GST Registration

OIDAR Service Providers GST Registration in India

RJA 21 Oct, 2022

OIDAR Service Providers GST Registration: What is an OIDAR service as per GST Act? Any company or originations giving online information & database retrieval services (OIDAR services) is needed to compulsory take GST registration in India, irrespective of the threshold for aggregate turnover, online information & database retrieval services providers ...

TDS

Equalization Levy for Online Google Ads not attached, If it does not accrue in India

RJA 17 Oct, 2022

Equalization Levy for Google Ads Online Not attached Because, If it does not accrue in India: ITAT The Equalisation Levy version 1.0 will not be applicable on Google Ads Due to Foreign Audience if recipient of service is located outside India & advertisement income is not accruing in India ...

GST Consultancy

AO not to imposed penalty without giving him the opportunity of being heard

RJA 13 Oct, 2022

A person cannot be imposed penalty under GST without giving him the opportunity of being heard What is issue: Whether or not the Petitioner is GST liable to pay GST tax along with penalty equal to 100% of tax? An e-way bill was created with a validity date of September 28, 2020. By ...

GST Consultancy

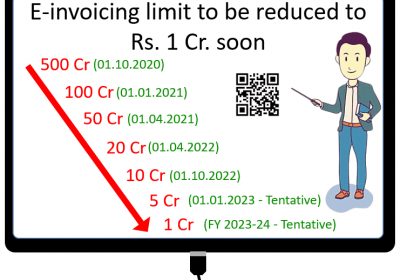

GST E-invoicing threshold limit to be decrease to INR. 1 Crore very soon

RJA 10 Oct, 2022

GST E-invoicing threshold limit to be decrease to INR. 1 Crore Very soon. Companies/Firm business with yearly Sales or annual turnover of over INR Five Cr. will have to move to e-invoicing under Goods and services tax from 1 January 2023. The Goods and Services Tax Network has asked its technology ...

ROC Compliance

Key changes in Schedule-III of the Companies Act wef FY 2021-22

RJA 30 Sep, 2022

Key changes in Schedule-III of the Companies Act which is applicable from 1-april- 2021 the MCA revised Schedule III of the Companies Act 2013 with the goal of increasing openness and giving users of financial statements more disclosures with effect from On March 24, 2021. These changes will be in effect as ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Oct 2022

RJA 30 Sep, 2022

Tax & Statutory Compliance Calendar for Oct 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Goods and Services Tax GSTR -5 Sep-2022 20-Oct-22 GSTR-5 is to be filed by a Non-Resident Taxable Person for the previous month. 2 Goods and Services Tax GSTR-7- TDS ...

GST Filling

Continuous Non-Filling of GSTR-3B can be ground for GST Registration Cancellation

RJA 30 Sep, 2022

Continuous Non-Filling of GSTR-3B a Ground for Cancellation of GST Registration: CBIC Notifies Amendment to GST Rules As a consequence of the Central Board of Indirect Taxes and Custom (CBIC) amending the CGST Rules, individuals who fail to file their GST (Goods & Services Tax) reports risk having their ...

ROC Compliance

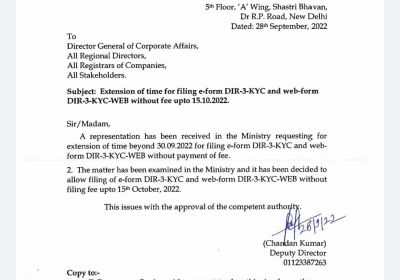

Is Dir 3 KYC date extended for FY 2022?

RJA 28 Sep, 2022

Is Dir 3 KYC date extended for FY 2022? For FY 2022-23 - all the individual who has been allotted “DPIN/DIN” on or before 31.03.2022 & status of such Director Identification Numbers is 'Approved', needs to file form DIR-3 KYC to update KYC details in the MCA system on ...

Chartered Accountants

Implications on statutory Auditor if mistake in Schedule III Format

RJA 25 Sep, 2022

What are the implications for statutory auditors in case a mistake happens Schedule III Format? No reporting or qualification in his statutory Audit Reporting with respect to mistakes or omissions in the audited financial statements vis-à-vis format specified by Schedule III of Companies Act, 2013 is being taken as ...

INCOME TAX

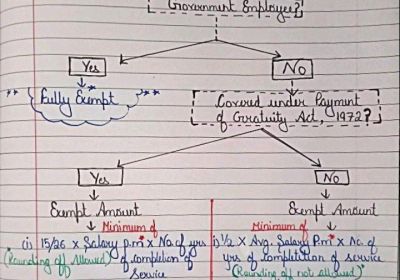

How to calculation of the gratuity amount exempted from income tax ?

RJA 20 Sep, 2022

How to calculation of the gratuity amount exempted from income tax ? When a monetary reward provided by the employer but not included in the employee's regular monthly salary is known as a gratuity. The Payment of Gratuity Act, 1972 regulates the gratuity provisions, and it is paid upon the occurrence ...

COMPANY LAW

What is Change in threshold limit of small company definition?

RJA 16 Sep, 2022

What is Change in threshold limit of small company definition? Small Company many advantages over mediam & large companies, a small business promotes entrepreneurship, employment, and jobs while also being simpler to manage. Change in definition of a Small Company via Increased paid-up share capital & turnover ...

INCOME TAX

Timeline For Filling Form 67 under Income tax

RJA 15 Sep, 2022

What is Timeline For Filling Form 67 under Income tax act ? FTC would be claimed only if income tax Form-67, along with the required documents, was filling within timeline date for filing original Income-tax return in India, As per Latest amendment Income tax taxpayer restricting ability of claiming Foreign ...

