Table of Contents

- All About Taxation Of Non-resident Indians

- Tax Slab Applicable For Ay 2021-22

- Taxability Of Income

- Determination Of Residential Status

- Recognition Of Nri Income

- Income Taxed In Case Of Nri

- Tds On Sale Of Property By Nri

- Deductions Available To Nris

- Details Of Deduction Available

- Due Date For Itr Filing

- Ways To Save Tax

ALL ABOUT TAXATION OF NON-RESIDENT INDIANS

BRIEF INTRODUCTION

It is commonly seen that taxation system is an integral part of Indian economy. In India, several taxes have been levied on products and services, being available to the citizens of India. These taxes are used to finance social projects, and to boost the products and services utilized by consumers. Some other taxes being leviable on the residents of India as well as the non-residents Goods and service Tax (GST), income tax, property tax, and TDS, etc. During this article, we would be decoding the importance of income tax in respect of NRIs in India and will also understand about the Income Tax Slab for NRIs as well.

TAX SLAB APPLICABLE FOR AY 2021-22

The tax slabs applicable to NRIs under the new tax regime is as follows -

|

INCOME TAX SLAB |

RATE |

|

UP TO RS. 2.50 LAKH |

NIL |

|

ABOVE RS. 2.50 LAKH TO RS. 5.00 LAKH |

5% OF (TAXABLE INCOME – RS. 2.50 LAKH) |

|

ABOVE RS. 5 LAKH TO RS. 7.5 LAKH |

RS. 12,500 + 10% OF (TOTAL INCOME – RS. 5 LAKH) |

|

ABOVE RS. 7.5 LAKH TO RS. 10 LAKH |

RS. 37, 500 + 15% OF (TOTAL INCOME – RS. 7.5 LAKH) |

|

ABOVE RS. 10 LAKH TO RS. 12.50 LAKH |

RS. 75,000 + 20% OF (TOTAL INCOME – RS. 10 LAKH) |

|

ABOVE RS. 12.50 LAKH TO RS. 15 LAKH |

RS. 1,25,000 + 25% OF (TOTAL INCOME – RS. 12,50,000) |

|

ABOVE RS. 15 LAKH |

RS. 1,87, 500 + 30% OF (TOTAL INCOME – RS. 15,00,000) |

|

SURCHARGE (SUBJECT TO MARGINAL RELIEF) |

– 10% OF INCOME TAX FOR TAXABLE INCOME ABOVE RS. 50 LAKH |

TAXABILITY OF INCOME

NRIs are liable to make payment of taxes, as and when the income earned by them in a particular FY, falls under the provisions of Income Tax Act, 1961. The main points about tax for NRIs and also the method of dealing with them fall into the category of NRI taxation. NRI taxation covers all the aspects of taxation, property tax and wealth tax. However, the point of interest of taxation lies on the income tax.

Income tax for NRIs

DETERMINATION OF RESIDENTIAL STATUS

The foreign exchange Management Act (FEMA) has issued clear guidelines to establish the residential status of an individual. As per the Indian income tax Law, a personal shall be treated as a resident Indian for a year if he/she satisfies any of the subsequent conditions:

- He/ she has lived in India for a period of a minimum of 182 days during the financial year. Or

- He/ she has lived in India for a period of 60 days or more within the year and for a period of a minimum of twelve months or more within the preceding four years.

However, if an Indian citizen leaves India in any previous year as a crewman of an Indian cargo vessel or for the aim of employment, the amount of 60 days, being provided in the second point, shall stand substituted with 182 days.

If the individual satisfies anyone or both the conditions, he/she will be considered as a resident. If he/she satisfies no conditions, he/she will become a Non-Resident Indian (NRI).

RECOGNITION OF NRI INCOME

If you reside and work abroad, your liabilities as an NRI will rely upon your residential status for the year. Residential status of a personal is split into three categories – Resident and Ordinarily Resident (ROR), Resident but Not Ordinarily Resident (RNOR) and Non-Resident (NR). The scope of taxation in India supported the residential status of a personal would be as under:

