DICGC issue a list of banks whose a/c holders will likely get up to INR 5 lakh.

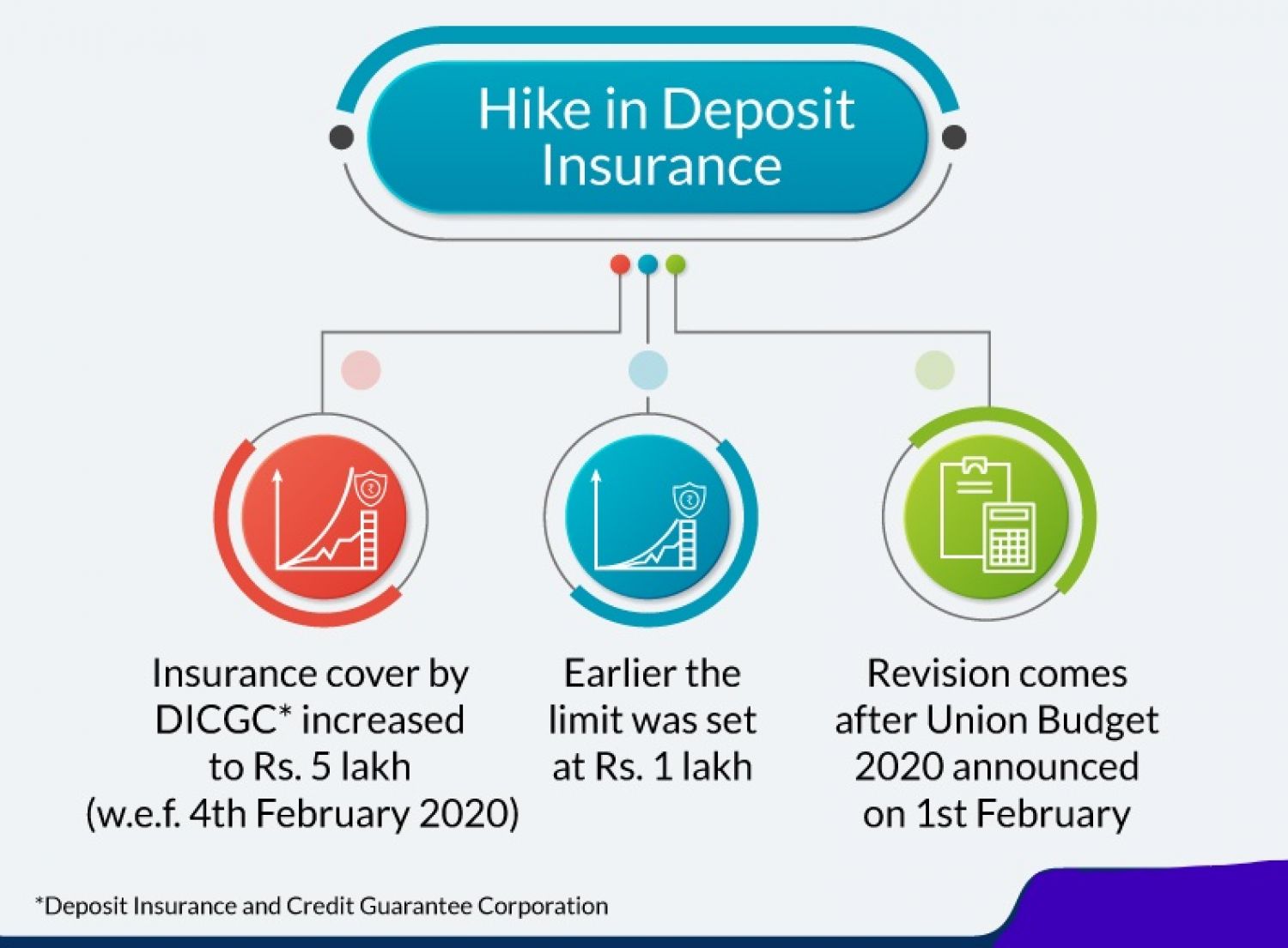

Deposit Insurance and Credit Guarantee Corporation Act was amended to increase the deposit insurance from earlier INR 1 lakh to INR 5 lakh.

- DICGC on September 21 announced it shall pay the depositors of the insured banks placed under the all-inclusive directions (AID) an amount equivalent to the deposits outstanding up to a maximum of Rs 5 lakh only within a period of not exceeding 90 days,

- According to a statement made by the Deposit Insurance and Credit Guarantee Corporation (DICGC), account holders at 21 banks will likely get up to Rs 5 lakh. These banks' operations have been stopped.

- Total of 21 banks including PMC Bank have been placed under AID and the depositors of the insured bank will be getting funds under the deposit insurance scheme.

- The Deposit Insurance and Credit Guarantee Corporation Act, 1961 (DICGC Act) and the Deposit Insurance and Credit Guarantee Corporation General Regulations, 1961 (DICGC General Regulations) framed by the Reserve Bank of India in exercise of the powers conferred by sub-section (3) of Section 50 of the said Act govern the DICGC's functions.