Table of Contents

Frequently Asked Question on Income Tax return filling in India

Q.: What is the difference between an ITR-V form and an ITR-Acknowledgement?

Form ITR-V contains information from income tax returns filed in Forms ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, and ITR-7 but not e-verified.

Form ITR-Acknowledgement shows and verifies data from income tax returns filed in Forms ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, and ITR-7.

Q.: Is it required to attach any documents while filing an income tax return?

Only documentary proof is required for claiming a deduction, according to the Income Tax Act. Therefore, no document at the time of ITR filing is required to be presented as evidence.

Q.: If revenue is generated from more than one house, which form should be chosen for ITR filing?

The taxpayer can opt for Form ITR-2 if more than one household property generates revenue.

Q.: What are the provisions of paragraphs 139 (4A), 4(B), 4(C), 4(D), 4(E), and 4(F)?

The following can be understood in sub-sections of Section 139:

- Section 139(4A): – Individuals earning income from the property held for religious or charitable purposes as a trust.

- Section 139 (4B): – political parties whose total income exceeds the exemption limit.

- Section 139(4C): – An institution or association under section 10(23A), medical or educational institution, scientific research association or news agency.

- Section 139(4D): – Institutions such as universities and colleges.

- Section 139(4E): – It includes business trust.

- Section 139(4F): – Investment Funds under Section 115UB.

Q.: What is the meaning of self-assessment tax?

The tax that a person must pay before filing his or her income tax return is known as self-assessment tax. TDS and advance tax are taken into account when calculating self-assessment tax.

Q.: How will the excess tax be reimbursed if it has been deducted?

An individual must file an income tax return in order to receive a refund of the excess tax deducted. The money will be deposited into the taxpaying person's pre-approved bank account.

Q.: Can I claim the HRA tax exemption when I file my tax return?

Yes, you can claim HRA tax exemption when completing your income tax return.

Q.: How long does it take for a tax refund to be credited to a bank account?

Once the tax return is processed by the tax department, the income tax refund will be credited to your bank account, if the department accepts that the refund is due. To ensure timely crediting of tax refunds, your bank account must be pre-validated.

Q.: How do I file an online income return?

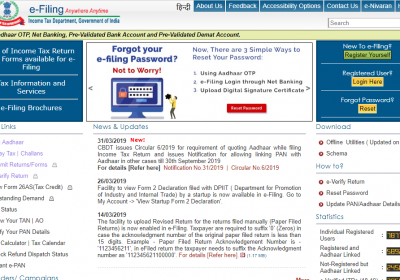

Either through the e-filing portal of the tax department, incometaxindiaefiling.gov.in, you can file a return online. Your tax return can also be filed on private websites.

Q.: Is tax reimbursement taxable?

No, it is not taxable to pay income tax refund amount for you. However, tax refund interest paid in your hands is taxable. It is taxable in accordance with the income tax bracket applicable to your earnings.

Q.: What is standard deduction, and how does it work?

A standard deduction is a fixed amount available to salaried/pensioners. The deduction is deducted from the salary or pension before calculating the taxable net salary/pension income. Individuals can claim a deduction of up to Rs 50,000 for the fiscal year 2019-20.

Q.: When is the deadline for ITR verification?

ITR must be verified within 120 days of the date of filing the return, either electronically or by physically sending the ITR-V to the income tax department.

Q.: What is the procedure for re-verifying an income tax return?

Any of the following methods can be used to electronically verify an income tax return: Adhaar-based OTP, net bank EVC, bank EVC, Demat account EVC and ATM bank EVC.

Q.: Do I need PAN for a return on income tax?

The income tax return may be filed on a PAN or Aadhaar basis starting September 1, 2019, as long as the PAN is linked to Aadhaar.

Q.: I'm a non-resident. I'm a non-resident. In my jurisdiction of residence, the Taxpayer Identification Number (TIN) is not allocated. How can I report in the "residential status" column the same?

Ans: If TIN was not assigned to the competence of the residence, it is appropriate to indicate a passport number instead of TIN. In the column "Jurisdiction of residence," the name of the country in which the passport was issued should be stated.

Q.: I am a director of a foreign corporation that does not have a PAN. How do I report this in the column "Whether you were a Director in a company at any time during the previous year?"

Ans: In the drop-down menu for "type of company," select "foreign company." In this event, a PAN is not required. However, if such a foreign firm has been assigned a PAN, it should be reported.

Q.: Is it also necessary for a non-resident, or a resident but not ordinary resident (RNOR), to declare information of his directorship in a foreign firm with no revenue flowing or generating in India?

