Table of Contents

FCRA Registration

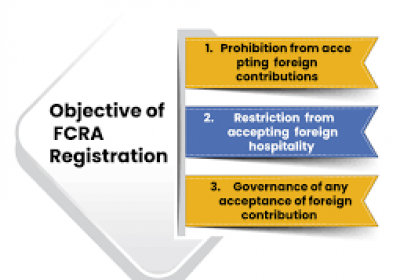

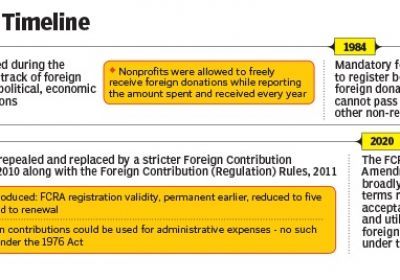

The 1976 Foreign Contribution Act (FCRA) was implemented in 1975 with the major purpose of regulating the acknowledgement and use of the foreign contribution and of foreign hospitality, by individuals and associations working in the important domestic areas. This is important to ensure that such assistance in India does not affect political or other circumstances. The legal arrangement is not particularly difficult to comply with for genuine contribution. Regularly scheduled compliance is limited to the yearly submission of the annual report. This law is applied by the Indian Government, the Ministry of Home Affairs. A separate branch of the ministry is responsible for ensuring compliance with the Foreign Funding Registration.

The Act will also regulate the inflows of international funds to volunteer organisations with an aim of preventing possible reversal of such funds towards operations that are detrimental to the national interest and ensuring that these individuals and organisations can operate in a manner that is in keeping with the values of the Sovereign democratic republic (SDR).

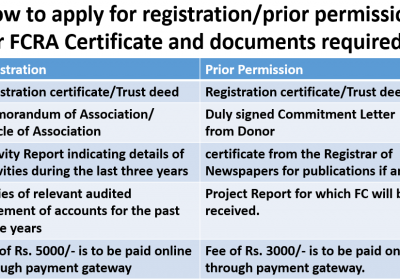

The foreign contribution seekers for certain cultural, social, economic, educational and religious programmes can, by making the application in the prescribed format and providing details of the activities and the audited accounts, obtain registration or prior consent from the Ministry of Home Affairs for receiving foreign contributions. Registration shall only be granted to a partnership which, in the last three years and after registration, has demonstrated a track record of its working in this field; the association shall be free to receive foreign contributions from any foreign source for stated purposes. Only after comprehensive security evaluation is granted the registration of the activities and background of the organisation and the officeholders. However, newly formed and not proven operating organisations may, once project-based prior permission (PP) from the Ministry of Home Affairs has been sought, receive the foreign contribution for a specific purpose and source from specific sources.

To enhance the transparency in the administration of the Foreign Contribution (Regulation) Act, 1976 and the Regulations framed thereunder, improve the functioning, disseminate information, and improve the user-friendliness of the multiple processes, the browser is loaded with all the FCRA forms, Citizens' Charter, catalogue of registered associations, State-wise position of an application for registration, and other information. The following additional charters/materials are uploaded for information and guidance of all concerned in order to further improve the system:

- Charter of Citizens.

- NGO/Association Charter applying for FCRA Prior Authorization/Registration grant.

- NGO/association charter authorised FCRA prior authorisation/registration.

- Charter for Accountants Chartered.

- Banks' charter.

- Offers to deal with

Foreign contributions must be received in a single specified bank account. As a result, the applicant organisation should open new savings account with the intent of using it for such funds and include it in the application. The concerned Ministry will immediately notify the concerned bank to keep a close eye on the use of the foreign contribution and report back to the Ministry if there is any inconsistency. Organizations that have signed up under the FCRA must keep separate accounts for expenses incurred under the Foreign Contribution (FC) head and submit a return in the recommended format to the Ministry, along with the audited statement of accounts for the previous year, by July 31st of each year.

