Table of Contents

Needed to file income tax returns for your bitcoin profits earn

- Profited from Bitcoins or other Cryptocurrencies and not sure how to file your income tax returns? Did you know gains from bitcoin is treated as capital gains and hence taxed? We are India’s leading tax filing portal to help you to file your returns to calculate your tax and finish filing income tax returns within 2 days.

- anyone who earns any income in Bitcoin needs to declare their income and pay taxes. That seems fair enough. But this is also where things start getting confusing for most people.

- The fact is that, in the absence of any guidelines from CBDT, ICAI, RBI, or the Income Tax Department, cryptocurrency investors from India are largely left to figure this out on their own. As an early adopter of crypto, I was perplexed with the subject of accounting for my income in cryptocurrency from blogging and consulting. During my research into this subject, I’ve interviewed professional tax consultants and an income tax official.

- The fact is that the IT Act does not stop you from earning or profiteering from investments in cryptocurrencies and allows you to declare your gains and pay taxes on them. Therefore, as per a professional tax consultant, the four most common and safe ways of filing your returns after declaring your income from cryptocurrencies are as follows:

Capital Gains

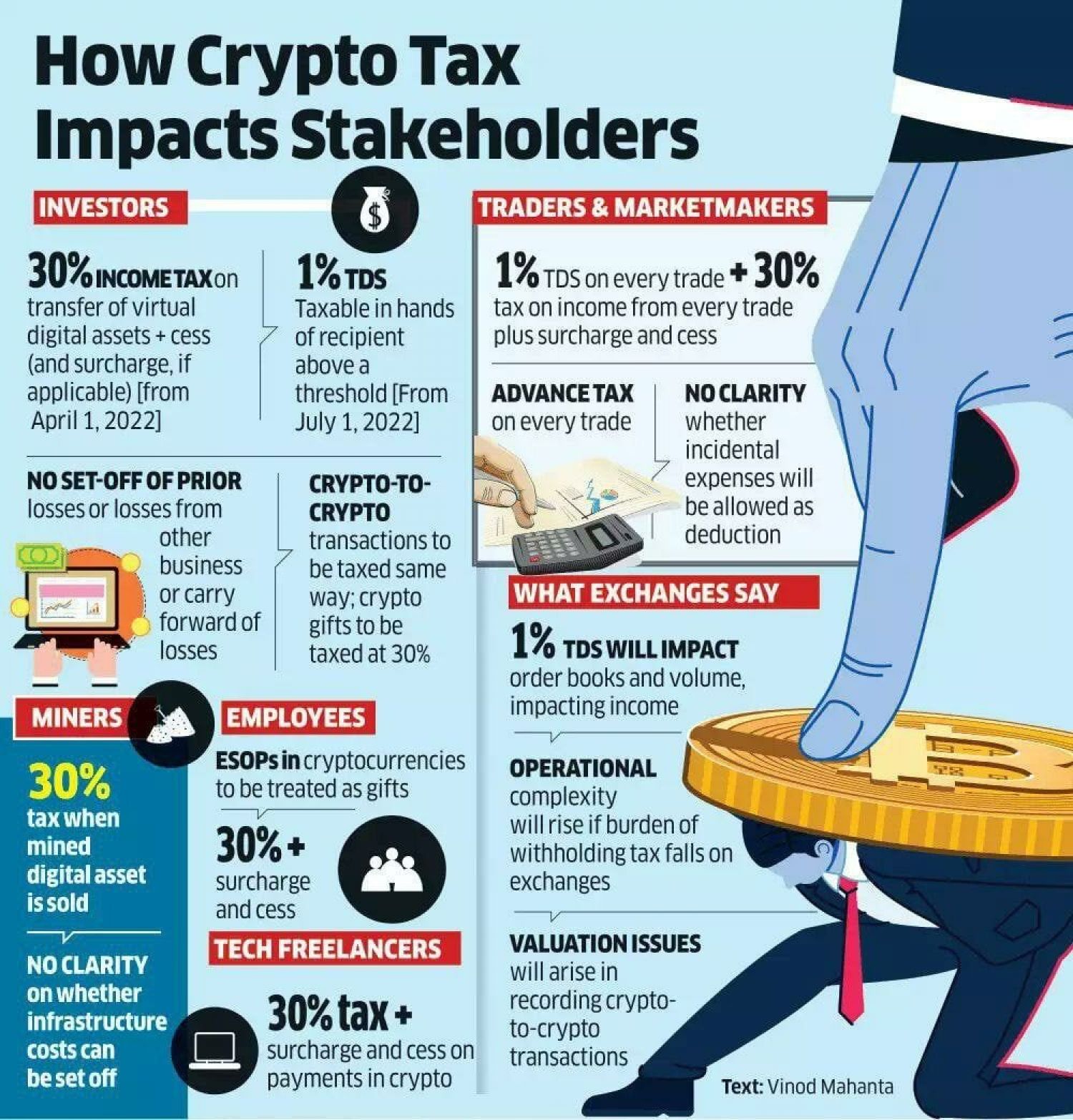

- If you are a casual investor in Bitcoins, any profit resulting from the sale of your cryptocurrency is taxed as short-term capital gains as per your income tax slab rate. If your income exceeds Rs 10 lakh then there will be a 30 per cent tax on the profits plus surcharge and cess.

