Table of Contents

ITR Forms- LATEST UPDATE ON INCOME TAX RETURN FORMS FOR FY 2020-21

Identifying the ITR form for the specific income of the taxpayer was a very important and technical task when all ITRs were filed in physical mode. However, in today's technological age, this task is done by software, and no one needs to apply that expertise in their daily lives.

However, it is critical to understand ITR forms because they are the first step in filing an ITR. If you are unfamiliar with these forms, there is no need to worry because this article will explain the basics of ITR forms in simple and understandable language.

What is ITR?

The fundamental question is that it is a form or structure by which a person can tell the government and the government of his income sources how much they get money to support their livelihoods. It is a very simple thing. Certainly, it is a method for the government to obtain revenue in the form of taxes.

What are ITR forms?

When everyone started filling out their ITRs in the same format, the government ran into trouble organizing the data of different taxpayers in its records. As a result, the government created the form system as a system in which a specific form is defined for a specific type of taxpaye0072 based on the type of revenue.

Types of ITR form:

The government has defined seven different types of ITR forms, which are listed below.

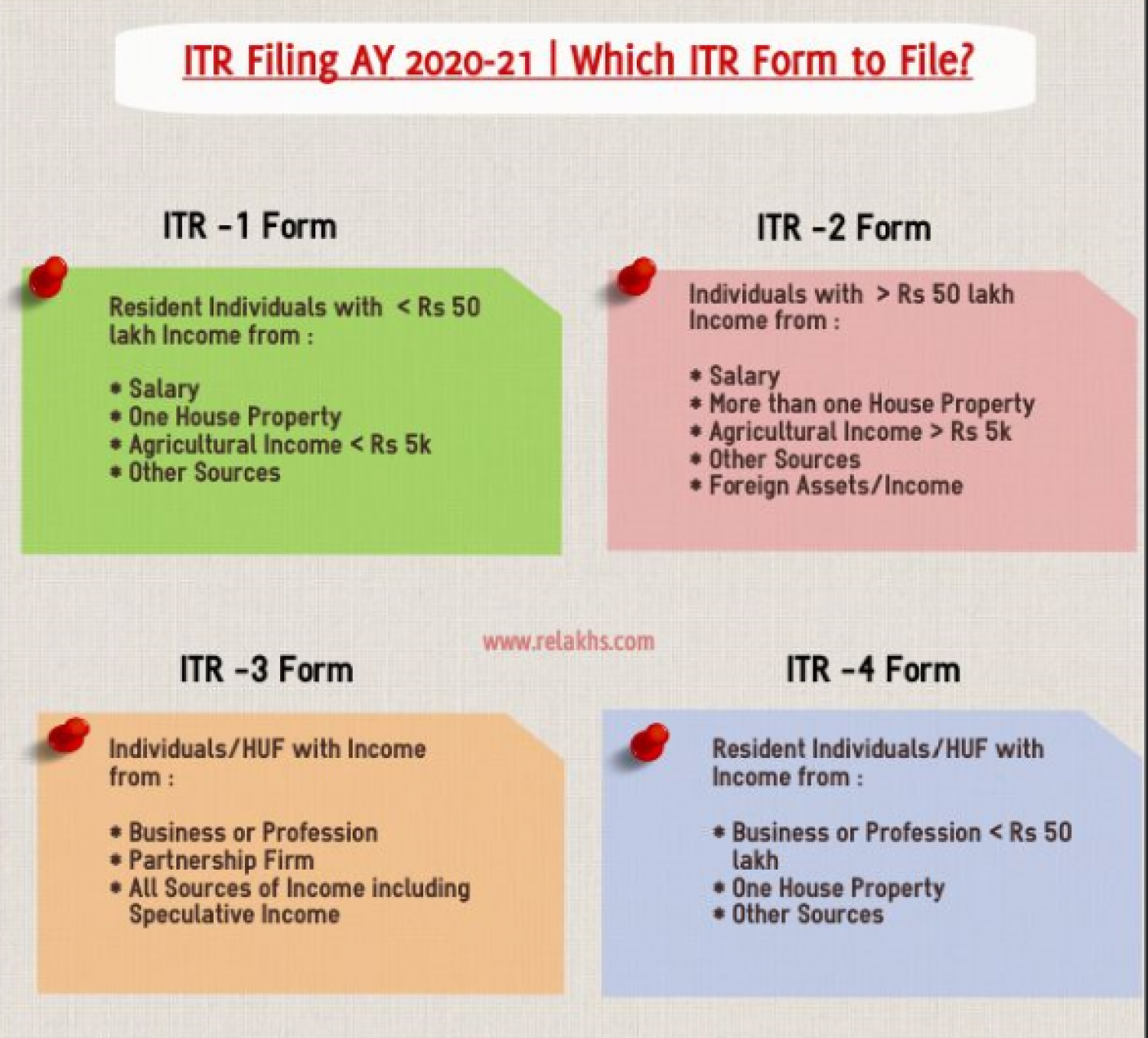

SAHAJ or ITR-1:

Individuals residing in India who earn less than or equal to Rs.50 lakhs from salary/pension, other sources, and any one house property.

ITR-2:

- Individuals who earn more than Rs.50 lakhs from all sources covered by the ITR-1, including capital gains, multiple residential properties, international income, and foreign assets.

- An individual who earns money as a director of a firm and lives in the area.

- Unlisted equity shares are held by a resident.

ITR-3:

A resident individual with income from a business or profession, as a partner in a firm, or any presumptive income of more than Rs.50 lakh, as defined in ITR-2.

ITR4:

Every income covered in ITR-1 presumptive income under salary/pension, other sources, and one dwelling property, when total income is greater than Rs.50 lakhs, must be reported on Form ITR-4.

ITR-5:

