Table of Contents

The CBDT has notified Format & Particulars ITR Forms for AY 2023-24

- The Central Board of Direct Taxes notified Particulars as well as Format of Income tax return Forms along with ITR Acknowledgement (ITR-V) for AY 2023-24 has been officially notified, Basically Central Board of Direct Taxes is a authority functioning under the Central Board of Revenue Act, 1963, who are dealing in the Direct Tax and related changes and amendment on time to time,

- Aforesaid income tax Forms include ITR-2, ITR-3, ITR-4 SUGAM, ITR-5, ITR-6, ITR-1 SAHAJ and ITR-V & ITR Return Acknowledgement.

- The CBDT had issue Offline Utility for Income tax filing ITR-1 & ITR-4 for AY 2022-23 in April previous year. Income tax Taxpayers can download Income tax return Offline Utility via “Downloads” Menu option, & fill and file the ITR through the same. The year before, the Central Board of Direct Taxes had change Java versions as well as Excel of Income tax return utilities with JSON for ITR-4 and ITR-1,

For detail reference of Press releases you can download Notifications as link here Income tax Form

- Last year, the CBDT had replaced the Excel and Java versions of Income tax return utilities with JSON for ITR-1 and ITR-4.

- Like last year's ITR forms, no major changes have been made to the ITR forms to improve filing simplification.

- As according official sources, the Income Tax Act, 1961 amendments have only needed the barest minimum changes.

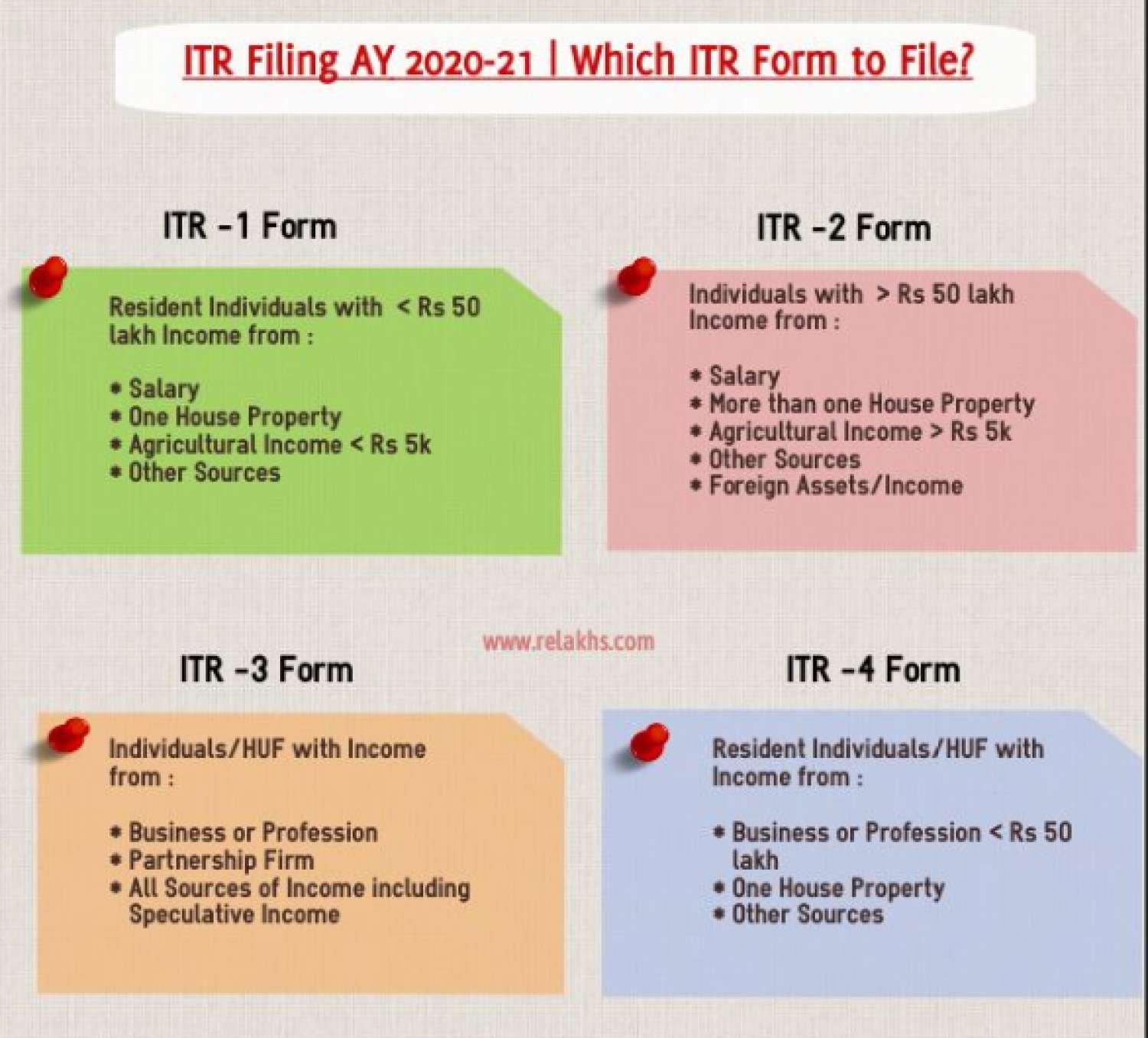

- ITR Forms 1 (Sahaj) and 4 (Sugam), which are less complex forms, are used by many smaller and medium-sized taxpayers.

- Income tax return Form Sugam can be submit by HUFs, individuals, & firms (other than LLPs being a resident having total income up to Rs. 50,00,000/- and Income from business & profession computed U/s 44ADA, 44AE or 44AD.

- Hindu Undivided Families & Individuals not having income from business or profession (Which are not eligible for filing Income tax return Form Sahaj) can submit Income tax return Form 2 while those having income from business or profession can file Income tax return Form 3.

- Hindu Undivided Families and Companies, i.e., partnership firms, Limited Liability Partnerships, etc means Persons other than individuals can submit Income tax return Form 5.

- Charitable institutions, political parties, Trusts etc., are claiming income tax exempt via submitting Tax return Through the Income tax Form 7.

- Companies who are not claiming exemption U/s 11 can their Income tax return Form 6.