Table of Contents

Document Checklist for ITR Filing

| Documents | ITR 1 | ITR 2 | ITR 3 | ITR 4 |

|---|---|---|---|---|

| Basic Information (PAN, Aadhaar, bank details, Form 26AS, AIS/TIS, etc.) |

YES | YES | ||

| Salary (Form 16, salary slips, proof of deductions under 80C, 80D, 80E, 80TTA) |

YES | YES | YES | NO |

| House Property (Rent receipts, home loan statements, property tax receipts) |

YES | YES | YES | YES |

| Capital Gains (Broker statements, purchase/sale deeds, indexed cost) |

NO | YES | YES | NO |

| Business/Profession (Profit & loss, balance sheet, expense proofs, GST returns if applicable) |

NO | NO | YES | YES |

| Other Income (Interest/dividend certificates, TDS certificates, income from other sources) |

YES | YES | YES | YES |

| Exempt Income (PPF interest, agricultural income, tax-free bonds — disclose even if exempt) |

YES | YES | YES | YES |

| Foreign Income/Assets (Foreign accounts/assets, FTC claims, Schedule FA details) |

No | YES | YES | No |

| Assets & Liabilities (If income > ₹1 crore — details in Schedule AL) |

NO | YES | YES | NO |

| Tax Payments (Advance tax challans, self-assessment tax proofs) |

YES | YES | YES | YES |

Notes:

-

Supporting documents (Form 16, challans, rent receipts, etc.) are needed only if applicable.

-

Capital gains up to ₹1.25 lakh under Section 112A are allowed only in ITR 1 and 4.

Tax filing: changes are taken into account when making the ITR

New Notified ITR forms are subject to certain major changes. Taxpayers should keep these changes into account before filing their ITR for FY 2020-21.

The new Financial budget for 2021 adopted the interchangeability of and Aadhaar Vs PAN. A person who does not have a PAN can quote the Aadhaar number at different places in the Income Tax Return. For illustration, Income Tax Returns make it possible to quote Aadhaar in the case of Income Tax Return filing by the representative assessee, a tenant while disclosing household income, of a purchaser of immovable property, etc.

- Expenditure on electricity use in excess of Rs 1 lakh in total during the period 2020-21.

- The Government provided sufficient time until 31 July 2020 for making Income tax-saving investments for the financial year 2019-20. The Income-tax return provides for the disclosure of specifics of the investment and the deduction of claims in Schedule DI. Similarly, the Income-tax return also provides for the disclosure of capital gains exemptions for investments made up to 30 September for exemptions under sections 54 to 54GB.

- The Income Tax Return also introduces a new provision for compulsory filing of an Income-tax return even if the gross total income of the person is below the basic concession amount. The Mandatory filing is appropriate in the case if any of the following conditions is fulfilled:

- Deposited in one or multiple current accounts (s) by a sum or aggregate of amounts above Rs. 1 crore during the financial year 2019-20.

- Expenditure on travel to an international country in excess of Rs 2 lakh in total for itself or any other individual

- The Income-tax return also requires the disclosure of the name of the company of which the person is the director or shareholder of unquoted equity.

- The Income-tax return provides for an expanded list of the kind of employment, including the bifurcation between the central government & state government employees. Also, another class is included for 'not applicable – for example the family's pension.

- The income tax allowance under section 87A was increased to Rs. 12,500 for overall revenue up to Rs 5 lakh. The Income-tax return accordingly allows for a tax refund of up to Rs 12,500 in the case of individuals residents whose total income (after claiming deductions & exemptions) may not exceed Rs 5 lakh. The amount of the rebate was INR 2.5k for the last financial year 2019-20 for total revenue up to INR 3.5 lakh. Income-tax returns should be filed on a mandatory basis if the gross total income exceeds the basic exemption of INR 2.5 lakh. The filing is essential even if the taxpayer is eligible for a rebate and their income tax liability is none.

- The standard deduction for the financial year 2020-21 allowed under Salaries Income has been increased to INR 50k from INR 40k.

