before December 27, 1996, and were registered are not bound by any such undertaking. The undertaking is part of Form FC-8, and nothing about it is mentioned in the FCRA. As a result, those organisations that are not participants in the undertaking are not legally obligated by its provisions. The company did not have the change clause in the earlier form for more than 50 percent of officeholders. The undertaking provided in Form FC-8 does not create any obligatory obligations for older organisations in the absence of any specific arrangements within the FCRA. However, it is advisable to inform and officially regularise such changes.

Q.: Can a non-governmental organisation (NGO) have a foreigner on board at the time of registration?

Under the FCRA, any organisation registered in India with a specific cultural, economic, educational, religious, or social programme may apply for registration. Even if its members/board members are foreigners, an organisation can apply for FCRA registration. The only issue here is that FCRA officials may exercise greater vigilance and caution in processing such applications. However, as a matter of internal policy, the FCRA does not grant registration to organisations that employ foreigners. Such registrations are only granted in exceptional circumstances, and there are only a few examples available.

Q.: Is the FCRA application being recommended by a local authority?

Clause 10A of the Foreign Contribution Amendment Rules of 2000 required the inclusion of a certificate from a competent authority in Form FC-1A. Any of the following individuals or organisations can provide this certificate:

(1) District Collector (2) State Government Department (3) Ministry or Department of the Government of India

The competent authority confirms the address and the field of operations in which the organisation operates in this certificate. It also specifies that the organisation has no negative history that the proposed activities will benefit the residents of the area and that prior approval if granted, will be detailed.

Q.: What are the possibilities if an application is rejected?

To request registration, send a copy of Form FC-8, along with any attachments, to the Secretary, Government of India, Ministry of Home Affairs, Internal Security Wing-FCRA, 4th Floor, Lok Nayak Bhawan, Near Khan Market, New Delhi-110003.

Q.: Who is the authority to whom the registration application is to be made?

To apply for registration, send a copy of Form FC-8, along with any attachments, to the Secretary, Government of India, Ministry of Home Affairs, Internal Security Wing-FCRA, 4th Floor, Lok Nayak Bhawan, Near Khan Market, New Delhi-110003.

Q.: What is the procedure for requesting permission in advance?

The organisation must submit a Form FC-1A together with the relevant paperwork to the FCRA department for prior approval.

Q.: What is the list of required documents that must be presented in order to obtain prior approval?

The required list of documents that must be presented in order to obtain prior approval are as follows:

i) Form FC 1A, properly filled up in triplicate.

ii) Accounts for the previous three years that have been audited.

iii) An annual report detailing the activities of the previous three years.

iv) Information on the recipients and the project for which a foreign contribution is expected. The narrative, as well as financial data, should be included in the detail.

v) Letter of commitment from a foreign donor agreeing to give monies in principle.

vi) A certified copy of the registration certificate issued in accordance with the Societies Act and the Companies Act.

vii) If relevant, a certified copy of the Bylaws, Memorandum, and Articles of Association.

viii) A copy of the Income Tax Department's exemption or registration certificates issued under sections 80G or 12A.

ix) A copy of any prior approval the organisation has been granted.

x) A copy of the organization's governing body's resolution authorizing the prior consent.

xi) A copy of the Chief Functionary's power of attorney or the governing body's resolution authorizing the submission of FC-1A.

xii) A list of the current members of the organization's governing board, as well as the office-bearers.

xiii) A copy of the organization's journal or other publication.

Q.: What if funds are received prior to obtaining prior approval?

If funds are credited to a bank account prior to receiving approval from FCRA authorities, they should not be used for the purposes for which they were received; instead, they should be kept intact and spent only after receiving prior permission. If the application is turned down, the monies must be returned to the original donors. Depending on the size of the contribution, legal requirements under the Foreign Exchange Management Act may be required to return funds to foreign agencies.

Q.: What is the law regarding the opening of a bank account?

According to Section 6(1)(b), an organisation that has either registered with the Central Government in accordance with the FCRA rules or obtained prior permission may only receive foreign contributions through one bank account specified in its application for registration or prior permission.

Form FC-8 and Form FC-1A, which engage with applications for registration and prior permission; require the mention of a separate bank account number as well as the bank's branch.

Q.: How is the bank account change procedure?