Non-government organisations registered under the FCRA are required to notify the Ministry of any change in the organization's name, Registered Workplace, or purposes and objects in under 30 days of the appropriate change. Likewise, prior approval from the Ministry will be required for any changes to the designated bank or the replacement of more than half of the governing body at the time of its registration under the FCRA. The management should be aware of different FCRA arrangements and must follow strictly the exact same, otherwise, a series of extensive sanctions under the law can be applied.

Foreign Contribution Regulation Act (FCRA) was implemented in the year 1976 and then modified in the year 2010 with the primary aim of managing the approval and utilization of foreign contribution and foreign hospitality by individuals and groups working in the major cities of nationwide interest. The goal of this Act is to ensure that the foreign contribution and foreign hospitality is not made use of effect electoral politics, public servants, judges and other persons operating into the vital locations of national interest viz reporters, printers and publishers of publications, etc.

Organizations seeking foreign contributions for specific cultural, social, economic, educational, or religious programmes may apply for FCRA registration or receive foreign contributions via the "prior permission" route. An FCRA applicant should preferably be a Trust, Society, or Section 8 Company. The non-profit organisation must also have been in operation for at least three years prior to filing the FCRA application and must not have received any foreign contributions prior to that without the approval of the government. Furthermore, the entity seeking registration must have spent at least Rs.10,00,000/- on its aims and objectives in the previous three years, excluding administrative expenditures. Statements of Income and Expenditure for the last three years, duly audited by a Chartered Accountant, must be submitted to validate that it needs to meet the financial parameters.

If a newly registered entity wishes to receive foreign contributions, the Prior Permission (PP) method can be used to apply to the Ministry of Home Affairs for approval for a particular activity, specific purpose, even from a specific source.

FCRA Registration is granted based on a set of criteria.

After submitting an FCRA application in the prescribed manner, the following conditions are checked before registration is granted.

a. The ‘individual' or ‘entity' submitting registration or prior authorization application should not be fake.

- Has never been charged or convicted for engaging in actions aimed at converting people from one religious faith to another using coercion or force, either directly or indirectly.

- Has never been charged or convicted of inciting communal strife or dissension in any district or elsewhere in the country.

- Has not been found guilty of misappropriation or diversion of funds.

- Is not involved in or likely to engage in the propagation of sedition or the use of violent methods to achieve its goals.

- Is unlikely to divert or use foreign contributions for personal gain.

- Has not violated any of the Act's provisions.

- Accepting foreign contributions is not prohibited.

- An individual has not been convicted under any law currently in force, nor is any court case for any offence pending against him.

- Other than an individual, any of its directors, or any of its offices.

b. the entity's or individual's acceptance of foreign contributions is unlikely to have a negative impact –

- India's sovereignty and territorial integrity.

- The state's security, geopolitical, scientific, or economic interests

- The general public's interest

- Elections to any legislature must be free and fair.

- Any foreign country with which you have a friendly relationship.

- Religious, racial, socioeconomic, linguistic, and geographical groupings, castes, or communities living in peace.

C. Acceptance of a foreign contribution:

- Shall not constitute an inducement to commit an offence;

- Shall not risk any person's life or physical safety.

Required documents for FCRA Registration:

According to Section 6 of the Foreign Contribution Regulation Act, any company with a specific social/useful/religious/monetary article must simply acknowledge outside commitment after obtaining international funds registration. The following documents are required for FCRA registration.

- Copy of the society's or trust deed's registration certification, as applicable.

- Copies of the last three years' audited financial statements.

- Copies of the last three years' annual reports.

- Bank details.

- Name of the bank.

- The account number.

- Address of the bank

- The following is a list of the governing bodies.

- Identify.

- Name of the father.

- Designation.

- Occupation.

- Address proof.

- Phone number of the office.

- A copy of the Society's or Trust's PAN card.

FCRA Registration Types

Foreign Contribution Regulation Act certificates are classified into two types.

1. After one year, prior consent certification is possible.

2. Certificate valid for 5 years.

These criteria must be met in order for Prior Approval to be granted:

1. Prior authorization certificates are issued to NGOs that have been in operation for at least one year.

2. The non-governmental organisation must provide a list of foreign benefactors, as well as their addresses, classifications, and the cause to which they are donating.