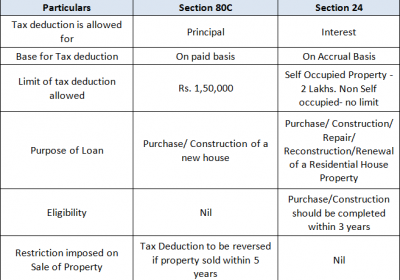

- From the Financial year 2019-20, when declaring income from household property, a person can identify two properties as "self-occupied." Till Financial Year 2018-19, a person who had a second unused property had to pay taxes on the notional rent measured on that land.

- Budget 2019 modified the capital gain exemption U/s 54 to provide for the purchase or construction of two residential properties rather than one to claim the deduction. This term for claiming this deduction is that it can be used only once in a lifetime and that the long-term capital benefit arising should be less than INR 2 Crores.

- The Income-tax return also allows for the claim of additional interest deduction U/s 80EEA for affordable housing in the case of a first-time home purchaser where the stamp value of the property does not surpass INR 45 lakh. The maximum deduction permitted is INR 1.5 lakhs for a loan made available by a person from any financial institution. Similarly, the Income Tax Return has an interest deduction allowance introduced in Budget 2019 for loans obtained for the purchase of electric vehicles.

-

The Income-tax Return filing for FY 2020-21 (AY 2021-22) will begin from 1st June 2021 the ITR forms for which needed to be notified.

FY 2018-19 (AY 2019-20)

FY 2019-20 (AY 2020-21)

FY 2020-21 (AY 2021-22)

Original Due Date

Extended Due Date

Original Due Date

Extended Due Date

Original Due Date

Working Partner of a Firm or LLP where Audit is required

30th September 2019

31st October 2019

30th September 2020

31st December 2020

31st October 2021

Audit Cases (Company, Tax Audit cases, etc)

30th September 2019

31st October 2019

30th September 2020

31st December 2020

*31st October 2020 (in case of tax audit)31st October 2021

Report being filed u/s 92E

30th November 2019

-

31st December 2020

-

30th November 2021

Non- Audit Cases (Individuals, professionals, small businesses, etc)

31st July 2019

31st August 2019

31st July 2020

31st December 2020

31st July 2021

Revised Return

Till 31st March 2020

30th June 2020

Till 31st March 2021

-

Till 31st March 2022

Non-Working Partner

31st July 2019

31st August 2019

31st July 2020

31st December 2020

31st October 2021

Belated/Late Return

Till 31st March 2020

30th June 2020

Till 31st March 2021

-

Till 31st March 2022

Note:

- As per section 92E, a person who enters into international or specified domestic transactions is required to submit a report u/s 92E.

- The audit is required for

- A working partner of a firm Or Firms, LLPs, etc, requiring an audit of accounts

- A Company

- An Individual requiring audit of accounts or

Due dates for Advance Tax payment installments

The due dates for the Advance Tax payment installments for the FY 2020-21 are.

|

For all Assessee |

|

|

Due Date |

Advance Tax to be paid |

|

Till 15th June |

15% of the amount of advance tax |

|

Till 15th September |

45% of the amount of advance tax |

|

Till 15th December |

75% of the amount of advance tax |

|

Till 15th March |

100% of the amount of advance tax |

Note:

- Prior to FY 2016-17 (AY 2017-18) there were different due dates prescribed for corporate and non-corporate assessees.

- The person furnishing ITR U/s 4AD or 44ADA is only required to adhere to the last installment i.e. make complete Payment for advance tax till 15th march of FY.

