Table of Contents

Returns under FCRA 2010

S. No. |

Return Name |

Due Date |

Details to be Provided |

|

1. |

Within 30 days of receipt (Part A&B) Within 45 days of being nominated (Part C) |

Intimation of receipt of foreign contribution by way of gift / as Articles / Securities / by candidate for Election |

|

|

2. |

Within 2 weeks from the date of proposed onward journey |

Application for FCRA Hospitality |

|

|

3. |

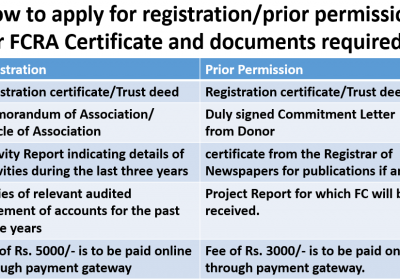

Normally done within 90 days of Application |

Application for FCRA Registration |

|

|

4. |

Normally done within 90 days of Application |

Application for FCRA Prior Permission |

|

|

5. |

Within 6 months from the date of expiry of FCRA Registration |

Application for Renewal of FCRA Registration |

|

|

6. |

Within 9 months from the closure of the relevant Financial year |

Intimation - Annual Returns |

|

|

7. |

Within 15 days from the date of change |

Intimation - Change of name and/ or address within the State of the Association |

|

|

8. |

Within 15 days from the date of change |

Intimation - Change of nature, aims and objects and registration with local/relevant authorities in respect of the association for which registration/ prior permission granted under the above Act |

|

|

9. |

Within 15 days from the date of change |

Intimation - Change of designated bank/ branch/ bank account number of designated FC receipt-cum-utilization bank account |

|

|

10. |

Within 15 days from the date of change |

Intimation - Opening of additional FC-utilization Bank Account for the purpose of utilization of foreign contribution |

|

|

11. |

Within 15 days from the date of change |

Intimation - Change in original Key Members of the Association |

|

|

12. |

After grant of permission by Central Government |

Application for surrender of certificate of registration |

Documents Required for FCRA Returns

S. No |

FCRA Returns |

Documents Required |

|

1. |

|

|

|

2. |

|

|

|

3. |

|

|

|

4. |

|

|

|

5. |

|

|

|

6. |

|

|

|

7. |

|

|

|

8. |

|

|

|

9. |

|

|

|

10. |

|

|

|

11. |

|

|

|

12. |

|