Table of Contents

LOWER TDS/NIL TDS/EXEMPTION CERTIFICATE U/S 197 ON PROPERTY SALE BY NRIs, OCIs CITIZENS

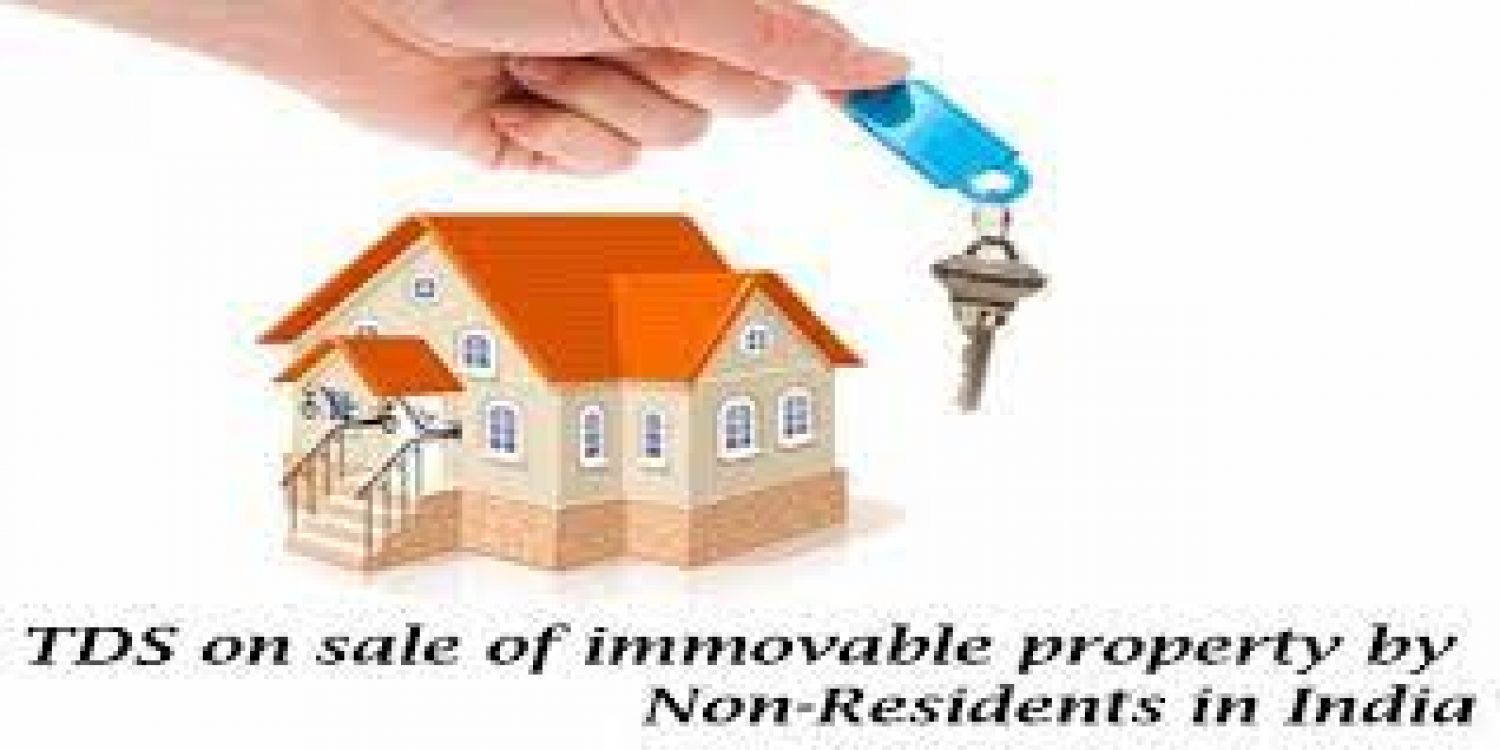

Non-Residents' TDS on Property Sale Transactions (NRIs, OCIs)

- According to the Indian tax Act 1961- TDS provisions apply to various financial transactions in India.

- Tax deduction at sources is also applicable to property sale transactions in the Indian jurisdiction.

- In the event of a property sale, when the seller is a Resident Indian. TDS rate is 1 Percentage & is governed by Section 194IA. But, if the seller is a Non-Resident (i.e. NRI, OCI, Foreign Residents), TDS is governed by Non-Resident TDS provisions, i.e. section 195.

- TDS Provisions for Non-Residents, i.e. under Section 195. TDS rates are applied at the maximum rates on the sale price of the property If the property is a long-term capital asset, the rate of LTGC is 20%. If the property is a short-term capital asset, the Tax rate is 30% and the Applicable surcharge & 4% cess is extra

Genuine hardship & Rate of TDS face by Non-resident property sellers

- Normally, In all the property selling transactions, the Actual tax liability in the hands of the taxpayer (non-resident seller) is lower than the proposed TDS on the transaction.

- An example will help you understand the pain of a non-resident property seller. As an example, An NRI offers to sell a property for Rs 1.50 crore, but the property purchasing cost (after indexation) is Rs 1.45 crore in his hands. As a result, there is just a capital gain of Rs 5 lakh. Now, under the Non-Resident TDS provisions (Sec 195), if the property is a long-term asset (i.e. it has been held for more than two years), the available TDS is 23.92 per cent (20 per cent + SC 15 per cent + cess 4 per cent) of the selling price, i.e. 35.88 lakh rupees. Though actual tax liability is Rs 1.04 Lakh only i.e. 80% of Rs 5 Lakh (20% + 4% cess; SC not applicable on below 50 Lakh Rs gain).