|

PARTICULARS |

ROR |

RNOR |

NR |

|

INCOME RECEIVED OR CONSIDERED TO BE RECEIVED IN INDIA |

TAXABLE |

TAXABLE |

TAXABLE |

|

INCOME EARNED OR ACCRUED IN INDIA |

TAXABLE |

TAXABLE |

TAXABLE |

|

INCOME THAT ACCRUES OUTSIDE INDIA FROM: |

|

|

|

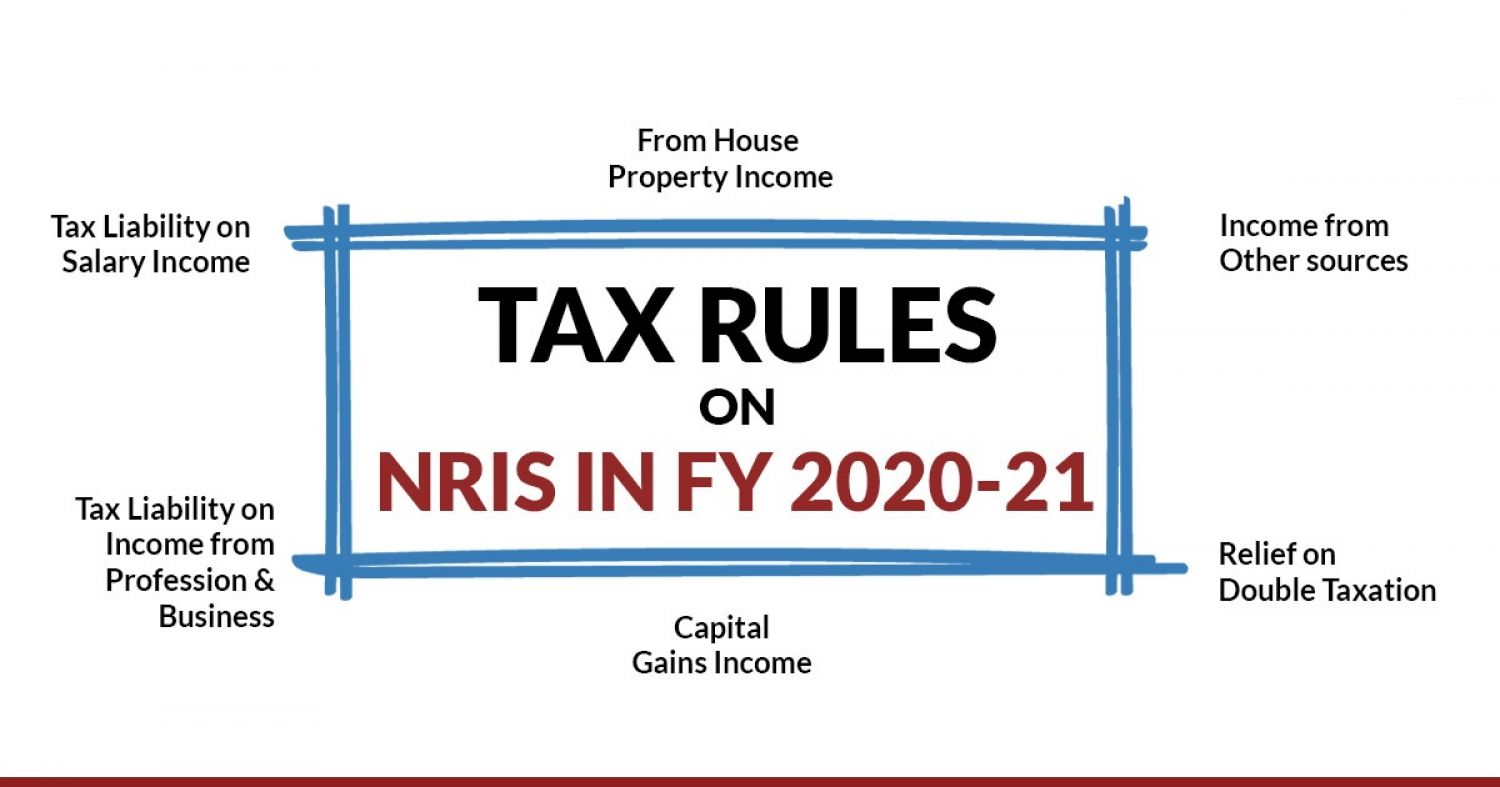

INCOME TAXED IN CASE OF NRI

In India, the following income, earned by an NRI, shall be liable for income tax -

Salary received for services provided in India

Salary or income received by an NRI for the services provided in India shall be taxable, no matter the place of receipt. Salary of an Indian citizen paid by the govt of India for the services rendered outside India are going to be considered as Indian income and taxed whether or not the status of the individual is Non-Resident.

House property income

- Rental income from property owned in India by an NRI is taxable within the same manner because the resident.

- Capital gains generated from the sale of a property, income, etc. in India are subject to tax.

- NRI can claim a standard deduction of 30% in India. Under Section 80C of the Income Tax Act, 1961, an NRI can claim deduction in respect of principal repayment of any housing loan, registration charges and tax, there and then. They can also claim tax deductions up to Rs. 1.5 lakh on interest paid on a home loan during a particular financial year.

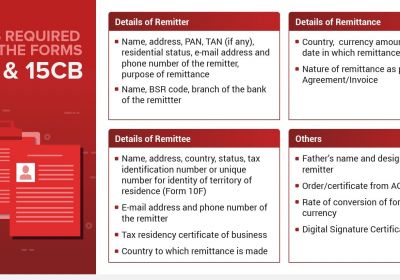

- The tenant who makes rental payments to NRI are to blame for TDS deduction at 30% under Section 195. He/she will have to fill the form 15CA and submit it online to the income tax department.