This form covers the income of any firm, LLP, AOPs, and BOIs.

ITR-6:

Income of companies that do not claim Section-11 exemption.

ITR7:

Persons/companies are covered by Sections 139 (4A), 139(4B), 139(4C), and 139(4D) of the Internal Revenue Code (4D).

To learn more about the above-mentioned ITR forms, look through the information in the table below.

|

Form |

Applicability |

Salary |

Exempt Income |

Capital Gain |

House Property |

Business Income |

Other Sources. |

|

ITR-1 |

Resident Indian Individuals and HUFs. |

YES |

YES, if agriculture income is not more than Rs. 5000. |

NO |

YES, but it should be from only one house property. |

NO |

NO |

|

ITR-2 |

HUF and Individuals. |

YES |

YES |

NO |

YES |

NO |

YES |

|

ITR-3 |

Individuals and Partners in Firms, HUFs |

YES |

YES |

NO |

YES |

YES |

YES |

|

ITR-4 |

Firm, HUF and Individuals |

YES |

YES, if agriculture income is not more than Rs. 5000. |

YES |

YES, but it should be from only one house property. |

Only business income that is presumptive. |

YES |

|

ITR-5 |

LLPs, Partnership Firms, AOPs and BOIs. |

NO |

YES |

NO |

YES |

YES |

YES |

|

ITR-6 |

Companies |

NO |

YES |

NO |

YES |

YES |

YES |

|

ITR-7 |

Trusts |

NO |

YES |

NO |

YES |

YES |

YES |

ITR Return Forms

|

Sr. No. |

ITR Forms |

Instruction for Filing ITR Forms |

Description |

|

1. |

To be filed by resident individuals having total income up to ? 50 lakhs from following sources :

|

||

|

2. |

For Individuals and HUFs not having income from profits and gains of business or profession |

||

|

3. |

To be filed by Individuals and HUFs having income from profits and gains from business or profession |

||

|

4. |

For Individuals, HUFs and Firms (other than LLP) being a resident having total income up to Rs. 50 lakhs and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE |

||

|

5. |

For firms, LLP, AOPs, BOIs, Artificial juridical Person, Estate of deceased, estate of insolvent, business trust and investment fund. |

||

|

6. |

For Companies other than companies claiming exemption under section 11. |

||

|

7. |

For persons including companies required to furnish returns under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) or section 139(4E) or section 139(4F) |

Where these ITR forms could be obtained?

