Table of Contents

Comprehensive Guide on filing Income Tax Returns for the FY 2023-2024

For the fiscal year 2023-2024, salaried individuals can start the process of filing their Income Tax Returns (ITR) in June 2024, after receiving Form 16 from their employers. Filing on or before 31st July 2024 helps avoid interest and penalties. Timely filing ensures faster processing of refunds if you have paid excess tax. Banks and financial institutions often require the latest ITR for processing loan applications.

What is the Deadline for ITR Submission?

ITR Filing Deadline for 2024 : The last date to submit your Income Tax Return for the Financial Year 2023-2024 (assessment year 2024-2025) is July 31, 2024.

ITR filing Timeline Dates for Financial Year 2023-24 (Assessment Year 2024-25)

|

Class of Taxpayer |

Timeline Date for ITR Filing - Financial Year 2023-24 *(unless extended) |

|

Individual / Hindu Undivided Family/ Association of Persons / Body of Individuals (books of accounts not required to be audited) |

31st July 2024 |

|

Taxpayer Have a Businesses (books of accounts required to be audited Audit) |

31st Oct 2024 |

|

Businesses requiring transfer pricing reports |

30th Nov 2024 |

|

If you needed to Revised Income Tax Returns |

31 Dec 2024 |

|

In case you required to file Belated/late Income Tax Returns |

31 Dec 2024 |

|

In case you required to file Updated Income Tax Returns |

31 March 2027 (2 years from the end of the relevant Assessment Year |

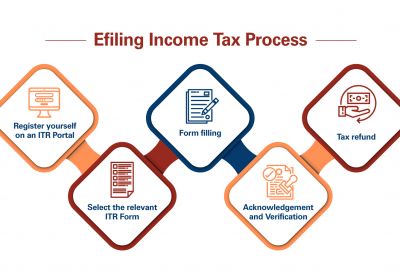

Steps for Filing ITR for Fiscal Year 2023-2024:

By following these steps and utilizing Form 16 effectively, salaried individuals can ensure a smooth and accurate process of filing their Income Tax Returns for the fiscal year 2023-2024.

1. Obtain Form 16:

Form 16 includes details such as PAN, TAN, salary information, deductions, and TDS. Employers must issue Form 16 by June 15, 2024. Form 16 is crucial as it provides a consolidated summary of your salary, deductions, and TDS. It simplifies the process of filing your ITR by providing all necessary details in one document. Ensures that the TDS reported by the employer is accurately credited to your PAN. Helps in claiming deductions under various sections, reducing the overall tax liability.

2. Collect Necessary Documents:

- Form 16: Provided by your employer.

- Form 16A/16B/16C: If applicable, for TDS on other incomes like interest, rent, etc.

- Bank Statements: For details of interest earned on savings accounts, fixed deposits, etc.

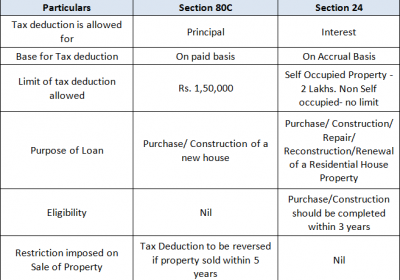

- Investment Proofs: For deductions claimed under Section 80C, 80D, and other relevant sections.

- Home Loan Statements: If claiming interest on home loan deductions.

3. Calculate Total Income:

Salary Income: As per Form 16. Other Incomes: From other sources like interest, rental income, etc. Deduction under various sections like 80C, 80D, 80G, etc.

4. Verify TDS Details:

Cross-check TDS details in Form 16 with Form 26AS (available on the Income Tax Department's website). Verify that the details in Form 16 match with those in Form 26AS. Make sure to claim all eligible deductions to reduce taxable income. Include all sources of income to avoid discrepancies. Avoid late filing to prevent penalties and interest charges.