Capital gains income

- Capital gains arising out the sale of any listed securities, mutual funds, whether long term or short term, would be taxable.

- Capital gains arising from the sale of shares held acquired in India, would be subject to tax.

- Income from any capital assets, being acquired or situated in Indian, would also be taxable in India.

- Capital gains arising on account of transfer of any capital asset, being situated in India, shall also be liable for taxation in India.

Income from other sources

- The interest income arising on account of any fixed deposits as well as the savings bank accounts, being held by an NRI with any of the Indian bank, would be taxable in India.

Interest income arising from an NRO account would also be taxable in India. However, the interest income arising on account of NRE and FCNR accounts would be tax-free.

Income from business and profession

Also, any sought of income, being earned from a business or profession, established or controlled in India, would also be taxable in India.

TDS ON SALE OF PROPERTY BY NRI

The income tax slab for NRIs explains what proporstion of taxes are applicable for a specific bracket of income. The following are the TDS rates, being applicable in case of sale of property by NRIs:

|

NATURE OF GAINS |

TAX LIABLE |

TAX DEDUCTED AT SOURCE (TDS) |

|

SHORT TERM |

AS PER TAX SLAB |

30% |

|

LONG TERM |

20% |

20% (PLUS SURCHARGE AND CESS) WITH INDEXATION |

Note: The minimum holding period, in order to classify as Long Term Capital Gains would be 2 years.

DEDUCTIONS AVAILABLE TO NRIS

As per the Income Tax Act, 1963, NRIs have been provided with certain deductions and exemptions which they can claim from their income taxable in India. The subsequent table provides for the eligible deductions and exemptions available to an NRI in India -

|

PARTICULARS |

DEDUCTIONS |

|

SECTION 80C |

THE FOLLOWING DEDUCTIONS ARE AVAILABLE UNDER SECTION 80C |

|

SECTION 80D |

PREMIUM PAID TOWARDS A HEALTH INSURANCE POLICY |

|

SECTION 80E |

INTEREST PAID IN RESPECT OF LOAN TAKEN FOR HIGHER EDUCATION |

|

SECTION 80G |

DONATIONS FOR SOCIAL SERVICE ACTIVITIES |

|

SECTION 80TTA |

DEDUCTION UP TO RS. 10,000, IN RESPECT OF INTEREST RECEIVED FROM INDIAN SAVINGS BANK ACCOUNT |

|

HOUSE PROPERTY INCOME OF NRIS |

NRIS CAN CLAIM DEDUCTIONS ON INCOME FROM HOUSE PROPERTY IN INDIA, THE PROPERTY TAX PAID, AND INTEREST ON HOME LOAN |

DETAILS OF DEDUCTION AVAILABLE

NRIs aren't entitled to avail the subsequent deductions under the income tax Act, 1961:

- Investment made to Rajiv Gandhi Equity Savings Scheme under the Section 80CCG of the Act.

- Deductions in respect of expenses towards differently-abled, being provided under Section 80U, Section 80DD and Section 80DDB.

- Investments which don't seem to be available for NRIs as listed below:

- National Savings Certificate (NSC)

- Public Provident Fund (PPF)

- Senior Citizen Savings Scheme

- Post Office 5-year Deposit Scheme

DUE DATE FOR ITR FILING

Just like individual Indian residents, NRIs are also required to file their income tax return latest by 31st July of the relevant assessment year. Double Taxation Avoidance Agreement (DTAA). India has entered into the Double Taxation Avoidance Agreement (DTAA) with over 90 countries across the globe. Thus, the NRIs have been benefitted, by avaoiding paying taxes twice, in respect of same income.

There are two ways to assert tax relief – exemption method and tax credit method. Under the exemption method, the NRI would be liable to make payment of tax in one country and can claim exepmtion in the other country. As per the tax credit method, the income is taxed in both countries, the exemption is claimed within the country of residence.

WAYS TO SAVE TAX

Usually Non-Resident Indians (NRIs) need to pay tax twice. Non-Resident Indians who live and earn abroad must pay tax in their host country. And if they earn income from investments, assets or business transactions in India, they're going to must pay tax on this income in India also. However, tax payment has some benefits. does one make the foremost of any tax deductions and provisions available to you? During this article, we are going to discuss the 5 ways to save on the tax NRIs need to pay.

There are several ways to avoid wasting on taxes paid in India. Out of which 5 ways to save on the tax NRIs should pay while living and earning abroad include making the foremost of your deductions, PAN card application, home loan deductions, maintenance of NRI status and also maximizing the provisions in respect of sale of foreign assets.

NRI Tax Services

- Rajput Jain and Associates is a professional firm based in New Delhi, India, with associate offices throughout the country. We also have associates all over the world in various countries. We help non-residents with their financial affairs both in India and abroad.

- NRI Tax Service offers advisory and compliance services in the areas of taxation (Income Tax, Wealth Tax, DTAA, Customs, etc.) and foreign exchange law (RBI/FEMA, FCRA, Companies Act, etc.).