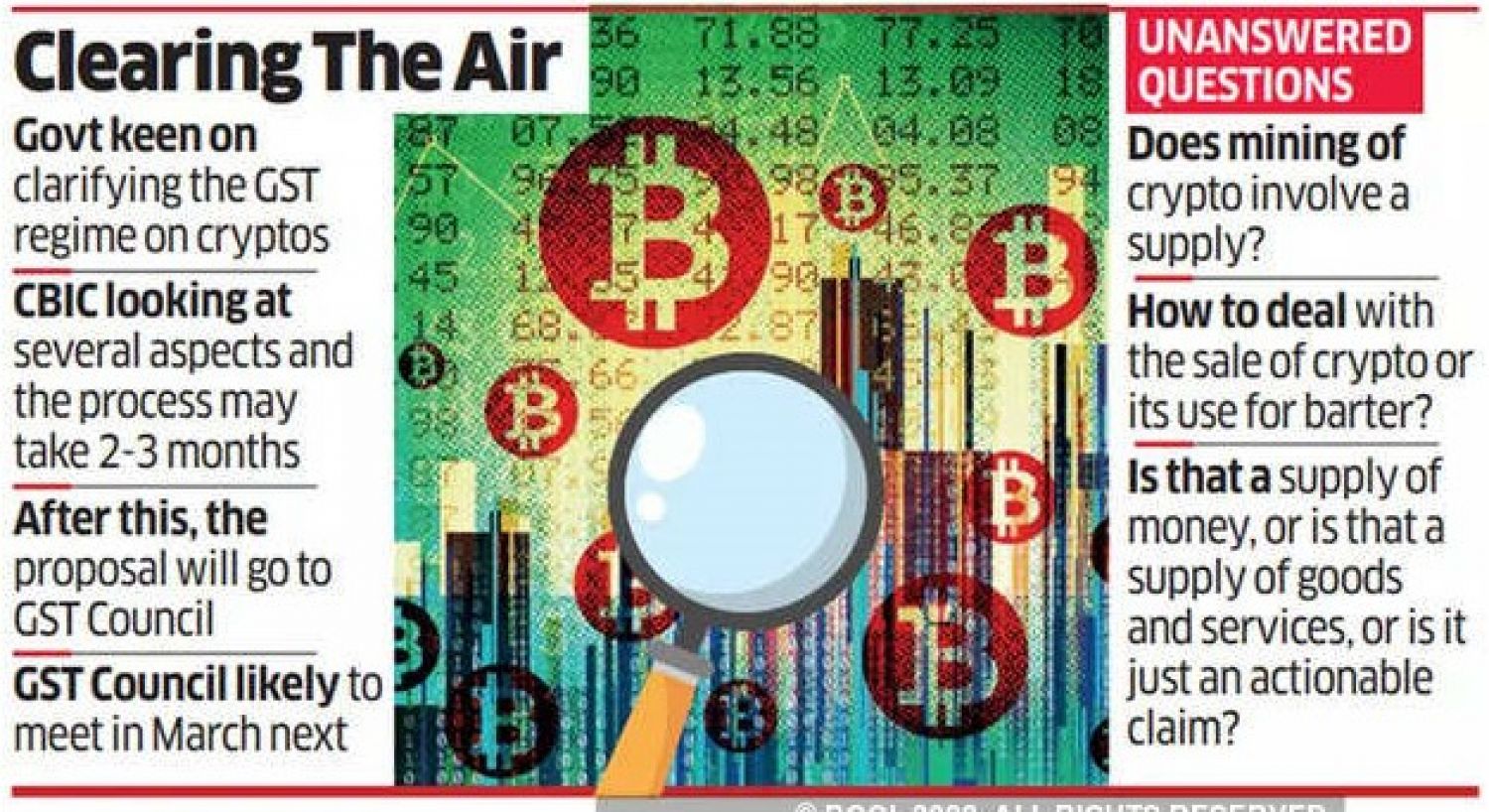

CBIC examine crypto ecosystem to bring more activities on GST framework

The CBIC's GST policy department is carefully analysing how to extend the reach of taxation to the cryptocurrency ecosystem. It intends to grow its activities by providing platforms for mining cryptocurrency assets and the usage of virtual digital assets (VDAs) as a suitable medium of exchange for transactions covered by the tax net.

- According to the Financial express Souris : GST Council- law committee may take up matter later this year in the meeting upcoming Sept 2022,

- Presently GST @ 18% is levied only on crypto exchanges services & the same Services is classify as financial services.

- As per the Income tax department : cryptocurrency assets refer to the decentralised convertible virtual assets protected by cryptography which is on algorithm-based.

- cryptocurrency ecosystem involves different-2 activities, which including wallet services, exchange services, barter system mining, payment processing, & other different transactions.

- According to the a senior official of GST Council- law committee will vet the complete recommendations:

“We are in process of examining few of issues such as what is nature of the business/ transactions, how transactions or business are happen, which are the originations are involved in these System, is it usually business-to-consumer or consumer-to-consumer, is there an registration system, could there be offshore transactions or onshore transactions. Also, there requirements to be explanation or clarification whether few transactions are services or goods,”

Source from: https://www.financialexpress.com

CLASS & CATEGORIES OF EXEMPTIONS UNDER GOODS AND SERVICES TAX

-

Education Sector

-

Banking & Financial Sector

-

Construction Industry

-

Agriculture Sector

-

Government Services

-

Healthcare Services

-

Goods Transportation

-

Passenger Transportation

-

Artist Services

-

Admission to various events

-

In-depth Interlinking of Import of Services

-

Charitable Entity

-

Religious Institution

-

Legal Services

-

Life Insurance

-

General Insurance

-

Leasing Services

-

Services by Unincorporated Body / non-profit organization / resident welfare association

-

IGST Exemptions

-

Miscellaneous Exemptions as per GST law