Table of Contents

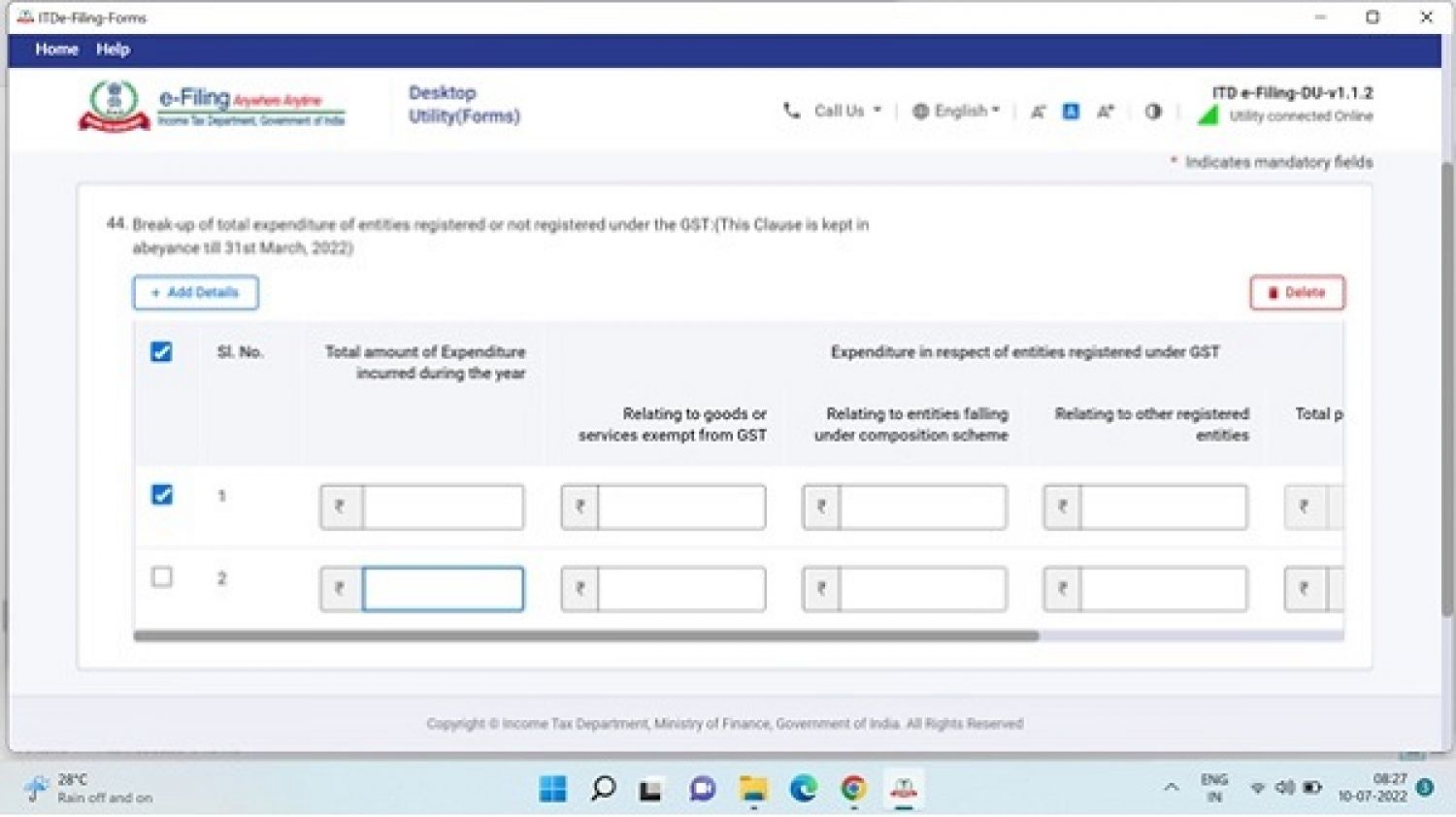

Needed to fill Clause 44 of Form 3CD under Tax audit

If you are subjected to an Income Tax audit provision, you must shall adhere by Clause 44 of Form 3CD.

Tax Auditor Reporting under the Tax Audit Report clause No 44 under the Form 3CD of Tax Audit Report Under Income tax Act

- What are the Expenditure amount incurred during the Financial Year.

- What are the Expenditure amount which is taken from GST registered Firm:

- Relating to Firm falling under composition scheme

- Relating to services & goods which are exempt under the GST.

- Total payment to GST Registered firm.

- Expenditures relating to other GST Registered Firm

- Total Expenditure relating to Firm not GST registered under the GST act.

Main bullet points:-

A Chartered Accountants / Tax auditor should verify details bullet point in with the document to be verify on test check basis & retain same as part of his Auditors Tax audit working Documents & paper: –

- Total value debited to expenditure account

- Amount of payment made to the vendor

- Total Expenditure head bifurcated under the different head,

- Total Value for which ITC is taken

- Reason for NIL GST

- Name of the Firms to whom payment is made

- GST No of the Firm

- Normal any other Remarks, if any

The issue is that Clause 44 continue to cause a lot of confusion, and data validation is still a cumbersome procedure.

But it's not as challenging as people think. Your tax auditor must be able to communicate with a GST specialist utilising Rajput Jain & associates about this compliance.