During the previous year, I owned shares in a company that was listed on a recognised stock exchange outside of India. Where do I have to report the details of the column 'Whether in the previous year you had any unlisted share??

No.

Q.: I've held equity shares in a company that was once listed on a recognized stock exchange but was later delisted and became unlisted. How can I report a company's PAN in the "if you held unlisted shares anytime in the last year?" column?

The company's PAN can be equipped if it is available in such cases. If the PAN of a delisted company cannot be obtained, a default value of “NNNNN0000N” may be entered in place of the PAN.

Q.: How should the “cost of acquisition” and “sale consideration” be reported in the relevant column if unlisted equity shares are acquired or transferred by gift, will, amalgamation, merger, demerger, or bonus issue, for example?

In such cases, enter zero or the appropriate value for "cost of acquisition" or "sale consideration." Please keep in mind that the information on unlisted equity shares held during the year is only required for reporting purposes. The quantitative information given in this column is irrelevant for calculating total income or tax liability.

Q.: I own shares in an unlisted foreign corporation that has been properly reported on Schedule FA. Is it necessary for me to enter the same information in the section "Have you ever held unlisted equity shares during the previous year?"

During the preceding year, I had unlisted equity shares as a stock-in-trade of business. Is it necessary for me to mention this in the column "Have you ever held unlisted equity shares during the previous year?"

The quantitative information given in this column is irrelevant for calculating total income or tax liability.

Q.: I own shares in an unlisted foreign corporation that has been properly reported on Schedule FA. Is it necessary for me to enter the same information in the section "Have you ever held unlisted equity shares during the previous year?"?

During the preceding year, I had unlisted equity shares as a stock-in-trade of business. Is it necessary for me to mention this in the column "Have you ever held unlisted equity shares during the previous year?"

Q.: Could you please clarify whether unlisted equity shares in Co-operative Banks or Credit Societies are required to be reported?

Only the details of equity shareholding in any entity registered under the Companies Act that is not listed on any recognised stock exchange must be reported.

Q.: I sold a piece of land and a building to a non-resident. Is it necessary to report the buyer's PAN in Schedule CG table A1/B1?

As stated in the ITR form, quoting the buyer's PAN is required only if tax is deducted under section 194-IA or is mentioned in the documents

Q.: I am a resident of India who has sold land and buildings outside the country. Is it necessary for me to record the property's data and the buyer's identification in Schedule CG?

The property specifics and buyer's name should always be mentioned. However, only if tax is deducted under section 194-IA or is indicated in the paperwork, is the buyer's PAN required.

Q.: Is it necessary to give ISIN information and a scrip-by-scrip calculation of Long Term Capital Gains (LTCG) on the sale of Shares/Mutual Funds units on which STT has been paid?

For the convenience of taxpayers, tools for calculating LTCG under sections 112A and 115AD have been included in the departmental utility. These are optional tools for calculating LTCG figures, which are then reported in Schedule CG, respectively. Alternatively, taxpayers can compute their own aggregate long-term gain or loss and enter it directly into the relevant Schedule CG items.

Q.: Is it necessary for an unlisted company to provide asset and liability information in Schedule AL-1 of ITR-6? Please clarify whether details of assets held as stock-in-trade of a business must also be reported.

If you are holding the stock in business for jewellery/motor car, the value "stack-in-trade," while filling in details in the corresponding table (table 'I' or table 'H') should be set against the "use for which it was used" column. Only the aggregate values must be filled out in such cases, and no particular details of each asset held as inventory are required.

Q.: During the previous year, I held foreign assets that were duly reported on Schedule FA. Is it necessary for me to report such foreign assets again in Schedule AL (if applicable)?

In the Schedule SH-1 of ITR-6, an unlisted firm must report its shareholding as of the preceding year's end. Please clarify whether these facts must be provided in the event of a foreign firm that is not publicly traded.

No, it is not required.

Q.: In ITR-6 Schedule AL-1, an unlisted company must include details of its assets and liabilities. Please clarify whether these facts must be provided in the event of a foreign firm that is not publicly traded.

No, it is not required.

Q.: The head under which the corresponding receipt has been offered must be entered in the TDS schedule. In some circumstances, the payer deducts TDS in the current year, but the equivalent income must be provided in subsequent years. How to fill out the TDS Schedule.

In such scenarios, no TDS credit should be claimed for the current year under the column "in own hands." If you do this, the column "Corresponding receipt offered" will be greyed out and you won't have to fill it in.

