NRI

Lower TDS Certificate for NRI Property Sales

RJA 21 May, 2021

LOWER TDS/NIL TDS/EXEMPTION CERTIFICATE U/S 197 ON PROPERTY SALE BY NRIs, OCIs CITIZENS Non-Residents' TDS on Property Sale Transactions (NRIs, OCIs) According to the Indian tax Act 1961- TDS provisions apply to various financial transactions in India. Tax deduction at sources is also applicable to property sale transactions ...

INCOME TAX

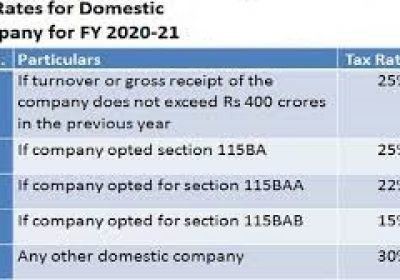

TAXATION UNDER SEC-115BAA & 115BAB

RJA 21 May, 2021

SECTION 115BAA Under this section, newly set up manufacturing companies are provided with a concessional rate of tax. The tax rate is as follows – The annual income is subject to a tax @ 22%. In Addition to this, a surcharge of 10 % and cess of 4 % is also levied, thus making the effective ...

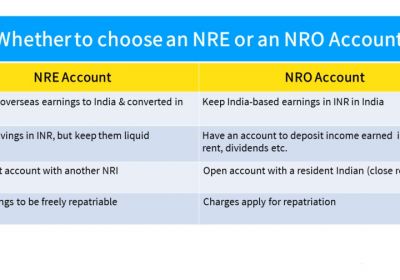

NRI

NRE A/c Salary Income Receipt - Not Taxable in the Hand of NRIs Working Abroad

RJA 19 May, 2021

Mumbai ITAT decided in a recent judgment that it was not possible to cause a tax incident that the only receipt of salary income by the employee of the NRE Bank accounts in India (which works in a ship on international routes run by Singapore's shipping company). Under ...

NRI

Capital Gains on the Sale of NRI Immovable Property

RJA 19 May, 2021

Capital Gains on the Sale of NRI Immovable Property Purchase Immovable Property in India by Non-Resident Indians. This purchase is made either through the Non-Resident Indians' own investment or through inheritance from their parents/grandparents, etc. Non-Resident Indians always want to sell their immovable property for two reasons. It is ...

INCOME TAX

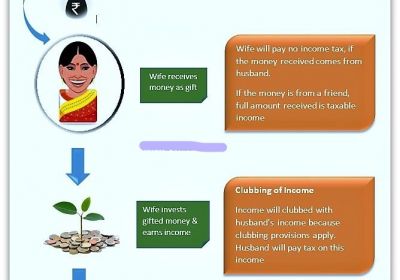

Income/Assets Transferred to Spouse Taxable In the Hands of Transferor Spouse

RJA 19 May, 2021

Income/Assets Transferred to Spouse Taxable In the Hands of Transferor Spouse In India there is normal practice to buy/transfer properties under the name of a woman, for example, acquisition of real estate under the name of a wife, buying jewelry or stock under the name of a wife, ...

OTHERS

RISK AND SAFETY GUIDE FOR INVESTMENT IN CRYPTO

RJA 18 May, 2021

ANSWERS TO SOME BIG/TOP QUESTIONS RELATED TO CRYPTO Cryptocurrency is gaining the attention of investors worldwide. The beginning of 2021 saw a huge spike in crypto prices as Bitcoin hit its record high of $62,575 in April and Ethereum price soared above $4,000 with the rest following the trend. Presently, Bitcoin is ...

FCRA

Overview about FCRA Registration renewal

RJA 12 May, 2021

FCRA Registration Renewal The registration certificate's validity has been limited to 5 years under the updated FCRA 2010. It should be remembered that under previous legislation, FCRA registration was virtually permanent until it was revoked. The FCRA 2010 requires organizations to update their registration every five years. Organizations who want to extend ...

OTHERS

WHAT ARE THE TOP CRYPTOCURRENCY OF 2021

RJA 08 May, 2021

Cryptocurrencies are making investors enthusiastic and are creating thought in their minds. It is such a hot popcorn from the media’s outlook due to its volatile price highs and lows. In case one knows only about Bitcoin, then they are underestimating the strength of the crypto market. There ...

Income tax return

Must Know Significant changes in ITR Form for FY 2020-21

RJA 07 May, 2021

Must Know Significant changes in ITR Form for FY 2020-21 Income tax return Form ITR-1 cannot be filed in cases where TDS has been deducted under section 194N: If the amount of cash withdrawn during the year from a co-operative bank, a banking company or post-office from 1 or more bank ...

OTHERS

RISE IN ETHER: A THREAT TO BITCOIN

RJA 01 May, 2021

RISE IN ETHER: A THREAT TO BITCOIN Ether price went beyond $4,000 on 10th May, Monday, thereby hitting its all-time high. Though it is the second-largest cryptocurrency, this new record is seen as an out beat to Bitcoin for the world’s largest cryptocurrency. Ether runs on the ...

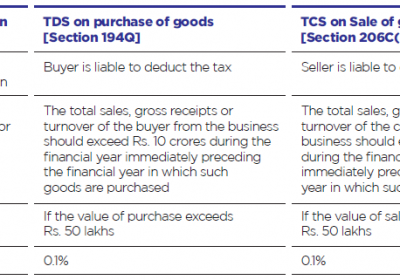

TDS

FAQs ON TDS ON PURCHASE OF GOODS

RJA 01 May, 2021

FAQs ON TDS ON PURCHASE OF GOODS Q.: Who will be liable to deduct TDS under Section 194Q? The provisions of section 194Q apply to a buyer, who makes a total sales, gross receipts, or turnover from any business undertaken by them, exceeds Rs 10 Crores during the financial year immediately ...

