Must Know Significant changes in ITR Form for FY 2020-21

Income tax return Form ITR-1 cannot be filed in cases where TDS has been deducted under section 194N:

- If the amount of cash withdrawn during the year from a co-operative bank, a banking company or post-office from 1 or more bank accounts held by the taxpayer cross the amount mentioned in Section 194N, the TDS must be deducted.

- INR 20 lakhs if the return is not filed;

- INR 1 crore in all other cases

- Through Income Tax (7th Amendment) Rule, 2021, the New Rules 12 of the Income-tax Rules has been amended to restrict an assessee to file the ITR 1, in whose case TDS has been deducted under section 194N.

- If a tax has been deducted under section 194N, a taxpayer can only file his income tax return under the ITR 2/3/4, depending on the situation.

NOTE: Tax deduction at source deducted u/s 194N will not be ably carried forward/transferred on to the next years. This means that the credit for tax deducted under Section 194N can be obtained in the previous year relevant to the corresponding to the assessment year in which the tax was deducted.

A choice has been given to HUF or Individual as per Section 115BAC of Income-tax act :

- Section 115BAC of the Income Tax Act was recently introduced to deal with the new income tax system. Individuals and Hindu Undivided Families are subject to this section and have an alternative income tax system, which was implemented in the Union Budget 2020.

- The key feature of the new income tax system introduced, The income tax slab rates have been substantially reduced under this current system.

- But this new rate applies only if various Exemptions and deductions will not be available which were previously available under the old taxation system.

- As a result, Assessors have the option of choosing the new Section 115BAC scheme and are required to file Form-10IE before filing the Section 139 return (1).

Change in Schedule 112A-i.e Long term capital gain from the sale of a unit of the equity-oriented fund or equity share on which Securities Transaction Tax is paid

- New Changes Schedule 112A now includes the selling price per share/unit, which was not previously included.

The dividend is taxable from FY 2020-21

- Dividend income is chargeable to the tax of the assessee starting in FY 2020-21, so the assessee must provide a quarterly break-up of dividends earned to avoid interest charges U/s 234C of the income Act 1961

What are Changes in Section 44AB

- The basic threshold limit for accounts to be audited under the income tax act has been raised from INR 1 Cr to INR 10 Cr, However, if the below requirements of a Tax audit are fulfilled:

- The total amount of cash receipts during the last year did not cross 5% of total receipts.

- The total amount of cash payments made in the previous year did not exceed 5% of total payments.

ITR Return Forms

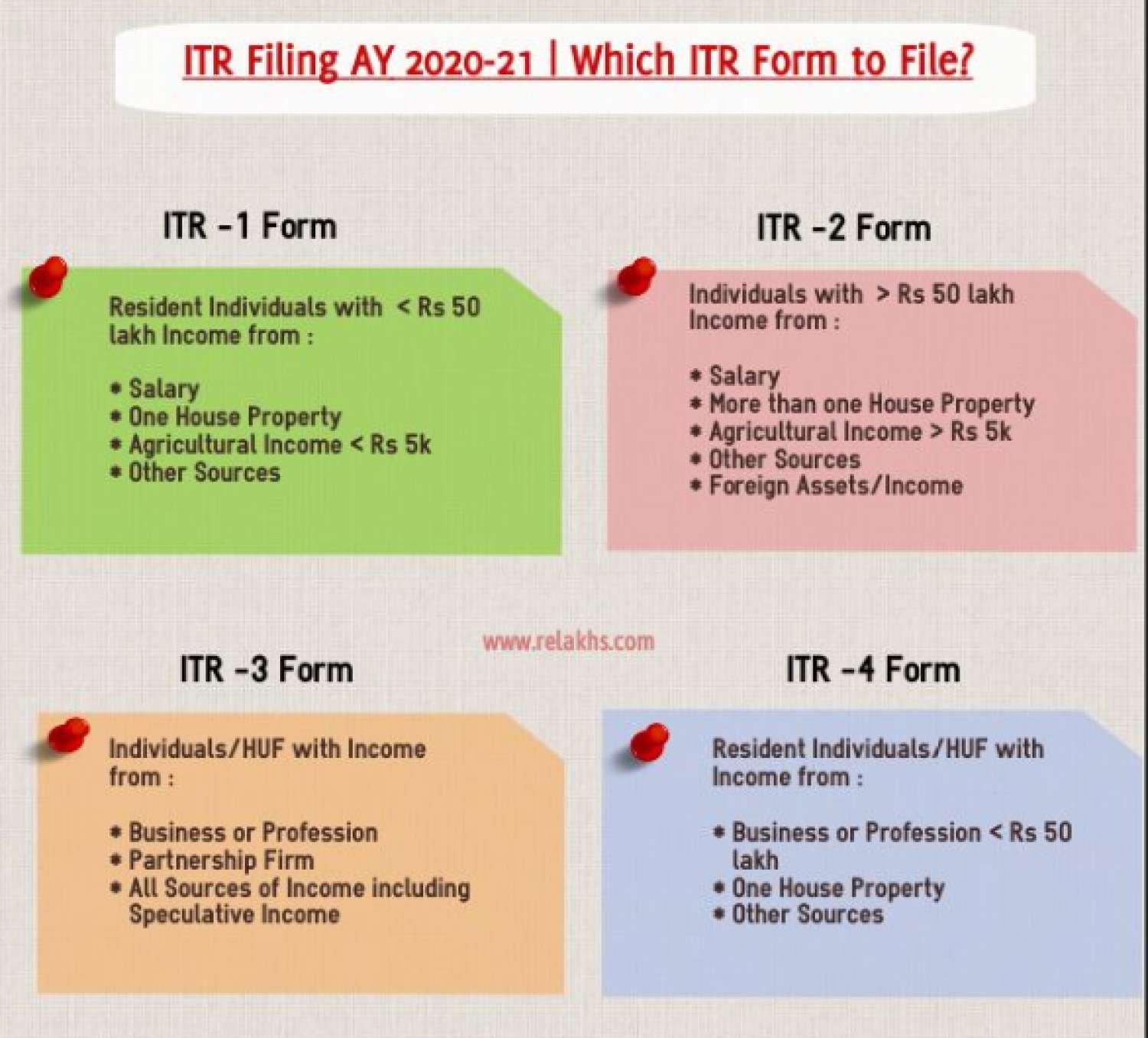

|

Sr. No. |

ITR Forms |

Instruction for Filing ITR Forms |

Description |

|

1. |

To be filed by resident individuals having total income up to ? 50 lakhs from following sources :

|

||

|

2. |

For Individuals and HUFs not having income from profits and gains of business or profession |

||

|

3. |

To be filed by Individuals and HUFs having income from profits and gains from business or profession |

||

|

4. |

For Individuals, HUFs and Firms (other than LLP) being a resident having total income up to Rs. 50 lakhs and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE |

||

|

5. |

For firms, LLP, AOPs, BOIs, Artificial juridical Person, Estate of deceased, estate of insolvent, business trust and investment fund. |

||

|

6. |

For Companies other than companies claiming exemption under section 11. |

||

|

7. |

For persons including companies required to furnish returns under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) or section 139(4E) or section 139(4F) |