Q.: Why is it necessary to file a tax return?

Individuals are required to file returns only if their income exceeds the basic exemption limit or if they meet certain criteria such as spending more than Rs 2 lakh on foreign travel and spending more than Rs 1 lakh on electricity in FY 2019-20 or later.

In the case of a resident whose asset is located outside of India or who has signing authority for an account-based outside of India. Even if you are not eligible for benefits, it is always a good idea to file your ITR.

- Filing an ITR generates legal proof of income.

- In the future, ITR will be required when applying for a loan.

- Banks require ITR even when applying for credit cards.

- VISA applications, for example, require an ITR.

- As a result, even if your income is below the basic exemption limit, you should file an ITR.

Q.: How do I pay my income taxes online?

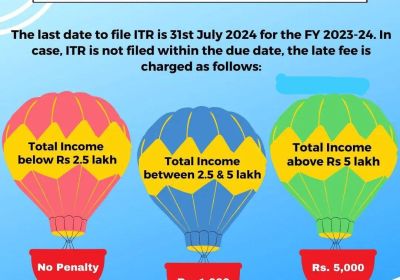

Before you can file your tax return, you must first pay your taxes. If you are a salaried employee, the majority of your tax liability is deducted from your salary in the form of TDS and paid to the government on your behalf by your employer. If you are required to pay advance tax, you must pay 90 per cent of it before the 31st of March of each fiscal year. However, the deadline for filing ITR may be extended, and the IT department will notify you of this via notifications. It is always best to file your ITR by the due date. It is worth noting that if you fail to file your ITR by the due date of the assessment year, you will be charged a late filing fee of Rs 5,000.

Q.: How can I save money on income taxes?

There are numerous ways to save money on income taxes through careful tax planning. The Income Tax Act provides certain deductions and exemptions that can be claimed, lowering your total taxable income and lowering your tax outflow. Some of the most common deductions and exemptions are listed below:

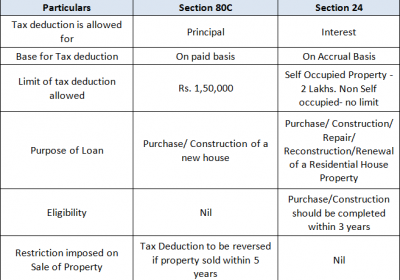

- Deduction of up to Rs 1.5 lakh under 80C – Investing in tax-saving options such as 80 C- investing in ELSS, LIC, mutual funds, the deduction for tuition fees for children, the deduction for the principal amount of home loan, and so on.

- Additional deduction of Rs 50,000 in excess of Rs 1.5 lakh in 80 CCC (1b) for contributions to central government national pension schemes.

- Medical insurance premiums paid for self, spouse, children (Rs 25000 / 50,000) and dependent parents (Rs 25000 / 50,000) are deductible under Section 80D.

- Donations made to recognised institutions and trusts are tax-deductible up to certain limits under Section 80G.

- Exemption from house rent allowance allowed in part or in full under 10 (13A).

- Deduction for higher education loans under Section 80E of the Internal Revenue Code.

- Deduction for home loans paid under section 24 up to 2 lakhs for self-occupied property and the full amount for rented property.

Q.: How do I obtain a copy of my income tax return online?

- Log in with your credentials to incometaxindiaefiling.com.

- Select View Returns/Forms.

- Select “Income tax returns” as the option and the relevant assessment year, then click submit.

- A window with a list of ITRs filed will appear.

- Select the ITR-V acknowledgement number you want to download by clicking on it.

- The ITR V PDF file will be opened and downloaded.

Q.:How do I file my tax return online?

