Table of Contents

Common Mistakes in Income Tax Return Filling

Mistakes that are commonly done by taxpayers in filing ITR are listed below. These mistakes may create some problems or may bring tax notice for the taxpayers. So it is beneficial to avoid such mistakes that are given below:-

-

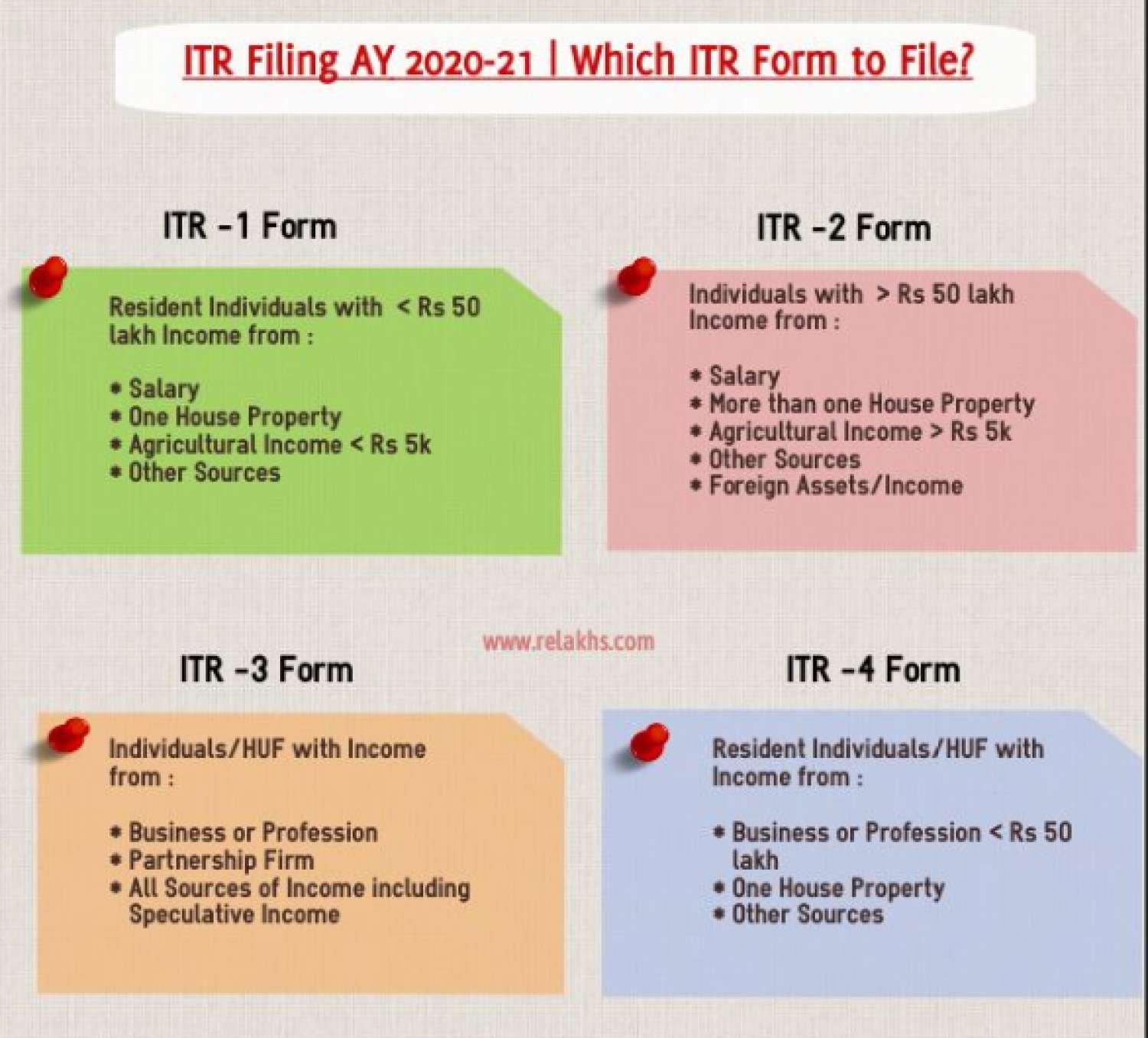

Filing ITR using the wrong form

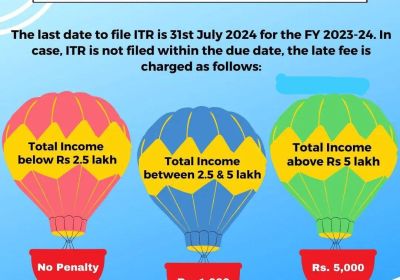

as per rules given in income tax laws, it is mandatory for taxpayers to show all sources of income and ITR will be filed incorrect form which is applicable to him. If a taxpayer file ITR in the wrong form then that ITR will be treated as ‘defective’ and the taxpayer will require to file the revised ITR in correct form.

