NRI REPATRIATION SERVICE

An NRI, OCI and a Foreign Citizen, residing in India, are often into the transaction of remitting the money from Indian Bank accounts to foreign or NRI accounts.

To undertake such type of transactions, the banks are authorized to ask for certain documents namely -

- Application form duly filed and supported with required documents for outward remittance from NRO Account

- A2 Form as required to be filed under the regulation of RBI.

- Form 15CB, a certificate issued by a Chartered Accountant, practicing in India.

- Form 15CA, a declaration to the IT department.

- The source or way the said income was earned.

- Passport of the NRI.

REMITTANCE SERVICE TO NRI

For all the above procedures, NRIs/PIOs look for a Chartered Accountant or Tax Consultant to assist them in complying with the above requirements.

REGULATION UNDER FEMA ACT FOR REMITTANCE BY NRI

- The NRI is required to submit the required information in Form A2.

- Form 15CB, a certificate issued by a Chartered Accountant, practicing in India.

- Preparation & filing of Form 15CB and 15CA on Income Tax Department portal.

- Make the payment of taxes, in case if any is applicable.

FORM 15 CA, CB REGULATION AND PURPOSE

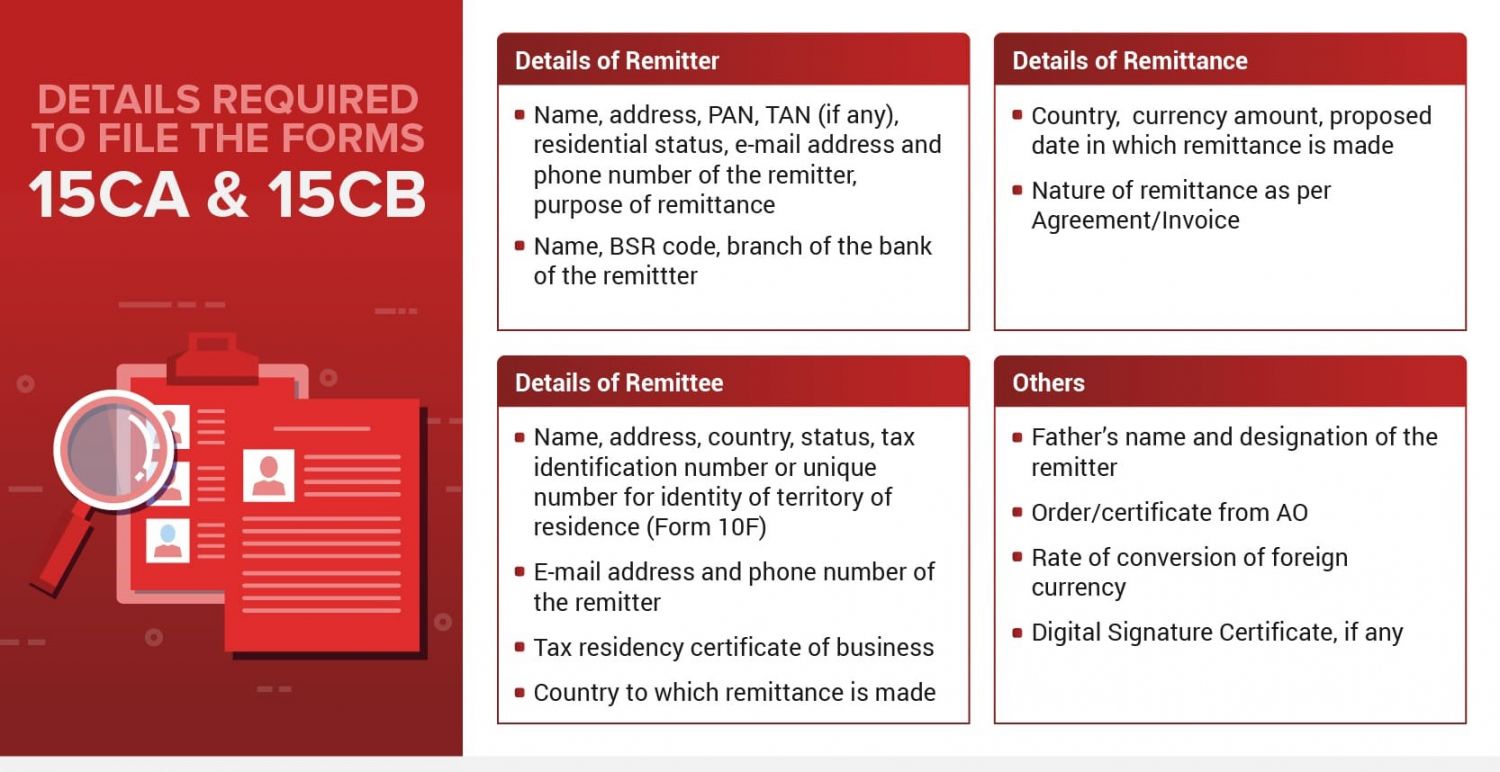

Form 15 CA and 15CB are the Income Tax forms as required to be filed by the NRIs under section 195 of the Income Tax Act,1961. These forms are required to be filed by a NRI while making any remittance outside India. Such forms are regulated by Income Tax Authorities.

Form 15CB is a declaration which is required to be certified by a Chartered Accountant practising in India and Form 15CA is a declaration by the NRI. TDS provisions are also triggered while making these remittances. It is to be noted that section 195 is not applicable on remittances made from the NRO account to NRE account by the NRI. Both these forms can be downloaded and filed on the Income Tax portal and the certification of the Chartered Accountant can also be done using their Digital Signature.

CERTIFICATION BY CHARTERED ACCOUNTANT

There are certain steps to be followed in order to obtain certification in Form 15 CB -

- The NRI is required to approach a certified Chartered Accountant and submit his/her bank statement for the last 1-2 years.

- The CA will verify their source of income.

- Once the source is identified, the CA will calculate the taxable income of the NRI and estimate the tax liability on the said income.

- Once the NRI makes the payment of the requisite tax amount, the CA will file a return for the same.

- After filing of return, the CA will keep a record of the same and certify the Form 15 CB.

STEP BY STEP PROCEDURE FOR FILING FORM 15CA

- First the NRI needs to login to the Income Tax Web Portal.

- Create a new user account with the help of PAN card and other proofs.

- Then visit the E-File option and select Form 15CA.

- Form 15CA will have certain steps to be followed.

- Fill in the required details in all the Parts from A to D.

- On completing the information, submit the form by clicking on the submit button.

- On successful filing, the NRI is required to submit a copy of the filed form with their bank.

- The bank official will sign on the same and thereby complete the procedure.

Talking about the time required for such a procedure, usually a CA or tax consultant requires at least 1-3 days, to verify the documents and submitting Form 15CA and 15CB. After successful submitting, the NRI is required to submit the copy of the form to the respective Bank and thereafter the bank remit the funds immediately thereafter. Thus, on average, it takes 2-4 days time in order to initiate the whole process of remittance.