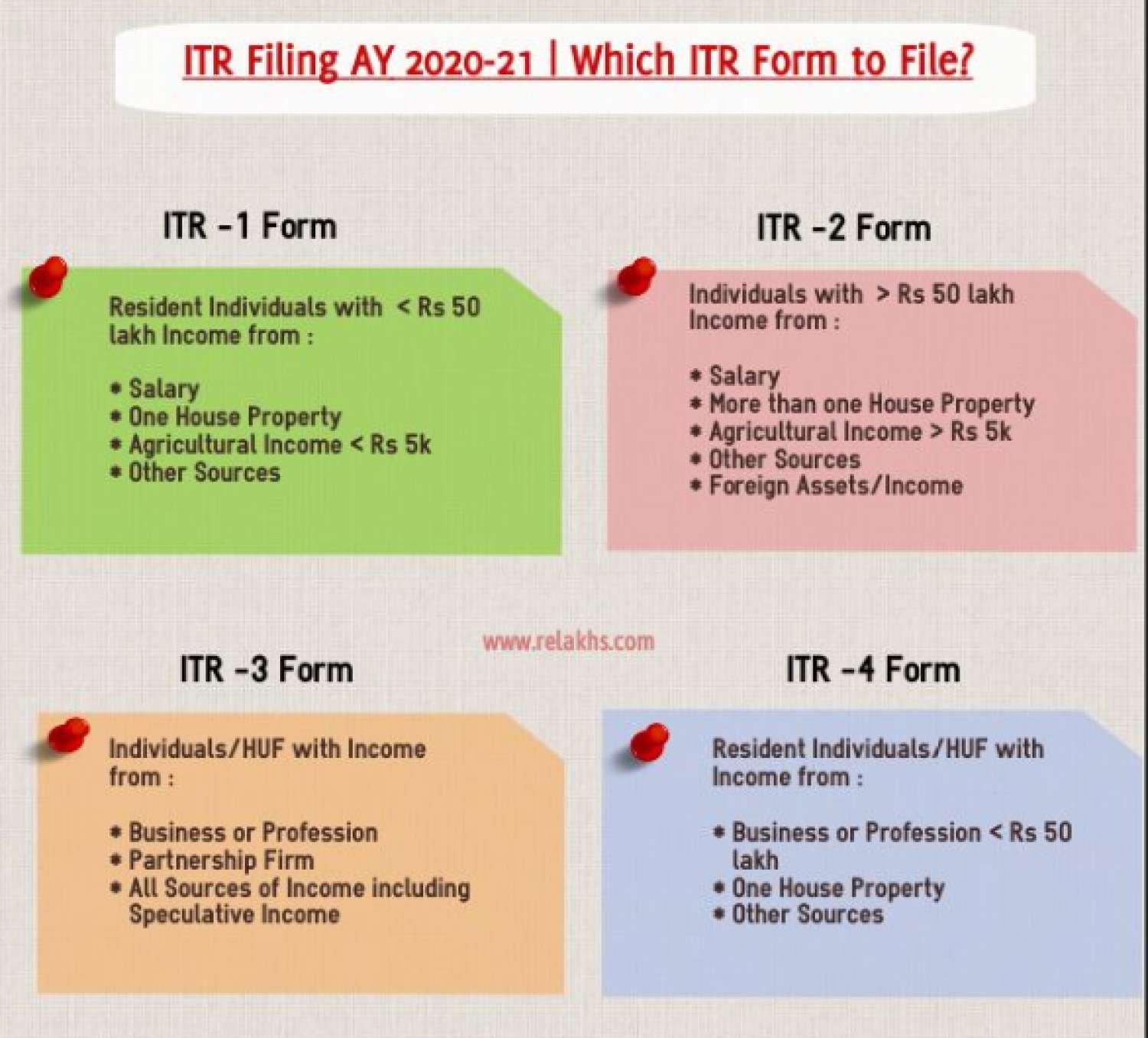

ITR-1

Who can file ITR-1?

ITR-1 form is to be used by an individual having income up to Rs 50 lakh from the following sources

- Income from Salary/Pension

- Income from One house property(not being brought forward losses from the previous year)

- Income from other sources(excluding income from lottery and racehorses)

- Agriculture income up to Rs 5000

Who cannot file ITR-1?

- Total income exceeding Rs 50 lakh

- Agricultural income exceeding Rs 5000

- Income from business or profession

- Income from more than one house property

- resident not ordinarily resident (RNOR) and non-resident cannot file ITR-1

- Having foreign assets or foreign income

ITR-2

Who can file ITR-2?

ITR 2 is designed to be used by an individual or a Hindu Undivided Family (HUF) whose total income for AY 2020-21 includes:

- Income from received Salary/Pension/2 or more House property/other sources including lottery or racehorses(Total income from these should be more than Rs 50 Lakhs)

- Agriculture Income more than Rs 5000

- Individuals who do not earn money from business Ventures

- Income from Capital Gains

- An individual who is invested in a company's unlisted share capital

Who cannot file ITR-2?