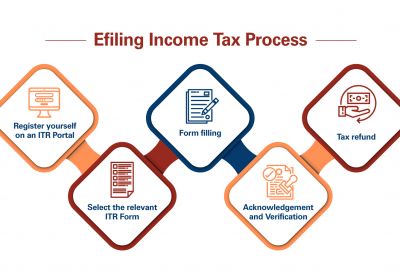

If a taxpayer wants to download these forms, the official income tax website provides them in PDF format along with instructions on how to fill them out. As a result, the forms can be easily downloaded by simply opening the official Income Tax website and clicking on downloads, and here are the forms that you need to download.

How do I submit a return tax on income?

After identifying the ITR form and entering the necessary data in the form based on the type of income and taxpayer, one should follow the steps outlined below to file their Income Tax Return with minimal errors.

- Download the 26AS form, identify any inconsistencies in the details filed and in the 26AS form, and correct them if applicable.

- Form 26AS is the type of tax passbook that clearly shows TDS, TCS or Advance tax details if paid in a fiscal year by the taxpayer.

- Calculate Financial year total revenue in accordance with the records mentioned above.

- After applying current tax rates, calculate tax liabilities.

Extension of Income Tax Due Dates -2021:

In consideration of this serious epidemic (COVID 19), the Central Board Of Direct Taxes (CBDT) has extended the time limits for certain compliance to grant relief to taxpayers under Section 119 of the Income Tax Act, 1961 for FY 20-21 and AY 21-22.

INCOME TAX DEPARTMENT PROVIDES RELAXATION:

Some relaxation is provided in connection with the return on income tax (ITR).

|

PARTICULARS |

Original Due Dates |

Extended Due Dates |

|

Due date of furnishing return of income for AY-2021-22 U/s 139(1) |

31st July 2021 |

30TH September 2021 |

|

Due date of Furnishing of the report of audit for py-2020-21 |

30TH September 2021 |

31st October 2021 |

|

Due date of Furnishing report from an accountant by persons entering into an international transaction or specified domestic transaction U/s 92 E for PY-2020-21 |

31st October 2021 |

30th November 2021 |

|

Due date of furnishing return of income for AY-2021-22 U/s 139(1) |

31st October 2021 |

30th November 2021 |

|

Due date of furnishing return of income for AY-2021-22 U/s 139(1) |

30th November 2021 |

31st December 2021 |

|

Due date of furnishing belated or revised return of income for AY-2021-22 U/s 139(4)or 139(5) |

31st December 2021 |

31st January 2022 |

2) Some relaxation is provided within the context of TDS AND TCS.

|

PARTICULARS |

Original Due Dates |

Extended Due Dates |

|

For furnishing Statement of deduction of tax for the last quarter of FY-2020-21 under Rule 31A |

On or before 15TH JUNE 2021 |

On or before 15TH JULY 2021 |

|

For furnishing TDS/TCS book adjustment statement in Form No 24G for May 2021 under Rule 30 and Rule 37CA |

On or before 15TH JUNE 2021 |

On or before 30th June 2021 |

|

For furnishing Statement of deduction of tax from contributions paid by the trustees of a superannuation fund for FY- 2020-21 under Rule 33 |

On or before 31st May 2021 |

On or before 30th June 2021 |

3) And there will be some more miscellaneous rest as well.

|

PARTICULARS |

Original Due Dates |

Extended Due Dates |

|

For furnishing The Statement Of Financial (SFT) for FY-2020-21 under Rule 114E |

On or before 31st May 2021 |

On or before 30th June 2021 |

|

For furnishing The Statement of Reportable account for the calendar year 2020 under Rule 114G |

On or before 31st May 2021 |

On or before 30th June 2021 |

|

For furnishing The Statement Of Income paid or credited by an investment fund to its unit holder in Form No.64 D for PY- 2020-21 under Rule 12CB |

