Table of Contents

Major changes in Insolvency and Bankruptcy Board of India

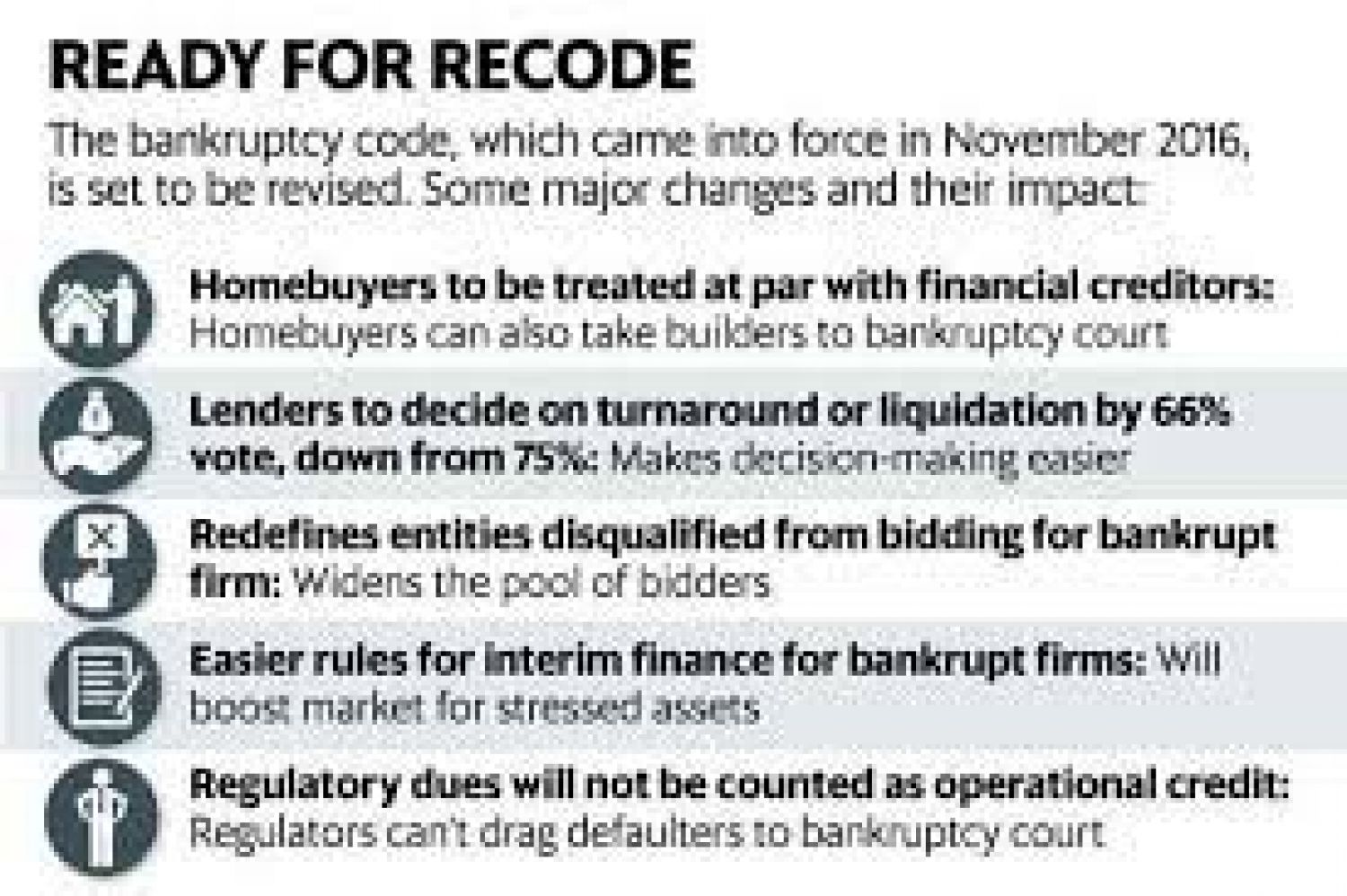

- Eligibility of resolution applicant for submitting resolution plans (barring defaulting promoters to bid for the company) – Section 29A.

- Voting threshold for decision making by the committee of creditors (from 75% to 66%)- Section 21, 22, 27, 28.

- Categorization of Home Buyers as Financial Creditors and thereby threshold limit for filing application i.e. 10% of total no. or 100 in no. under same real estate project - Section 5(8).

- Applicability of Limitation Act on the Insolvency and Bankruptcy Code - Section 238A.

- Withdrawal of an application by COC having approval of 90% – Section 12A.

- Allowing comprehensive corporate restructuring through merger, amalgamation and demerger under a resolution plan & Liquidation- Section 2(26) and Regulation 37 of CIRP.

- Resolution plan shall be binding on the all stakeholders including the Central Government, any State Government- Section 31.

- Manner of distribution of amounts amongst financial and operational creditors under Resolution Plan- Section 30.

- Timeline for completion of CIRP increased to an overall limit of 330 days- Section 12.

- Corporate Debtor cannot not be prosecuted for any offence committed prior to commencement of the CIRP, if a resolution plan has been approved by the NCLT- Section 32A.

Evolution of law through Judicial Pronouncements

- Resolution plan is not approved by requisite percent of voting share of the financial creditors within the statutory period of 270 days, it is liable to be liquidated. – SC.

- Only in exceptional cases over all limit of 330 days can be extended. – SC.

- NCLT & NCLAT have no jurisdiction /authority to analyse or evaluate commercial decisions of COC- SC.

- The role of RP under IBC is administrative and not adjudicatory – SC.

- Fair and equitable treatment of operational creditors means that a resolution plan should protect their interests but it did not mean proportionate payment of debts. – SC.

- RBI issued circular directing banks for initiating CIRP against companies. In all the cases where banks have initiated CIRP due to said circular, all such cases are declared non est in law. RBI circular declared ultra vires as whole- SC.

- NCLT on receipt of a rejected resolution plan is not expected to do anything more but is obligated to initiate liquidation process against the corporate debtor- SC.

- For effective participation of directors in the meetings of COC, directors are entitled to receive copy of relevant documents including the insolvency resolution plans- SC.

- Once a resolution plan is approved by the CoC, it shall be binding on all stakeholders, including the guarantors. The resolution plan would therefore limit the guarantor's right of subrogation towards the creditor – SC.

- Corporate Debtor cannot not be prosecuted for any offence committed prior to commencement of the CIRP, If a Resolution Plan Has Been approved by the NCLT- HC.

- The NCLT has power and authority to pass an interim order to direct moratorium period over the corporate debtors if there is an apprehension of the selling off of the assets of the Corporate Debtor by its directors– NCLAT.

- Exit route u/s 12A of the Code (i.e. for withdrawing the application) is only provided to the applicants invoking section 7,9,10 of the Code and not applicable to the resolution applicant.- NCLAT.

Key Highlights Insolvency and Bankruptcy Board of India

- Commercial determination instead of judicial determination (powers to the committee of creditors)

- Time-bound process: Unlike previous practice, now the entire insolvency resolution process shall complete in a max of 270 days + 30 Days.

- Repository of financial information (proof of debt): The information which shall be maintained shall avoid the undue delay caused because of the non-availability of this information.

- Automatic standstill: The company is restricted for 180/270+30 days from disposing of assets.