GST Consultancy

GSTN Guidelines issued for prosecution in GST

RJA 07 Sep, 2022

GSTN Guidelines issued for prosecution in GST- Key Points The Central Board of Indirect Taxes & Customs has issued instructions for the Goods and Services Tax investigation officers which are to be followed while launching any prosecution proceedings exhibiting criminal charges against any person. Central Board of Indirect ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Sept. 2022

RJA 01 Sep, 2022

Tax & Statutory Compliance Calendar for Sept. 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1. Goods and Services Tax. GST Form No GSTR -7 Tax Deducted At Source return under GST August-2022 10-Sep-22 GSTR-7 is a return to be filed by the persons who are required ...

GST Consultancy

Reopening of TRAN 1 & TRAN 2 Forms is a One-Time Opportunity

RJA 01 Sep, 2022

CBIC Guidelines on Reopening of TRAN 1 & TRAN 2 Forms is a One-Time Opportunity Central Board of Indirect Taxes and Customs has issued the guidelines in terms of the order passed by the Supreme Court in the case of UOI vs. Filco Trade Centre Pvt. Ltd. has provided the following ...

COMPANY LAW

Physical Verification of the Registered Office of the Company By ROC

RJA 19 Aug, 2022

MCA Amends Incorporation Rules: ROC has to prepare a Physical Verification Report of the Registered Office of the company in the given format. {MCA notifies Companies (Incorporation) Third Amendment Rules,2022.} A Registrar of Companies (RoC) is allowed under Section 12 of the Act to physically inspect a company's registered office ...

GST Compliance

CBEC Clarification on 5% GST on the ticket cancellation fee,

RJA 18 Aug, 2022

CBEC Clarification on 5% GST on the ticket cancellation fee, 5 % GST is only applicable on the cancellation of the tickets of AC class which will be subject to penalty, affirmation made by south central railways official by a statement given. GST on cancelled train tickets is one of the wide spread ...

Chartered Accountants

ICAI issue Notice to CA Firms on violate Company Law Via Chinese Co.

RJA 11 Aug, 2022

ICAI issue Notice to CA Firms on violate Company Law Via Indian subsidiaries Chinese Co. About 200 CA firms have received Disciplinary Notices from the ICAI for allegedly engaging in or assisting Chinese firms that were violating the law through Indian subsidiaries and shell entities. Considering the extensive alleged/complained by ...

Chartered Accountants

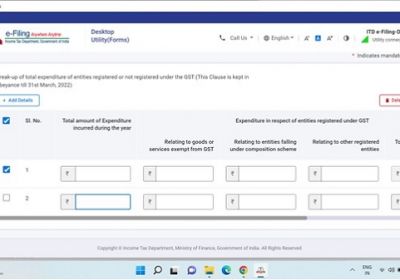

Required to fill Clause 44 of Form 3CD under Tax audit

RJA 11 Aug, 2022

Needed to fill Clause 44 of Form 3CD under Tax audit If you are subjected to an Income Tax audit provision, you must shall adhere by Clause 44 of Form 3CD. Tax Auditor Reporting under the Tax Audit Report clause No 44 under the Form 3CD of Tax Audit Report Under Income ...

GST Consultancy

CBIC examine crypto ecosystem to bring more activities on GST framework

RJA 10 Aug, 2022

CBIC examine crypto ecosystem to bring more activities on GST framework The CBIC's GST policy department is carefully analysing how to extend the reach of taxation to the cryptocurrency ecosystem. It intends to grow its activities by providing platforms for mining cryptocurrency assets and the usage of virtual digital ...

Goods and Services Tax

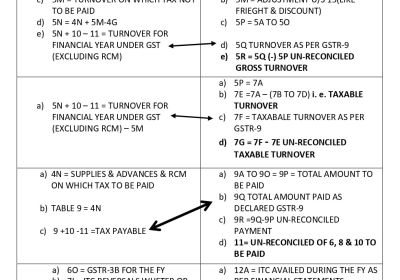

GSTR-9 and GSTR-9C(i.e GST Annual Return) are Available for filing Now

RJA 08 Aug, 2022

GSTR-9 and GSTR-9C(i.e GST Annual Return) are Available for filing Now GSTR 9C is a statement that reconciles the information from the yearly returns filed under GSTR 9 for a given financial year with the data from the taxpayer's audited annual financial statements. A cost accountant or ...

INCOME TAX

Extension of tax returns filing deadline for AY 2022–23 till 31st Aug 2022

RJA 08 Aug, 2022

Extension of the Due date of filing ITR for AY 2022–23 till 31st August 2022 A Representation from the Gujarat Federation of Tax Consultants and the Income Tax Bar Association have been submitted to the Indian Minister of Finance and the Chairman of the CBDT to extend the date for submitting ...

Goods and Services Tax

Advisory for SGST to Issue DIN While Issuing Notice

RJA 06 Aug, 2022

Advisory to Issue Document Identification Number (DIN) By SGST, While Issuing GST Notice What is Document Identification Number in GST? A DIN Number (DIN) is a unique 20-digit identification code attached to every correspondence issued by the Govt offices to GST taxpayers. With this Document Identification Number, the GST Taxpayer ...

Goods and Services Tax

Pay GST on bookings of train or air tickets hotel cancellation charges

RJA 05 Aug, 2022

Pay GST on bookings of train or air tickets hotel cancellation charges Finance ministry Tax Research Unit (TRU) issued 3 circulars along with clarifications or explanations as far as the Goods and Services tax levy is concerned. In accordance with CBDT circular, GST levy in cases where payments arise from ...