When a bank account change becomes necessary due to relevant and justifiable reasons, the following procedure may be followed:

(i) A new bank account, proposed to be a designated bank account, should be opened by depositing the minimum amount required for account opening.

(ii) Because the proposed account is subject to approval, it should not be funded with foreign funds.

(iii) An application should be sent to the FCRA authorities, indicating the relevant and justified grounds for the change, as well as detailed data of the old and new accounts.

(iv) The whole unspent balance of foreign contribution from the old designated account shall be transferred to the new account after gaining permission from FCRA authorities.

(v) The old account does not need to be closed. As a result, the old account can be used as a local account by the organisation. However, it is preferable to cancel the previous account to guarantee that foreign monies are not credited to it by mistake.

Q.: Is it necessary to report a change in the signatory of a bank account?

Changes in bank account signatories are a routine procedural issue that does not require notification to the FCRA authorities. The Chief Functionary's undertaking in the form FC-8 for informing changes in the bank account is limited to a change in the bank or branch of the bank. Any changes to the same bank account's procedures do not require the approval of the FCRA authorities.

Q.: What if the account number changes due to computerization?

Because of computerization, Many designated FC bank account numbers have changed. In such cases, it is best to notify the FCRA authorities of any changes. For all subsequent reporting and correspondence, the new account number should be used.

Q.: Is it permissible to keep separate bank accounts for different donors under the FCRA?

Some donors have insisted on keeping a separate bank account for their contribution and using it only for that purpose. However, under the FCRA, all foreign contributions must be received in a single bank account. As a result, no separate bank account should be formed to receive payments from diverse donors under any circumstances. Following the receipt of funds in the designated bank account, the organisation may open different sub-accounts (also known as link-up bank accounts) for operational purposes as needed.

Q.: Is it possible for an NGO to have more than one account for project purposes?

Opening project accounts in different locations to use funds appears relevant and justifiable in our opinion. An NGO may establish bank accounts for various projects that are linked to the main foreign contribution bank account. All foreign contributions should be received at the designated bank, and funds should then be transferred to various project accounts.

Having more than one account for FCRA purposes is not the same as opening an imprest or project area account. There can only be one designated bank account for receiving foreign cash at any given time under the FCRA. The other project accounts should be sub-accounts or link-up accounts with only the primary account as a source of receipts. Every year, the Form FC-3 return should include a list of such subsidiary bank accounts. Local revenue should not be deposited in the above-mentioned link-up bank accounts at any time.

Q.: Is it possible to receive an inter-project loan in an FCRA account?

In our view, the transaction between the projects will not involve the receipt of any new foreign contribution, nor will this transaction violate any FCRA provision. However, such transactions must take place within the scope of the organization's FC projects. If a loan or advance is received from another organisation, it should be received in the designated bank account only if it is an FC receipt.

Q.: Is bank interest on foreign funds considered a foreign contribution?

The treatment of interest earned from the designated bank account is not addressed in the Act or the Rules. In the absence of clear provisions, it is common practice to treat interest earned on FCRA funds as a foreign contribution only. This argument was further supported by the addition of a column to the FC-3 Form in GSR 557 (E) dated July 26, 2001, which allowed for the reporting of interest income. As a result, any interest received in FC-3 as well as the FCRA receipt and payment account should be disclosed.

Q.: Is it possible to construct FDRs from an FC's bank account balance?

There does not appear to be any restriction on the formation of fixed deposits with FCRA funding. All funds must be received on the designated bank account, but any temporary surplus funds may be deposited with the bank in fixed deposits pending use on the items they were received for. It is important to ensure that investments comply with the provisions of Section 11(5) of the Income Tax Act.

Q.: What is the treatment if both foreign contribution and domestic funds generate fixed assets?

Any foreign-funded asset should only be recorded in the account books of the FC. Regardless of the project's time factor or closing, FC assets continue to remain FC assets. It is possible that a portion of the asset is funded from domestic sources at times.

For example, a building built on land purchased from domestic sources. In such cases, the land cost should be reflected in the domestic books of account, while the building cost should be reflected in the FC books of account. Only the total cost of land and building will be shown on the consolidated statement.

Q.: What is the procedure for the sale of joint fixed assets?

