Table of Contents

- Investigation At The Time Of Fcra Renewal

- Postponed Of Renewal Application

- Documents Needed For The Fcra Registration Renewal

- Check Your Fcra Registration Status Or Update Your Fcra Registration Online.

- Few Things You Should Know Before Using The Fcra Online Service

- Faq On Renew Its Fcra Registration

- Post By Rajput Jain & Associates:

FCRA Registration Renewal

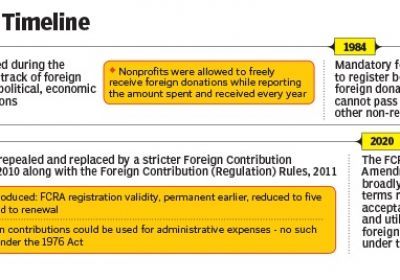

- The registration certificate's validity has been limited to 5 years under the updated FCRA 2010. It should be remembered that under previous legislation, FCRA registration was virtually permanent until it was revoked. The FCRA 2010 requires organizations to update their registration every five years.

- Organizations who want to extend their registration certificate will do so six months before it expires by filling out Form FC-3C online.

- Existing registrations under the FCRA, 2010, will expire after the five-year term from the date of grant of registration has expired, and they will no longer be able to receive international donations. In this situation, the association would have to reapply for registration.

Investigation at the time of FCRA Renewal

The process for FCRA renewal is outlined in Section 16 of the FCRA Act of 2010, which must be completed every five years. However, the aforementioned provision does not grant the department the authority to conduct an investigation when processing the renewal application, even though the FCRA department can conduct audits and inspections at any time under sections 20 and 23, respectively. However, in both sections 20 and 23, the Central Government must have a valid cause to start an investigation or audit.

However, the FCRA Amendment Act of 2020 enacted on September 29, 2020, states that the central government has the authority to make inquiries and satisfy itself as to Section 12(4) conformity prior to FCRA renewal. It's worth noting that Section 12(4) is the law that governs authentication at the time of registration. To put it another way, the government can conduct similar investigations before renewing FCRA registration. As a result of the proposed amendment, the extension process has been identical to the registration or prior permission process.

Postponed of Renewal Application

If a Non- Profit Organization does not apply for renewal by the deadline, its registration will be revoked. However, if appropriate explanations for not sending the renewal application are given, the department could be willing to overlook the delay. A pending application for renewal may be sent up to one year after the FCRA Certificate expires.

The validity of a person's certificate of registration shall be deemed to have ceased from the date of completion of the term of five years from the date of grant of registration if no application for renewal of registration is issued or such application is not followed by the required fee, according to Rule 12(6) of the FC(R) Rules 2011. For example, if no application is made or is not followed by the renewal charge, the validity of the registration certificate granted on November 1, 2016 will be considered to have lapsed as of October 31, 2021.

Documents Needed for the FCRA Registration Renewal

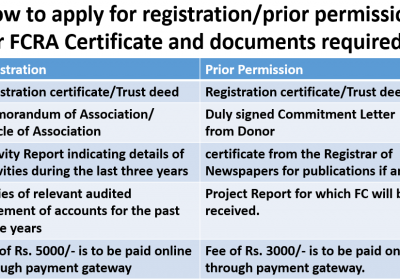

The following documents are needed for FCRA registration renewal:

- Image of Chief Functionary's signature

- Image of the Association's seal

- Association registration certificate

- Memorandum of Association/ Trust Deed

- MHA's FCRA Registration Certificate of Association.

- Information about each main functionary, including Aadhar numbers for Indian members and copies of passports or overseas resident cards (OCI) for international members.

- Each key functionary's affidavit must be uploaded by the association.

The following documents are needed to file a renewal application in the specified format:

- The organization's registration certificate

- In the case of a society, the Memorandum of Association (MOA), and in the case of a trust, the Registered Trust Deed.

- A registration certificate is granted by the MHA under the Fair Credit Reporting Act (FCRA).

- An image of the organization's seal

- Image of the Chief Functionary's Signature

The following information is needed to submit Form FC-3 for renewal:

- Basic information about all members, including gender, father's name, ethnicity, profession, connection to other members, Aadhaar number (not needed yet), and contact information (email id, phone number, etc...).

- Organizational basics, such as a registered address, phone number (not the same as the chief functionary's), email address, and website address (not compulsory)

- Information on FCRA-designated bank accounts and, if applicable, utilization of bank accounts

- The Organization's PAN

- Main Aims & Objectives that can be filled out using the MOA/Trust Deed

- Organizational nature, for which only five choices have been provided:

a) Religious; b) Cultural; c) Economic; d) Educational; e) Social

It may be selected based on the essence of the organization's operations.

Procedure for FCRA registration Renewal

The FCRA registration is valid for five years after it is granted. To hold the registration valid, an application for renewal of FCRA registration must be submitted six months prior to the expiry date.

Stage 1: From the FCRA Online Forms, choose Application for Renewal of FCRA Registration.

Stage 2: When you press this, you'll be taken to the next tab. To apply online, choose Click.

Stage 3: Log in to the FCRA portal using ‘your user ID and password’.

Stage 4: Pick FCRA renewal from the drop-down menu under the option "I am applying for." Follow steps 12 through 28 to upgrade your FCRA registration.

