Table of Contents

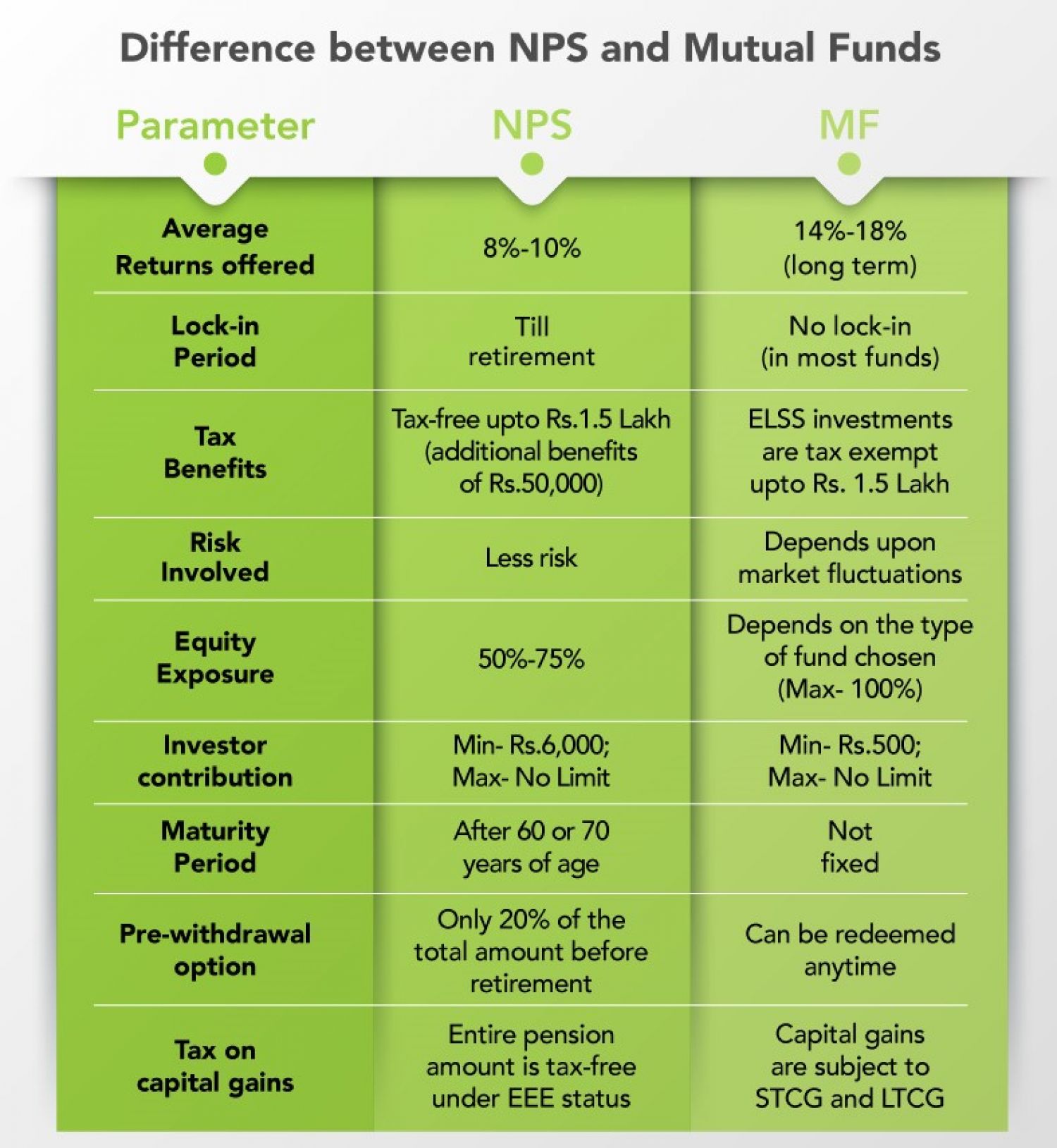

Why we Should invest in NPS just for the tax benefits?

- “Since the Income Tax Act introduced a new deduction of $50,000 under Section 80CCD, NPS has grown in popularity (1b). This deduction is in addition to the 1.5 lakh deduction granted under Section 80C.

- As a result, investment in National Pension Scheme plans can result in a tax deduction of up to $2 lakh."

- The National Pension Scheme helps investors save lump-sum sum for their retirement. This is Apart from tax savings,

- "The National Pension Scheme (NPS) is a retirement-oriented plan that provides monthly pension payments as well as a lump sum payment when the investor reaches retirement age.

- This plan not only saves money on taxes, but it also ensures a comfortable retirement for investors. This system has extended the benefits of the monthly pension enjoyed by government employees to others such as employees, freelancers, and self-employed individuals, among others."

- An investor with a high risk tolerance can put up to 75% of their money in the stock market. Because the investment is market-linked, it provides long-term returns that outperform inflation.

- This is one of the best tax-saving investment options because it invests its corpus in equity and debt segments based on the risk appetite of the investor.

- However, it has been found that when it comes to investing in NPS, many people confuse it with the Public Provident Fund.

- Normally People compare National Pension Scheme & Public Provident Fund investments before deciding between the two.

| Criterion | PPF | NPS |

| Safety | High | Low |

| Returns | Moderate | High* |

| Liquidity | Low | Low |

| Taxation | Fully exempt | Low** |

*High return potential due to long holding period, if the portfolio has sufficient equity allocation.

**40% of NPS is tax-free so the overall rate on NPS is low.

- The National Pension Scheme provides an annuity option, which makes it more appealing. People who are self-employed or have another source of income can also open an National Pension Scheme. Also, while Public Provident Fund is purely fixed income,

- National Pension Scheme allows you to invest up to 60% in equity, whereas Public Provident Fund is purely fixed income, so in a growth environment like last year, a Public Provident Fund investor would have made a fixed return of 7.1 percent, while an NPS holder with 50% equity exposure would have made 25%+ returns. Fund managers might dynamically convert to more debt-like securities in riskier times and auto mode, giving returns on par with PPM,

- National Pension Scheme account maintenance charges are relatively cheap, and benefit of accumulated pension wealth to subscriber timely becomes significant.