OTHERS

Are you looking for a Top CA firm in India?

RJA 01 Nov, 2021

Are you looking for a Top CA (Chartered Accountant) firm in India? We've compiled a list of the Top 11 Chartered Accountants Firms in India as of today, complete with descriptions. There are Top CA firms based in India that have branches both in India and internationally. We also witness ...

OTHERS

Why do you need to hire a Top CA Firm in India?

RJA 01 Nov, 2021

WHY DO YOU NEED TO HIRE A TOP CA FIRM IN INDIA ? Everyone believes that a Chartered Accountants is only needed once a year to file our returns and pay our taxes, which is a major fallacy. CA can assist a company in growing and improving its financial situation. ...

INCOME TAX

CBDT Notifies E-settlement scheme 2021 for pending applications with settlement commission

RJA 01 Nov, 2021

CBDT notifies E-settlement scheme 2021 for pending applications with settlement commission CBDT of Direct Taxes by exercise power u/s 245D (11) and 245D (12) of Income-tax Act has issued a Scheme may be called E-Settlement Scheme 2021 to settle pending income-tax settlement applications transferred to a settlement commission. (Notification No. 129/2021/ F.No. 370142/52/2021...

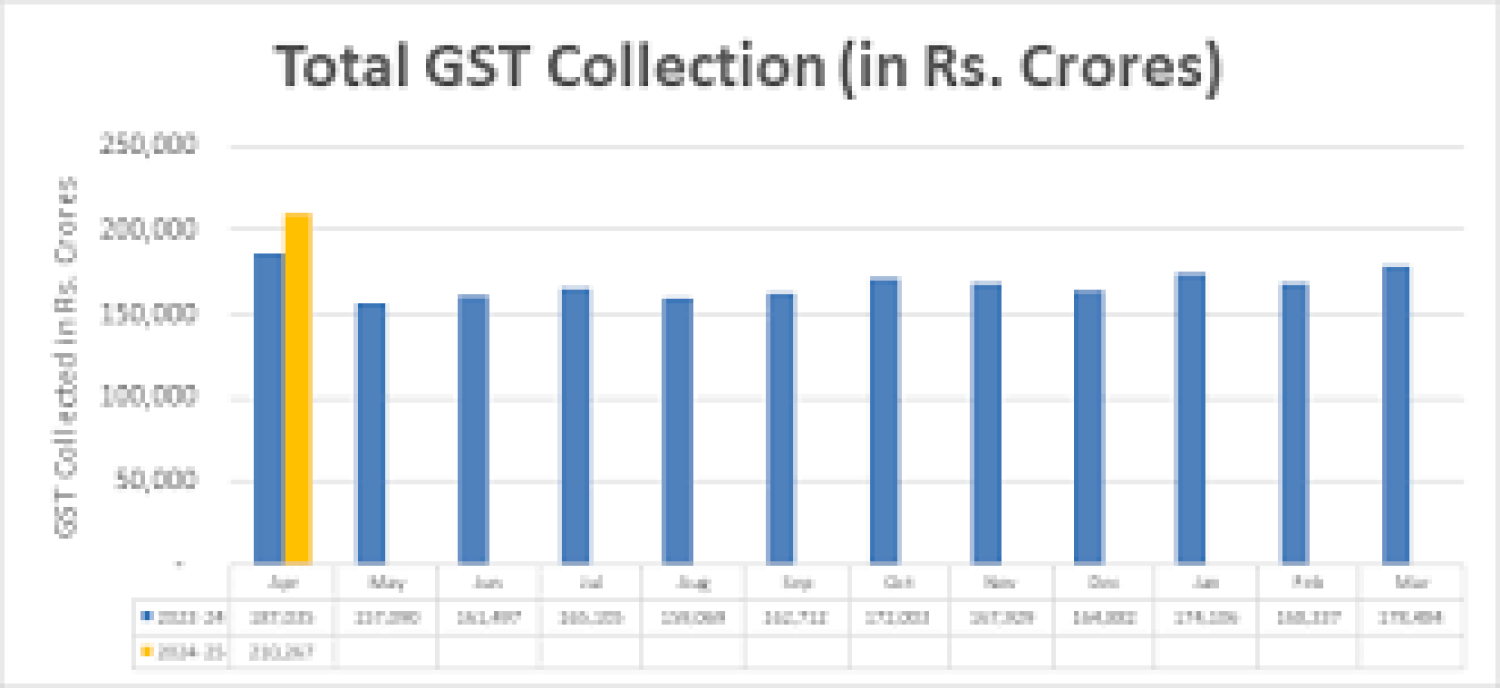

Goods and Services Tax

SC disallowed Bharti from taking INR 923 Cr GST refund by changing GSTR Return

RJA 30 Oct, 2021

Supreme Court Bench Disallows Bharti Airtel from seeking Rs. 923 crore GST Refund by Rectifying Return Facts- The Respondent was having issues filling GSTR Form 3B due to several glitches in the Online GST Portal, according the brief facts of the case. Despite these issues, the Respondent filed its GST ...