- Professional tax consultants seem to be favouring these parameters to consider Bitcoin as a store of value similar to a stock in a company as opposed to a mode of payment in order to make it easier to file returns for their respective clients.

- In case of any long-term capital gains, the tax rate applicable is only 20 per cent on your profits. The time period of the asset needs to be considered here while making an assessment and most auditors seem to be preferring to equate the time period of equity (minimum holding period of 2 years) to Bitcoins. You can also account for indexation to reduce your tax burden.

Business Income

- If you are a Bitcoin trader with substantial and frequent transactions it could be considered as a business (trading) income. Here you can account for your profit and loss accordingly. CBDT in the past has issued a circular to distinguish when equity is held short-term as an investment versus a stock-in-trade.

- Here, an applicable rate of income tax as per your income slab will apply. If your income exceeds 10 lakh rupees then the applicable tax rate is 30 per cent plus surcharge and cess.

Professional Income

- If you are a blogger, freelancer, or consultant earning in Bitcoins, you may be wondering how to file your taxes for income from any services rendered to clients in India or abroad.

- For example. I’m a consultant paid in Bitcoin and also a professional blogger on Steemit.com. On Steemit, I earn in the cryptocurrency, ‘Steem’, which I then sell to purchase Bitcoin. Then, I use an Indian Bitcoin exchange such as CoinSecure.in or Zebpay to sell Bitcoin for Indian rupees and cash out my earnings. This is fully transparent as all Indian exchanges adhere to KYC norms.

- Here, an applicable rate of income tax as per your income slab will apply. If your income exceeds Rs 10 lakh then the applicable tax rate is 30 per cent plus surcharge and cess.

Income from Other Sources

- What if you are mining Bitcoins? If you fall under this category of Bitcoin users then you are likely to be only selling and never purchasing any Bitcoins. This is somewhat similar to rendering services as a consultant and earning in Bitcoin with the only difference being that you are not a professional.

- You will be taxed as per the Income-tax slabs and if your income exceeds 10 lakhs, then the applicable tax rate is 30 per cent plus surcharge and cess.

- It is wise to declare your income from Bitcoins in your annual tax returns and hire an excellent professional tax consultant to do your accounting if you plan on mining, earning, or investing regularly in Bitcoins.

Income tax dept will scrutinize NFT transactions in case found any kind of suspicion that few amount may accepted in cash to to decrese tax ouflow.

According to tax experts, a recent drop in the price of high-value non-fungible tokens (NFTs), combined with ambiguity in the recently established tax framework, will result in increased tax scrutiny for Indian investors in the coming months, as asset valuation norms for digital assets remain unclear:

- They predicted that the tax authorities would examine the rapid reduction in the valuations of these virtual digital assets. On suspicion that some of the money was accepted in cash to decrease the tax bill, the department would check NFT transactions.

- Unlike a cryptocurrency like bitcoin, NFT is essentially a one-of-a-kind code or digital file based on the blockchain. As an underlying value, an NFT can have artwork, films, or even a poem performed by Amitabh Bachchan.

- The buyers may have purchased NFTs with cryptocurrencies such as bitcoin and then sold them in rupees.

- As according to tax experts, such transactions will be scrutinised in the following months.

- In the union budget for 2022-23, a flat 30% tax on all gains from the sale of virtual digital assets was introduced, as well as a 1% tax deducted at source on all crypto transactions.

?Also Read Articles :

How to Bitcoin Tax in India?

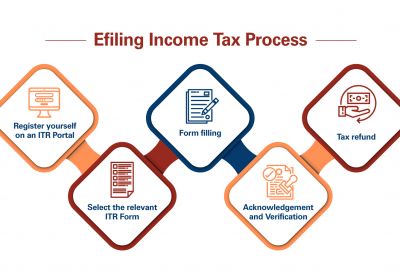

File ITR for your BITCOIN profit earned

Read About GST Applicability on Bitcoin In India

How to file ITR for profit earned on BITCOIN

Bitcoin Taxability under GST Act,2017

India’s Latest Development on Crypto-Currencies

Cryptocurrencies Taxation Scenario in India

Pm modi chairs meet on cryptocurrency

Guidance on major concern in Cryptocurrency

https://www.caindelhiindia.com/blog/bitcoin-taxability-under-gst-act-2017/