Table of Contents

Frequently Asked Questions (FAQs) on FCRA

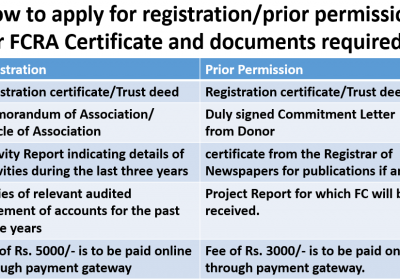

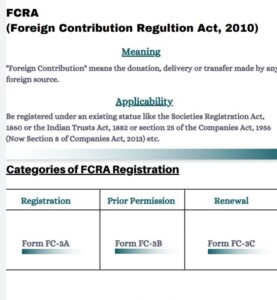

Q1: What are the various kind of FCRA registrations?

The below are the two forms of FCRA registration:

-

Proper FCRA registration

-

Proper FCRA registration permission

The eligibility requirements, as well as the duration of the registration, vary depending on the type of FCRA registration.

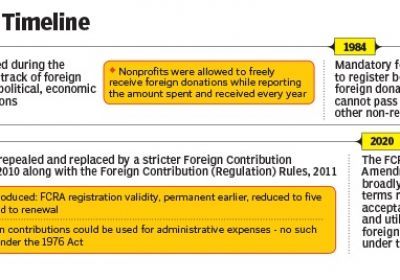

Q2. What is the timeline of the FCRA Registration?

FCRA Registration is valid for 5 years after it is issued, and it can be extended by applying within six months of the expiry date.

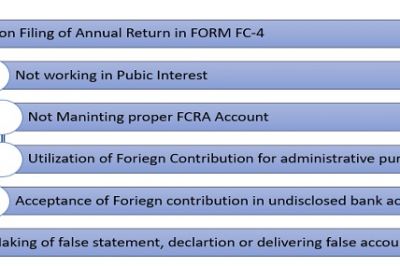

Q3. What are the requirements for FCRA annual compliance after registration?

The organization must file an annual return in specified form FC-4 online via the official website of https://fcraonline.nic.in after receiving the FCRA License, along with the following documents approved by a chartered accountant:

- an income statement scanned copy

- a balance sheet scanned copy

- International receipt statement scanned copy

- an entity's payments and expenditures

Q4. What is the deadline for the FCRA registered company to file an annual return?

FC-4 is an annual compliance form that must be submitted within 9 months of the end of the financial year, i.e., on or before December 31st of each year.

Q5. Is it necessary to update required for the FCRA Registration certificate?

According to Section 16 of the FCRA, 2010, someone who has been issued a certificate of registration under Section 12 must have it renewed within six months of the certificate's expiry date.

Q6. What is the procedure for FCRA Re-registering?

Associations who want to extend their registration certificate will do so six months before it expires by filling out Form FC-3 online.

Q7. When does an organization that was given registration under the FCRA in 1976 file for renewal?

- The registration issued to associations under the revoked FCRA, 1976 is valid until April 30, 2016,

- Those associations should have applied for renewal of their registration six months before the validity expires on or before October 31, 2015.

- With effect from May 1, 2016, the renewed certificate will be valid for five years.

Q8. What documents must be submitted to update your FCRA Registration?

For renewal of registration,

-

- Chief Functionary's signature,

- the seal of association's,

- Registration certificate of association's,

- the Memorandum of Association/ Trust Deed of association's, and

- a self-certified copy of the registration must be uploaded.

Q9. What happens if the association fails to renew its FCRA registration online?

- The existing registration under the FCRA, 2010, will expire after the five-year term from the date of grant of registration has expired. In this situation, the association would have to reapply for registration.

Q10. Is it necessary to update the registration certificate?

- According to Section 16 of the FCRA, 2010, someone who has been issued a certificate of registration under Section 12 must have it renewed within six months of the certificate's expiry date.

Q11. What is the procedure for re-registering?

- Associations who want to extend their registration certificate will do so six months before it expires by filling out Form FC-3 online.

Q12. When does an organization that was given registration under the FCRA in 1976 file for renewal?

- Since the registration issued to associations under the revoked FCRA, 1976 is valid until April 30, 2016, those associations should have applied for renewal of their registration six months before the validity expires, on or before October 31, 2015.

- With effect from May 1, 2016, the renewed certificate will be valid for five years.

Q13. What documents must be submitted to update your registration?

For renewal of registration,

-

- Chief Functionary's signature,

- the seal of association's,

- Registration certificate of association's,

- the Memorandum of Association/ Trust Deed of association's, and

- a self-certified copy of the registration must be uploaded.

Q14. What happens if the association fails to renew its FCRA registration online?

- The existing registration under the FCRA, 2010, will expire after the five-year term from the date of grant of registration has expired. In this situation, the association would have to reapply for registration.

Popular article :