OTHERS

8.5% interest rate on PF Deposits: Approval by Ministry of Finance for FY21

RJA 30 Oct, 2021

8.5% interest rate on PF Deposits: Approval by Ministry of Finance for FY21 The board of retirement fund body of EPFO had recommended an 8.5 percent interest rate for FY21. Ministry of Finance endorsed a 8.5 % interest rate for FY 2020-21 for PF, Board of retirement fund body Employees Provident Fund Organization (...

OTHERS

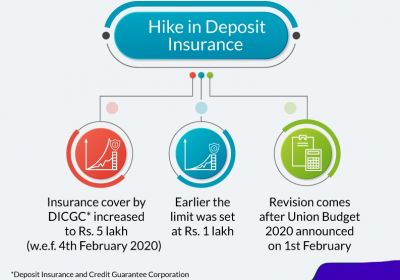

DICGC issue a list of banks whose a/c holders will likely get up to INR 5 lakh

RJA 30 Oct, 2021

DICGC issue a list of banks whose a/c holders will likely get up to INR 5 lakh. Deposit Insurance and Credit Guarantee Corporation Act was amended to increase the deposit insurance from earlier INR 1 lakh to INR 5 lakh. DICGC on September 21 announced it shall pay the depositors of the insured ...

Goods and Services Tax

DGGI Unit arrests 3 Persons for running multiple fake firm & Evading GST of more than INR 48 Crore

RJA 30 Oct, 2021

DGGI Unit (Gurugram) arrests 3 Persons for running multiple fake firm & Evading GST of more than INR 48 Crore Directorate General of GST Intelligence (DGGI) of Gurugram Zonal Unit (GZU) has arrested 3 persons on charges of running multiple fake firms on the strength of fake documents in two different cases under ...

FCRA

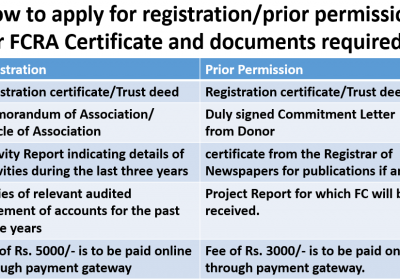

FAQs on obtain prior permission from FCRA authorities

RJA 28 Oct, 2021

FAQs on obtain prior permission from FCRA authorities Q1 What is the different type of registrations provided under FCRA 2010? There are generally two types of pf FCRA registration granted in India, namely – Prior Permission and Proper Registration. Each of the above type requires some prerequisites such as – PRIOR ...

Goods and Services Tax

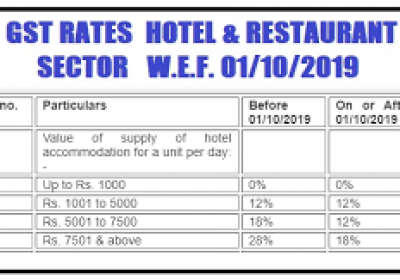

FAQs ON GST ON HOTELS & RESTAURANT INDUSTRY

RJA 28 Oct, 2021

FAQs ON GST ON HOTELS & RESTAURANT INDUSTRY Q.: A hotel is registered on the Fab hotels site. Fab hotels give their listing on Goibibo. During this case, Gobibo was not having any information in respect of such hotel. In this case who is susceptible to collect TCS? As ...

FCRA

Frequently Asked Questions (FAQs) on FCRA

RJA 28 Oct, 2021

Frequently Asked Questions (FAQs) on FCRA Q1: What are the various kind of FCRA registrations? The below are the two forms of FCRA registration: Proper FCRA registration Proper FCRA registration permission The eligibility requirements, as well as the duration of the registration, vary depending on the type of FCRA ...

Financial Services

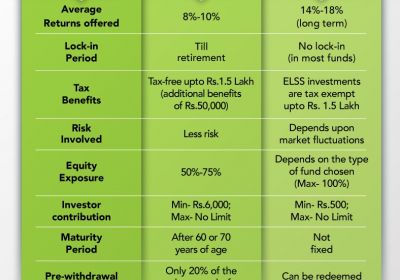

Why we Should invest in NPS just for the tax benefits?

RJA 28 Oct, 2021

Why we Should invest in NPS just for the tax benefits? “Since the Income Tax Act introduced a new deduction of $50,000 under Section 80CCD, NPS has grown in popularity (1b). This deduction is in addition to the 1.5 lakh deduction granted under Section 80C. As a result, investment in National ...