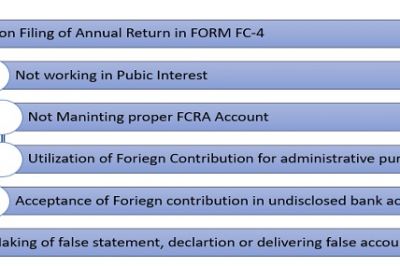

FCRA Registration Cancellation/Suspension

If officials believe that a licensed company is not acting in accordance with the legislation and that its license should be revoked, they will do so by sending a notice to the concerned entity. The below are some of the factors to remember before terminating the license:

- The Foreign Contribution (Regulation) Act is not being followed by the NGO.

- If an agency fails to file an annual return by the deadline

- In the event that some allegation of wrongdoing in activities is brought against such an organisation, and the allegation is shown to be valid,

- Contributions obtained are not used to achieve the entity's key goal or the intent specified in the FCRA registration application.

Fees for registering for FCRA license

A fee of INR 1000 is required for a prior permission application. Despite the fact that a premium of 2,000 would be charged on a new registration application. The fee for obtaining FCRA online services such as registration is payable to the "Pay and Accounts Officer, Ministry of Home Affairs," in New Delhi. The claimant will submit it by draft or review. Using the most favored way to pay the processing fees whether you are filing online or with the assistance of a Charted Accountant.

Check your FCRA registration status or update your FCRA registration online.

Remember to keep track of the application's FCRA online status. You would do so by taking the steps below:

- Go to the FCRA's official website.

- Choose ‘Track your submission' from the drop-down menu.

- Choose the kind of application you've submitted.

- Enter the MHA (Ministry of Home Affairs) file number and birthdate (If asked).

- Click the ‘Submit button.

Few things you should know Before using the FCRA online service

•The applicant must have a DARPAN ID, which can be obtained via the NITI Ayog Portal.

•Pay fees and upload records online.

•Provide specific economic, environmental, social, or educational systems. And contribute to society by working in that area.

- Details of Foreign contribution Bank Account

•Ability to include a separate audit report on both the official and the FCRA account.

Things to stay away from during the FCRA

- Never combine domestic or personal account receipts with an international donation.

- If you've applied for the FCRA program, don't change your opinion

- Should not use ATM or debit cards. The Foreign Contribution Bank usually does not have an ATM or debit card. In the meantime, if you have one, do not use it to make any cash payments.

- If you want to get the most out of your perks, avoid cash withdrawals.

- Don't put the Foreign Contribution money into some kind of savings or liquid fund. Mutual funds, investing, and so on

- If you're on a world trip, stay away from foreign hospitality.

- Do not use FC for any form of personal or administrative function.

- May not accept foreign contributions if your FCRA registration is on hold, canceled, or approval has not been given.

- Foreign contributions can never be accepted in any bank account other than an FC account.

- Never skip any of Section 18 annual returns that are needed.

Furthermore, avoiding any of these blunders would aid in the smooth operation of your firm or confidence.

New Update on FCRA Renewal of certificate

Section 16 of the amendment mandates that the central government perform an investigation before renewing the registration certificate. The conditions that were met when the certificate of registration was issued under Section 12(4) must also be met at the time of renewal. The individual asking for renewal must, among other things, meet the standards set forth in Section 12(4).

- has not been found guilty of diversion or misutilization of its funds;

- has not been prosecuted or convicted for creating communal tension or disharmony in any specified district or any other part of the country;

- is not fictitious or benami;

- has not been prosecuted or convicted for indulging in activities aimed at conversion through inducement or force, either directly or indirectly, from one religious faith to another;

- has not been prohibited from accepting foreign contribution;

- has not contravened any of the provisions of this Act.

- is not likely to use the foreign contribution for personal gains or divert it for undesirable purposes;

Before renewing the certificate, the Central Government must ensure that all of the conditions set forth in Section 12(4) have been met. This criterion serves as a deterrent to those who have been registered under the FCRA from breaking its rules once they have received their registration certificate.

FAQ ON RENEW ITS FCRA REGISTRATION

Q. 1: What happens if the association fails to renew its FCRA registration online?

The existing registration under the FCRA, 2010, will expire after the five-year term from the date of grant of registration has expired. In this situation, the association would have to reapply for registration.

Q. 2: What documents must be submitted in order to update your registration?

For renewal of registration,

- the Chief Functionary's signature,

- the association's seal,

- the association's registration certificate,

- the association's Memorandum of Association/ Trust Deed, and

- A self-certified copy of the registration must be uploaded.

Q.3: What is the procedure for re-registering?

Associations who want to extend their registration certificate will do so six months before it expires by filling out Form FC-3 online.

Q.4: When does an organization that was given registration under the FCRA in 1976 file for renewal?

Since the registration issued to associations under the revoked FCRA, 1976 is valid until April 30, 2016, those associations should have applied for renewal of their registration six months before the validity expires, on or before October 31, 2015. With effect from May 1, 2016, the renewed certificate will be valid for five years.

Q. 5: Is it necessary to update the registration certificate?

According to Section 16 of the FCRA, 2010, someone who has been issued a certificate of registration under Section 12 must have it renewed within six months of the certificate's expiry date.

Popular article :

- Online FCRA Registration

- All About FCRA Act amendment Bill

- Fcra Registration renewal & cancellation suspension

- Growing Concerns about FCRA Renewals

Post by Rajput Jain & Associates:

Legal and various types of document works are involved in FCRA registration-related queries in India other than approvals from the Government of India. We can assist you in FCRA registration renewal for your company or for individuals in India along with getting vital documents and approvals from the government.

For any information/queries, you can contact us. Our team of experts can provide all the assistance related to FCRA Registration: Website- Click here Email id- info@carajput.com; call or what up on 9555 555 480