“In the above case, some time will be provided to taxpayers to rectify mistakes. The taxpayer will be required to file the rectified return within 15 days from the date on which intimation is received u/s 139(9). If the assessee applies for time extension and the assessing officer will agree then time can be extended by the assessing officer. If mistakes are not rectified within the time then the return will be treated as an invalid return or treated as a return not filed at all. Taxpayers will be liable to pay the penalties of non-filing of ITR and also liable to payment of some interest u/s 234A for delay filing in ITR.

2. Not reporting interest incomes

it is compulsory for every taxpayer to report all the interest income received or earned during the financial year (for which return is filed) in his ITR. Normally it has been noticed that individuals generally forget to show the interest earned from savings bank accounts, fixed deposits, recurring deposits, etc. All the interest discusses above are shown under the head ‘Income from other sources. Briefly, interest received or accrued on fixed and recurring deposits are 100% taxable but some tax relief will be provided on interest earned from saving bank accounts. According to section 80TTA of the Income Tax Act, interest earned from the post office and bank saving accounts can claim deduction up to Rs. 10000 from the gross total income.

“There is some extra deduction in addition to section 80TTA will be provided if taxpayer have post office saving accounts. The interest earned from the post office saving account will be exempt up to Rs. 3500 for an individual account and Rs. 7000 for a joint account u/s 10(15)(i) of Income Tax Act”

-

Not filing income tax returns

Earlier if any people have long-term capital gain which is exempt from tax and because of that exempted long-term capital gain gross total income is below the tax payable limit then there is no need to file any ITR.

Now as per the recent amendment in section 139(1) of the Income Tax Act, if you have any long-term capital gain which is exempted from tax and if without this exemption your gross total income exceeds from minimum exemption limit then you have to file ITR.

For instance, let us assume that in a financial year your gross total income is Rs 1 lakh and long term exempted capital gains is Rs 2 lakh. Earlier you were not required to file an income tax return as your total income was below the minimum exemption limit of Rs 2.5 lakh.

Now due to the recent amendment in tax laws, you are required to file ITR as your gross total income plus long-term capital gains (Rs 1 lakh + Rs 2 lakh > Rs. 2.5 lakh) exceeds the minimum exemption limit.

-

Not clubbing incomes

As per the provision of Income Tax Act section 60 to 64 “ for a taxpayer it is mandatory to add the income of specified persons in their total income at the time of ITR filing and tax is calculated on total income including specified person income. Specified persons include minor children, spouse and son’s spouse. Most taxpayers will forget to add the income of their minor child to his income.

“if minor child income is included in his parents' income then taxpayer will claim an exemption of Rs. 1500 u/s 10(32). If you forget to include the income of a minor child then you are liable to pay the tax due along with interest and also may be you are liable to pay the penalty of 50% of underreporting or 200% for misreporting of your income. Earlier this penalty was 100-300% of taxes avoided up to A.Y. 2016-17.

-

Not reporting income from the last job

if you change your job in the previous financial year then you have to show the income of the previous job and current job. If you forget to report any income received from a previous job then you are bound to show that difference in your TDS certificates, Form 16 and Form 26AS. And also it can bring a tax officer to your door. Penalties for this are the same as clubbing of income.

-

Not reporting tax free incomes

If you have any income which is tax-free then you have to report such income in ITR. For example, interest earned from a provident fund is a tax-free income but you have to report this income in your ITR. After that, you can claim an exemption under various sections of the income tax act. All the exempted income will be shown under the head of ‘exempted income’ under the schedule of ITR.

-

Not reporting all bank accounts

Earlier you are bound to report only one single bank account in which you to receive an income tax refund (if any). But now from A.Y. 2015-16, you are required to give details of all the bank accounts held in the previous year (for which ITR is filed) in his ITR. Only dormant accounts excluded to show in the ITR.

“you are mandatory to report all the details regarding cash deposited in your all bank accounts during the demonetization period of 09.11.16 to 30.11.16 for A.Y. 2017-18, if the aggregate sum of cash deposited, is exceeding from Rs. 2 lakh for that demonetization period. If you forget to report details of all bank accounts then it will be treated as incorrect particulars and may be made liable for paying some penalties or even prosecution if it is proved that some taxes are remain escaped due to such non-reporting.”

8. Not declaring deemed rent/expected rent

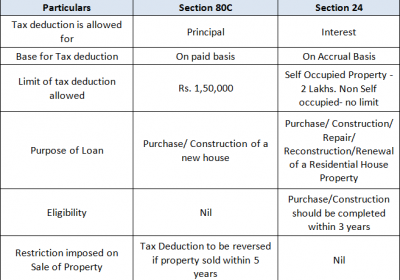

In case if you have another owned house other than a self-occupied house and that another house remains vacant then you have to report the expected rent of that house in your gross total income. Because that notional rent increases the gross total income that may lead to an increase in tax and non-reporting of that make you liable to pay some penalties as discussed above. If in any case you have taken a house loan on that property and you pay interest for that loan then you can claim the benefit of some tax-saving by set-off the loss from house property from interest has been capped at Rs. 2 lakh starting from 01.04.2017.