Goods and Services Tax

SUMMARY OF PENALTY ON DEFAULTS UNDER THE GST LAW

RJA 01 May, 2021

Summary of Penalty on Defaults under the GST Law The GST law specifies the types of violations that can be committed and the penalties that will be imposed in each case. This is critical information for all business owners, accountants, and tax professionals, as even a minor error can ...

INCOME TAX

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT

RJA 28 Apr, 2021

GUIDELINES TO BANKS TO REPORT TAXPAYERS INTEREST INCOME: CBDT Exempted Income tax income under the Income Tax Act 1961 like interest on PPF account etc need not be reported. The CBDT published detailed guidelines for reporting information on taxpayers' interest & dividend income from banks and companies. The “specified reporting ...

GST Registration

Complete Overview of GST Registration

RJA 25 Apr, 2021

PERSON LIABLE FOR GST REGISTRATION OR NOT Provisions on persons responsible for registering for GST are provided for. Under Section 22 & Section 24 the Central Goods and Service Tax Act (CGST) 2017, are provide and made the provision for GST registration explained by this article. Personal persons registered under Pre-GST law ...

INCOME TAX

Highlights of Faceless Penalty Scheme, 2021.- E-penalty or faceless penalty Scheme, 2021

RJA 22 Apr, 2021

Highlights of Faceless Penalty Scheme, 2021.- E-penalty or faceless penalty Scheme, 2021 CBDT Through Notification No. 03/2021 dated 12.01.2021 - has notified Faceless Penalty Scheme, 2021. to provide for the online imposition of e-penalty or faceless penalty by the Tax Authorities. This scheme shall become effective with effect from 13.01.2021. Salient features Faceless Penalty Scheme, 2021 ...

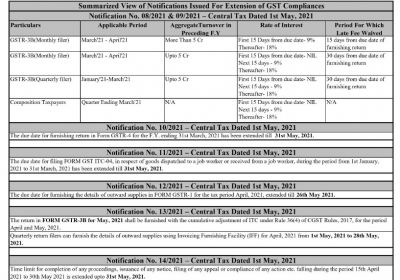

GST Filling

Extension of the due dates for different GST returns in April-2021

RJA 22 Apr, 2021

Extension of the due dates for different GST returns in April-2021 All India Traders' Confederation has demanded the enhancement in April-2021 of due dates in respect of the income tax and GST compliance. All the following compliance measures may lead to interest and late fees if not complied in time. ...

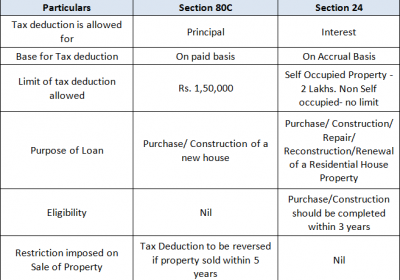

Income tax return

Can HRA & Home Loan Benefits be claimed when ITR is filing?

RJA 22 Apr, 2021

Can HRA & Home Loan Benefits be claimed when ITR is filing? Manny Employees earning a monthly income for both the House Rent Allocation (HRA) and home loans are often confused that they claim the income tax benefit on ITR furnishings. Based on rent, but payment for the domestic loan. ...

INCOME TAX

Document Required For Permanent Account Number (PAN) application

RJA 21 Apr, 2021

Document Required For Permanent Account Number (PAN) application Proof of Identity- Copy of following : Ration card having a photograph of the applicant; or Aadhaar Card issued by the Unique Identification Authority of India; or Elector’s photo identity card; or Pensioner card having a photograph of the applicant; or ...

One Person Company

WITHDRAWAL OR DEATH EITHER NOMINEE OR ITS MEMBER OF A ONE-PERSON COMPANY

RJA 08 Apr, 2021

WITHDRAWAL OR DEATH EITHER NOMINEE OR ITS MEMBER OF A ONE-PERSON COMPANY A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to the one-person company. NOMINEE OF A ...

One Person Company

CONVERSION OF ONE PERSON COMPANY INTO PUBLIC OR PRIVATE COMPANY OR VICE - VERSA

RJA 08 Apr, 2021

CONVERSION OF ONE PERSON COMPANY INTO PUBLIC OR PRIVATE COMPANY OR VICE - VERSA A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to one person company. CONVERSION ...

One Person Company

DOCUMENTS REQUIRED CLOSURE OF ONE PERSON COMPANY.

RJA 08 Apr, 2021

CLOSURE OF ONE-PERSON COMPANY A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to the one-person company. If one person company is inoperative for more than one year ...

FCRA

MHA extends FCRA registration certificates validity of NGOs till 31.05.2021

RJA 03 Apr, 2021

Ministry of Home Affairs extends FCRA registration certificates validity of NGOs till 31.05.2021 The Ministry of Home Affairs said that Non-governmental organization’s whose registration in accordance with the 2010 Foreign Contributions Act expired between Sept 29, 2020 — when notifying fresh amendments to the Act were filed and May 31, 2021, will now receive ...

FCRA

Frequently Asked Question on Fcra Registration

RJA 01 Apr, 2021

Frequently Asked Question on Fcra Registration Q.: What is FCRA stand for? FCRA stands for Foreign Contribution Regulation Act. Q.: Is the Reserve Bank of India (RBI) is governed by the FCRA? The FCRA is an internal security law that is not governed by the RBI. It is ...

Business Setup in India

Planning for start a Private Limited company ?

RJA 28 Mar, 2021

Business setting-up in India It is much easier to set up a business in India nowadays. Starting a business in India now takes less time than it did years ago. A company can be registered in any part of India in just over 5 weeks. The time spent on company registration ...