Table of Contents

Changes to the Annual Return under the Foreign Contribution Regulations Act :

The Foreign Contribution Regulation Act of 2010 (“FCRA”) and the Foreign Contribution Regulation Rules (“FCRR”) have recently undergone some modifications. The modifications are as follows:

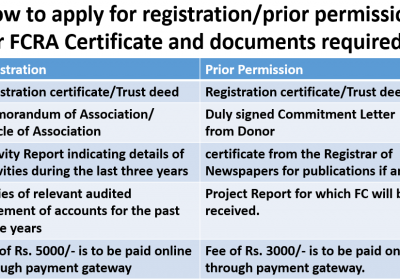

1. Registration, Prior Approval, and Renewal of Registration Consolidated Form:

Previously, Form FC-3 was exclusively used for requesting registration, while Form FC-4 was used for requesting prior approval and Form FC-5 was used for renewal.

From now on, the application forms for registration, prior permission, and renewal have been consolidated into one, and Form FC-3 is now available for all following phases.

From now on, the application forms for registration, prior authorization, and renewal have been consolidated into one, and Form FC-3 is now available for all three processes. Furthermore, from December 14, 2015, the Form must be filed online only; there will be no need to provide paper copies after completing the form online. The company's signature and seal must be scanned and attached to the online submitted form, and payment must also be done online.

2. The latest sequence of Forms has been supplied, along with their purposes, which are as follows: -

Form FC-1: Receipt of a gift from a relative or an FC accepted by-election candidates.

Form FC-2: Prior approval to receive Foreign Hospitality.

Form FC-3: Request for Registration/Prior Permission/Renewal.

Form FC-4: Annual Return.

Form FC-5: Transfer to unregistered NGO/persons.

3. Annual Uploading of Information on Website(Rule 13): -

Previously, only organizations that received more than INR1 Cr in a year were obligated to make their financial information public domain.

From now on, all organizations with registration or previous approval must submit their financial data on their website or to a website designated by the Central Govt.

4. Quarterly Grant Data Uploading to the Website (Rule 13):

Now, all NGO’s with registration or prior approval must upload their financial information related to the donor, as well as the details of donations received, on their website or to a website designated by the Central Government. The details of the donors, as well as the amount received and the date of receipt, must be uploaded. Within 15 days after the final day of the quarter in which the funds were received, the details should be posted.

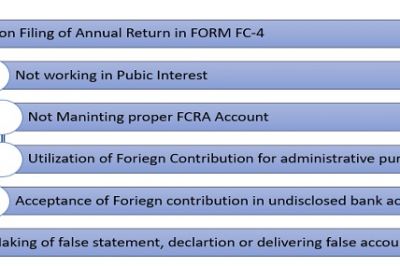

5. The FC-6 Annual Return Form has been replaced by the FC-4 Annual Return Form: -

Annual Returns must be submitted in Form FC-4 rather than FC-6. There is no need to transmit physical copies of the Annual Financials; instead, the organization must submit scanned copies with the return. Form FC-4 must be filed within 9 months after the end of the financial year, or by December 31st.

Furthermore, businesses that successfully completed form FC-6 for FY 2014-15 on or before December 14, 2015, are not needed to file the new form FC-4. Organizations that did not file Form FC-6 by December 15, 2015, must now file Form FC-4. The deadline for filing the 2014-15 annual return in the new Form FC-4 is March 15, 2016.

6. FC-7 and FC-8 forms have been removed.

An organization must now file Form FC-1 if it receives any Foreign Article and/or Foreign Security.

7. Rule 17: If the Ngo’s did not receive or use any foreign contributions during the year, then Nil return need to be submitted, and audited financial statements are not required to be enclosed. If there is an open carry forward of the foreign contribution that is used during the year, the aforementioned benefit cannot be taken advantage of, and an audit must be completed and filed together with the Annual Return.