If an asset purchased with FCRA funds is sold, the amount received on the sale should be reported as foreign receipts. There may be circumstances in which both FCRA and domestic funds create a property. In such cases, the allocation of receipts of the sale should be based on an adequate and reasonable basis on the receipt of the sale consideration, and the sum of the funds from FC assets that are received from the FC should be deposited to the designated bank account in relation to the foreign contribution portion of the asset.

Q.: Can an organisation take loans for the FC project from local sources?

In the absence of the receipt of FC funds in time, an organisation may temporarily use domestic funds for FC projects. However, the advance must be settled immediately when the funds in the FC accounts are available. Original bills must be kept in the FC account, while photocopies can be kept in the local contribution account.

Q.: Can FCRA funds be transferred to another NGO?

FCRA funds can only be given to other NGOs if they are also FCRA registered.

Q.: Does the fact that FC funds cannot be given to any unregistered NGO imply that funds cannot be transferred to village level SHGs that may not have FCRA registration?

As previously stated, the second or subsequent recipient must also have FCRA registration or prior permission. As a result, according to a strict reading of FCRA legislation, it is not possible to lend revolving money to community-based organisations that are not FCRA registered. The intention of the statute does not seem to be in favour of avoiding the use of funds by worthy village organisations. The modification made to FC-3 video GSR 557(E) by 26 July 2001 specifically covered the use of foreign funds in Microfinance projects and SCGs. In our view, in the light of the amended FC-3 funding allocations should appear as used in the FC-3 and as expenditure in the Income and Expenditure Account for the revolving funds and for microfinance activities. When loans are recovered, the funds should be put in the FCRA bank account and accounted for as foreign contributions received; when loans are disbursed again, the funds should be accounted for as utilisation and expenditure in the year of disbursement. Separate records of disbursements or receipts of revolving funds should be kept for control purposes.

It may be difficult for large organisations with projects spread across India to redeposit in the designated bank account. However, under the current FCRA provisions, it is preferable to receive all such recoveries in the designated bank account only.

Q.: Is it possible to transfer FCRA payments to the general fund?

Many NGOs have been observed transferring the surplus of income over expenditure to the general fund in their local accounting accounts. A general fund, which is an unrestricted fund that the organisation can spend at its discretion, is sometimes mistaken for a local fund. However, all monies generated by foreign contributions should be recorded only in the FC books of account. As a result, a company can have two general funds, one made up of international funds and the other made up of domestic money. The corpus and other funds are in the same boat.

Q.: Is it possible to combine domestic and international contributions?

The organisations should distinguish between contributions from within the country and contributions from outside the country. In the chosen bank account, only international contributions should be received. There's a chance that domestic and foreign donations will get mixed up because even funds sent from abroad in foreign currency could be considered a domestic donation. If an NRI maintains a valid Indian passport, a donation received in foreign currency from an NRI is not a foreign contribution. Foreign contributions received in Indian rupees, on the other hand, are considered foreign contributions.

Q.: What happens if a donor makes an undeclared or anonymous donation?

Many organisations receive donations from various international sources by direct credit into their bank accounts, where the donor's identity may not be known. In this scenario, the organisation should request that its bank investigate the source of the donation, including the donor's identity and country of origin. If the information is obtained from the bank, it should be reported in Form FC-3; otherwise, the organisation should record all such anonymous gifts based on bank advises in Form FC-3.

Q.: What is the accounting procedure for in-kind overseas contributions?

Accounts must be kept for foreign contributions received in kind, according to regulation 8(1)(a). The format for recording the receipt as well as the use of in-kind contributions is provided by Form FC-6. The entries in Form FC-6 should match the entries in Form FC-3.

Q.: What are the advantages of registering with the FCRA?

You will get the foreign donation or grant after completing the FCRA registration.

Q.: If we don't have an NGO pan card, do we need to prepare one?

Yes, you must apply for a new pan card.

Q.: How long will it take to register with the FCRA?

It will take no more than three months.

Q.: Who will be in charge of the investigation?

The Crime Branch Department conducted the investigation.

Q.: Where do we send the documents for FCRA registration?

Delhi's Ministry of Home Affairs.

Q.: Will you submit the documents and follow up, or will we have to?

We will submit the documents in Delhi and follow up with you.

Q.: Is it necessary to have worked for an NGO for three years before applying for FCRA?

Yes, your NGO should have been in operation for at least three years.

Popular article :