Complete Guidance on NRIs GST applicablity

Goods and Services Tax Act was passed in 2017, which is an indirect tax. GST was passed to subsume many indirect taxes under one law i.e., GST Law. GST Law in India is comprehensive, multi-stage, destination tax.

Non-Resident Taxable Person Under GST

Under GST Law, Non-Resident Taxable Person is defined as a person who undertakes any business transaction occasionally, involving the supply of goods or services, or both, whether as principal or agent or in any other capacity and has no fixed place of business or residence in India.

GST Registration aspacts on Non-Resident Taxable Person

As per Section 24 of the CGST act, 2017, a non-resident taxable person is required to take compulsory registration under GST, to undertake any transaction involving the supply of goods or services or both, without any threshold limit. Hence, an NRTP is required to obtain GST Registration irrespective of whether the business is involved in a one-time transaction or frequent taxable transactions.

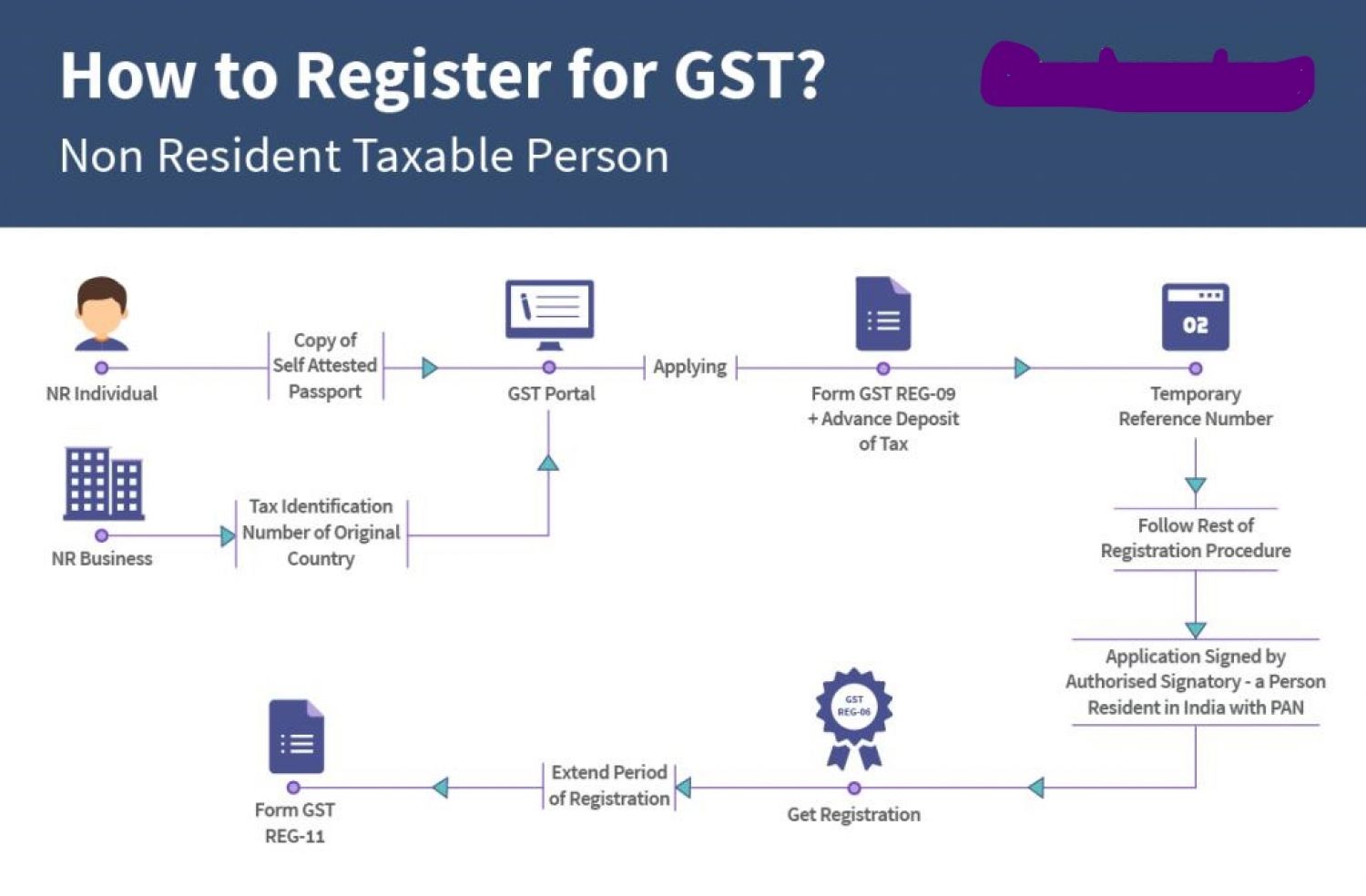

PROCEDURE FOR GST REGISTRATION FOR NRI

- Every NRTP is required to apply for GST registration, at least 5 days prior to the commencement of business.

- They need to have a Tax ID or a Unique number of their own country.

- PAN Card is not required as the same is not issued to them. The passport of such a person will act as their PAN card.

- Application for registration is required to be filed in Form REG-09.

- To undertake high-sea business in territorial waters, the NRI, as per the GST Law provisions, shall have to obtain registration in the coastal state or Union territory nearest to the appropriate baseline.

- After the successful filing of the form, a temporary reference number is generated electronically by the Common Portal. The purpose of this temporary number is to facilitate advance deposit of tax in Electronic Cash Ledger of the said NRI and acknowledgment will be issued thereafter.

GST ADVANCE PAYMENT

- NRTPs are required to make an advance payment of tax equivalent to the estimated tax liability airing during the period for which registration is being sought.

- After the said period lapses, the final tax liability of NRTP is assessed and any tax paid in excess is refunded back.

- The time period of GST registration can be extended by the non-resident taxable person and for that, an application using the form GST REG-11 should be furnished electronically on GST Common Portal.

GST PROVISION ON OTHER TRANSACTIONS

1. RENTING OF IMMOVABLE PROPERTY –

? any property let out on rent by a NRI in India for the purpose of commercial/business activity, the GST provisions shall be applicable on that transaction.

2. CONSULTING SERVICES -

Any sought of consultation service taken in India is subject to GST application, provided the same was supplied by an Indian resident.

COMMON QUESTIONS OF NRI REQUIRED TO BE ANSWERS

- Are GST provisions applicable on NRI and OCI?

- Regulations are applicable on NRI or not?

- What is the procedure for obtaining GST registration?

- GST application on various activities undertaken by an NRI in India?

- GST implications on rent received from property situated in India?

- NRI working in India and providing consultation services. Will any GST be attracted?