Table of Contents

FAQs on obtain prior permission from FCRA authorities

Q1 What is the different type of registrations provided under FCRA 2010?

- There are generally two types of pf FCRA registration granted in India, namely – Prior Permission and Proper Registration. Each of the above type requires some prerequisites such as –

PRIOR PERMISSION FCTRA REGISTRATION

-

- The entity applying for registration must be a newly established entity and must have been operational for at least 1 year.

- The amount of money raised be utilized for the specified objects only.

- At the time of registration, complete details in the form of name and address of the foreign donor be provided.

- The entity must not accept any amount of foreign donation before obtaining such registration.

PROPER FCRA REGISTRATION

-

- Entity must be registered and taken the prior permission registration.

- NGO must be continuously working for the objects prescribed in bye laws, for at least 5 years.

- The entity, during the last 3 years, have spent at least Rs. 10 lakhs on its objects.

- Entity is required to submit the audited annual statement of accounts and return for the last 3 previous years, along with their registered PAN card.

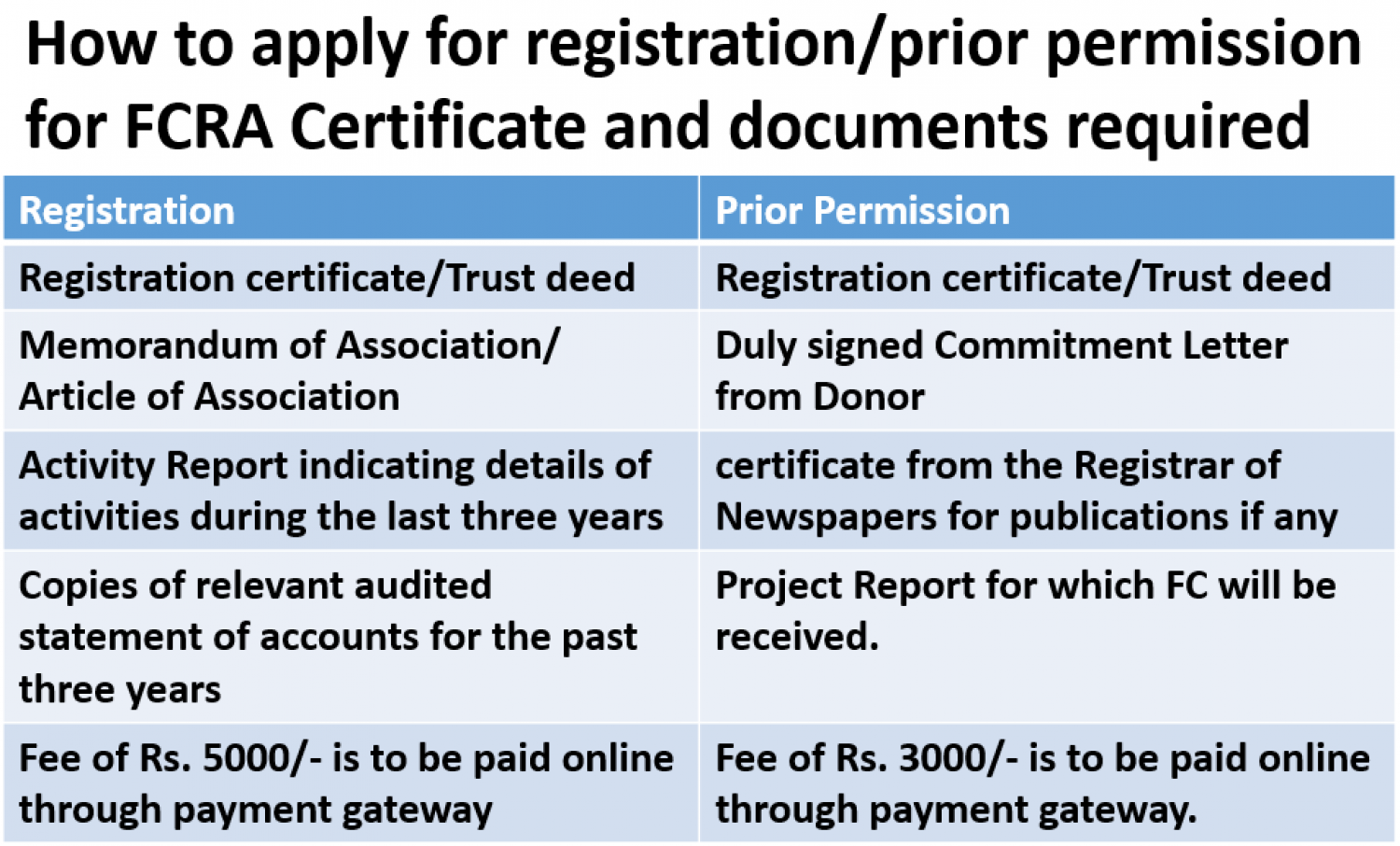

Q2. What are the documents required to obtain prior permission from FCRA authorities?

- To apply for FCRA registration, the entity should be in receipt of the following documents –

-

- PAN card duly issued in the name of the entity.

- Copy of Memorandum and Article of Association of the entity duly specifying their objects and area of operation.

- Self-certified copy of Incorporation certificate or trust deed, or any other document certifying the incorporation of the entity.

- Chief Justice's signature in format of JPG file.

- A report clearly specifying the objects for which the entity is working during the last 3 years.

- An audited copy of financial reporting, P&L account, income-expenditure information, and cash flow statement for the 3 years before the year in which application for FCRA registration is made.

- Certified copy of the resolution passed by an NGO-authorized governing body specifying the approval for obtaining the registration.

- Certificate issued under sections 80G and 12A of the Income Tax. These certificates exempt non-profit organizations from paying taxes under the Income Tax Act.

Q3. Can political parties receive foreign contribution?

- FCRA provides for provisions relating to foreign contribution received by the political parties. As per the provisions, the political parties are debarred and cannot receive foreign fund under any circumstances and neither can they apply for registration nor can they apply for prior permission in any case.

Q4. Can an entity receive foreign contribution, before obtaining the registration?

- An association can receive foreign contribution only when it receives permanent registration or take prior permission for the department. Thus, they cannot receive contribution, before registration or permission.

Q5. What happens if the application is not disposed of within 120 days from filing?

- Where the prior permission is not granted within the prescribed time limit of 120 days, the applicant shall presume that the prior permission has been granted. This deeming provision provides an automatic right for receiving foreign funds,

- even though no written permission is received. But the applicant is also required to ensure that no communication has been provided by post at the end of 120 days, and the same is in transit.