Is Dir 3 KYC date extended for FY 2022?

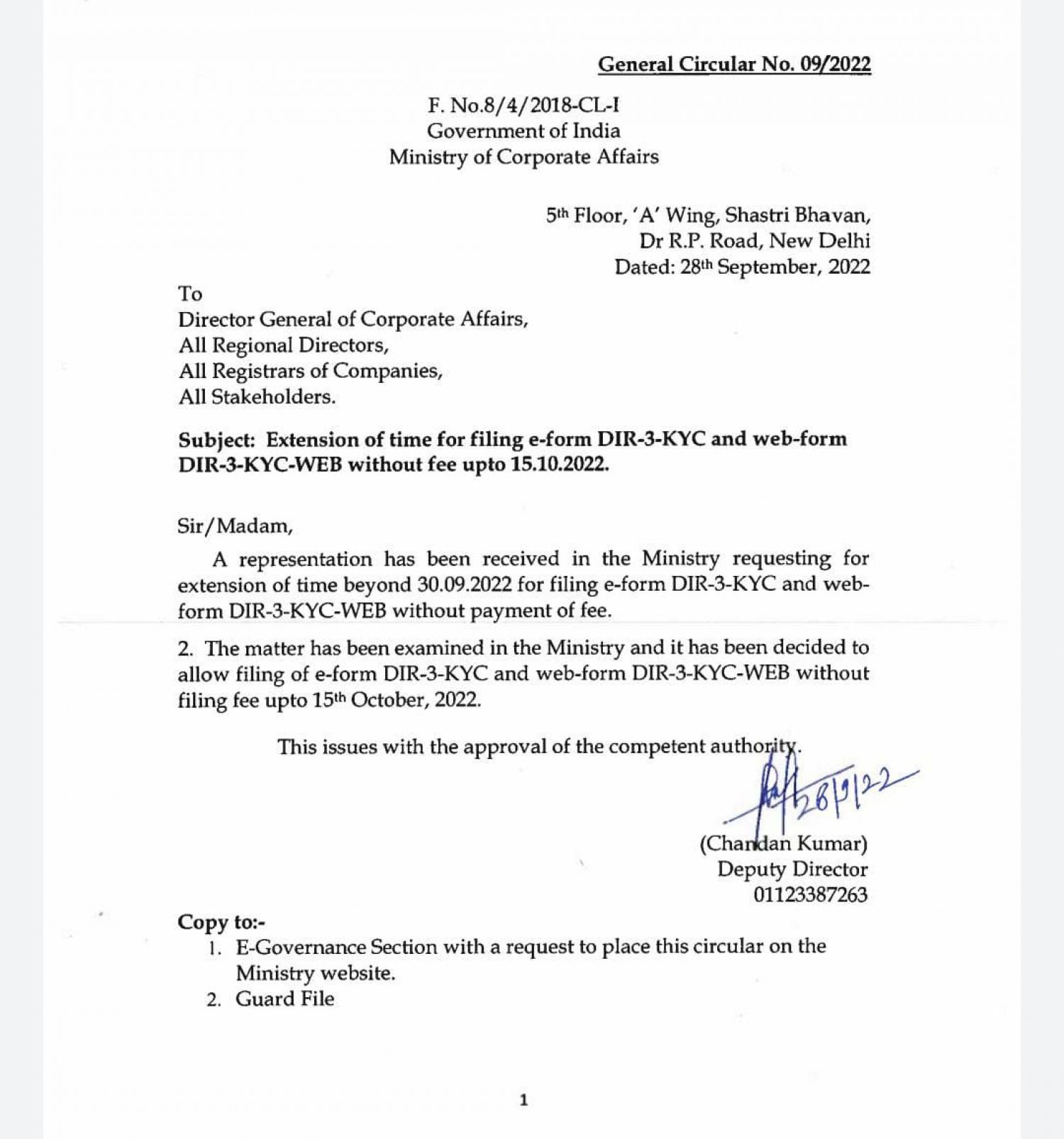

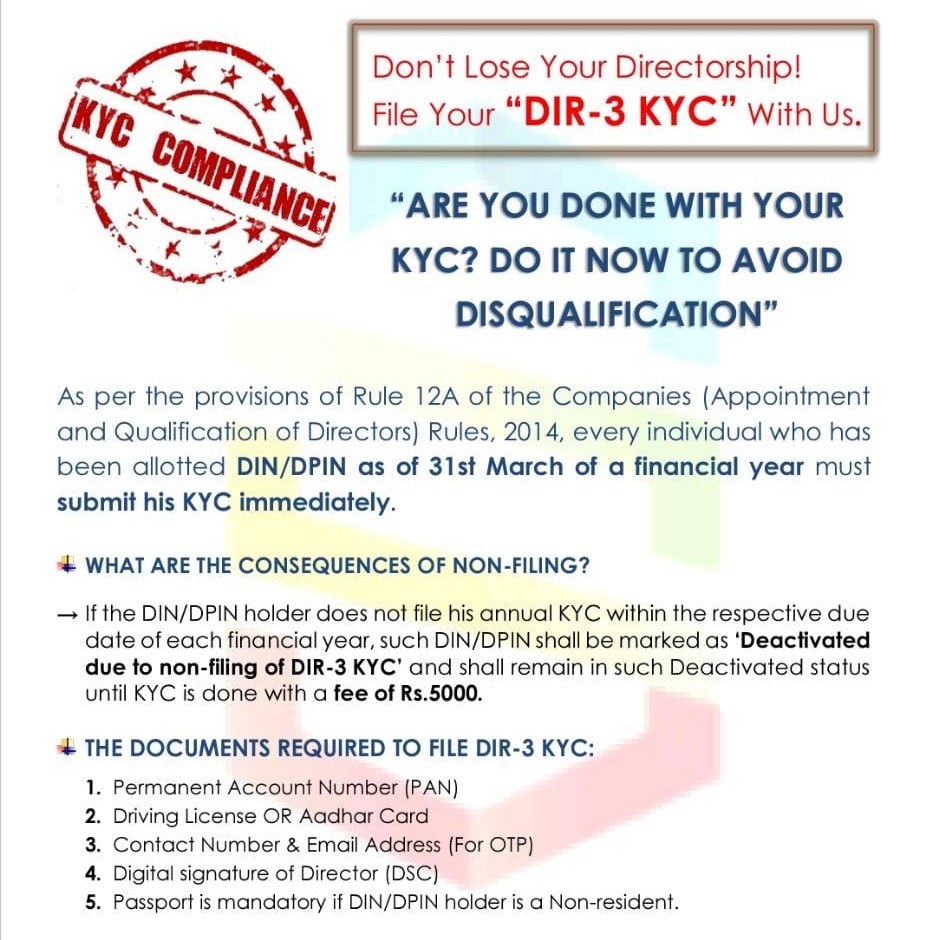

For FY 2022-23 - all the individual who has been allotted “DPIN/DIN” on or before 31.03.2022 & status of such Director Identification Numbers is 'Approved', needs to file form DIR-3 KYC to update KYC details in the MCA system on or before 15th October 2022. Warning for registration of eKYC of Directors for FY 2021-22, The last filing deadline for eKYC Directors for FY 2021-22 is 15 Oct 2022. The holders of the DIN labeled 'Deactivated' shall have an extended period of time until 15th Oct 2022 for the submission of DIR-3KYC / DIR-3 KYC-Web without payment of Rs 5,000. Companies classified as "ACTIVE non-compliant" were granted an extension of time until 15 Oct 2022 to file eForm ACTIVE without a fee of Rs 10,000.