- As a result, in the above scenario, According to existing NRI TDS provisions INR 35.88 lakh TDS would be deducted against the actual tax liability of Rs 1.04 lakh,. on the other hand, NRI will claim the excess TDS refund (Rs 34.84 lakh) by filing an Income tax return on time. But it is a lengthy procedure. If TDS is applied to the entire sum, non-resident funds will be Block in the Income Tax Department for a long time, resulting in a loss of bank interest.

- As a result, this is called as non-residents (NRIs, OCIs) face genuine hardship in relation to their Indian property selling transactions.

- To overcome these circumstances U/s 197 of the Income Tax Act provides for a Lower TDS Certificate (also known as a TDS Exemption Certificate).

TDS Exemption Certificate or Lower TDS Certificate for NRI (Sec 197 – Form 13):

NRI/Foreign Citizens may apply to the Jurisdictional Income Tax Authority for a Lower TDS Certificate (TDS Exemption Certificate) to obtain relief from the TDS/Withholding Tax Rates.

- Application Form 13 of the Income Tax form is used to apply this application document.

- With effect from Oct 25, 2018. Online NRI Lower TDS Certificate can be applied.

- For the purpose of the Lower TDS Certificate, NRI applicants must prepare & arrange various supporting documentation. All the documents are uploaded to the online application under the income tax Form 13.

- After completing the documentation submitted, the application is forwarded to the Jurisdictional TDS Certificate Officer. The officer examines the application and, if necessary, makes suggestions and requests.

- After all of the questions have been addressed, the officer processes the certificate and allows Lower TDS to the NRI/Foreign citizen in relation to the said Sale transaction

- As a result, the buyer deducts the TDS as per the Lower TDS Certificate (or TDS exemption certificate), and NRI/Foreign citizens receive TDS relief prior to the selling transaction, avoiding their money being blocked by the Income Tax Department.

Documents Requirement for NRI Lower TDS Certificate (Sec 197 – Form 13):

In this reference, while the documents and information needed for the preparation of a Lower TDS Certificate Application vary depending on the transaction and other facts of the Non-resident and property, the following is a standard list of documents and information is usually required:

- NRI/Foreign Citizen Income Tax Login Details If it hasn't already been done, it must be done (incometaxindiaefiling.gov.in)

- Registration on the TRACES (Lower TDS Application Portal) (For Filing Form 13 online)

- Buyer's Purchase Agreement (For Sale of Property)

- Property Buyer's TDS Account Number (TAN) and TAN Letter of property buyer. Property Buyer can make an application for that and it is received within 2-3 days by filing Form 49B with tax dept.

- By filing Form 49B with the Income Tax Department, the buyer will apply for it and receive it in 2-3 days.

- A copy of the seller's NRI/foreign citizen passport (along with the latest few years internal pages)

- Circle rate value of the property being sold (documentary evidence or website reference)

- All the records pertaining to property acquisition and purchase (i.e. Sale Deed, Agreement with Builder, Allotment Letter, Possession Letter, Receipts, etc; whichever exist)

- Last 18-24 months of Indian bank account statements

- Income Tax Return Copies (if ITRs have been filed) for the previous 2-3 years

- Tax History/ Record – 26AS very latest two or three years

Timeline for NRI Lower TDS Certificates (Sec 197 – Form 13)

In Normal circumstances, the certificate's validity period is as follows:

- In case preparing application & documents – Two days

- In case moving the application to the Tax deduction at source (TDS) Jurisdictional Officer (internal computerised procedure in Income Tax Department) – Four days

- In a case raising Observation & Other Requirements by Tax Deduction at Source (TDS) Officer – Two Days

- Complying with Tax Deduction at Source Officer(TDS) Queries – Two Days

- TDS Certificate Processing timeline – Two Days

- Senior Jurisdictional Authority Approval (Generally Additional CIT) – Two Days

- Tax Deduction at Source Certificate Issuing – One Day

The following is a normal timeline of the different steps involved in obtaining a TDS Certificate. However, the total timeline can vary depending on the facts and situation of the case.

What Do NRIs & OCIs Do After Obtaining a Lower TDS Certificate?

The Non-resident (NRI, Foreign Citizen) will continue with the property sale execution and closing transactions once the TDS Certificate is issued by the Income Tax Department. Following the completion of the selling process, the seller must take care of the following documents:

- The selling proceeds must be deposited into an NRO account in India.

- For tax enforcement (ITR filing) and potential tax/other queries, a copy of the sale deed (executed in the buyer's favour) must be received.

- Make a copy of the property's other records before handing them over to the buyer.

- TDS certificate (Form 16) for TDS withheld by the buyer on the selling of property (buyer can generate this after filing of TDS return with Inc Tax Deptt).

- If the seller wishes to transfer money from an NRO account to an NRE/Foreign account, a remittance process can be started with the bank. In this case, CA services are also needed for Form 15CB (CA Certificate) and 15CA filing with the income tax department.

- Non-resident sellers (NRIs, foreign citizens, and OCIs) may file an income tax return with the IRS after the fiscal year ends to record property sales, capital gains, and tax workings. NRI/OCIs may also claim 7 demand an income tax refund for excess TDS deducted by the consumer on this ITR.

- TDS & TCS Rate chart for FY 2024-25

- Comprehensive study about TDS & TCS chapter

- Yiou may contact us at singh@carajput.com or singh@caindelhiindia.com in if you have any questions. You can also follow our most recent blogs and articles.