9. Failing to revise your income

in case if you find any error in ITR after filing the return then it is your duty to rectify that error by filing a revised return. Earlier Income Tax Act allows you 2 years time period for filing a revised return but now from the financial year 2017-18, only one year from the relevant financial year for which return is filed is allowed.

“it is advised to all taxpayers that if they find any error in their ITR then rectify it as early as possible within the time and pay the remaining tax dues with interest to avoid the penalty of underreporting or misreporting. And also if you forget to take exemption or deduction in filing ITR then you can claim tax refunds by filing revised returns.”

-

Presuming tax dept. doesn’t want you to file a tax return:-

An uncommon mistake done by a taxpayer is presuming that he isn’t liable to file a tax return. You’re liable to file a return in the following case even if taxes due from you has been paid by way of advance tax or TDS:

Your income exceeds the basic exemption limit, which is Rs. 3 lakhs for senior citizens (age above 60 years), Rs. 5 lakhs for super senior citizens (age above 80 years) and Rs. 2.5 lakhs for all other individual taxpayers.

If you’re resident in India (other than not ordinarily resident) and you hold (as a beneficial owner or otherwise) any asset or financial interest in any entity located outside India or you have signing authority in any account located outside India. In this case, you can’t file a return in ITR-1.

-

Check Form 26AS before filing ITR:-

Form 26 AS is your tax passbook and it reflects details of tax deducted (TDS) from your income and payment of advance tax during the year. If you find any mistake in Form 26 AS then you should notify the same tax deductor to rectify it. The tax department matches the tax credit claimed by you in ITR and the tax credit available in Form 26 AS. The tax department will deny credit of TDS claimed in ITR if it is not shown in Form 26 AS. Further, if any entry is found in Form 26 AS but is not show in ITR, a tax notice will be received by you to explain the reason for not reporting it in ITR.

Recommendation towards: Common mistake to avoid when Filing ITR:

You should do it with the utmost caution before filing your tax return. If you make a mistake, you might end up with the department's tax notice asking you to justify the variance and, if any, pay tax. A common mistake made by the taxpayer while filing ITR are as following:

- Filing wrong ITR form: There are 7 types of income tax return (ITR) forms that have been issued by the Income Tax Department, and the choice of an ITR form for filling in the tax return depends on the type of income and the taxpayer's status. In both forms, the disclosure standards are different and it is, therefore, necessary to use the correct form when furnishing your income tax return, if your return should not be treated as faulty.

- Gross total revenue above the basic exemption limit: If the aggregate of all your income without deduction exceeds the basic exemption limit under different parts of chapter VIA, such as 80 C, 80 CCC, 80 CCD, 80 D, 80E, 80 GGA, 80 TTA, you are required to file your income tax return. These parts deal with deductions available for different investments or payments made by you, such as PPF, NPS, ELSS, NSC, principal repayment of your home loan, school fee, life insurance premiums, premiums for medication, gifts, interest on education loans, the rent charged by self-employed citizens, etc.

- Non-disclosure of losses conducted: It is compulsory to file one's income tax return on or before the due date in order to carry forward those expenses incurred during the set-off year against income in future years. If the income tax return seeking to carry forward the losses for the current year is filed after the due date, it will not be allowed to carry forward those losses.

- E-filed ITR Non-Verification: Many taxpayers are expected to electronically file their income tax returns. However, it is not enough to only furnish the return electronically and you are also expected to verify the return so that your identity is authenticated. You can either e-check Aadhaar OTP's return, connect your login to Demat Account, Net Banking, or send within 120 days a signed copy of the ITR acknowledgment to CPC, Bangalore. Failure to verify your return within the prescribed period will result in you being considered as a non-filer by the tax department,"​

- Assets or Signing Authority by resident taxpayers outside India: If you are resident in India for tax purposes and own any asset outside India in your own name as a beneficial owner or have an interest in any asset outside India, or even if you are an authorized signatory to any account outside India, you are also required to file your income tax return.

- Foreign Assets and Revenue Non-disclosure: It is compulsory for all ordinary resident taxpayers to disclose in their income tax returns the correct details of their foreign assets and income outside India. Tax officers can impose a penalty of Rs 10 lakh under the Black Money (Undisclosed Foreign Income and Assets) Imposition of Tax Act, 2015 if the taxpayer fails to include any information or furnishes incorrect information about foreign income and assets in the return. Nonetheless, many taxpayers do not report accurate information of their foreign assets and earnings outside India.

- Excluding interest on FD from taxable revenue: Though interest income of up to Rs 10,000 from savings accounts is excluded, interest income received from fixed deposits is subject to taxation. Taxpayers who are unaware of this provision, however, exclude fixed deposit interest from their taxable income, something that should never be done.

Incorrect filing of tax returns can lead to many issues and complications. It's not what we want or need. So, please avoid the mistakes listed above. Please seek specialist assistance if you are not sure of filing returns for all of yourself. To maintain mental peace, it is best to file returns correctly as well as on time. March 31, 2021, is the last day to submit the amended return for FY 2019-20.

Popular error while filing Income Tax Return