8. Alterations/changes in the FCRA bank accounts do not require prior approval (Rule 17A): -

Previously, prior approval of the FCRA Department was necessary for alterations to designated bank accounts; however, such changes can now be done without authorization, and only an intimation must be filed electronically online in Form FC-6 within 15 days of the alteration.

9. Changes in the Governing Board do not require prior approval (Rule 17A):

- Previously, prior permission of the FCRA Department was required for changes of more than 50% in the Governing Body. The list of Board members given at the time of application for FC registration or previous approval will be used to determine the 50 per cent change. Such changes can now be made without obtaining approval, and just an intimation must be filed electronically in FormFC-6 within 15 days of the modification.

10. Modifications/Change in Address within the State Require No Prior Approval (Rule 17A):

If a modification of address occurs inside the state, no previous approval from the FCRA Department is necessary; nevertheless, such a change can be effected without authorization and only an intimation must be filed electronically online in Form FC-6 within 15 days of the change.- If a modification of address occurs inside the state, no previous approval from the FCRA Department is necessary; nevertheless, such a change can be effected without authorization and only an intimation must be filed electronically online in Form FC-6 within 15 days of the change.

11. Organizational Objectives Modifications Do Not Require Prior Approval (Rule 17A): -

Previously, Prior Approval of the FCRA Department was required for modifications to the organization's Aims and Objectives. It is intended that any changes to goals should be made within the scope of the FCRA Department's approval at the time of registration. Such changes are now permitted without prior permission, and just an intimation must be filed electronically online in Form FC-6 within 15 days of the modification.

12. Application filling for Renewal in Form FC-3:

All NGO’s, even those that have already applied on the previous Form FC-5, must complete a renewal application. By the 15th of March 2016, all companies must electronically file a renewal application with the FCRA in Form FC-4.

13. In FC-4, you must submit your Darpan ID.

Each association was required to receive a Unique ID from the Niti Aayog's Darpan site (a requirement that was lifted a few months ago by the FCRA wing). The Darpan ID has been included in the FC4 response. This implies that the Darpan portal can provide more information on the NGO, its missions, its Board of Trustees, and so on, in a more convenient manner.

It is, however, OPTIONAL to provide Darpan ID.

14. Minor changes to the FCRA's basic registration criteria

The name of the association was formerly needed in Section 1 of FC-4, but that need has since been deleted. However, a need to provide the date on which the FCRA registration was received has been introduced.

15. Interest Income and Other Receipts are split into two categories.

‘Other receipts from projects/activities' is a new subsection under foreign money revenues. Interest income and other revenue were formerly reported together. Other revenues, on the other hand, must be reported individually in the amended version.

16. Provide more information in the part "donor-by-donor specifics of foreign contributions received" section.

The specific activity for which the ‘donation' was received by the association has been added to section 2 (ii) (a) on ‘donor-wise details of Foreign Contribution received'.

This functionality was previously available in the earlier FC6 version, and its reintroduction in the redesigned FC4 is a great improvement However, in the former FC6, the association had to choose from a list of precise categories (many of which were vague and unimaginative), but in the updated FC4, the association is requested to characterize the activity on its own.

Furthermore, under the former form FC4, only foreign contributions in excess of Rs. 20,000 had to be disclosed under the same condition. However, in amended FC4, the phrase "in excess of Rs.20,000" has been omitted. This will make reporting for each and every receipt made over the course of the year necessary.

17. Comprehensive information is necessary for the “Details of Foreign Contribution Utilization”

The most significant modification is in the section under "Utilization Details." This part, too, is based on the former FC6 structure, although it is far more thorough. The FCRA- non-governmental organization must report item-by-item details on how much money was spent on which activity, where it was spent, and other pertinent information.

Furthermore, unutilized money invested in term deposits and lying in cash/bank has been relocated to a new section 4 in updated FC4, which requires more data for deposits such as opening FD, additions, and realisation.