- Any Individual/HUFs having Income from Business or Profession

- The person already using ITR-1 Form

ITR-3

Who can File ITR-3?

Individual or HUF with income from the below sources

- Income from business or profession

- Income from salary/pension/property/commission/Bonus/Remuneration/other sources

- Profits earned as a partner in a Firm

- Investments in unlisted equity shares

- Taxpayers registered under presumptive taxation scheme and having a turnover of more than 2 crore

ITR-4

Who can file ITR-4?

An Individual/HUF/Firm whose total income for the year comprises one of the following:

- Company profits measured in compliance with the rules of Section 44AD or 44AE;

- Professional income as determined in compliance with the provisions of 44ADA

- Salary/pension benefit

- Revenue from single house property (excluding cases where loss is brought forward from previous years)

- Income from other sources (excluding winnings from lottery and income from racehorses)

Who cannot file the ITR-4?

- Income from more than one house property

- Revenue from lottery winnings or income from racehorse

- Taxable income under the heading "Capital Gain

- Profits of the type are referred to in Article 115BBE.

- Any citizen who has income from any source outside India.

- Agricultural income of more than 5,000 Rs.

ITR-5

Who can file the ITR-5?

The form can be used by a person being a

- Firm

- AOPs(Association of person)

- BOIs( Body of individuals)

- LLPs (Limited Liability Partnership)

Who cannot file the ITR-5?

- Individual

- HUFS

- Company

- And that person to whom ITR-7 is being applied.

ITR-6

Who can file ITR-6?

Any commercial company or business firm or establishment that has no profits and whose income does not come from any religious or charitable association or body shall be required to use the ITR6 form to file the returns.

ITR-7

Who can file ITR-7?

- All individuals who receive income from property if the property is in the name of the trust.

- All individuals earning income for the sole purpose of a charitable or a religious offering

- Any political party that receives a net income that exceeds the limit which is excluded from income tax

- Associations that perform scientific research

- Media agencies and companies

Filing your Indian Income Tax Returns

A financial year in India covers the period between 1 April and 31 March of the next year. Indian income taxes shall be filed by 31 July following the end of the financial year for each financial year. A person who is required to undergo a 'tax audit' in accordance with Income Tax Act 1961 shall, before September 30 following the end of the relevant financial year, submit both a tax audit report and his/her income tax return.

Why should you file a tax return? Mr. Ramesh is a non-resident Indian with an NRO (Non-Resident Ordinary) account. The interest collected on this account is taxed at a rate of, say, 30%. If the assessee submits his returns at the end of the year, he will be taxed at the applicable slab rates, such as 10%. (after self-assessment).

That indicates that if his annual income is Rs. 100, the bank will deduct Rs. 30 as TDS (Tax Deducted at Source). However, it should have been Rs. 10 instead. If the assessee had filed his tax return, he could have received an Rs. 20 refunds. The tax department will be unable to process the refund without this income return. As a result, in this case, it is critical to understand that filing tax returns is not only a burden but also a way to save money.

Rajput Jain and Associates, Chartered Accountants, are one of India's best ITR filing services providers. We assure you that with an expert tax consultant, we will provide you with one sort of personal finance for your financial situation.

We offer tax filing services in India as well as in the United States, Australia, and Singapore. In terms of income sources, assets, and other disclosures, we ensure that returns filed in both countries are in agreement.

Timely submission of tax returns is an essential step towards ensuring that tax regulations are complied with. In this respect, we encourage our customers to be effective in complying with timelines. We take into account the following when filing returns in India:

- Examination of income sources and taxation computing in India.

- Claims for tax deductions are reviewed.

- Checking disclosures of assets and income.

- Maintaining proper paperwork and records while keeping a close eye on every assessment or notice from the Internal Revenue Service.

- Calculation of exemptions and/or credits under the Internal Revenue Code in conjunction with Double Taxation Avoidance Agreements.

Rajput Jain and Associates, Chartered Accountants provide ITR filling Services to you online at our platform. The advantages of easy and accurate filing are exploited by 5,000+ users. You can too! Contact us to file your taxes or use our online services. Click Here