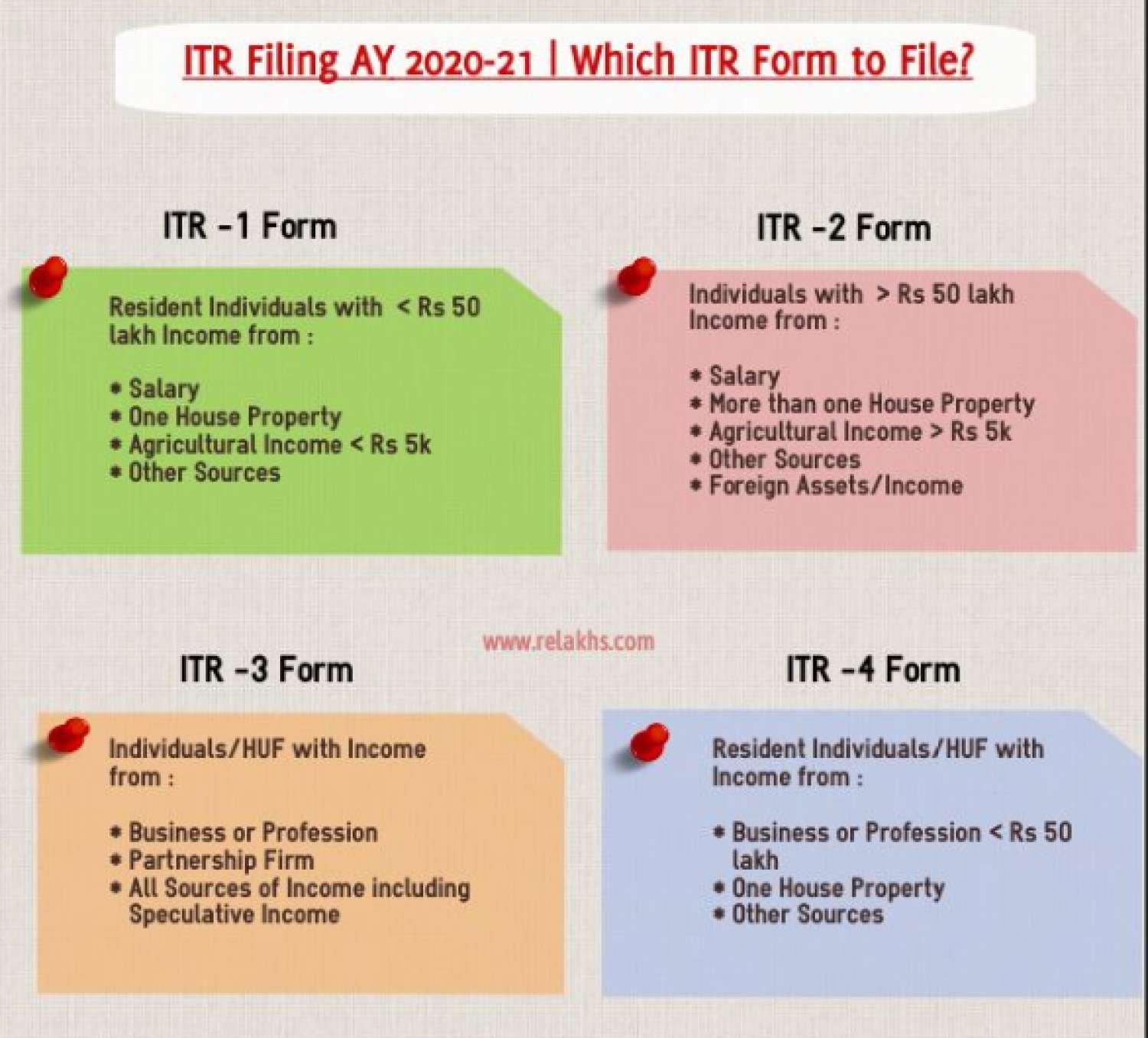

5. File Your ITR:

Use the Income Tax Department's e-filing portal. Typically, ITR-1 (Sahaj) for salaried individuals. Enter your personal information, income details, TDS, and deductions. Review the form, and ensure all details are accurate. Submit the form.

6. E-Verification:

After submitting the ITR, you need to verify it. You can do this electronically using methods like Aadhaar OTP, net banking, etc., or by sending a signed physical copy of ITR-V to the CPC Bangalore.