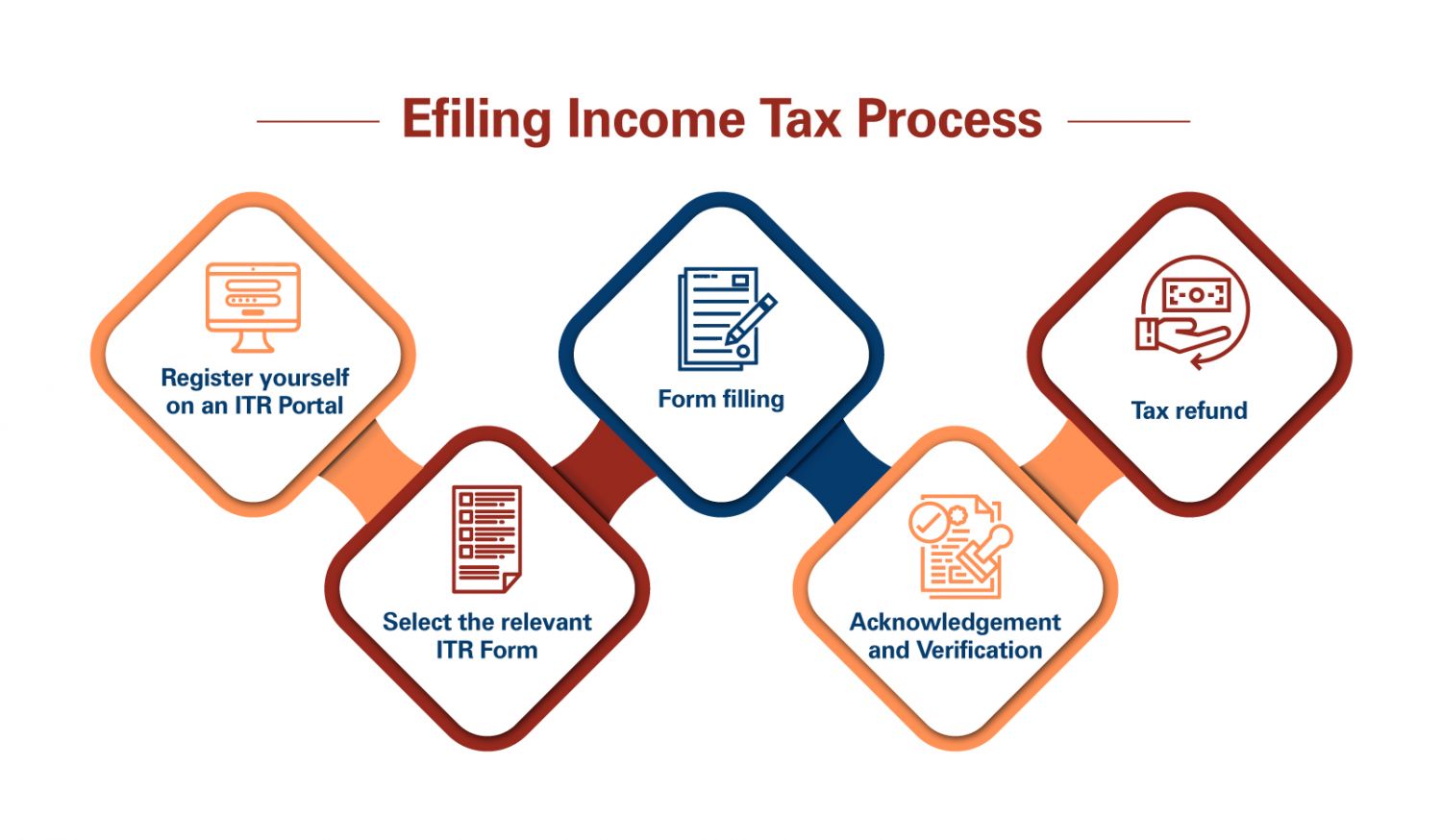

You can file your ITR return online using the income tax e-filing portal or ClearTax. If you want to file the return through the government portal, you must do so in either the "offline" or "online" mode.

- In offline mode, go to https://www.incometaxindiaefiling.gov.in /home and download the applicable ITR form's excel or java utilities from the download > ITR return preparation software tab. You will be given the option to download a ZIP file. Please unzip the ZIP file and fill out all of the required fields in the utility. Remember to validate all of the sheets before clicking on the calculate tax button. After that, create and save the XML utility. The Excel/Java utility is complete and ready for upload to the portal for e-filing. Fill out the return verification form, selecting one of the six options available, and then submit it.

- Log on to the e-filing portal using your PAN, password, and captcha to file your ITR offline. Kindly go to the "e-file" tab and open the drop-down link to the "revenue tax return." Fill in the necessary information and choose “prepare and submit online” as the submission mode. Fill out the ITR form that has been opened online. To save the completed return online, select "save as draught." Verify the return with an Aadhaar OTP/EVC or by sending a physical copy to the CPC. Finally, file the return.