3. The social welfare organisation actually pointed out the overall quantity of cash which is being received as a foreign donation.

* These criteria must be met in order to obtain Foreign Contribution Regulation Act certification for a period of five years.

1. The Non-Governmental Organization must be three years old.

2. Annual reports and audit reports from the previous three years should be sent.

3. A copy of the pan card and the Ngo’s by laws must also be provided.

* FCRA certification must be renewed every 5 years. This policy will be implemented beginning in 2015.

The applicant association should preferably be registered under any of the following Acts in order to obtain registration under the FCRA:

- The Societies Registration Act of 1860

- The Indian Trusts Act of 1882

- The Charitable and Religious Trusts Act of 1920

- Act of 1956 on Corporations (Section 25)

Time required registering under the Foreign Contribution Regulation Act: -

The registration process usually takes four months, though this might vary depending on how many branches the NGO has. The reason for this is that within one month of filing an online Foreign Funding Registration, officers from the Ministry of Home Affairs' Knowledge Bureau visit the organization's workplace to ensure that it is operating properly. The following are the three steps involved in registering for overseas funds: -

1. Online filing at the Ministry of House Affairs' website.

2. The IB Team will send a report after one month.

3. Submission of a hard copy to the Ministry.

The following are the advantages of the Foreign Contribution Regulation Act:

Following FCRA registration, the NGO can approach various foreign financing companies. Some examples are as follows:

- Canadian High Commission.

- New Zealand High Commission.

- Findhorn Foundation.

- GIFRID ( Israel ).

- European Commission (EC).

- UNESCO.

- AUSAID.

- Japanese Embassy.

Something is crystal clear. Foreign financing agencies just donate to non-governmental organisations (NGOs) that work in a particular field or for a specific cause, such as education, women's empowerment, wellness, and so on. For their excellent effort and achievement, social welfare groups that work in an authentic manner are acknowledged. The slogan of a non-profit organisation should not be to misappropriate funds, but rather to strive for the social upliftment of the poor and needy, as well as to give the world a boost.

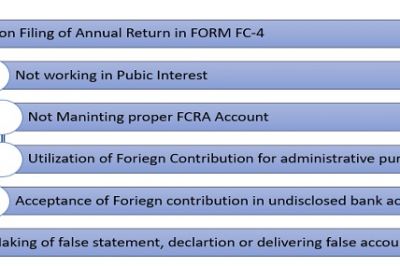

FCRA Registration Cancellation: -

The registration of a non-profit organisation for foreign funding can be revoked for a variety of reasons, including:

- The fund provided by the foreign contributor is not used correctly and is used for personal gain.

- The non-profit organisation fails to submit annual compliance for three years in a row.

- Any member of the company files a complaint alleging that the NGO is not operating effectively, and the complaint is proven.

Granting of FCRA Registration:

- The FCRA registration is granted only to organisations that have a proven track record of functioning in their chosen field of work for the previous three years, and after registration, such organisations are free to accept foreign contributions from any foreign source for stated objectives.

- Organizations that are new to the market and do not yet have a track record of success may accept foreign funding for specific activities or for a specific purpose from a specific source after obtaining project-based prior permission (PP) from the Ministry of Home Affairs.

Key Considerations for FCRA Registration

It is ensured that before beginning the registration process.

- The NGO has been in operation for at least three years.

- It lacks a parent society that is already FCRA-registered.

- The majority of the board members should not be on the board of another Society that is already registered under FCRA.

- The applicant's parent society, if any, should not be based in another country.

- There are no foreigners on the society's board of directors.

The registration process is likely to be ineffective if the above requirements are not met. There are no legal requirements for the previously mentioned condition.

Internally, the Ministry of Home Affairs will not grant a registration unless the previously mentioned major issues are met.

Bank account with the FCRA:

It is critical that all foreign contributions be received in a single designated bank account. As a result, the applicant organisation should open a new bank account with the intent of using it for such funds and include it in the application.