18. Asset creation (movable or immovable) must be recorded under the new Section 3 (c). Moreover, the new Section 3(d) mandates the reporting of foreign contributions transferred to other organizations.

19. Information about Unutilized land and buildings (created out of FC funds)

A new section 6 requests information on unutilized land and buildings (created with FC funding) that have been sitting idle for more than two years.

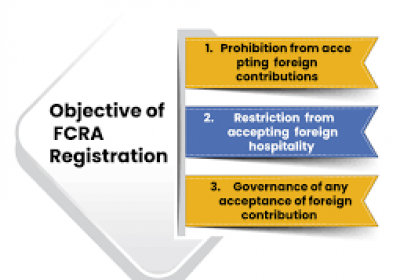

Compliance with the FCRA 2010 and FCRR 2011 amendments

All FCRA registered associations/potential applicants must comply with a number of compulsory conditions imposed by the FCRA 2010 Amendments and the FCRR 2011. These requirements include the following three major compliances, among others:

|

Compliance Item |

Get a Darpan ID from NITI Aayog portal. |

“FCRA Account” in SBI Parliament Street Branch, New Delhi. |

Aadhar Information of all office bearers / key functionaries. |

|

If a renewal application has already been submitted |

Such NGO’s will be provided access to their applications in order to seed the Darpan ID from the NITI Aayog's Darpan Portal (if it hasn't already been seeded). They must enter their DARPAN ID in Form FC 3C at the appropriate location on the fcraonline.nic.in portal. (This entry's online system is already operational.) |

Such NGO’s will have access to their applications to seed FCRA accounts at the SBI Main Branch in New Delhi's Parliament Street. (This entry's online system is already operational.) |

In Form FC 3-C on the fcraonline.nic.in the portal, such NGO’s must provide the Aadhar numbers of all office-bearers, directors, and other key functionaries in the required column. |

|

If the application for FCRA Registration or Prior Permission (PP) has already been submitted |

Such NGO’s are being given access to their applications to seed (if not already seeded) the Darpan ID from NITI Aayog’s Darpan Portal. They need to make entry of DARPAN ID in Form FC 3A / FC 3B at the specified place in the portal, fcraonline.nic.in (The online system for this entry is already functional) |

Such NGO’s are being given access to their applications to seed FCRA Account in the State Bank of India Main Branch at Parliament Street, New Delhi. (The online system for this entry is already functional) |

Such NGO’s need to enter Aadhar Nos. of all Office Bearers or Directors or Other Key Functionaries of the Association in the specified column in Form FC 3A / FC 3B in the portal fcraonline.nic.in |

|

If an application is yet to be submitted for renewal |

Such NGO’s will be automatically prompted to first obtain Darpan ID from NITI Aayog’s Darpan Portal when they open their online form for renewal in the modified Form FC 3C. |

Such NGO’s must open an FCRA Account in the State Bank of India Main Branch at Parliament Street, New Delhi before they initiate the online application for renewal. (The online system for this entry is already functional) |

Such NGO’s need to enter Aadhar Nos. of all Office Bearers or Directors or Other Key Functionaries of the Association in the portal fcraonline.nic.in while filling online form for renewal. |

|

If an application is yet to be submitted for FCRA Registration/ PP. |

The online registration/PP application will automatically prompt the applicant to first obtain Darpan ID from NITI Aayog’s Darpan Portal |

Such applicants must open an FCRA Account in the State Bank of India Main Branch at Parliament Street, New Delhi before they initiate their online application for registration. (The online system for this entry is already functional) |

Such applicants must enter Aadhar Nos. of all Office Bearers or Directors or Other Key Functionaries of the Association in the portal fcraonline.nic.in while filling online application for registration/PP. |

we can help in

- Registration of Trust

- Registration under FCRA (Foreign Contribution Regulation Act) ·

- Registration of Societies and Trusts.

- Registration of section 8 company

- Compliance related with them

Popular article :