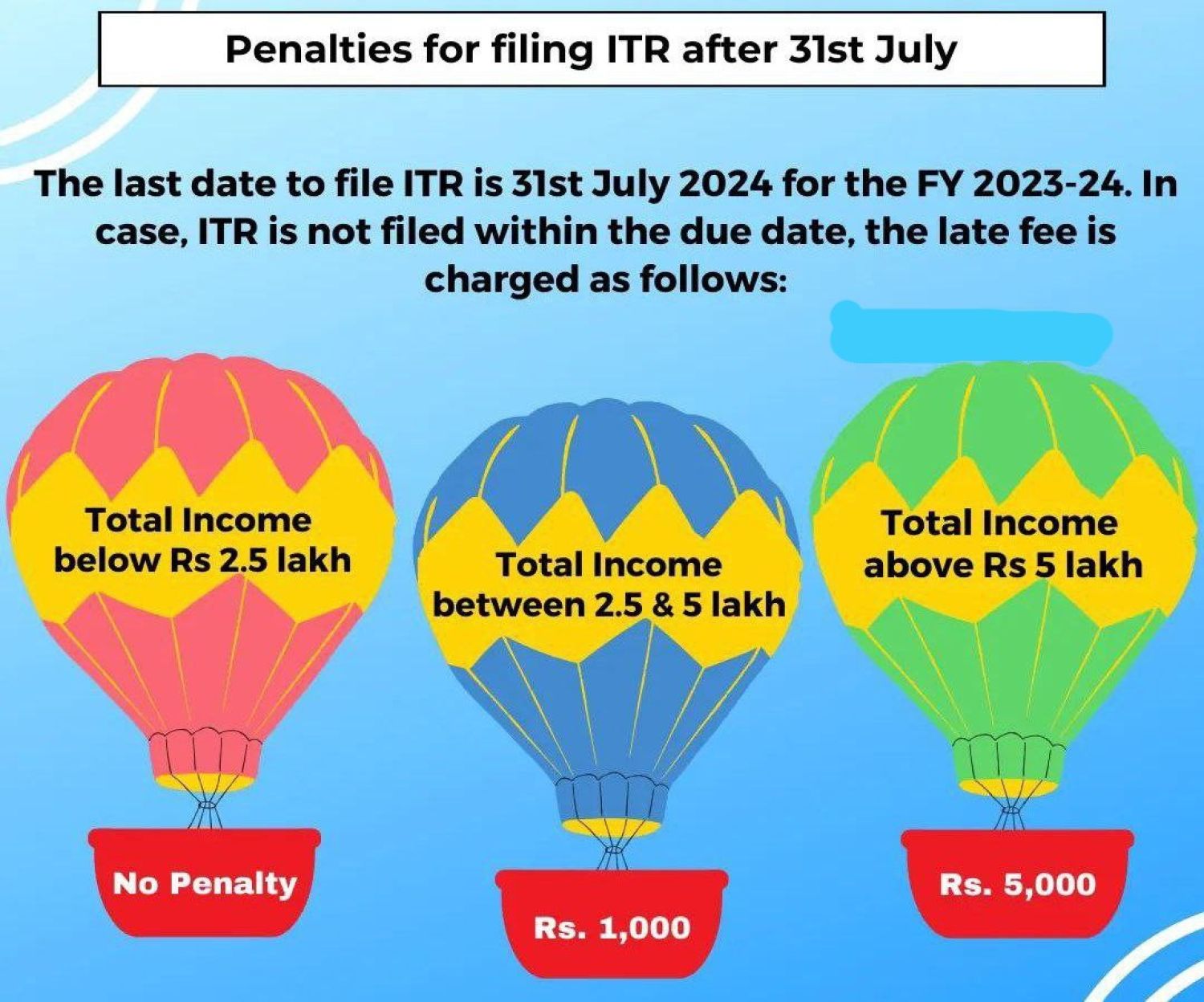

What is the Consequences of Late Filing of ITR FY 2023-24?

By adhering to the 31st July 2024 deadline and understanding the implications of late filing, taxpayers can manage their tax obligations efficiently and avoid unnecessary costs.

- Interest under Section 234A: If you file your ITR after the due date, you will have to pay interest on the outstanding tax liability.

- Interest Rate: 1% per month or part of the month on the amount of tax due.From the due date (31st July 2024) to the date of actual filing.

- Penalty under Section 234F: A penalty is imposed for late filing of ITR. Penalty Amount:

- INR 5,000 if the return is filed after the due date but before 31st December 2024.

- INR 10,000 if the return is filed after 31st December 2024.

- For taxpayers with a total income of up to ₹5 lakhs, the maximum penalty is INR 1,000.

Which is Better- Old vs New Tax Regime Comparison 2024 ?

All the Required Documents for Filing ITR