Table of Contents

TIPS FOR NRI RETURNING TO INDIA

If you're an NRI returning to India permanently, this blog is for you. During this article, we would be explaining the fundamentals attached with the smoothly transition of an NRI to a Resident Indian and the varied criteria that affect their NRI Status in India.

MEANING OF NRI

Indian Citizens who have gone out or are staying abroad for the aim of employment, business or vocation (occupation for which a personal is trained) or for a few other purpose with an intention to remain outside India for an uncertain period also are termed as NRIs. A Non Resident Indian is a person, who stays outside India for a minimum period of 183 days in a particular financial year.

NRI RETURNING TO INDIA

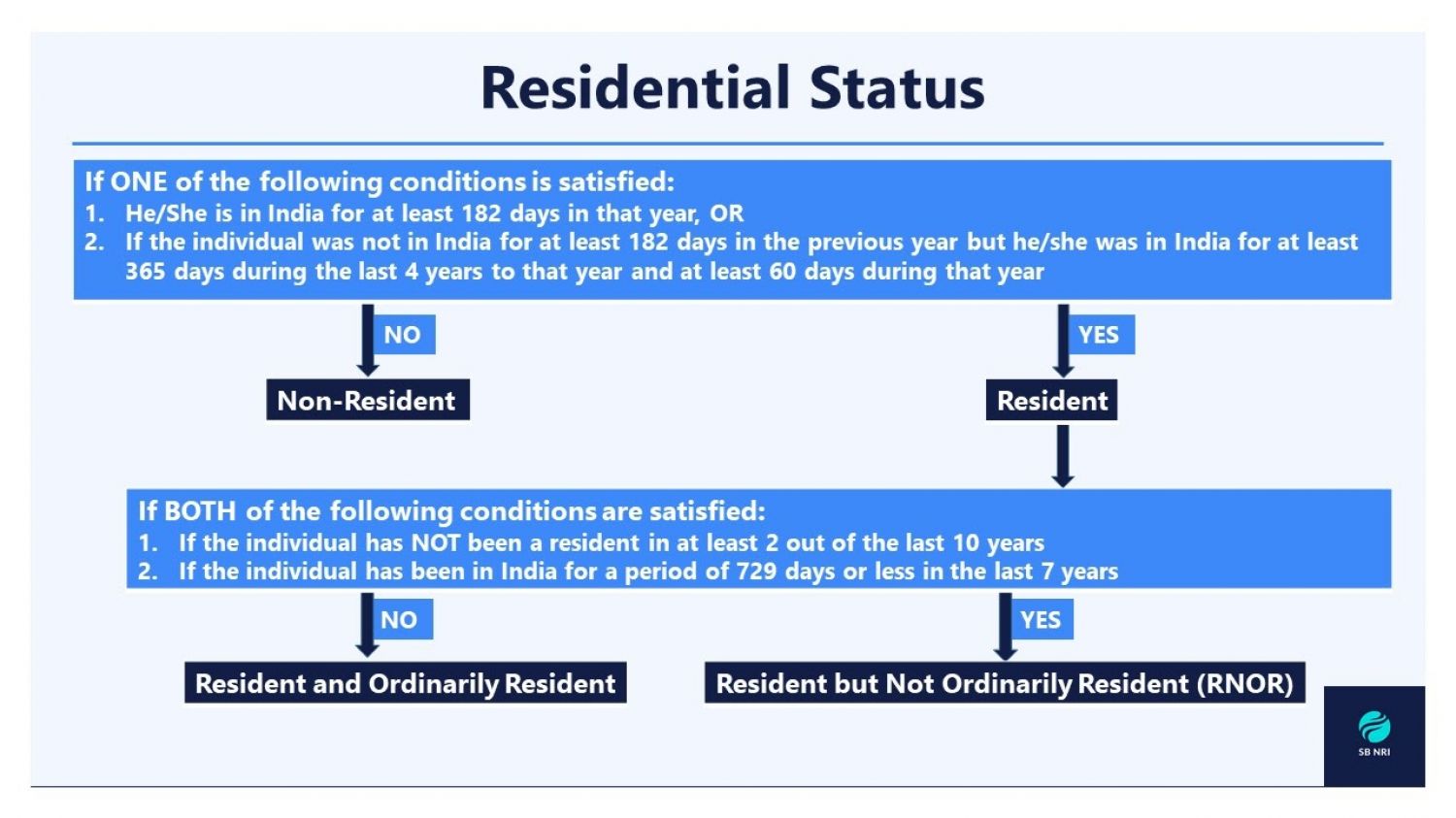

It is important to know that, after returning to India, an NRI can also become a resident of India, upon flfillment of certain conditions. In order to become Resident of India, an NRI can obtain two different types of status, namely - RNOR (Resident But Not Ordinarily Resident) and Resident and Ordinarily Resident.

WHAT IS MEANS OF RNOR STATUS

The RNOR status is provided to Indian Residents, upon fulfillment of certain criteria. These are –

- Where the Individual has been declared as a resident of India, for maximum of 1 FY out of the immediately preceding 10 FY.

- Where the Individual has stayed in India for a maximum period of 729 days, during the immediately preceeding 7 FY.

HOW TO CALCULATOR STATUS

A person is said to be an NRI, if he/she stays outside India for a period of more than 182 days during the relevant Financial Year. In order to calculate the number of days of stay in India, the same can be done by visiting the Indian Income Tax Department’s Residential Calculator page.

TOP 3 TIPS FOR NRI RETURNING TO INDIA

1. Know how long you would be able to hold your RNOR Status

- Where the Individual has been declared as a resident of India, for maximum of 1 FY out of the immediately preceding 10 FY, he/she will be an RNOR for 1 year.

- Where the Individual has stayed in India for a maximum period of 729 days, during the immediately preceeding 7 FY, he/she will be an RNOR for 3 years