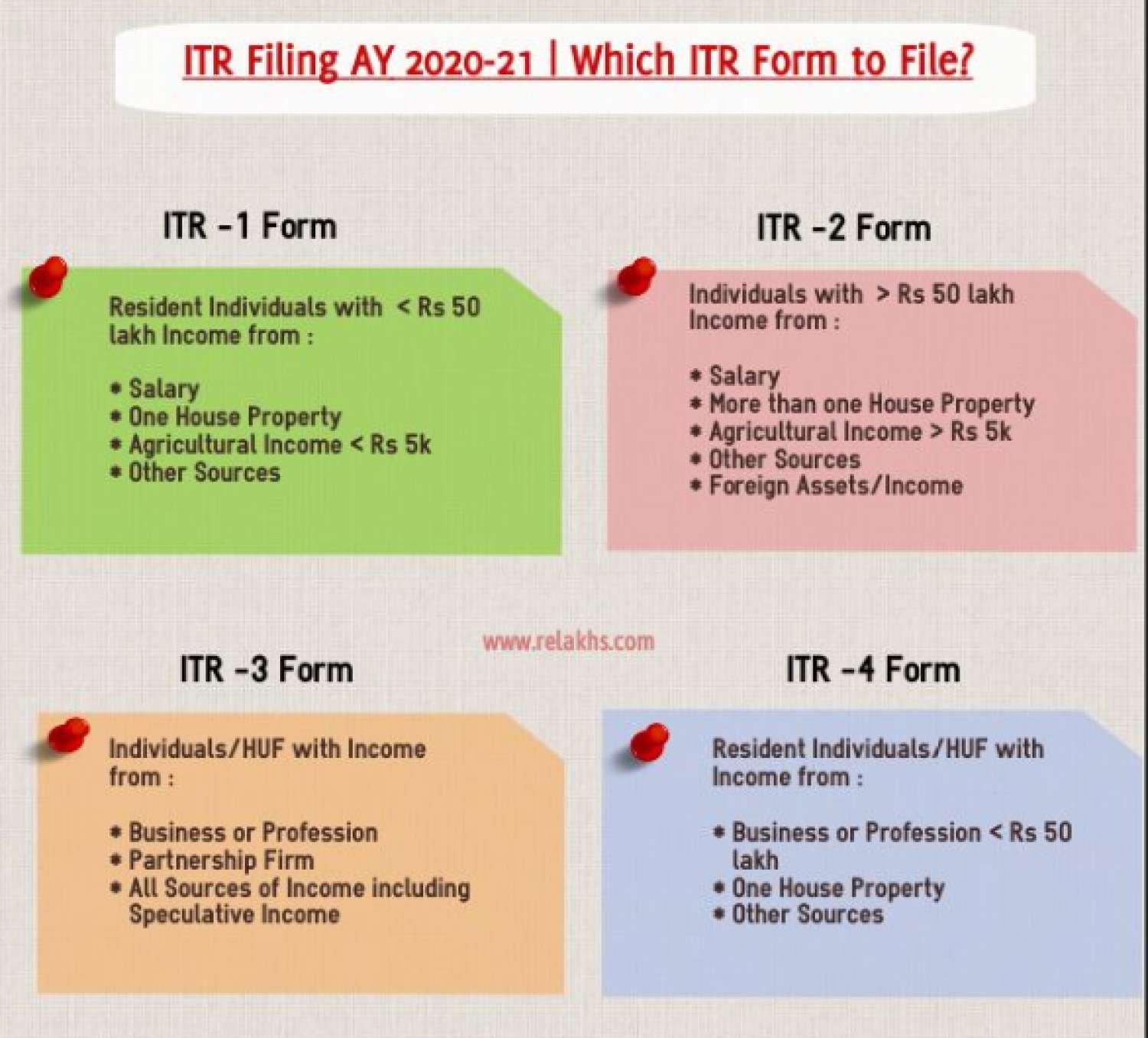

Part- 2: ITR Return Forms

|

Sr. No. |

ITR Forms |

Instruction for Filing ITR Forms |

Description |

|

1. |

To be filed by resident individuals having total income up to ? 50 lakhs from following sources :

|

||

|

2. |

For Individuals and HUFs not having income from profits and gains of business or profession |

||

|

3. |

To be filed by Individuals and HUFs having income from profits and gains from business or profession |

||

|

4. |

For Individuals, HUFs and Firms (other than LLP) being a resident having total income up to Rs. 50 lakhs and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE |

||

|

5. |

For firms, LLP, AOPs, BOIs, Artificial juridical Person, Estate of deceased, estate of insolvent, business trust and investment fund. |

||

|

6. |

For Companies other than companies claiming exemption under section 11. |

||

|

7. |

For persons including companies required to furnish returns under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) or section 139(4E) or section 139(4F) |

If you are looking for answers to more Frequently Asked Questions on ITR filling kindly write in the comment box,