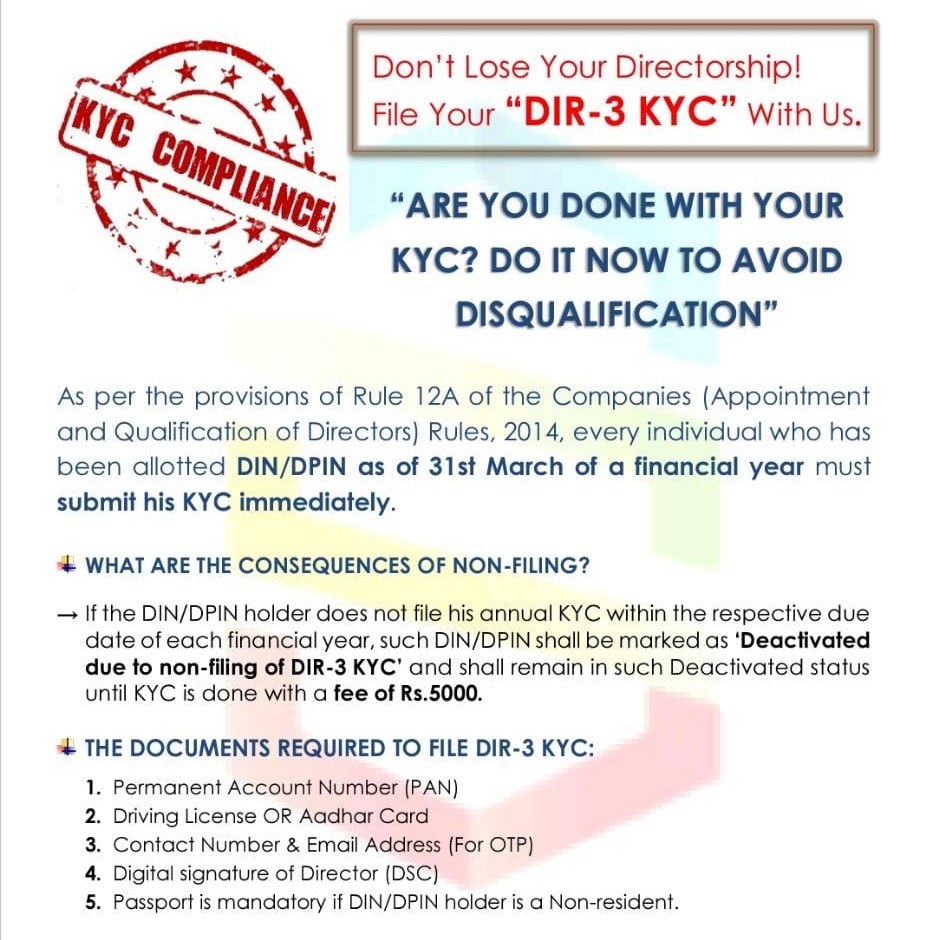

Documents need to be filed with e -form DIR-3 KYC:

Following documents need to be filed with e -form DIR-3 KYC:

| List of Documents |

foreign resident/ Indian residents Person required |

| Aadhaar Card (Self Attested) |

Mandatory, in case the applicant, is a citizen of India, if it is not assigned, then Voter ID or Passport or Driving Licence. |

Proof of Present Address

(In case ‘No’ is selected in the field “Whether the present residential address is same as permanent residential address”) |

Any 1 (one) from the following: –

- Bank Statement

- Electricity Bill

- Mobile Bill

- Telephone Bill

Note: Above documents to be Self-attested copy, not older than 2 months,

1 year for foreign nationals.

|

| Proof of Permanent Address (Mandatory) |

Any 1 (one) from the following: –

- Passport,

- Aadhar Card,

- Voter’s Identity Card,

- Driving license,

- Ration Card,

- Bank Statement,

- Electricity Bill,

- Telephone Bill,

- Utility Bills etc.

Note: Above documents to be Self-attested copy, not older than 2 months,

1 year for foreign national in case of point (f) to (i))

|

| Self-attested copy of PAN |

Mandatory, in case of applicant, is a citizen of India |

| Copy of Passport |

Mandatory, In case the applicant has a valid passport

In the case of a foreign national residing in India, a self-attested copy of the Visa along with an arrival stamp is also required.

|

New Online filing eForm DIR-3 eKYC Directors

KYC DIR

KYC DIR

MCA Update

Now Directors are able to update their Mobile Number & Email IDs by filing DIR-3 KYC by paying Rs.500/-.

W.e.f 01.08.2024

Disclaimer: The content of this post isn't considered to be professional or legal advice, We aren't responsible for any damages arising from your access to the location content & must not be relied on or used as a substitute for legal advice from a lawyer professional in your jurisdiction. CARajput is among India's big digital compliance services platform which committed to helping people have started & developed their businesses. We had started with the goal of creating it easier for start-ups to start out their business. Our main aim is to assist the businessman with applicable laws & regulations compliance and providing support at each & every level to make sure the business stays compliant and growing continuously. For any query, help or feedback you may in touch on singh@carajput.com or Call or what’s-up on 9-555-555-480