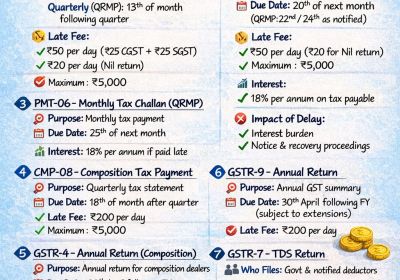

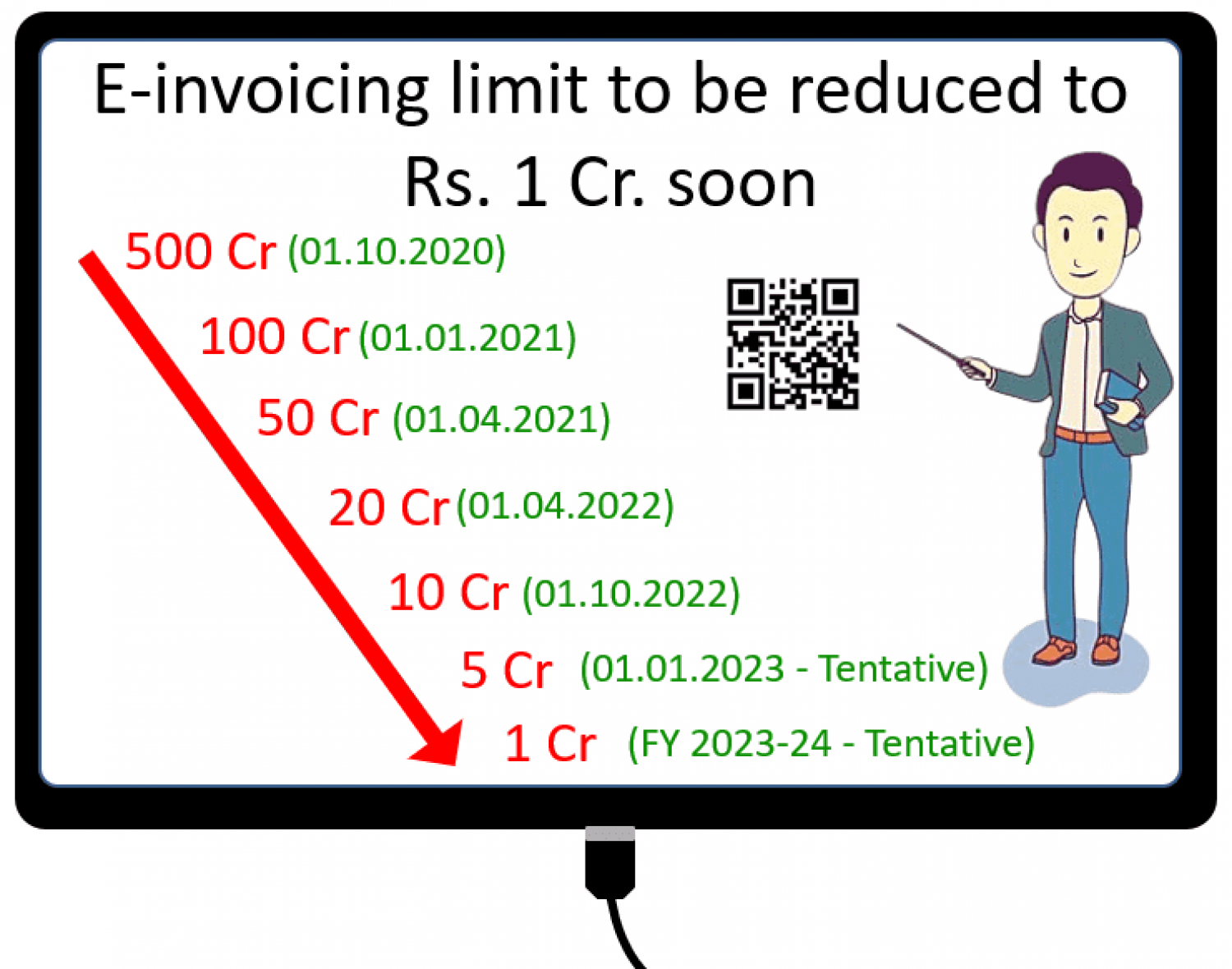

GST E-invoicing threshold limit to be decrease to INR. 1 Crore Very soon.

Companies/Firm business with yearly Sales or annual turnover of over INR Five Cr. will have to move to e-invoicing under Goods and services tax from 1 January 2023. The Goods and Services Tax Network has asked its technology providers to make the portal ready to handle the increased capacity by December, a government official privy to the development, told By economice Time.

GST official said the target is to bring all Companies or Firm with yearly Sales exceeds INR one Cr. under this system working by next Year, which will More improve compliance & plug revenue leakages.

The Goods and Services Tax Network & Council had decided to implement electronic invoice in a step-by-step manner. The objective is to bring all the Companies/Firm businesses under the formal economy. "As per the Goods and Services Tax Network suggestions, GST E-invoicing will become Compulsory for Companies/Firm businesses over INR Five Cr. turnover from 1 January ," the GST official Explained.

E-invoicing uses a standardised format that a machine can read.

New Update :

- New E-Invoice System will not accept Four digit Harmonised System of Nomenclature code codes.

- Compulsary for the taxpayers to mention Six Digit Harmonised System of Nomenclature Codes for their outward supplies having Annual Aggregate Turnover more than INR 5 Cr.