2. Claim Tax Benefits

When we take a look at these terms from the perspective of taxation, then both NRI and RNOR status are the same. Now, another doubt can arise within the minds of the RNORs,:

Advantages of RNOR

The benefit related to being an RNOR is presented in terms of taxation. For RNORs, the income that's generated outside India isn't taxable in India, rather, thay would be liable for tax payment only on the income earned or generated in India. Along with that there are other benefits that may help RNORs save taxes in India, which are:

-

No liability for tax payment on the interest earned on Foreign Currency Non Resident (FCNR ) and Non Resident External (NRE) Deposits, after conversion into Resident Foreign Currency (RFC) Accounts.

-

No liability for tax payment on withdrawals made from offshore retirement accounts.

-

No liability for tax payment om rent and capital gains made in abroad.

-

No liability for tax payment on interest on dividends received from investments made abroad.

3. Fixed Depsits in India-

Consequences on NRE Deposits -

- The NRE Deposits needn't be converted to resident accounts after your return to India. they will remain as-is till maturity while the NRI converts to a resident.

- Withdrawals can only be made in Indian Rupees.

- In case, the NRE FDs is cashed before maturity, the interest amount shall be calculated till the time FD was held with the bank.

- Premature breaking of NRE FDs are subject to penalties that change from bank to bank.

- Post maturity, NRE Deposit Accounts may be converted into Resident Foreign Currency (RFC) Accounts.

- The interest shall be paid at the initial rate, being decided at the time of making deposits, after conversion to an Resident Foreign Currency (RFC) Account.

- The interest earned on NRE Deposits, being converted to RFC Accounts, will be exempt from tax, provided the status of returning NRI is RNOR (Resident but Not Ordinarily Resident)

Such a transition from an NRI to a Resident seems to be seamless and beneficial. We hope with the assistance of above mentioned tips you extract the most out of it. For queries on NRI Status and its effects, kindly visit our blog section.