On or before 15TH June 2021 |

On or before 30th June 2021 |

|

For furnishing The Statement Of Income paid or credited by an investment fund to its unit holder in Form No.64 C for PY- 2020-21 under Rule 12CB |

On or before 15TH June 2021 |

On or before 30th June 2021 |

The New Income Tax e-Filing Portal's Features:

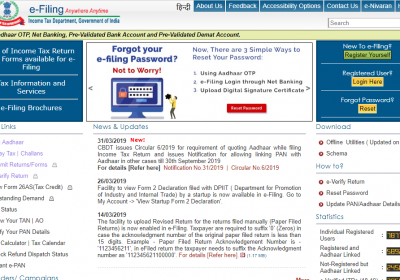

The new e-filing portal for income tax was launched on 7 June 2021 by the Central Board of Direct Taxes (CBDT). The new 'www.incometax.gov.in' portal replaced the existing 'www.incometaxindiaefiling.gov.in' e-filing portal. Taxpayers will now have to use the new portal to file their income tax returns (ITRs) and complete all other tax-related tasks. The site is being renovated for the convenience of taxpayers, and it will now offer modern and smooth income tax return filing and other tax-related services.

New Income Tax e-Filing Portal

- ITR Processing:

The new user-friendly interface will process a taxpayer's income tax return right away. Taxpayers will receive prompt refunds as a result of the quick processing of income tax forms.

- ITR Preparation Software for Free:

The free ITR preparation software will assist taxpayers. ITR-1 and ITR-4 software are currently available both online and offline, whereas ITR-2 is only available online. ITR-3, ITR-5, ITR-6, and ITR-7 preparation software will be available soon. The software's interactive questions will make the e-filing process easier.

- Call Center Services:

The new online portal is linked to a "new call centre" for quick response to customer inquiries. Furthermore, detailed FAQs, tutorials, videos, and chatbot/live agents address taxpayer concerns.

- Interaction on a Single Dashboard:

A taxpayer can view all interactions, uploads, and pending actions on a single dashboard, along with the follow-up action.

- Multiple Payment Options:

The new portal will provide a taxpayer with multiple payment options. These include RTGS/NEFT, credit card, UPI and net banking via a taxpayer's bank account. It will allow taxes to be paid easily. This facility will enable the income tax department to avoid difficulties for taxpayers to pay the first instalment of advance tax after 18 June 2021.

- Mobile appliance:

A mobile app will then be launched with all of the key features of the new portal. At any time, the taxpayer has access to the app through a mobile network.

- Pre-filled ITRs:

The new portal enables certain revenue data to be pre-filled.

It could be about salary, owning a home, business/profession, and so on. It also allows for detailed pre-filling of information such as salary income, interest, dividends, and capital gains. When the affected entities upload their TDS and SFT statements, the pre-filling will take place.

The Income Tax e-Filing Portal's Current Features:

The department built the income tax e-filing site, www.incometaxidiaefiling.gov.in, to facilitate e-filing services to taxpayers. Users file their income tax returns and other forms through the existing income tax e-filing facility. They can use the portal to complete the following things in addition to filing their income tax returns.

- E-verify income tax returns.

- View and respond to an outstanding income tax demand.

- File audit reports and certificates.

- View tax credit statement (Form 26AS).

- View tax credit mismatch.

- Request for refund re-issue.

- Request for intimations.

- Request for change of ITR particulars.

- Link Aadhaar with PAN.

- Lodge grievance online.

- Respond to e-proceedings.

- The portal is used by the income tax department to view and process uploaded income tax returns and other forms, send notices, collect responses from taxpayers, and convey final orders such as assessments, appeals, exemptions, and penalties.

Taxpayers have a lot of work to do:

- Their Digital Signature Certificate (DSC) must be re-registered, as the old DSCs will not be moved due to security concerns.

- They should change their user ID and mobile number in their profile's primary contacts.

- If you haven't already, link your Aadhaar and pre-validate your bank account.

- Higher security options reset e-Filing Vault.

Due to the country's crisis and pandemic scenario, the government has extended the deadlines for filing income tax returns and other deadlines.