Table of Contents

FOREIGN CURRENCY ACCOUNT PROVISIONS

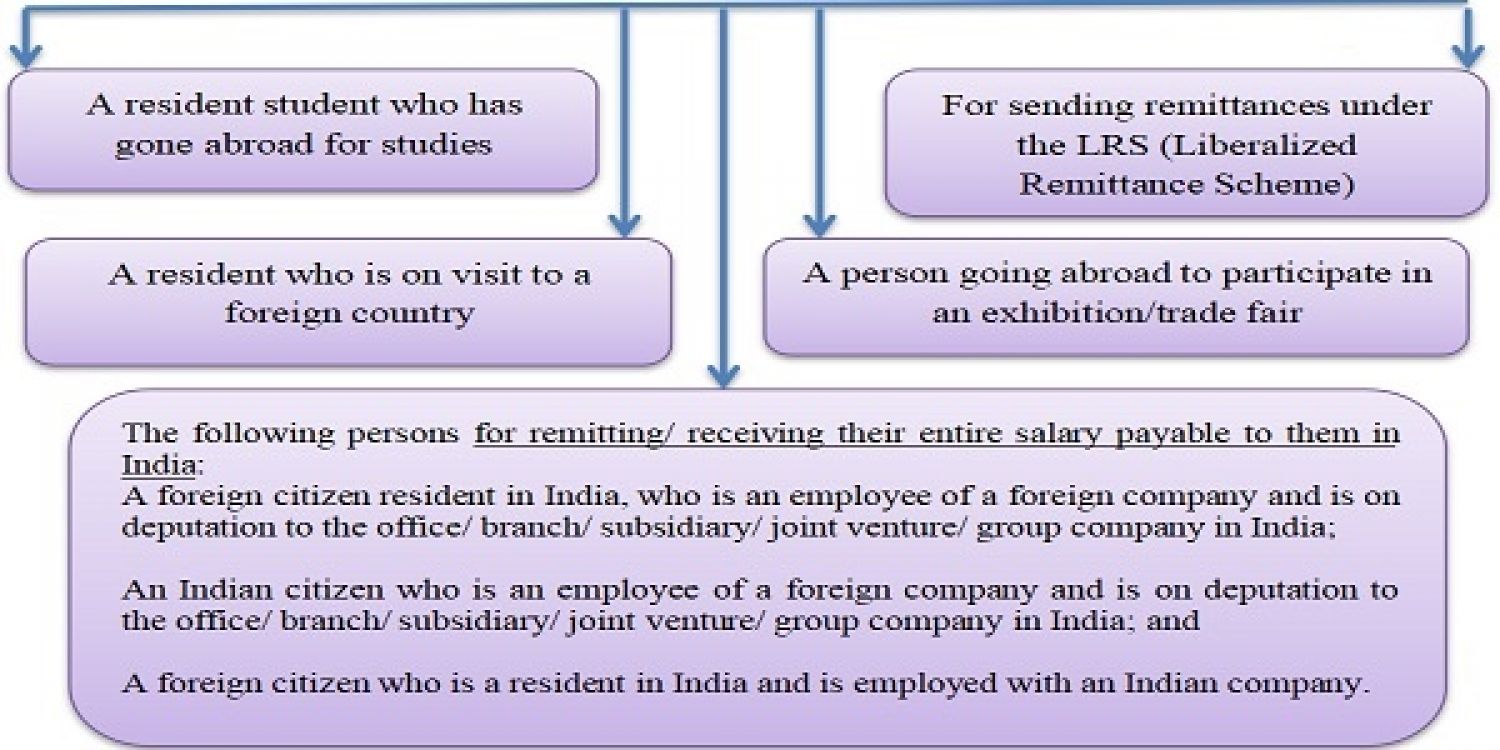

- An Indian resident going abroad for studies or who is on a visit to a foreign country may open, hold and maintain a Foreign Currency Account with a bank outside India during his stay outside India, and on his return to India, the balance in the account is repatriated to India. However, short visits to India by the student who has gone abroad for studies, before completion of his studies, are exempted from the above provisions.

- An Indian resident who went out of India to participate in an exhibition/trade fair outside India may open, hold and maintain a Foreign Currency Account with a bank outside India in order to receive the sale proceeds of goods on display in the exhibition/trade fair, and the balance in the account is repatriated to India through normal banking channels within a period of one month from the date of closure of the exhibition/trade fair.

RESIDENT FOREIGN CURRENCY ACCOUNT PROVISIONS

Normally a Resident Individual can maintain three kind of Foreign Currency Accounts for putting through the bonafide transactions in india.

-Resident Foreign Currency (Domestic) [RFC(D)] Account

-Resident Foreign Currency (RFC) Account

-Exchange Earners Foreign Currency (EEFC) Account

- NRIs /PIOs returning to India, may open, hold and maintain an RFC account with an authorised dealer in India, transfer balances held in NRE/FCNR(B) accounts.

- The proceeds from the sale of assets held outside India at the time of return are credited to the RFC account.

- The funds held in RFC accounts are under no restrictions in terms of utilization of foreign currency balances including any restriction on investment in any form outside India.

- These accounts can be in the form of current or savings or term deposit accounts, where the account holder is an individual, and in the form of current or term deposits in all other cases.

FAQ On NRI

Q: Can Exchange Earners Foreign Currency (EEFC) accounts be held jointly with a -resident Indian?

An EEFC account of a resident individual can be held jointly with a close relative who is also an Indian resident, on a ‘former or survivor basis. However, such resident Indian close relatives are restricted from operating the account during the lifetime of the resident account holder.

Q: Can a resident individual holding a savings bank account include a non-resident close relative as a joint account holder?

Yes, an individual Indian resident can include non-resident close relative(s) as a joint holder(s) in their resident bank accounts on a ‘former or survivor basis. However, such non-resident Indian close relatives shall be restricted from operating the account during the lifetime of the resident account holder.

Q: Can a gift involving shares/securities/convertible debentures etc be made to NRI close relatives by an Indian resident?

An Indian resident individual is permitted to gift shares/securities/convertible debentures etc to NRI close relative up to an amount of USD 50,000 per financial year subject to certain conditions.

Q: Can a resident individual give rupee gifts to his visiting NRI/PIO close relatives?

An Indian resident individual can provide gifts in terms of Indian rupees to his visiting NRI/PIO close relatives by way of crossed cheque/electronic transfer within the overall limit of USD 200,000 per financial year and the said amount be credited to the beneficiary’s NRO account.

Q: What services are allowed to be provided by a resident individual to his / her nonresident close relatives?

A resident can make payment in rupees towards meeting expenses on account of boarding, lodging, and services for traveling to and from and within India of a person resident outside India who is on a visit to India. Further, the medical expenses in respect of NRI close relative can be paid by a resident individual, provided such a payment is in the nature of a resident-to-resident transaction.