COMPANY LAW

Issues & suggestions in Consultation paper issued by the NFRA

RJA 24 Oct, 2021

Issues & suggestions in Consultation paper issued by the NFRA In Paragraph 1.2 of the Consultation paper dated 29.09.2021, it has been said that “As per view of significant role played by Corporates in India in Economic development & growth of the India, it is required that the regulatory environment of ...

OTHERS

Prime Minister Employment Generation Programme (PMEGP)

RJA 21 Oct, 2021

Prime Minister Employment Generation Programme (PMEGP)-Eligibility, Features PMEGP scheme was founded in 2008 by merging two schemes that were in operation till 31.03.2008 namely Prime Minister’s Rojgar Yojana (PMRY) and Rural Employment Generation Programme (REGP) for generation of employment opportunities through establishment of micro enterprises in rural as well ...

NRI

FAQ/Guidelines on Aadhaar-based PAN distribution

RJA 19 Oct, 2021

FAQ on Aadhaar-based PAN distribution What's the PAN? Answer: PAN, or Permanent Account Number, is a special 10-digit alphanumeric code. The Income Tax Department issues PAN in compliance with the Income Tax Act & Regulations. Financial institutions and agencies are also required to have PAN. What is Instant PAN ...

INCOME TAX

Validity of Partnership remuneration disallowed U/s 40A(2)(a)

RJA 16 Oct, 2021

Validity of Partnership remuneration disallowed U/s 40A(2)(a) Problem based on provisions of Sections 40(b)(v) & 40A(2)(a) of the Income Tax Act, 1961. LETS see the applicability of provision of applicable of section. SECTION 40(b)(v) of income tax provides that: Remuneration to Partners exceeding the limit prescribed ...

Goods and Services Tax

Pre deposit for GST appeal should be paid via cash ledger only

RJA 15 Oct, 2021

Orissa Honorable High court: Pre deposit for filing appeal under GST to be paid Via cash ledger only & adjustment not allowed from credit ledger Fact In case of Jyoti Construction v. Deputy Commissioner of CT & GST, Jajpur (Orissa) petitioner was a partnership firm doing the business of ...

ROC Compliance

Non-Filing of E-Form INC-20A- Consequences

RJA 15 Oct, 2021

Commencement of Business E-Form INC-20A Filing Brief Introduction Form INC-20A is basically a declaration form that's to be filed by the directors of the corporate at the time of commencement of business. The declaration form should be verified by ...

ROC Compliance

All About Form MGT-9 & its Filling requirement

RJA 14 Oct, 2021

All About Form MGT-9 & its filling requirement Brief Introduction At the end of each financial year, companies in India should file an annual return. There are numerous amendments associated with the filing of annual returns. There has also been lots ...

ROC Compliance

How to apply DIN before Company formation

RJA 14 Oct, 2021

DIN Allotment Prior to Incorporation of Company Brief Introduction DIN or the Director Identification Number is basically a unique identification number, that is compulsorily be obtained by all the directors. It's similar to an identity proof of a director. DIN is allotted by&...

AUDIT

Importance of Internal Audit in India

RJA 08 Oct, 2021

Importance of Internal Audit Checking the internal system is that the most frequent task. Several types will be distinguished here: audit, operational audit, compliance audit (compliance audit), audit of knowledge technology (information systems), audit within the field of environmental ...

Income tax return

Impact of Delay in filing Income tax returns

RJA 08 Oct, 2021

Impact of Delay in Filing Income Tax Returns The most important obligation for any tax payer is to file their income tax on time, on or before the due date. Whenever income tax returns are submitted late, the taxpayer misses a lot of benefits. Apart from the smaller exemptions, the ...

Form 15CA & 15CB Certificate

Form 15CA & 15CB Submission Process has been redesigned

RJA 07 Oct, 2021

Form 15CA & 15CB Submission Process has been redesigned The Income-tax Dept has introduced an entirely new re-engineered Form 15CA and Form 15CB submission process based on past year's feedback from numerous corporates and professionals across India. These alterations will optimise & simplify the Form's preparation, assignment, submission, ...

FEMA

Complete Coverage about FEMA Returns with RBI Forms

RJA 07 Oct, 2021

FEMA Returns with RBI, Forms for Foreign Company, Forms for Import Export Business FEMA Returns with RBI Forms for Foreign Company S. No. Particulars of Form Purpose of Form Periodicity Letter of Comfort Format for Letter of Comfort for LO/BO Before establishing LO/BO Report to ...

Income tax return

FREQUENTLY ASKED QUESTION ON INCOME TAX RETURN:

RJA 03 Oct, 2021

FREQUENTLY ASKED QUESTION ON INCOME TAX RETURN: Q.: What Are the Benefits of Filing Income Taxes? In recent years, the Government of India has taken restrictive action in enforcing the Income Tax Law by linking various benefits for prompt tax filers, which has resulted in low Income Tax filing Compliance ...